The Daily Shot: 27-Feb-24

• The United States

• Canada

• Europe

• Japan

• Asia-Pacific

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. Let’s begin with the housing market.

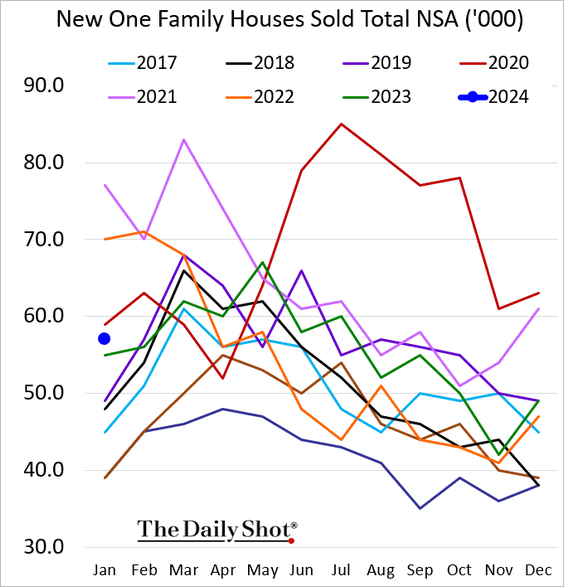

• New home sales modestly exceeded last year’s figures but fell short of projections.

Source: ABC News Read full article

Source: ABC News Read full article

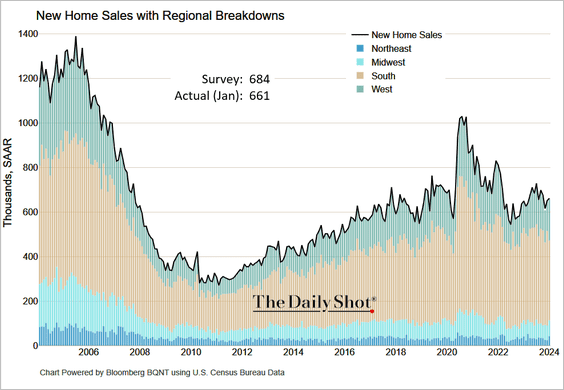

– Here is the seasonally adjusted chart with regional contributions.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

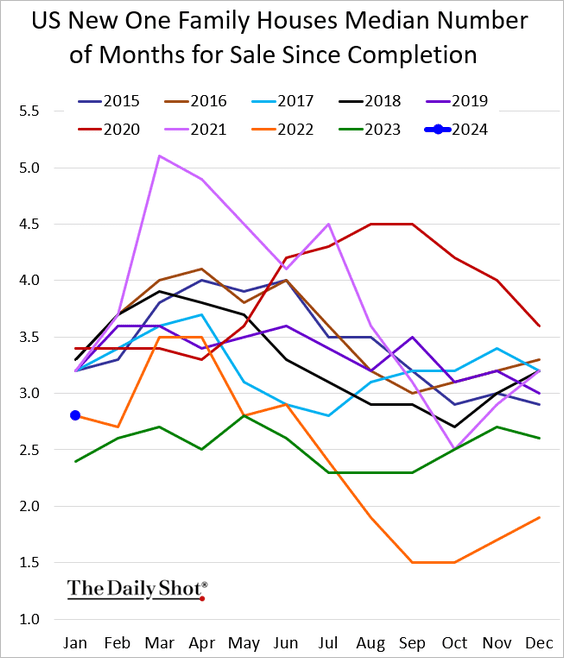

– Inventories were roughly in line with 2022 levels.

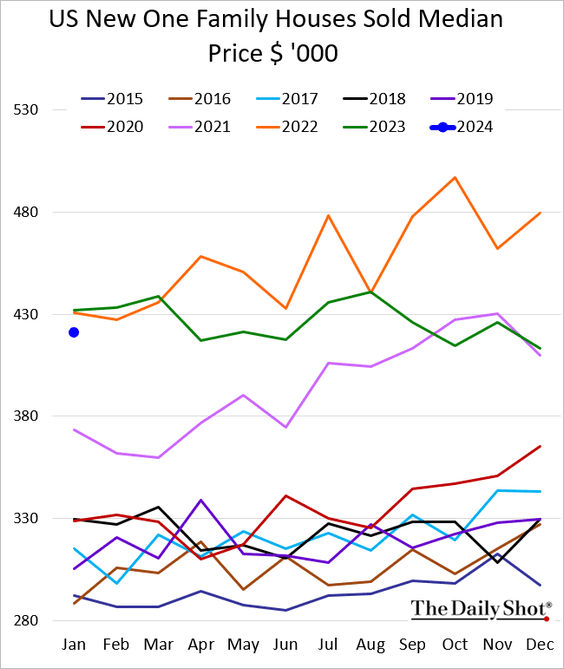

– The median new home price was below last year’s level.

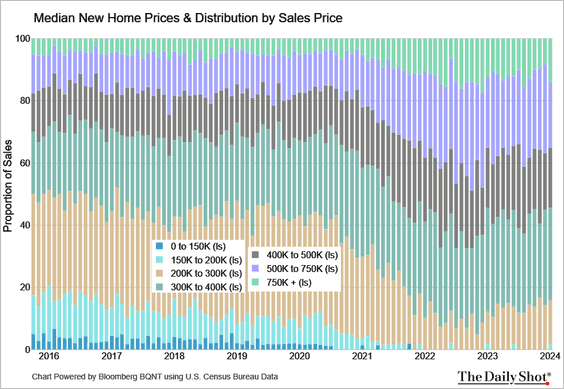

This chart shows the distribution of prices over time.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

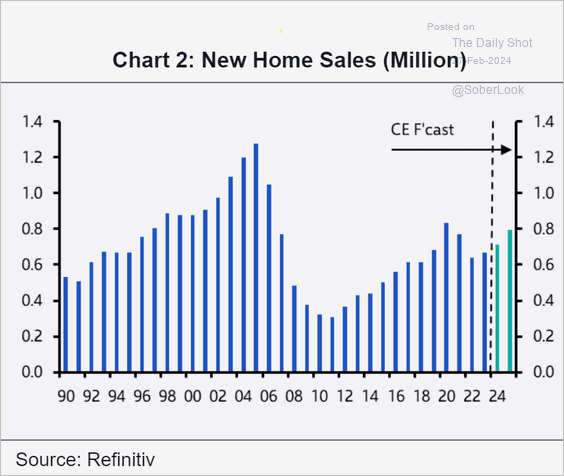

– Capital Economics expects new home sales to grow over the next couple of years.

Source: Capital Economics

Source: Capital Economics

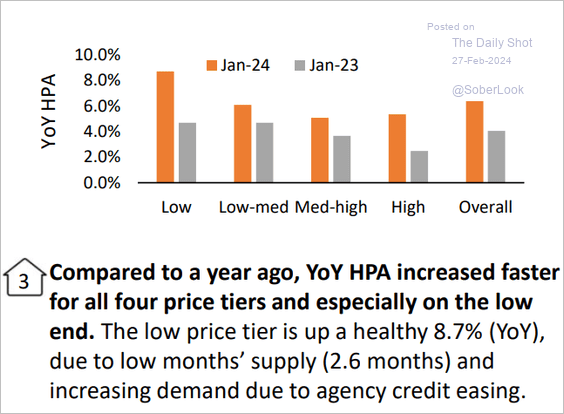

• In January, home prices registered robust year-over-year increases across all price tiers, with the most substantial gains observed in the lower-priced segment (due to tight inventories).

Source: AEI Housing Center

Source: AEI Housing Center

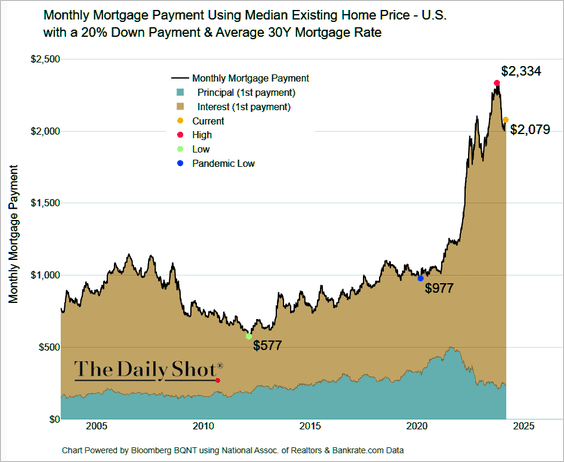

• The median mortgage payment for new homebuyers has decreased from the record highs of last year but still remains elevated.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

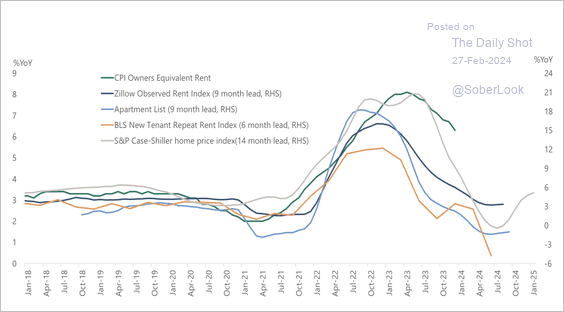

2. Could we see a rebound in housing inflation?

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

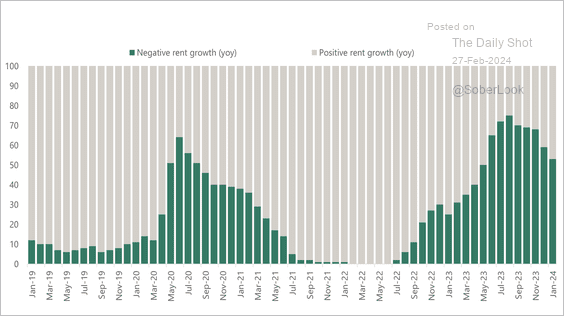

• The share of cities with positive rent growth is rising.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

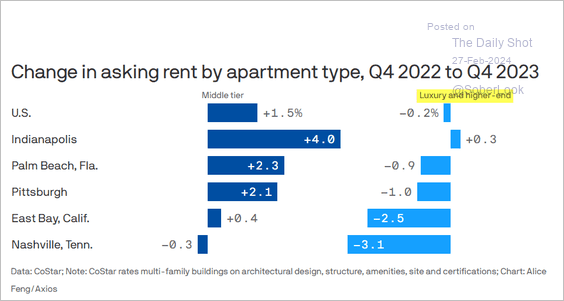

• The influx of new apartment units has predominantly affected the higher-end/luxury rental market. Meanwhile, rents for mid-tier apartments continue to rise in a number of cities.

