The Daily Shot: 28-Feb-24

• The United States

• Canada

• The Eurozone

• Japan

• Asia-Pacific

• Emerging Markets

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

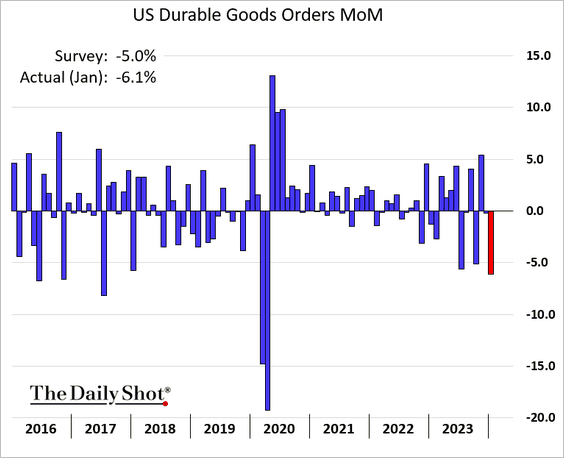

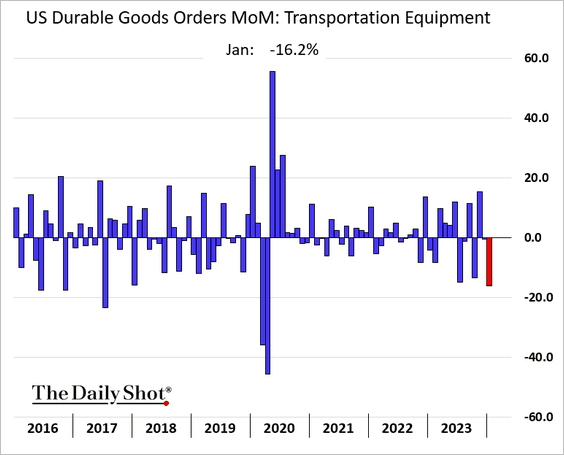

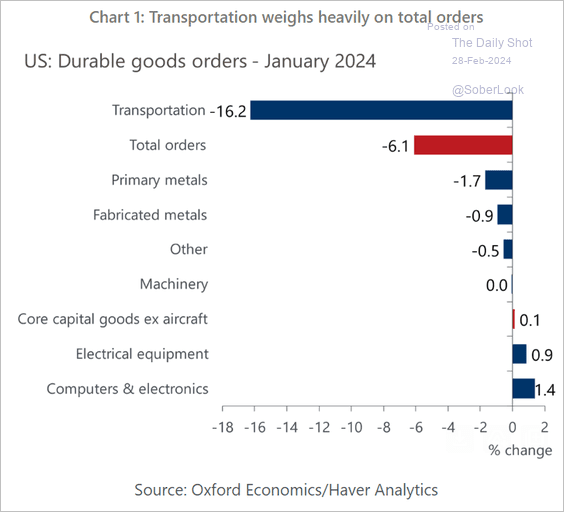

1. Durable goods orders dropped sharply in January, …

… primarily due to a decline in aircraft sales (which tend to be lumpy).

Source: Oxford Economics

Source: Oxford Economics

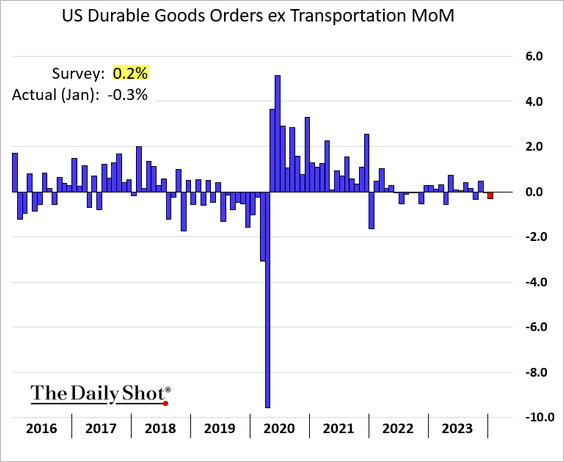

• Excluding transportation, there was still a slight reduction in orders for durable goods.

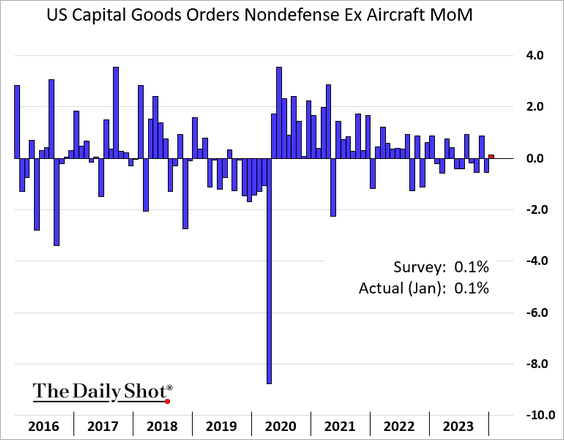

• Capital goods orders edged higher.

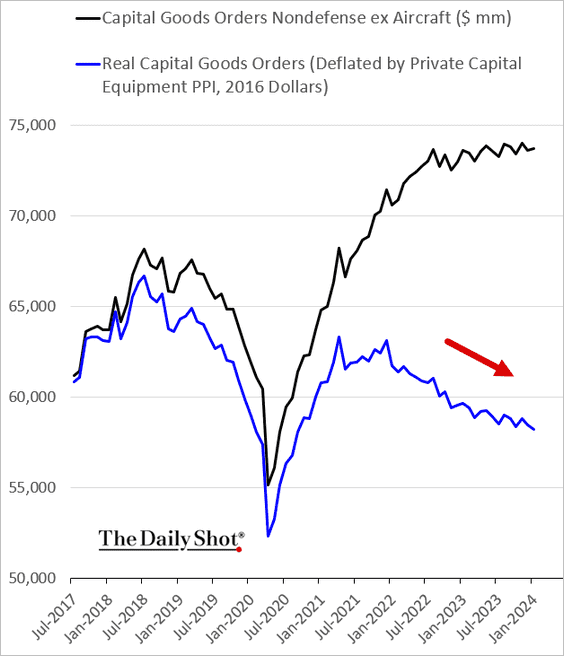

– However, capital goods orders keep trending down when adjusted for inflation, indicating softer business investment.

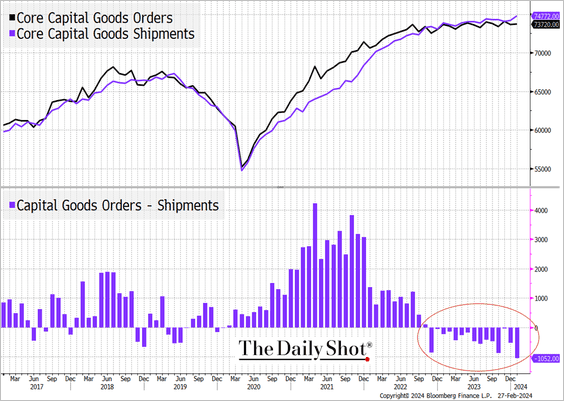

– Moreover, capital goods orders are now lagging shipments, signaling weaker demand.

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Eliza Winger, Bloomberg Economics

Source: @TheTerminal, Bloomberg Finance L.P.; h/t Eliza Winger, Bloomberg Economics

——————–

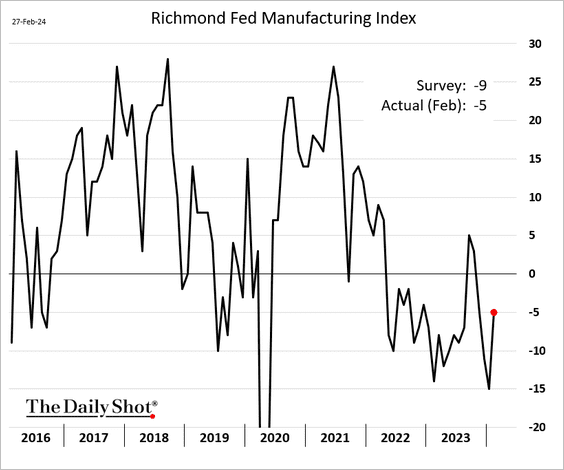

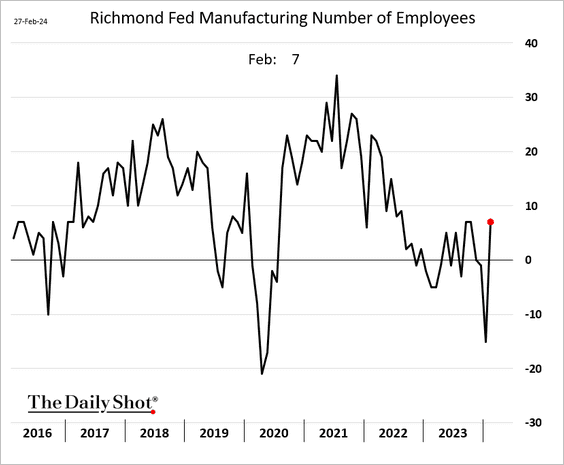

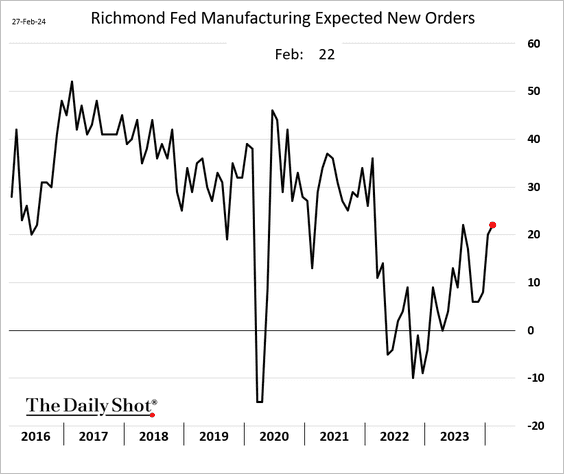

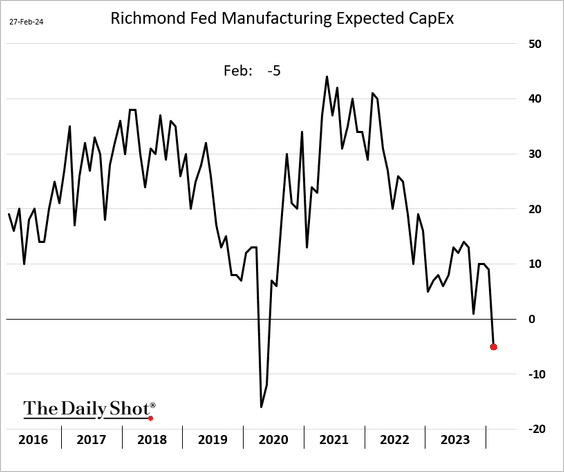

2. The Richmond Fed’s manufacturing report was mixed.

• Hiring and expected orders improved.

• But CapEx plans deteriorated.