Source: @axios Read full article

Source: @axios Read full article

——————–

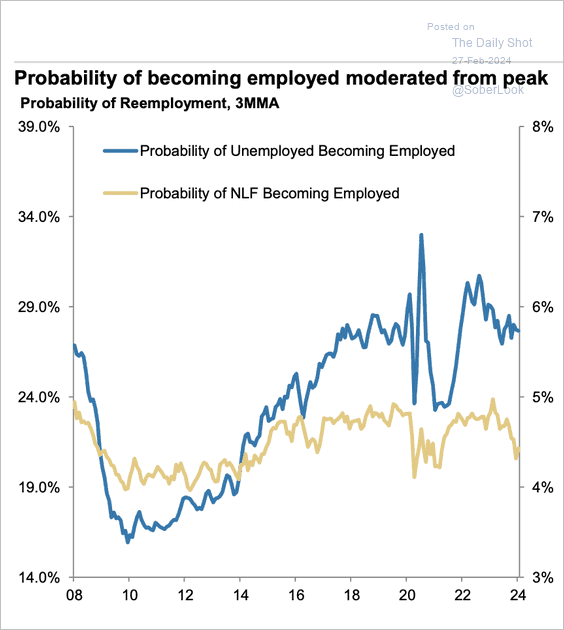

3. This chart shows the probability of becoming employed for Americans who are either unemployed or not in the labor force (NLF).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

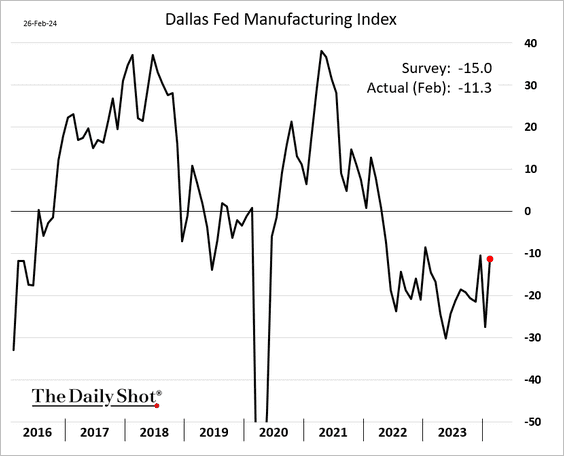

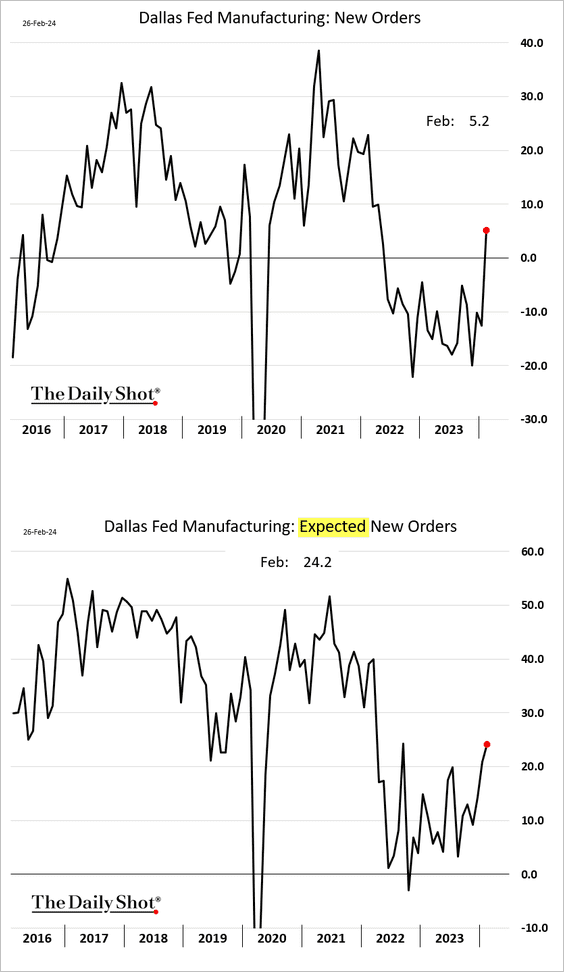

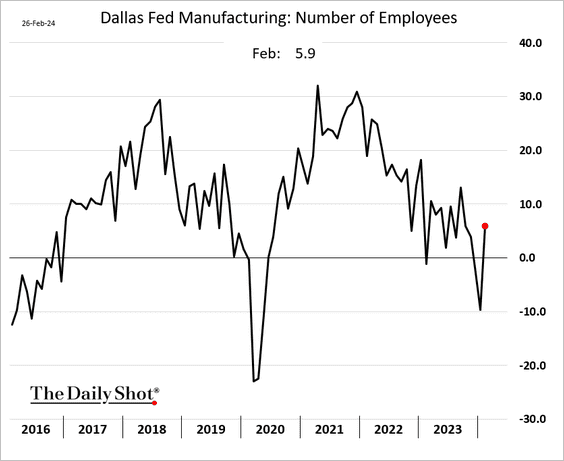

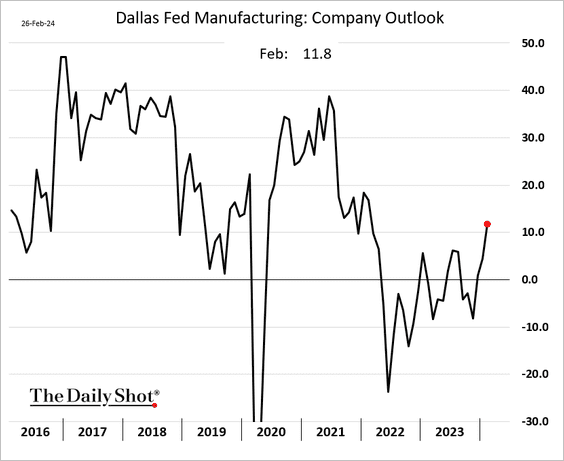

4. The Dallas Fed’s regional manufacturing index showed some improvement this month but remained in contraction territory.

However, the underlying trends point to a rebound in the Texas area factory activity.

• New orders:

• Employment:

• Company outlook:

Source: Dallas Fed Read full article

Source: Dallas Fed Read full article

——————–

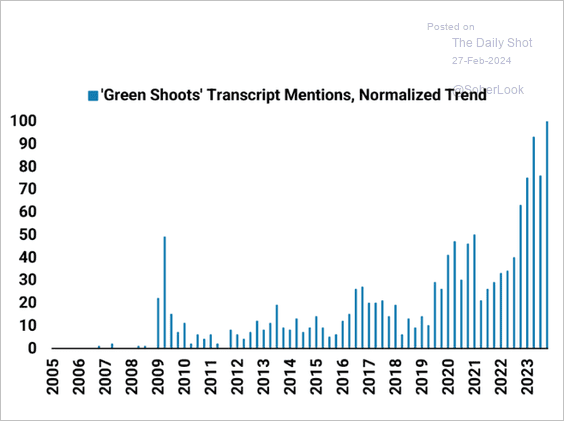

5. Companies are increasingly mentioning “green shoots” on earnings calls.

Source: Morgan Stanley Research; @GunjanJS

Source: Morgan Stanley Research; @GunjanJS

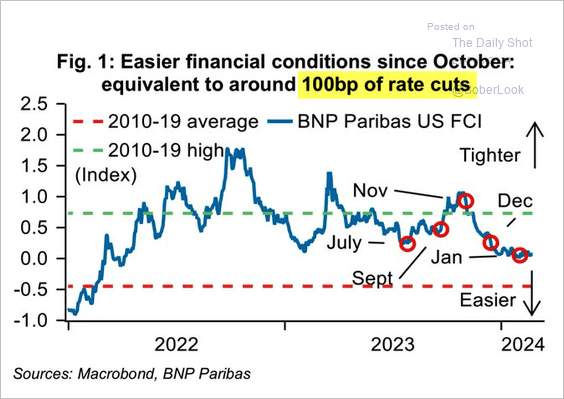

6. The easing of US financial conditions equates to approximately 100 basis points of rate cuts, providing the US central bank with additional justification to delay rate reductions.

Source: BNP Paribas; @WallStJesus

Source: BNP Paribas; @WallStJesus

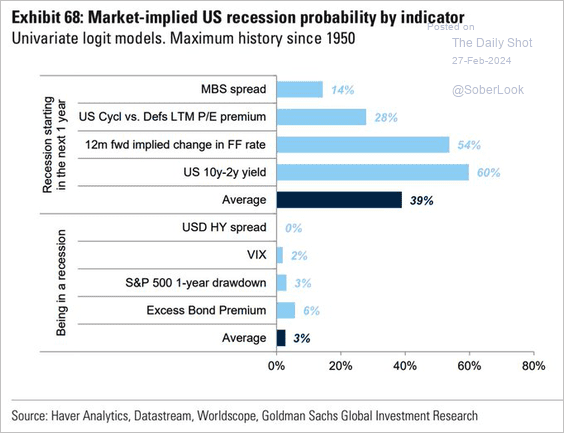

7. Market signals on the probability of a recession have been mixed.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

Back to Index

Canada

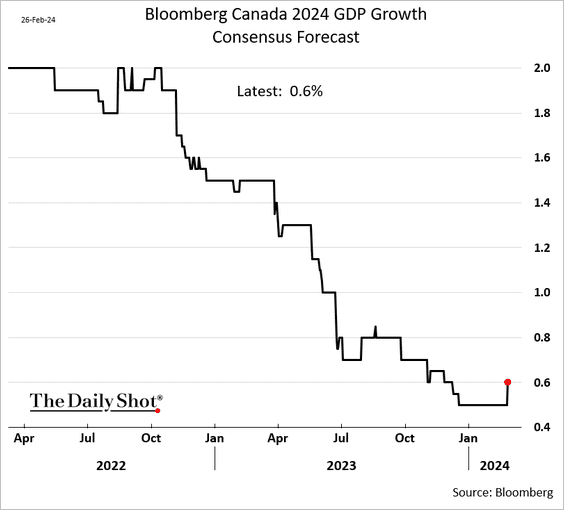

1. Economists have finally halted their downgrades for Canada’s 2024 GDP growth. Still, the economy is only expected to grow by 0.6% this year.

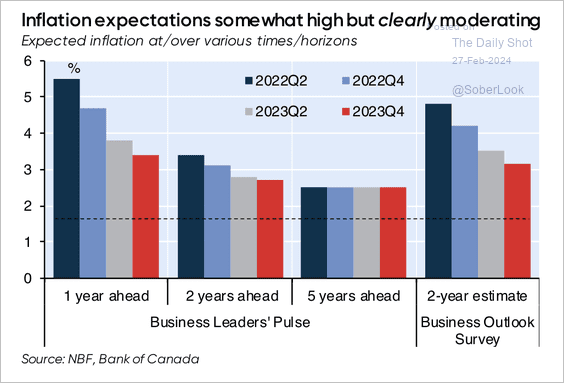

2. Corporate inflation expectations have consistently moderated over the past two years.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

Back to Index

Europe

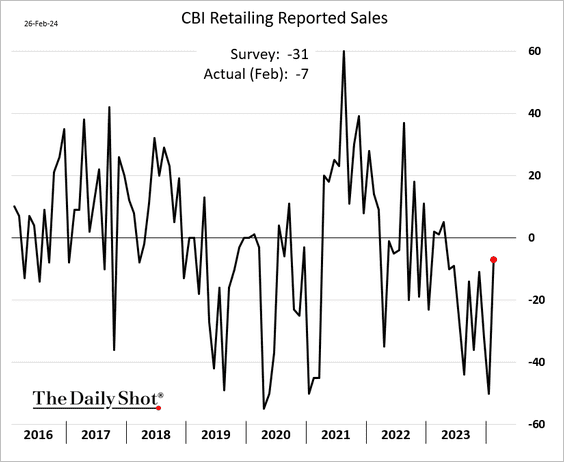

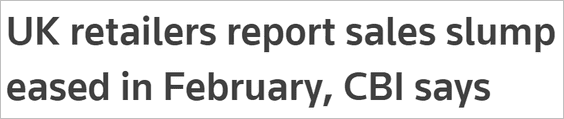

1. UK retail sales showed signs of stabilization this month.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

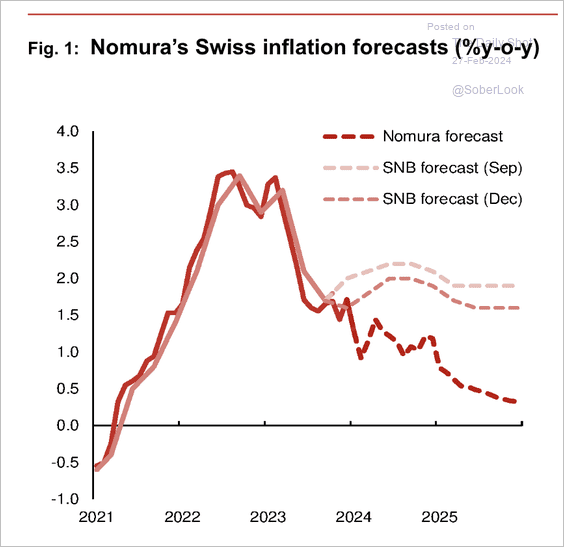

2. Nomura expects a decline in Switzerland’s inflation, undershooting the SNB’s forecasts.

Source: Nomura Securities

Source: Nomura Securities

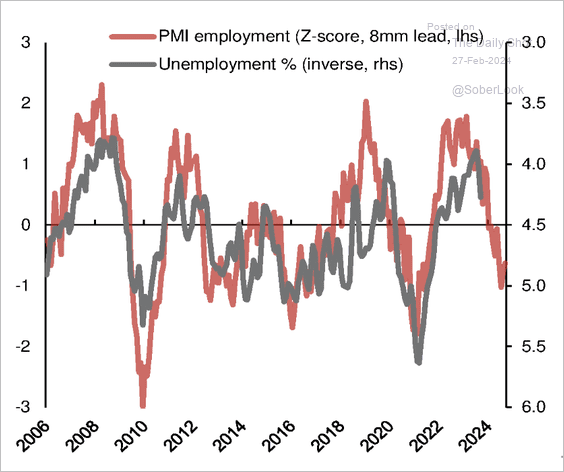

• The decline in Switzerland’s employment PMI points to a rise in unemployment ahead.

Source: Nomura Securities

Source: Nomura Securities

——————–

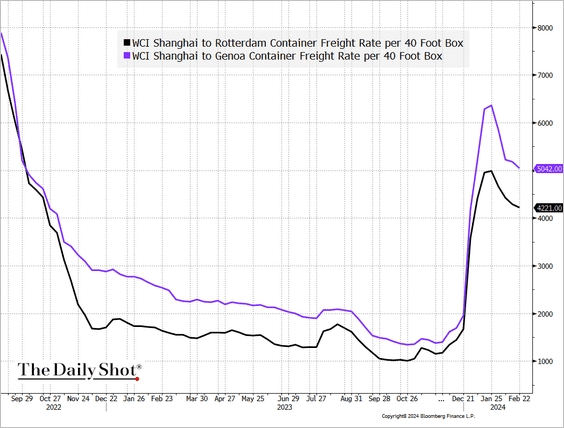

3. Container shipping costs from Asia appear to be easing.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

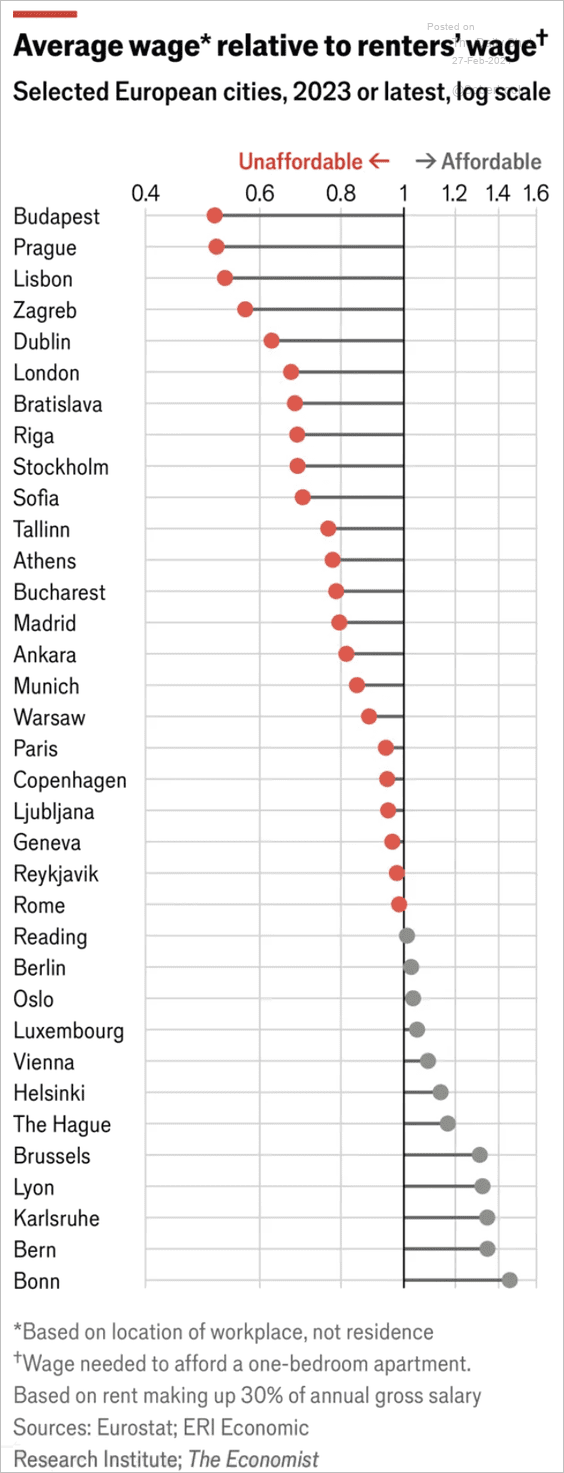

4. Here is a look at housing affordability in European cities.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Japan

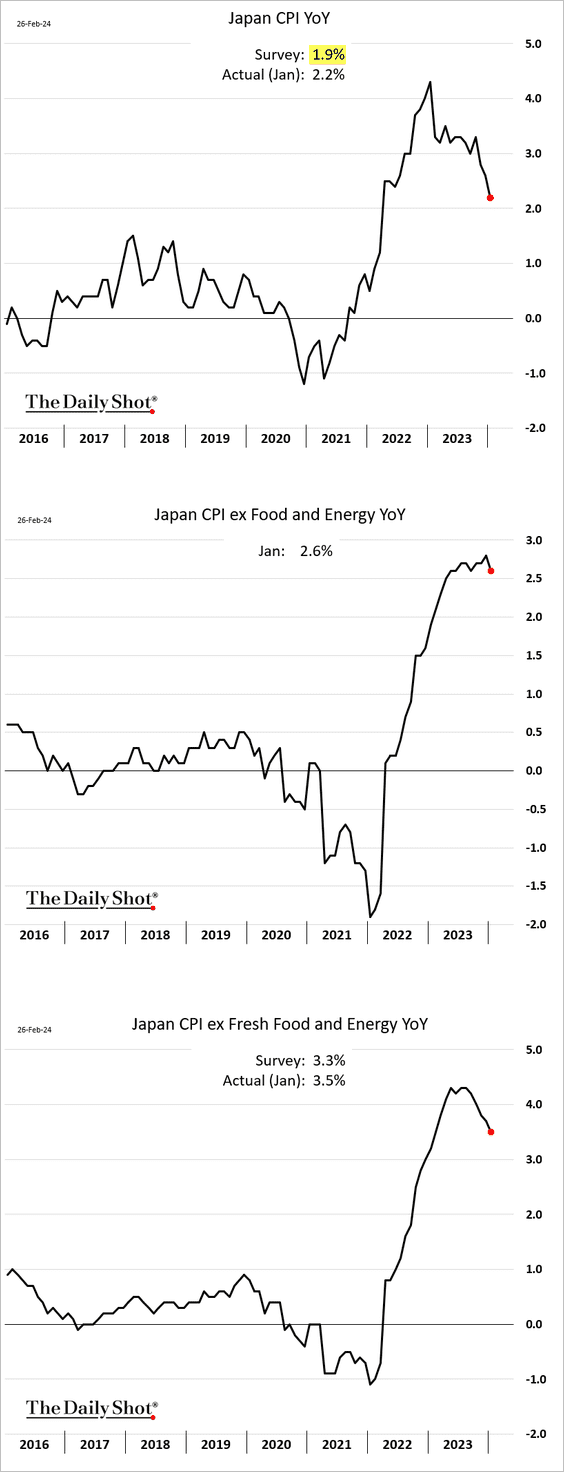

1. Japan’s inflation moderated last month but was well above forecasts.

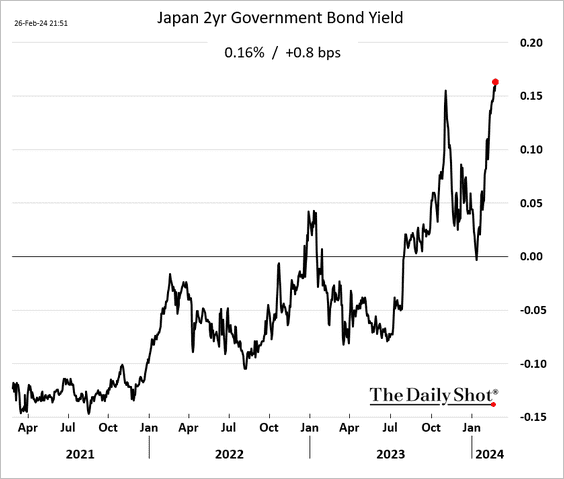

2. JGBs declined in response to the CPI report, with the 2-year yield reaching a multi-year high.

Source: @WSJ Read full article

Source: @WSJ Read full article

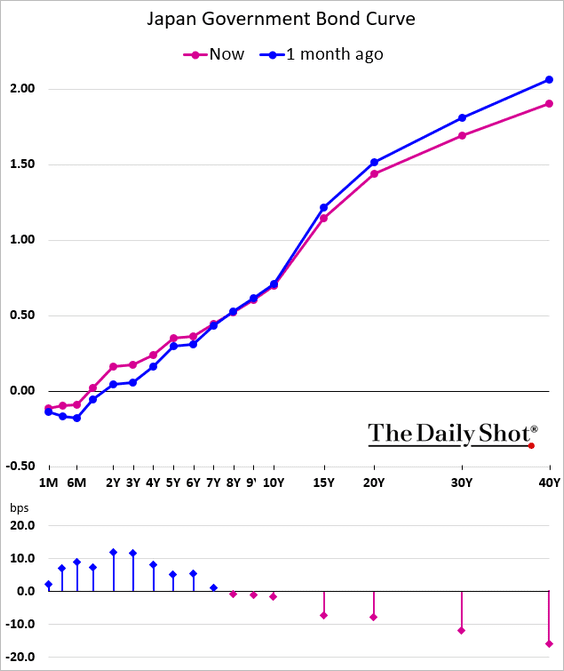

• The yield curve has been flattening.