——————–

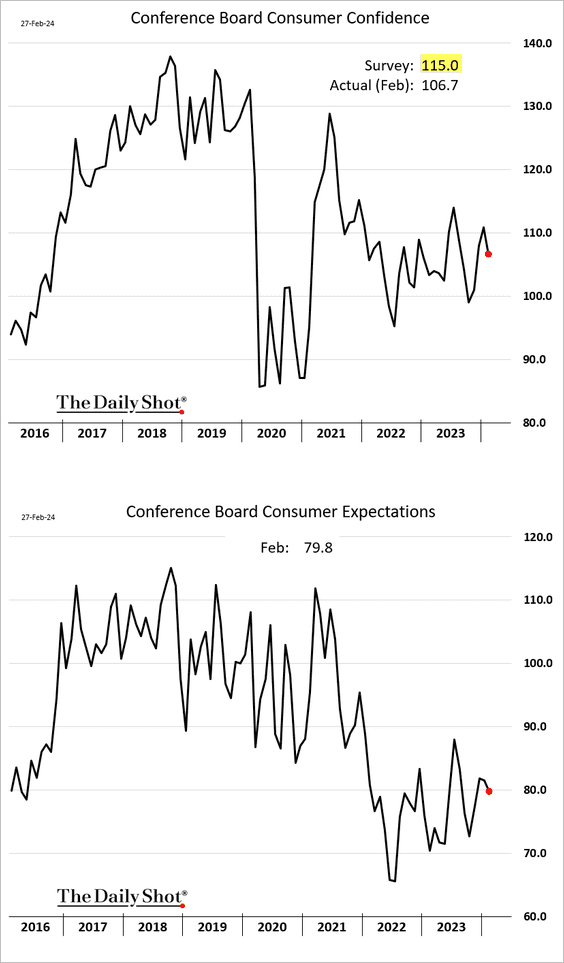

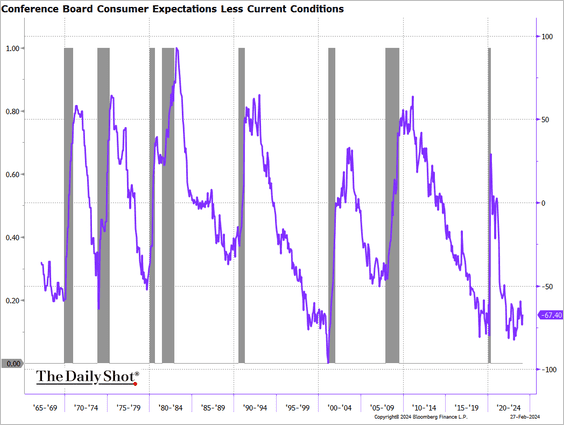

3. The Conference Board’s index of consumer confidence unexpectedly declined this month.

• The spread between expectations and current conditions remains at recessionary levels.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

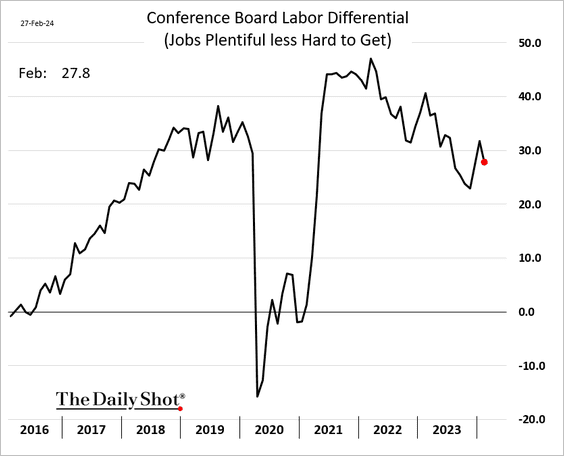

• Confidence in the job market edged lower.

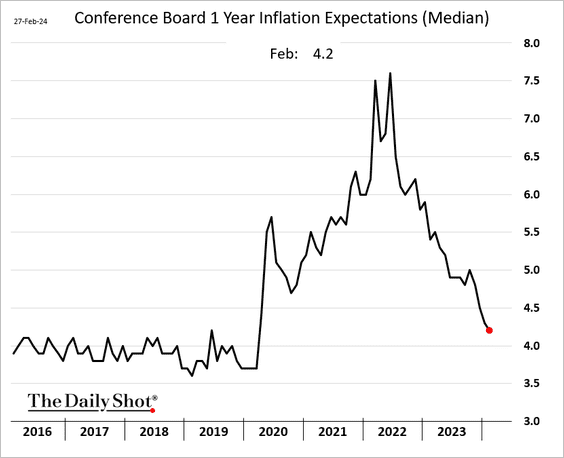

• Inflation expectations eased.