——————–

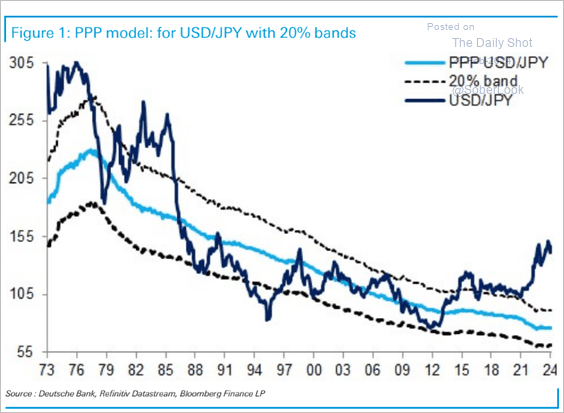

3. Based on fundamentals, the yen appears to be significantly undervalued.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Asia-Pacific

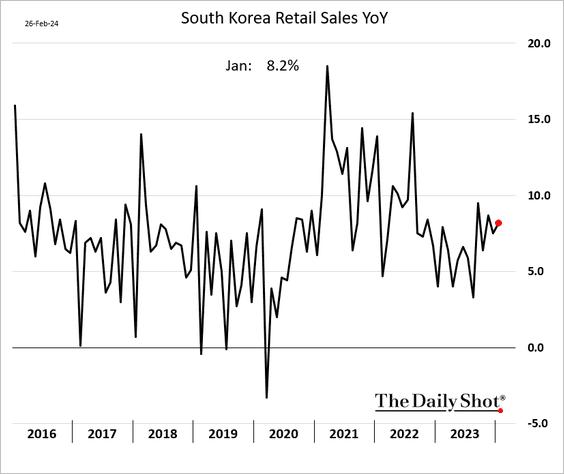

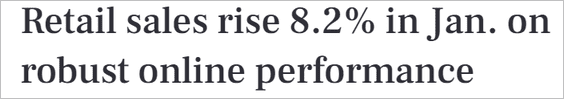

1. South Korea’s retail sales have been resilient.

Source: The Korea Herald Read full article

Source: The Korea Herald Read full article

——————–

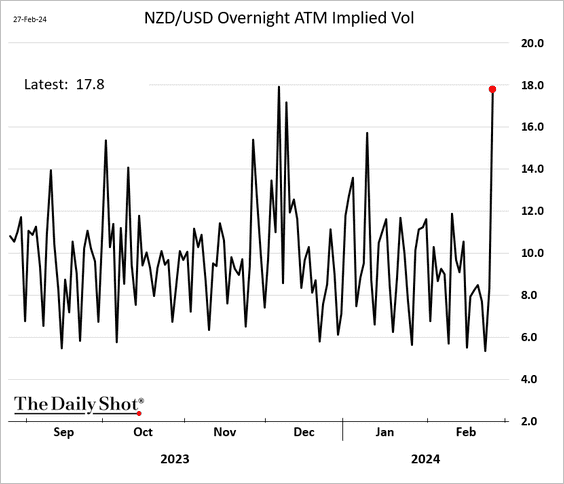

2. The NZD/USD one-day implied volatility surged ahead of the RBNZ decision.

Back to Index

Emerging Markets

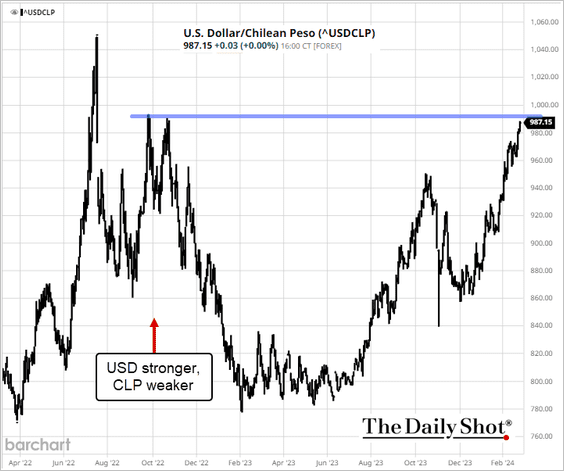

1. The Chilean peso continues to weaken, with USD/CLP nearing resistance.

h/t Davison Santana, Bloomberg

h/t Davison Santana, Bloomberg

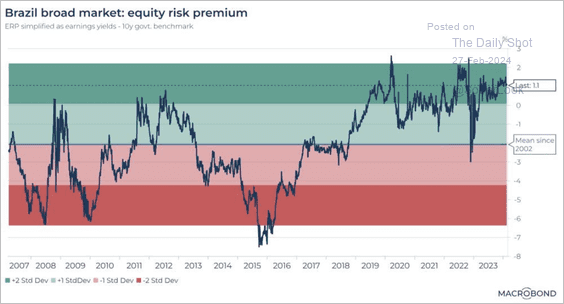

2. Brazil’s equity risk premium is near historic highs.

Source: Macrobond

Source: Macrobond

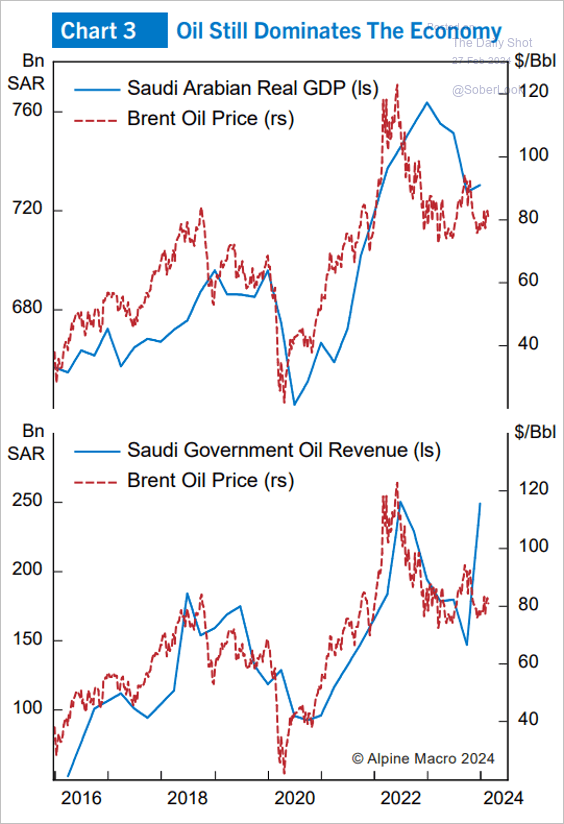

3. The Saudi economy remains linked to crude oil.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

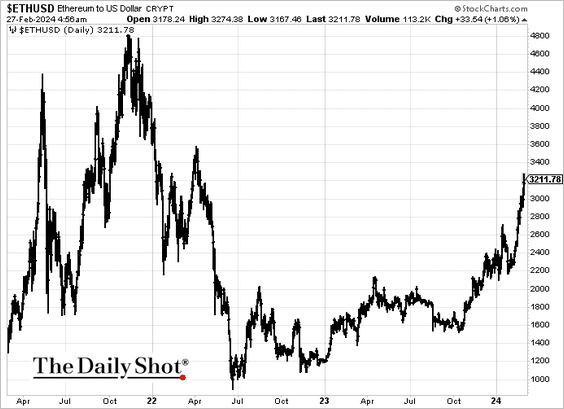

Cryptocurrency

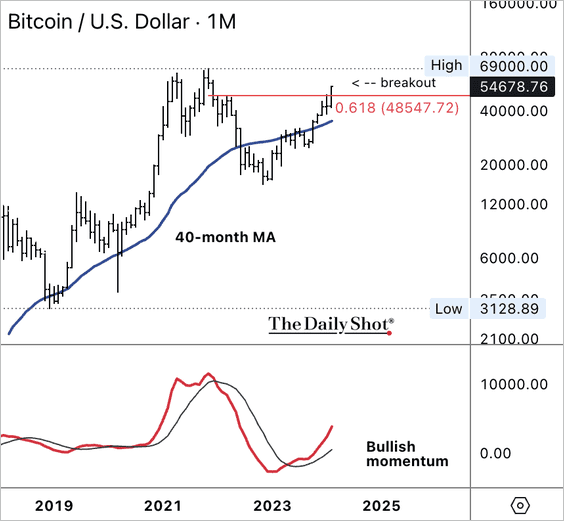

1. Bitcoin climbed above $55k, …

… and ether is now above $3.2k.

• BTC/USD is holding long-term support with strong momentum.

——————–

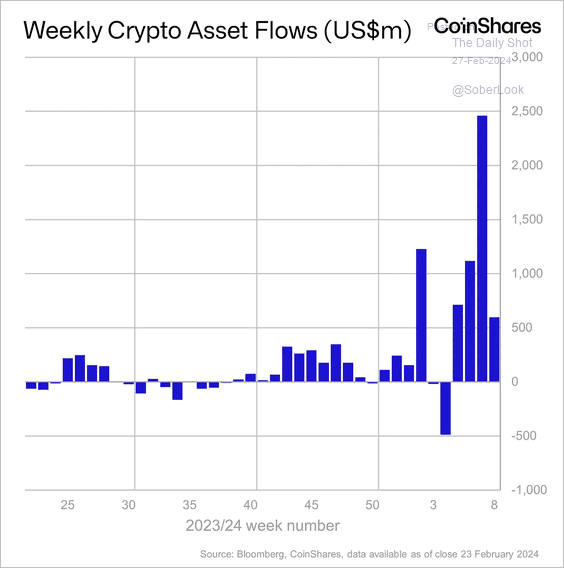

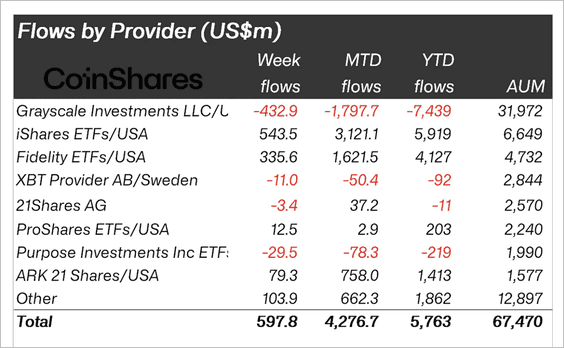

2. Crypto funds saw the fourth consecutive week of inflows.

Source: CoinShares Read full article

Source: CoinShares Read full article

• US funds accounted for most inflows, although incumbent issuer Grayscale saw further outflows last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

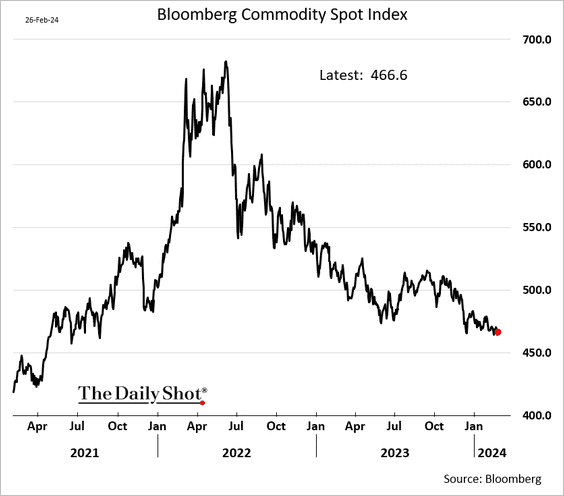

Commodities

1. Bloomberg’s broad commodity index has been trending down.

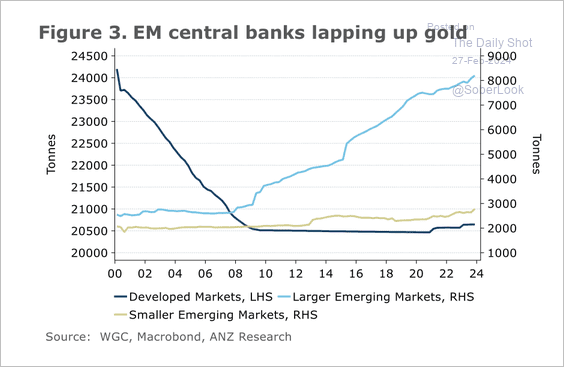

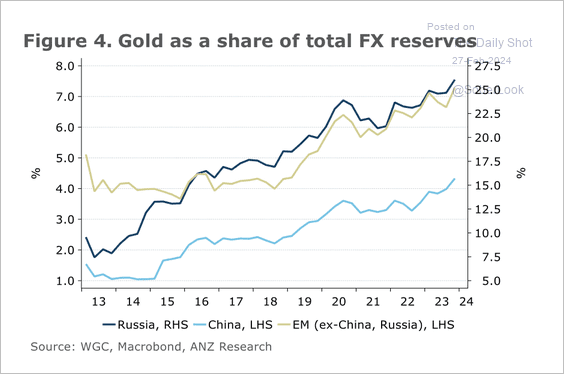

2. EM central banks have significantly increased their holdings of gold over the past decade, especially Russia and China. (2 charts)

Source: @ANZ_Research

Source: @ANZ_Research

Source: @ANZ_Research

Source: @ANZ_Research

——————–

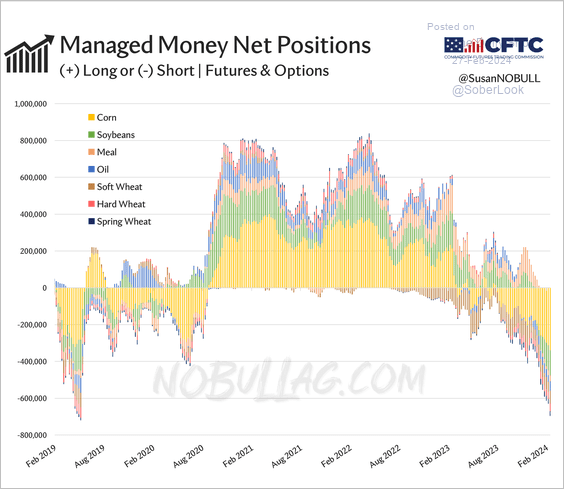

3. US grains positioning has been very bearish.

Source: @SusanNOBULL, @Barchart Read full article

Source: @SusanNOBULL, @Barchart Read full article

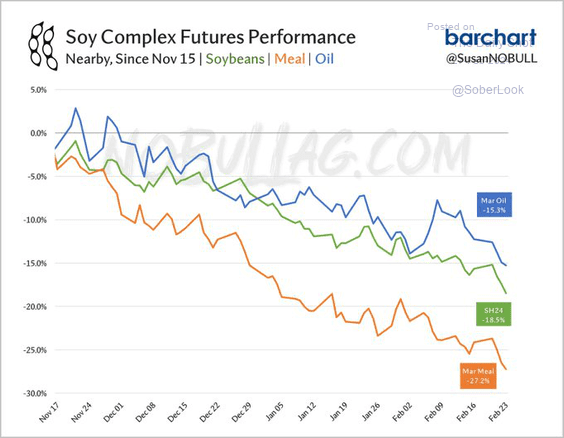

4. Prices for soybeans, soy meal, and soy oil have seen a marked decrease over the past few months.

Source: @SusanNOBULL, @Barchart Read full article

Source: @SusanNOBULL, @Barchart Read full article

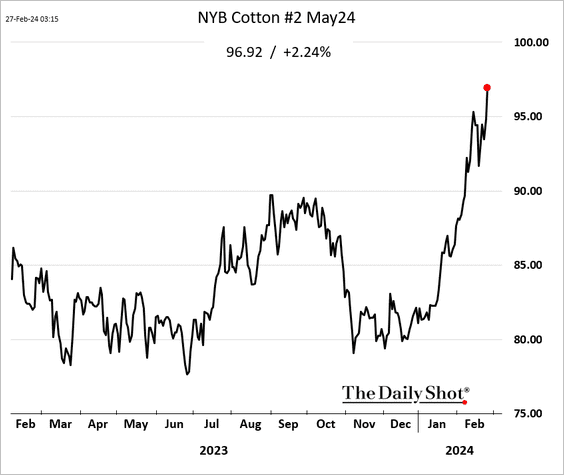

5. Cotton futures are surging.

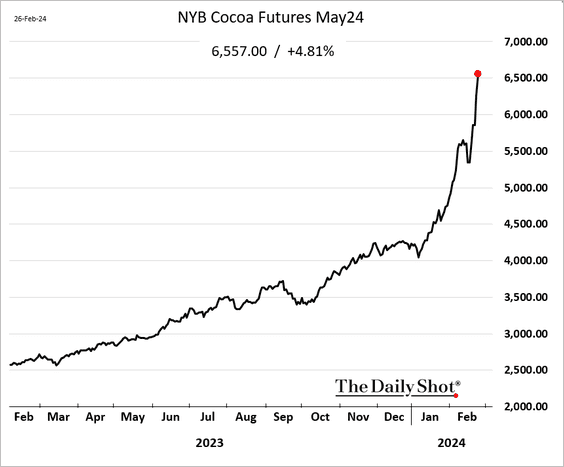

6. Cocoa prices keep hitting record highs.

Back to Index

Energy

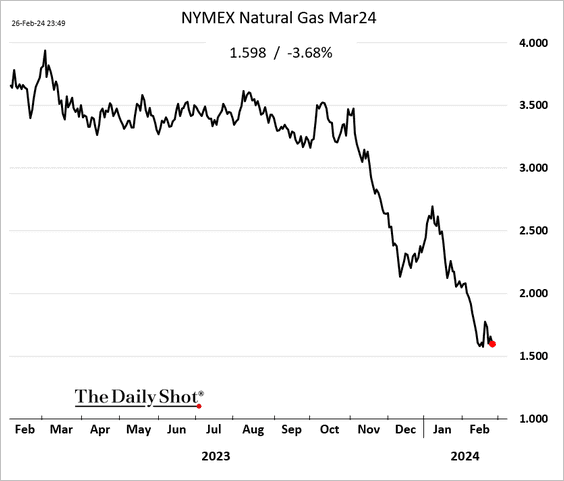

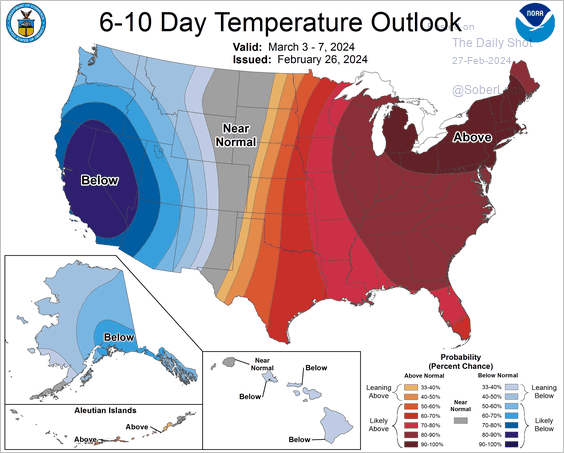

1. The recent jump in US natural gas prices proved to be fleeting, with forecasts calling for unusually warm weather in the eastern United States in the coming days.

Source: NOAA

Source: NOAA

——————–

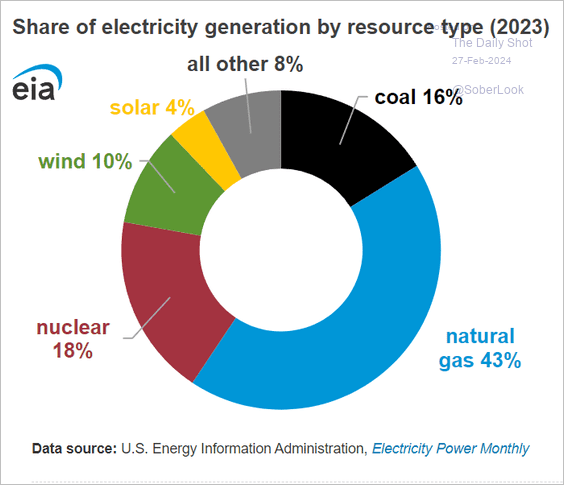

2. This chart shows the share of US electricity generation by resource type.

Source: @EIAgov

Source: @EIAgov

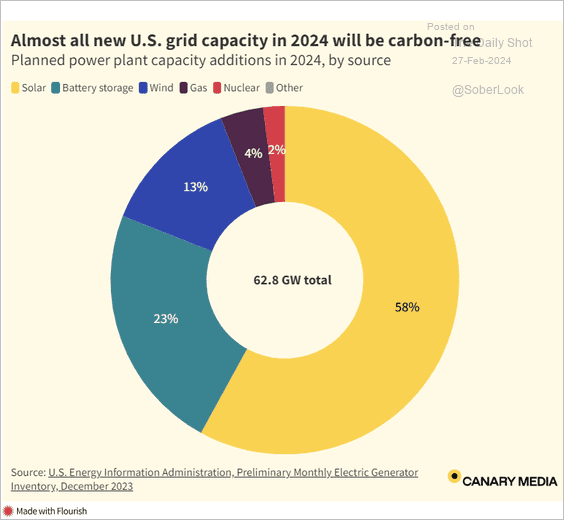

And here is a look at grid capacity additions in 2024.

Source: Canary Media Read full article

Source: Canary Media Read full article

Back to Index

Equities

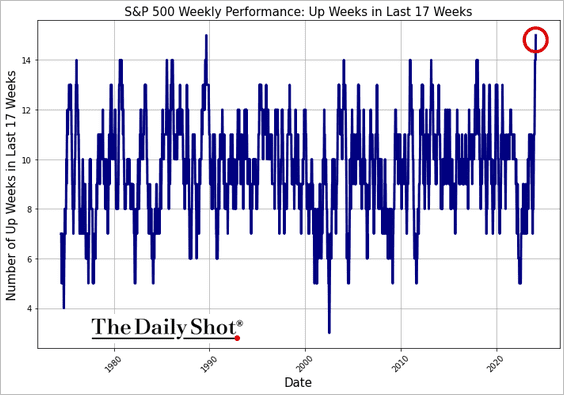

1. The S&P 500 has advanced for 15 of the last 17 weeks – the longest winning streak since 1989.

h/t Henry Allen, Deutsche Bank Research

h/t Henry Allen, Deutsche Bank Research

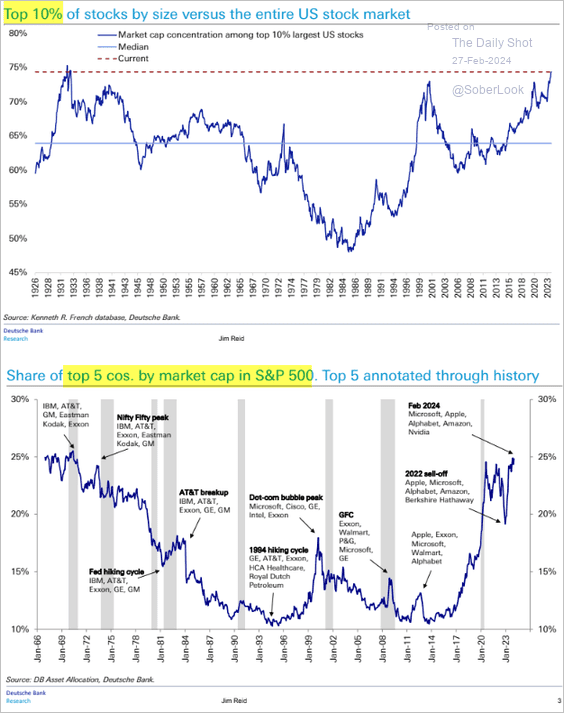

2. Rising market concentration remains a concern

Source: Deutsche Bank Research

Source: Deutsche Bank Research

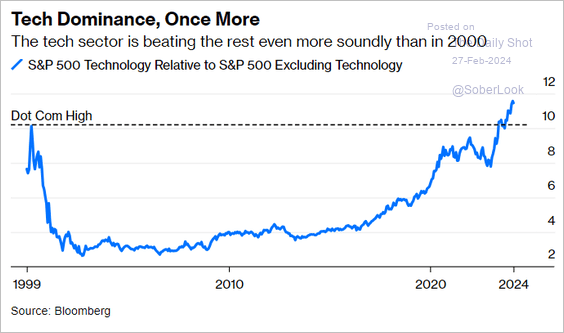

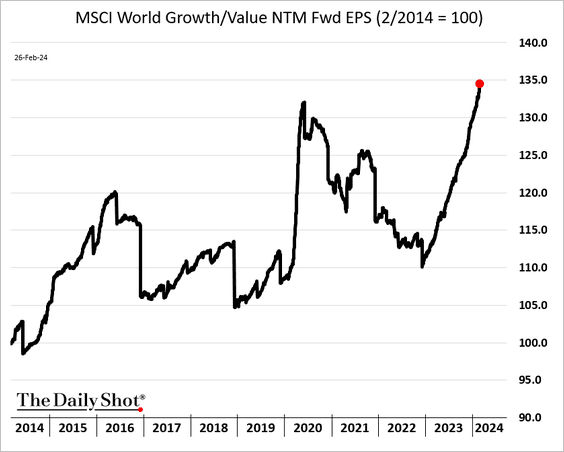

• Tech outperformance is hitting extreme levels.