——————–

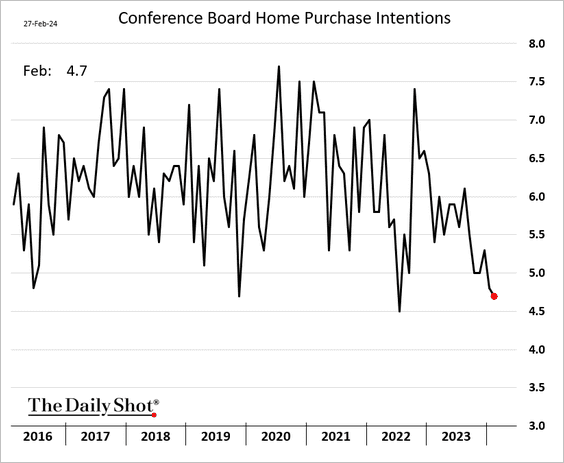

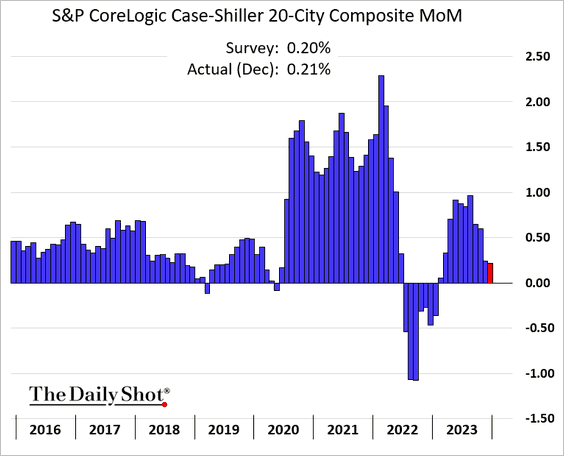

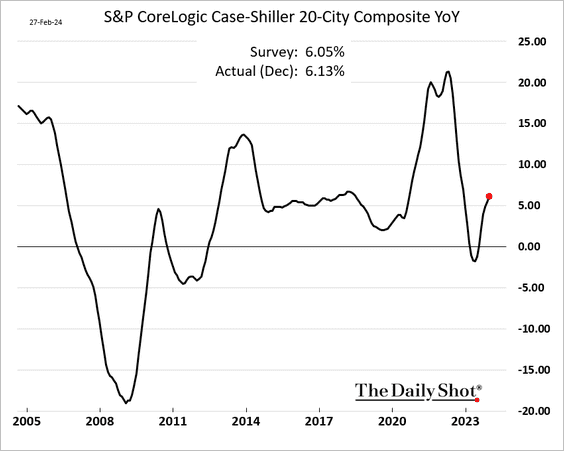

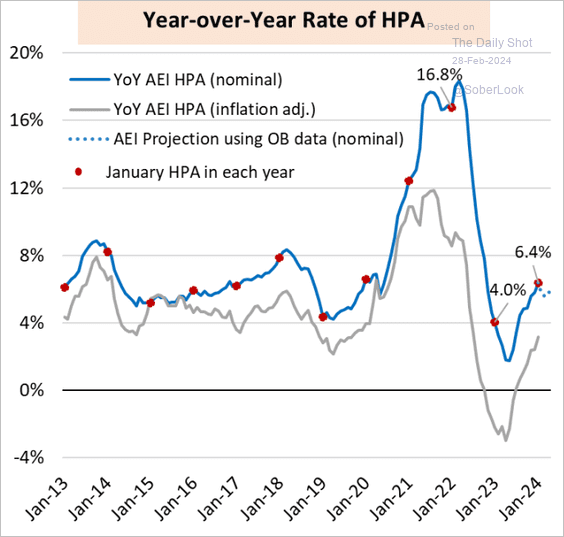

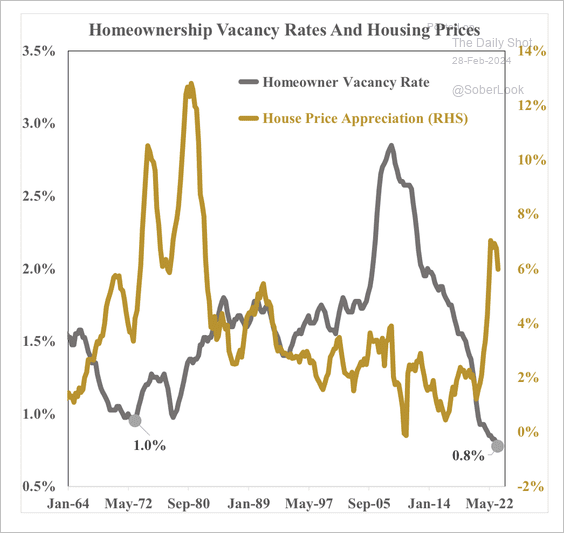

4. Next, we have some updates on the housing market.

• The Conference Board’s survey showed deteriorating intentions to purchase homes.

• Home prices climbed again in December.

For more current data, as Case-Shiller figures lag by two months, here is the home price index from Optimal Blue (via the AEI Housing Center), showing home price appreciation through January.

Source: AEI Housing Center

Source: AEI Housing Center

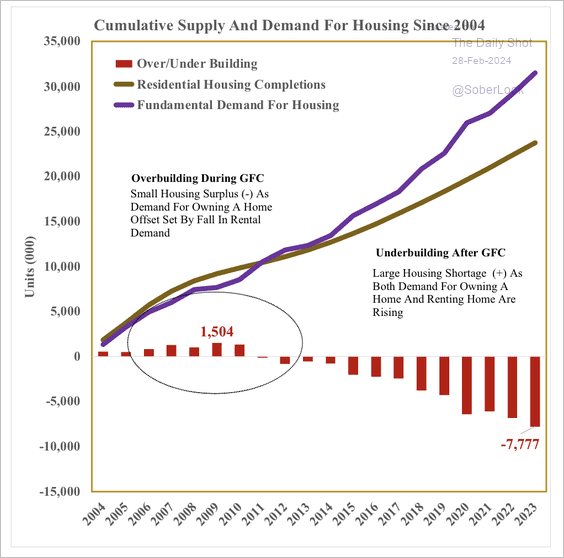

• Supply shortfalls have contributed to rising house prices.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

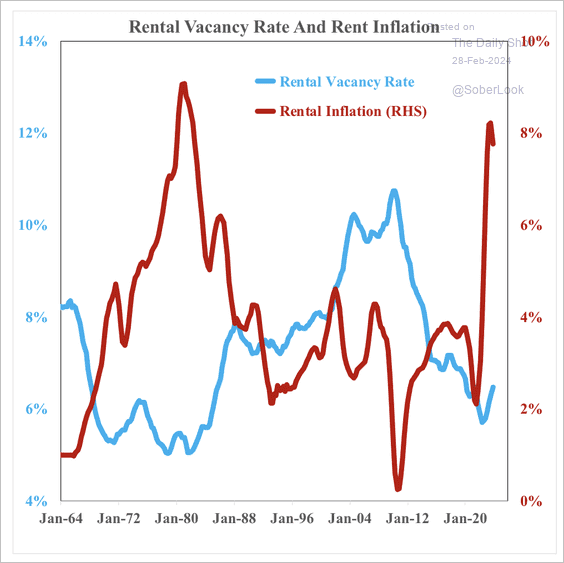

– Homeowner and rental vacancy rates remain low. (2 charts)

Source: SOM Macro Strategies

Source: SOM Macro Strategies

Source: SOM Macro Strategies

Source: SOM Macro Strategies

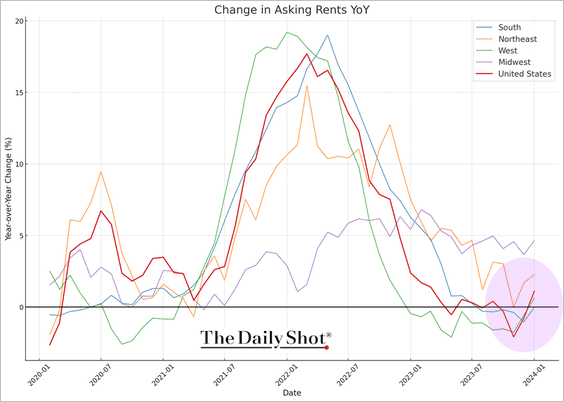

• As we saw yesterday, rents are rising again.