Source: @johnauthers, @opinion Read full article

Source: @johnauthers, @opinion Read full article

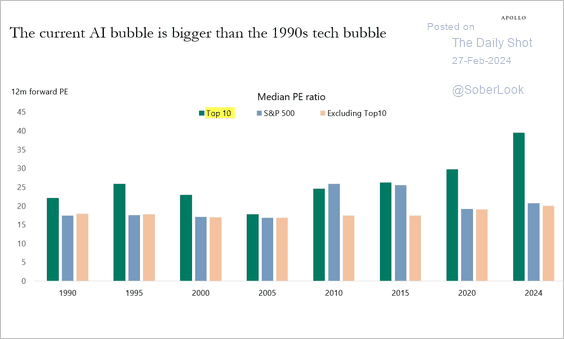

• The top-10 stock valuations look frothy.

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

——————–

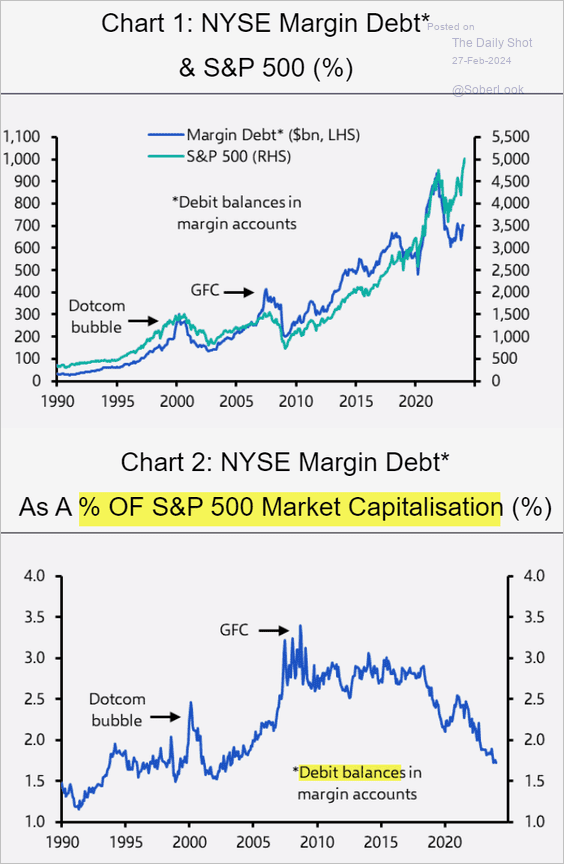

3. Current margin debt levels show limited leverage usage as the focus of leverage activities transitions into the options market.

Source: Capital Economics

Source: Capital Economics

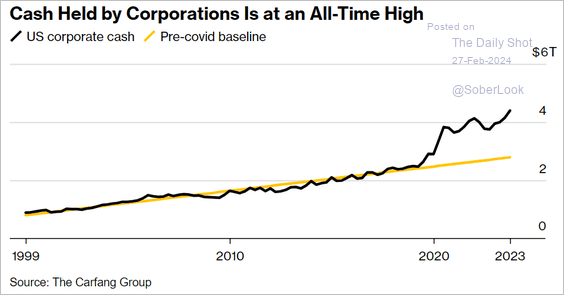

4. Corporate cash levels are at record highs.

Source: @markets Read full article

Source: @markets Read full article

5. Earnings expectations for global growth stocks are rapidly outpacing those for value stocks.

h/t Goldman Sachs

h/t Goldman Sachs

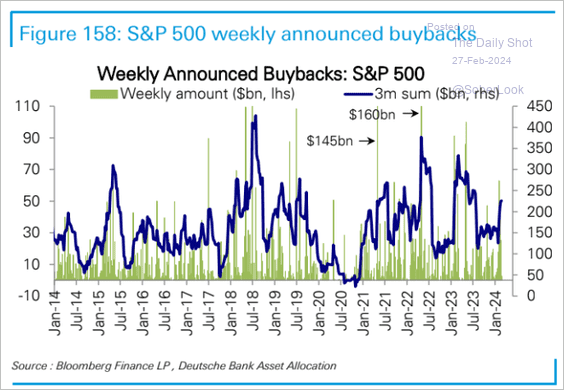

6. Buyback announcements have been rising.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

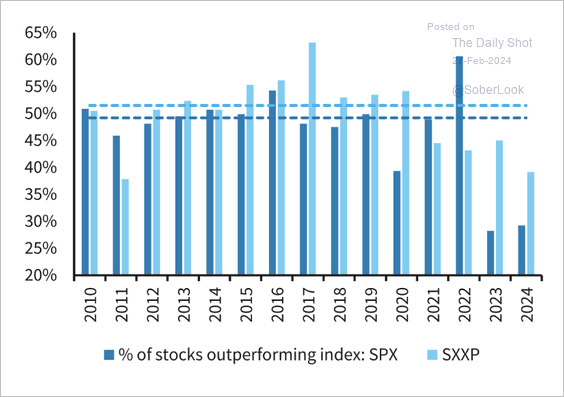

7. Market breadth has been narrow in the US but less so in Europe.

Source: Barclays Research

Source: Barclays Research

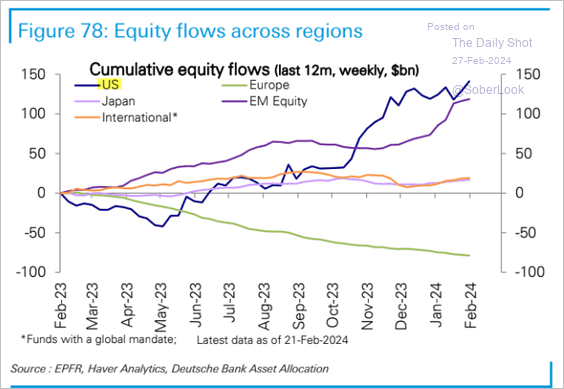

8. Here is a look at regional fund flows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

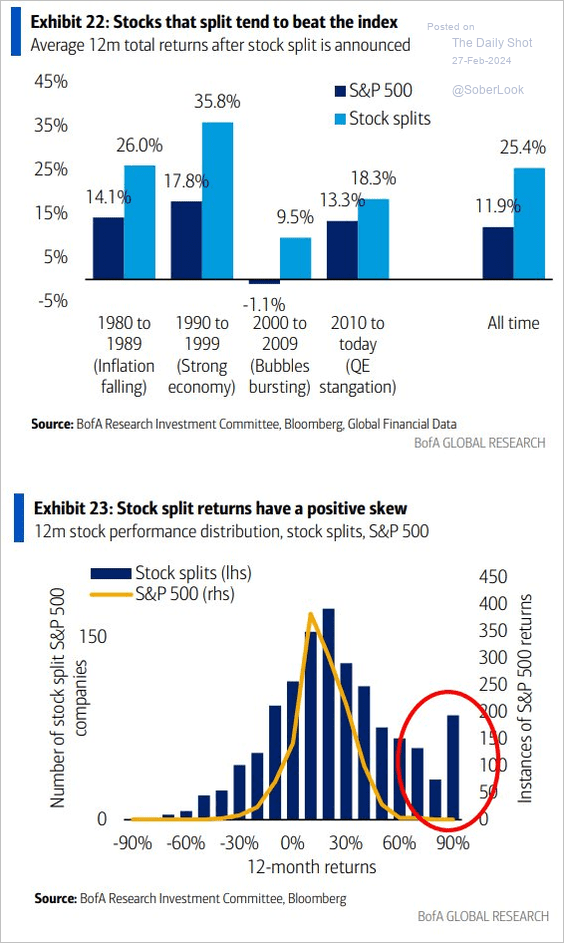

9. How does a stock split impact the share price?

Source: BofA Global Research

Source: BofA Global Research

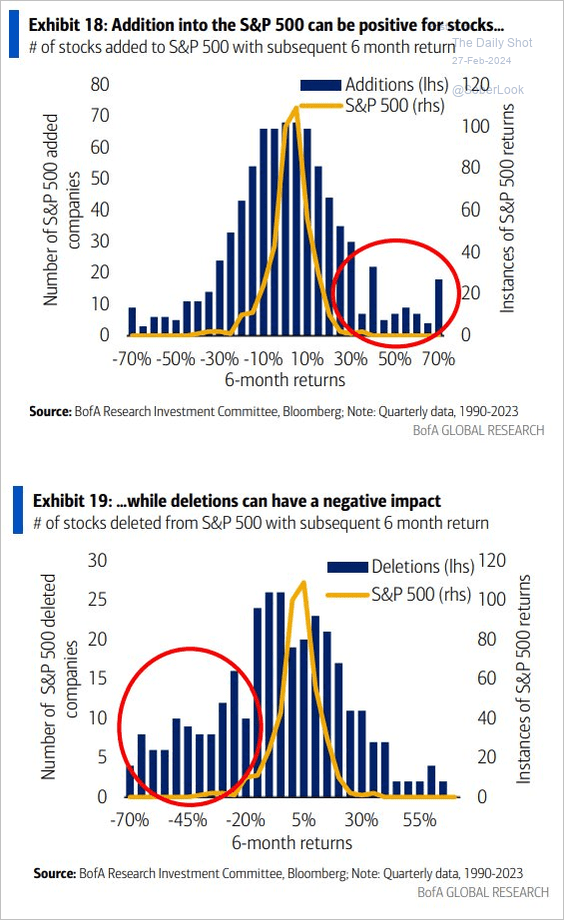

• How does being added to or removed from the S&P 500 affect a stock’s price?

Source: BofA Global Research

Source: BofA Global Research

——————–

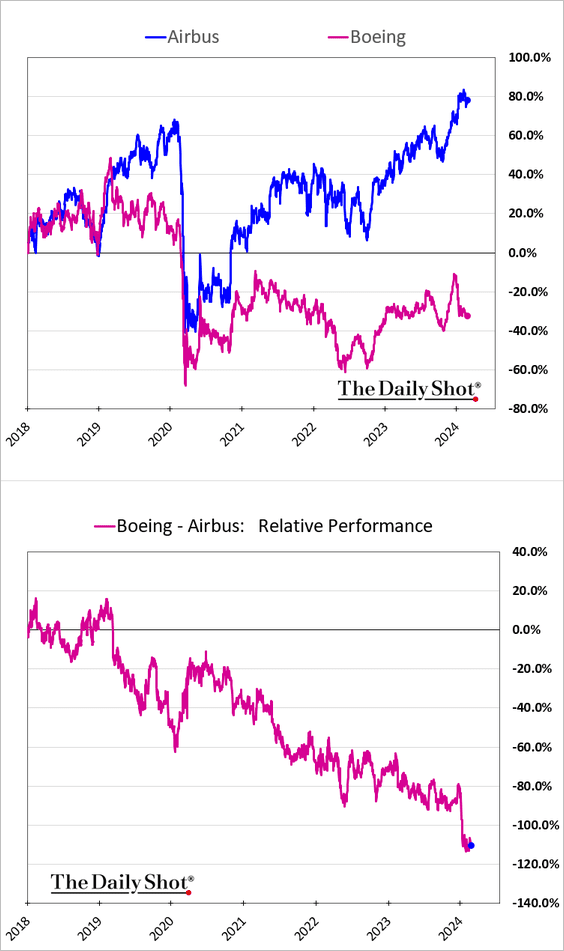

10. Boeing can’t catch a break. With China venturing into commercial aircraft production, the US manufacturer may face further challenges ahead.

Source: @business Read full article

Source: @business Read full article

Back to Index

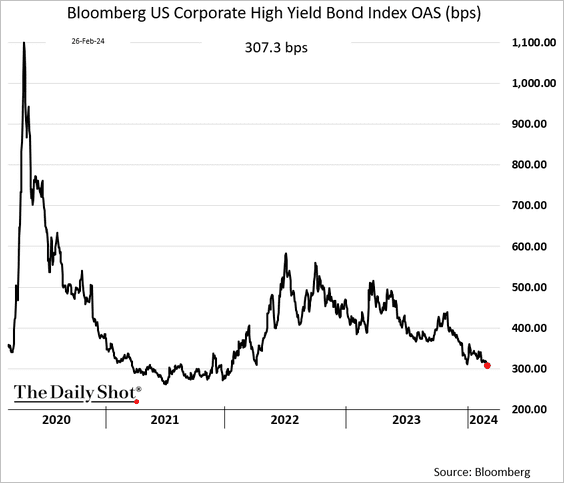

Credit

1. High-yield bond spreads continue to tighten.

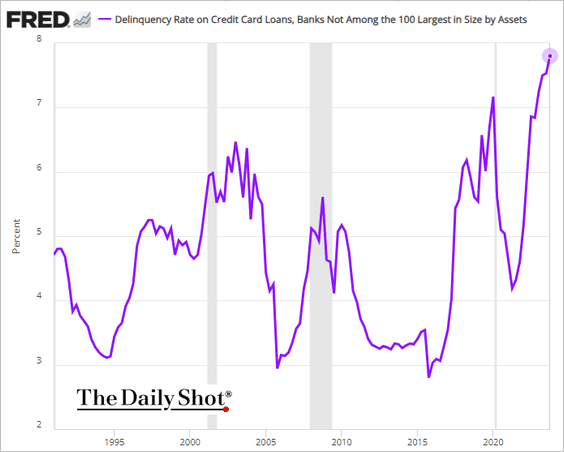

2. Small banks are reporting elevated delinquency rates on credit card debt.

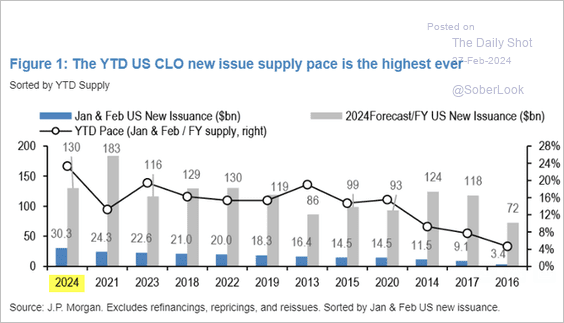

3. US CLO activity has been heating up.

Source: JP Morgan Research; @GunjanJS

Source: JP Morgan Research; @GunjanJS

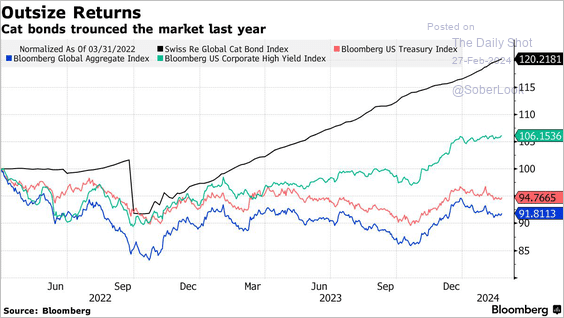

4. Cat bonds continue to outperform.

Source: @climate Read full article

Source: @climate Read full article

Back to Index

Rates

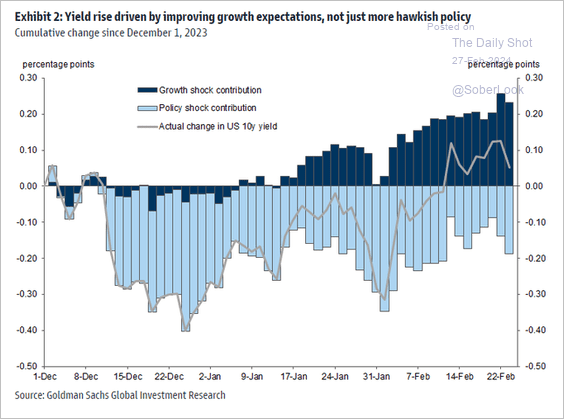

1. The recent increase in Treasury yields has been about economic growth expectations, not just hawkish monetary policy.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

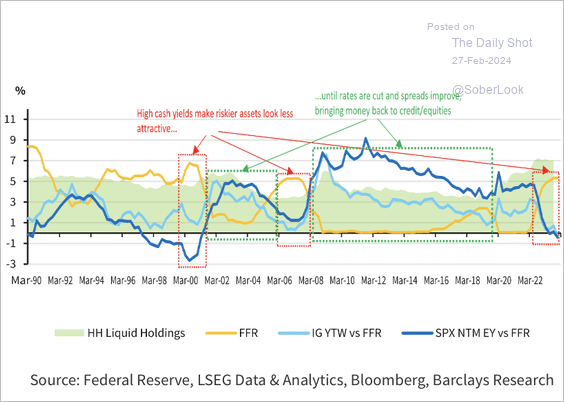

2. US cash yields are historically attractive compared to riskier assets’ yields. An easing cycle could trigger a flow out of cash and into risk assets.