Source: Rent.

Source: Rent.

——————–

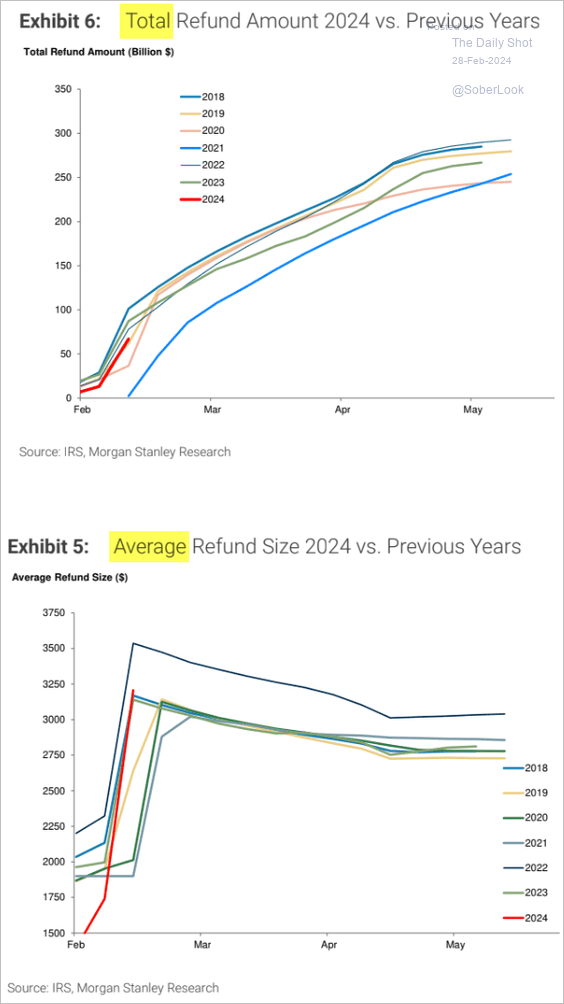

5. Finally, let’s take a look at tax refund trends (US total and average).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Canada

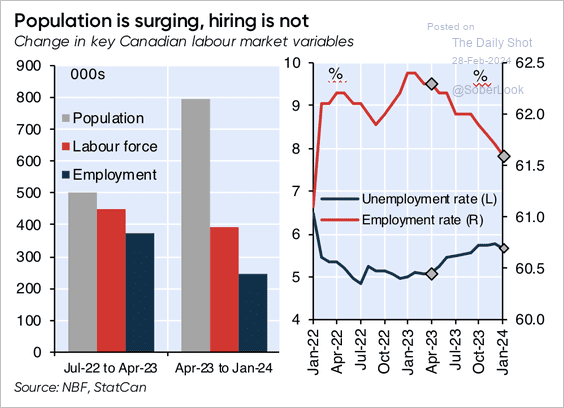

1. Hiring has not kept pace with the population surge (some of which was driven by the influx of students).

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

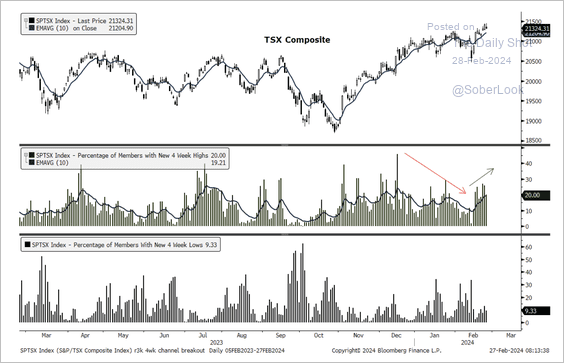

2. Short-term breadth is improving within the TSX Index.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

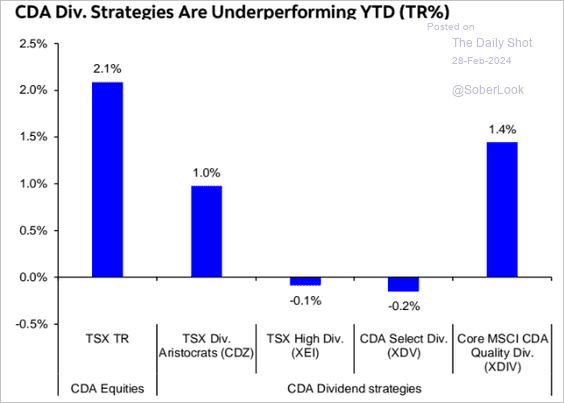

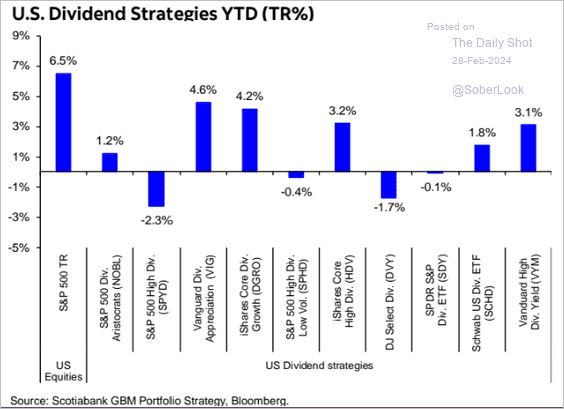

• Dividend strategies have underperformed this year.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

The Eurozone

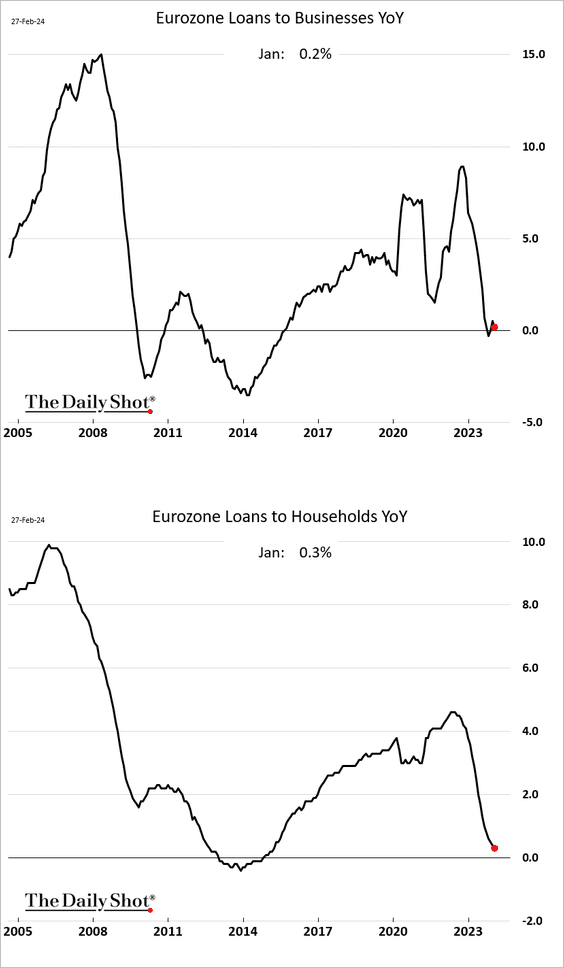

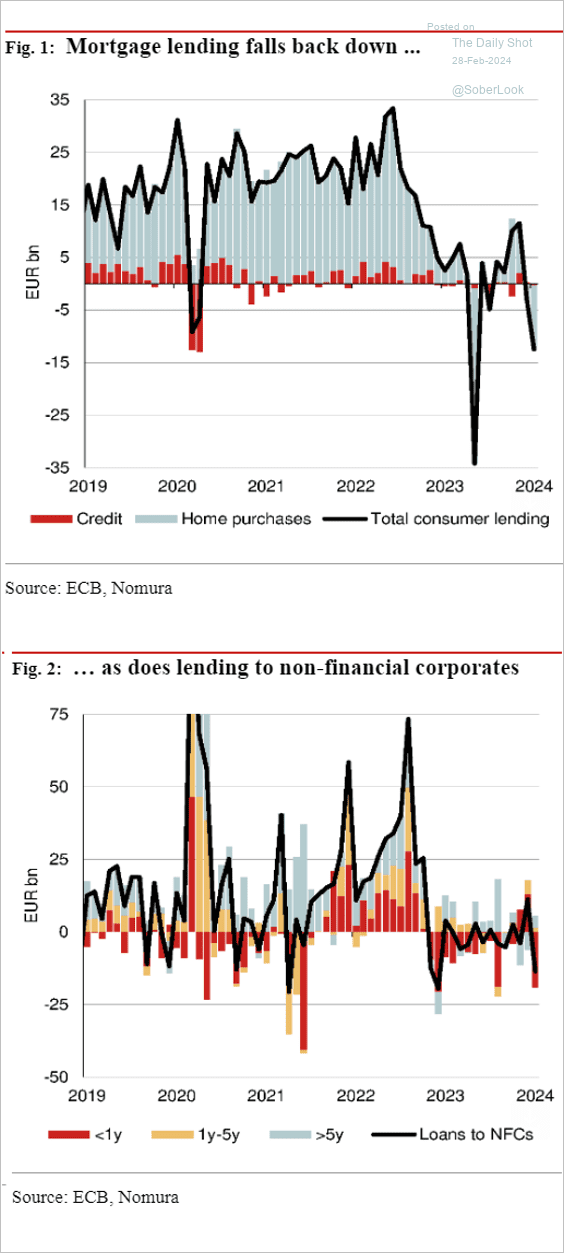

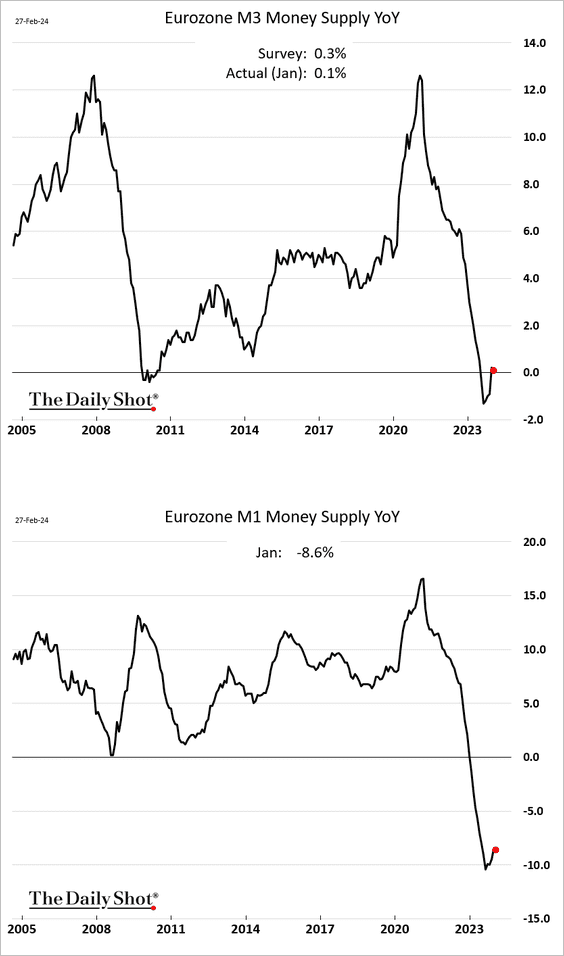

1. Credit growth in the euro area remains at a standstill.

• Loans (2 charts):

Source: Nomura Securities

Source: Nomura Securities

• The money supply:

——————–

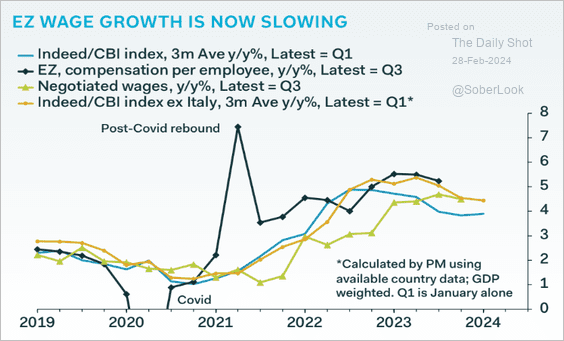

2. Wage growth is slowing.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

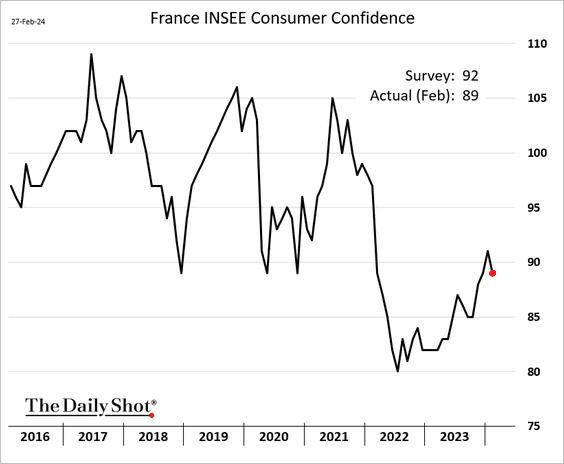

3. Fench consumer sentiment declined this month.

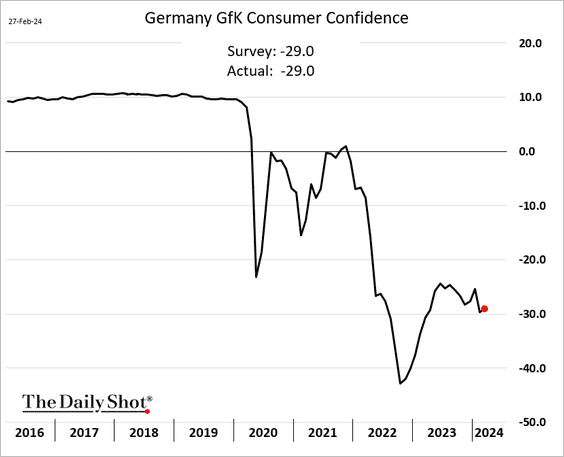

But German confidence edged higher.

——————–

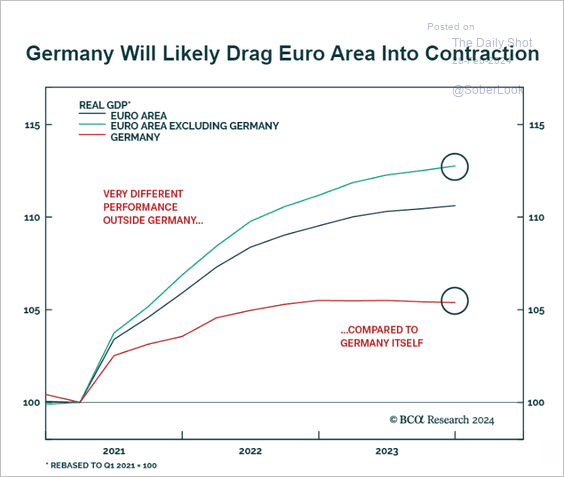

4. Here are a couple of additional updates on Germany.

• The nation’s economy has been a significant drag on the euro-area GDP.

Source: BCA Research

Source: BCA Research

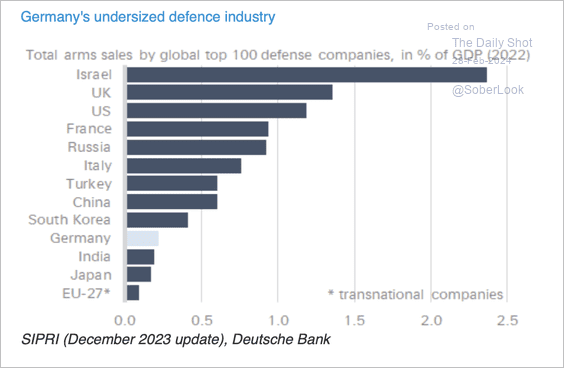

• Germany’s defense industry is comparatively small as a percent of GDP.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Japan