Source: Barclays Research

Source: Barclays Research

Back to Index

Global Developments

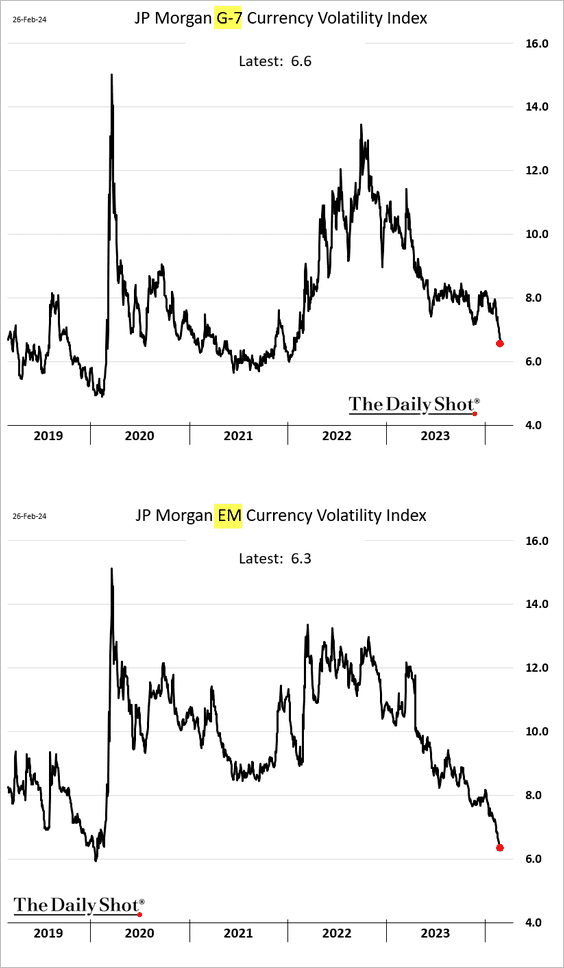

1. Implied volatility in the currency markets is crashing.

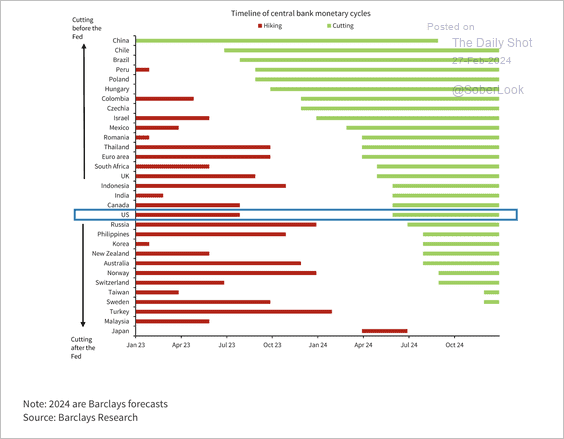

2. Barclays expects the ECB, BoE, and several EM central banks to start easing before the Fed.

Source: Barclays Research

Source: Barclays Research

——————–

Food for Thought

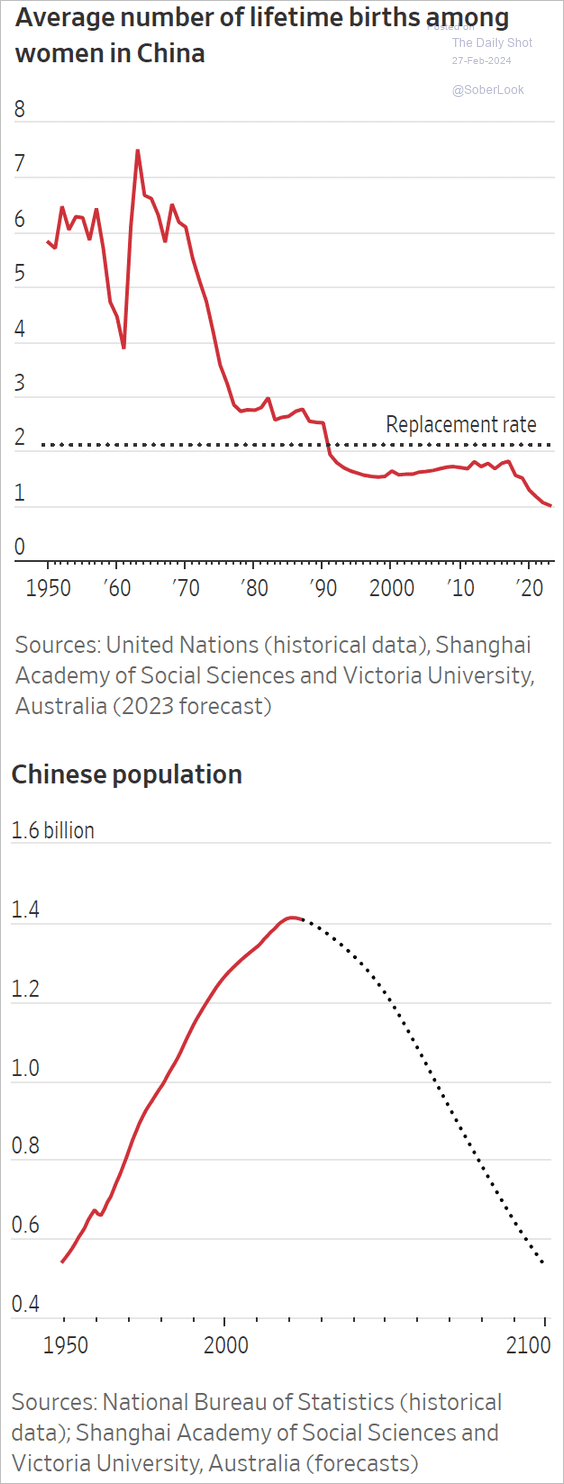

1. China’s daunting demographic challenges:

Source: @WSJ Read full article

Source: @WSJ Read full article

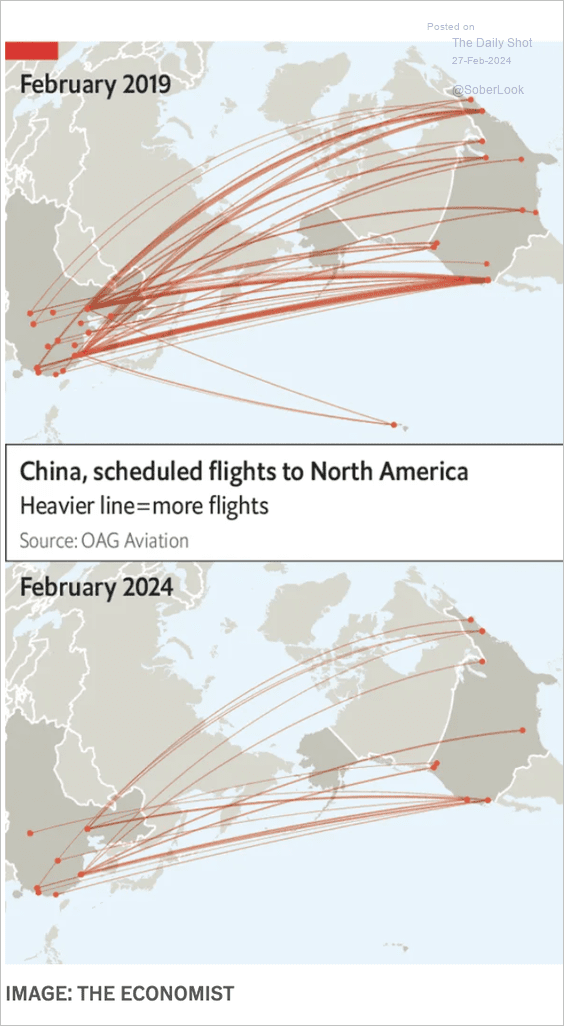

2. Flights from China to North America:

Source: The Economist Read full article

Source: The Economist Read full article

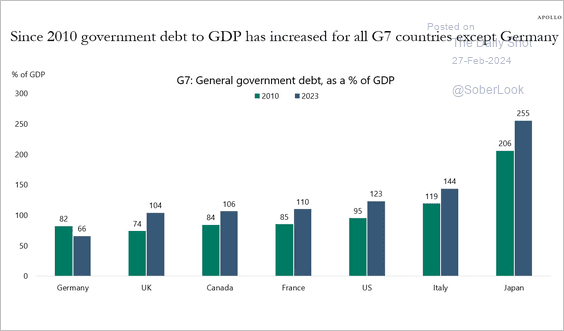

3. Changes in government debt-to-GDP ratios:

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

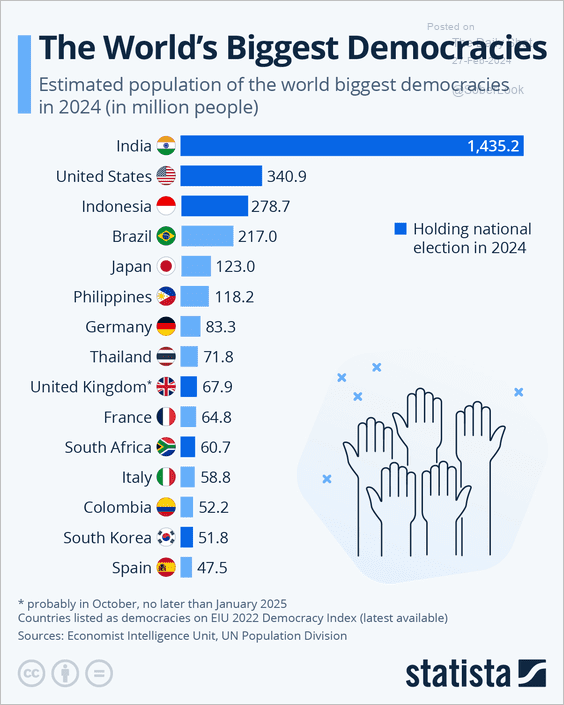

4. Democracies with the highest populations:

Source: Statista

Source: Statista

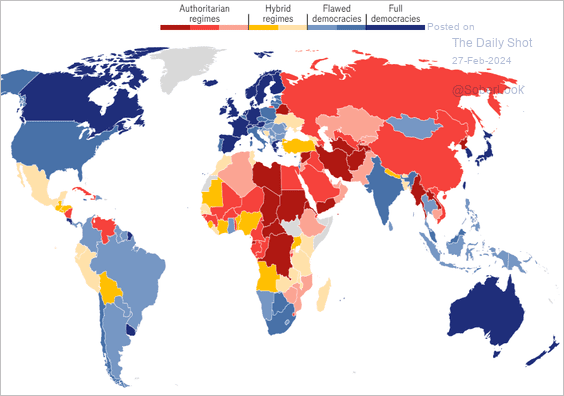

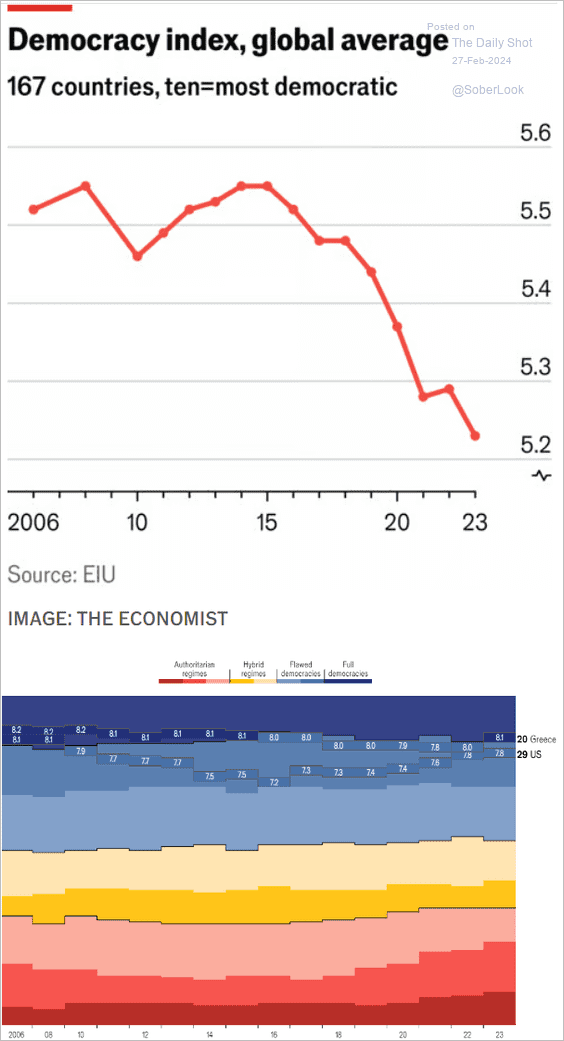

5. The EIU Democracy Index:

Source: The Economist Read full article

Source: The Economist Read full article

• The EIU Democracy Index over time:

Source: The Economist Read full article

Source: The Economist Read full article

——————–

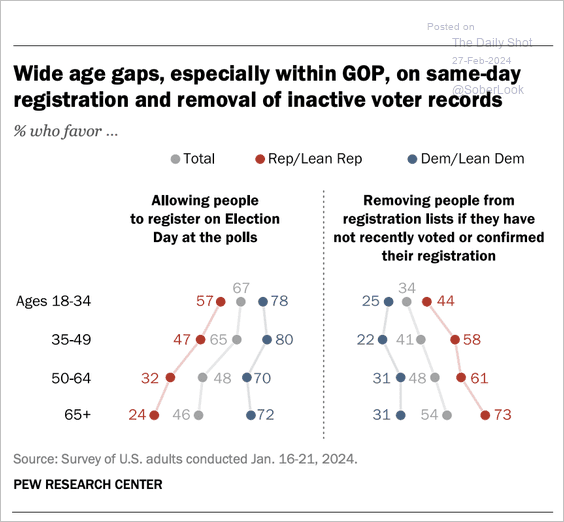

6. Views on removing inactive voters or allowing Election-Day registrations:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

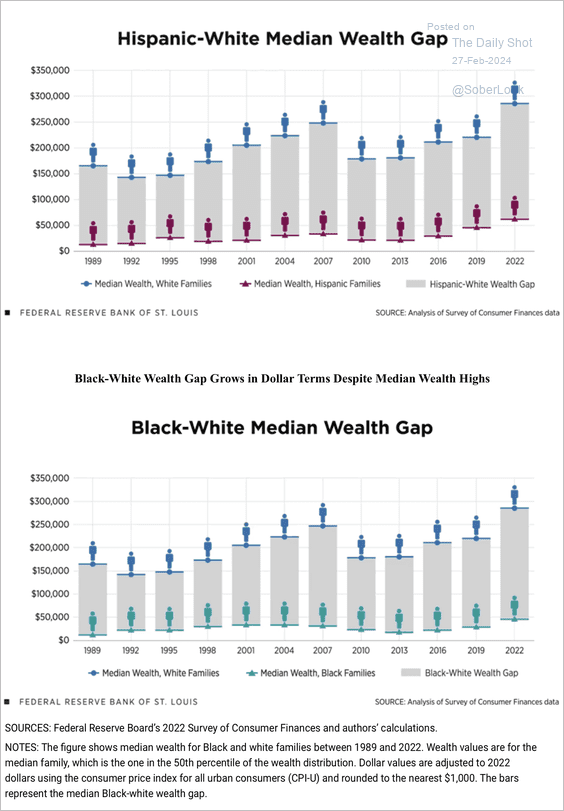

7. The racial wealth gap:

Source: St. Louis Fed Read full article

Source: St. Louis Fed Read full article

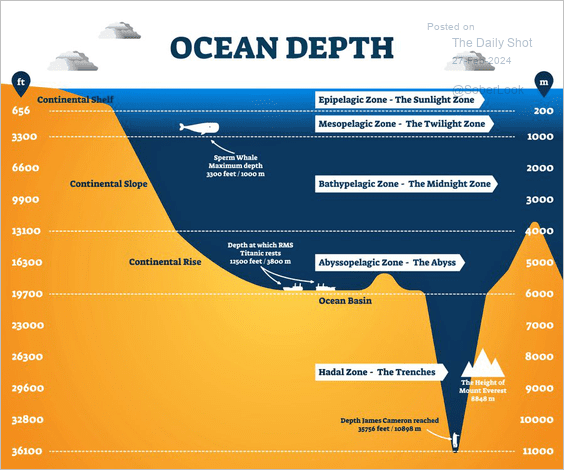

8. Ocean depth zones:

Source: @WorldAndScience

Source: @WorldAndScience

——————–

Back to Index