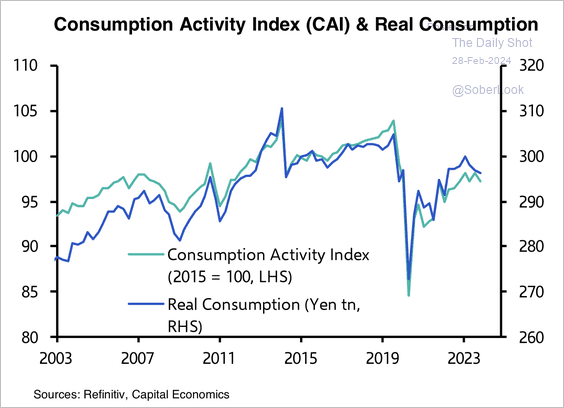

1. The post-pandemic rise in consumption activity has stalled.

Source: Capital Economics

Source: Capital Economics

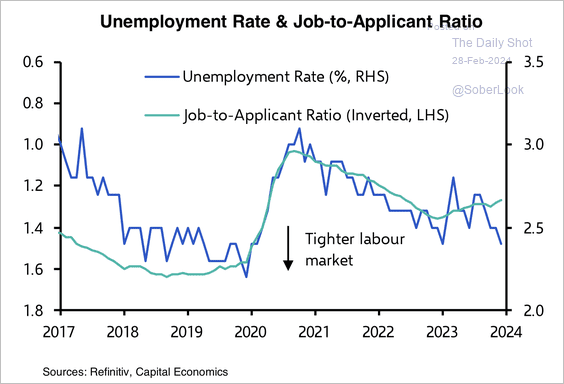

2. The rise in the jobs-to-application ratio suggests the labor market will loosen from here.

Source: Capital Economics

Source: Capital Economics

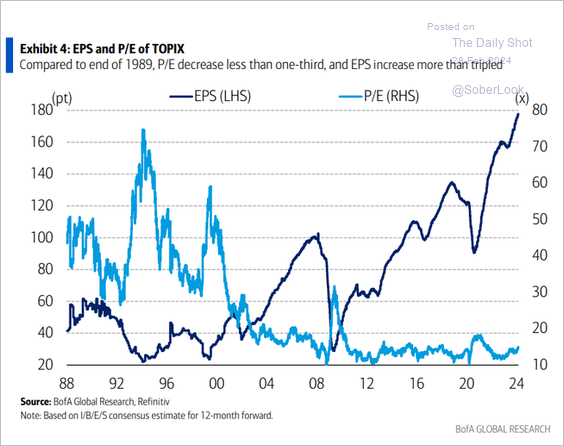

3. Japan’s corporate profits have seen a significant upswing, maintaining balanced valuations even amidst a massive market rally.

Source: BofA Global Research

Source: BofA Global Research

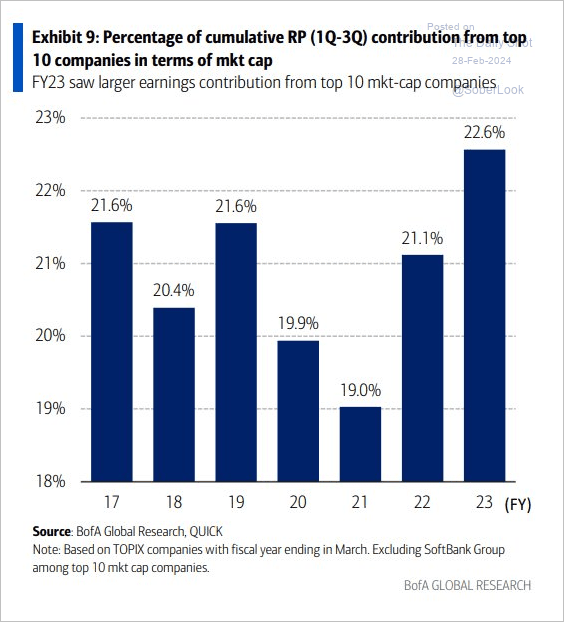

• Earnings have become more concentrated.

Source: BofA Global Research

Source: BofA Global Research

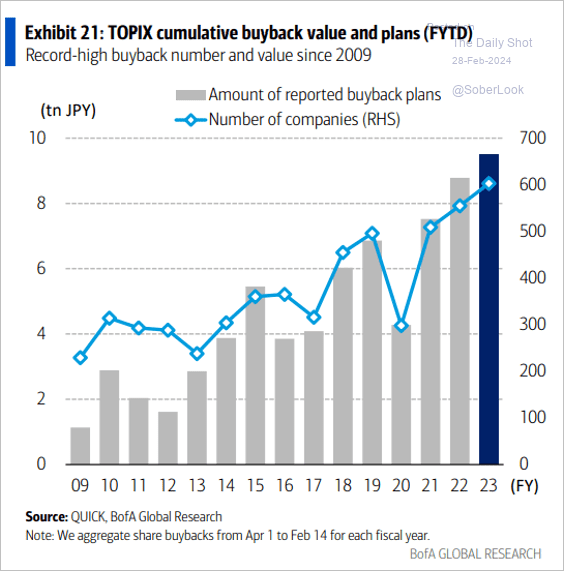

• Share buybacks have accelerated.

Source: BofA Global Research

Source: BofA Global Research

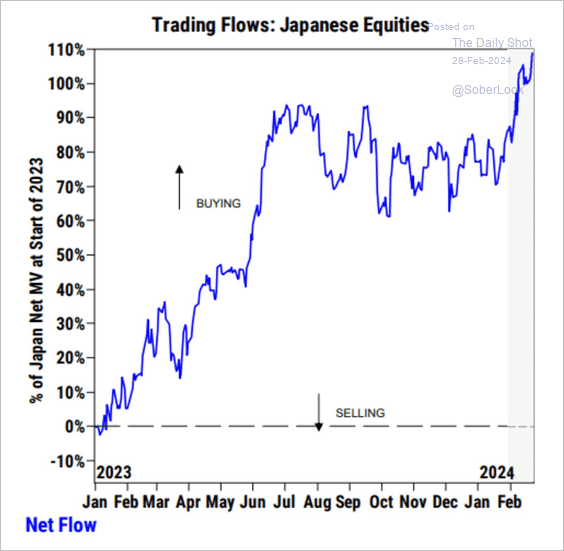

• Hedge funds have been loading up on Japanese stocks.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

Back to Index

Asia-Pacific

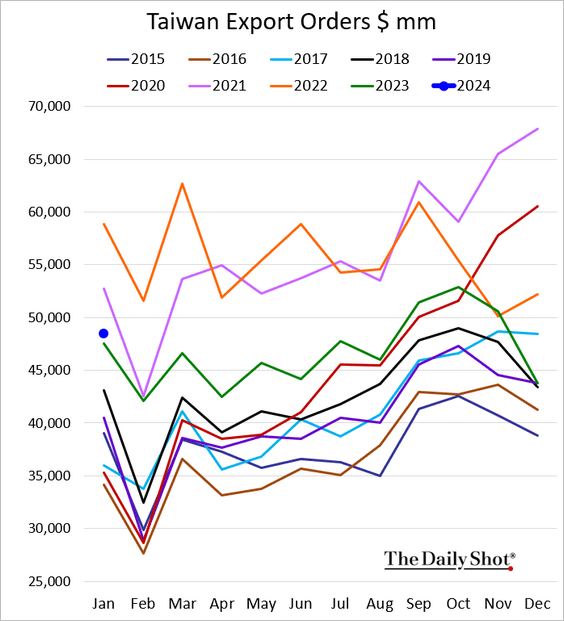

1. Taiwan’s export orders were above last year’s levels in January.

Source: South China Morning Post Read full article

Source: South China Morning Post Read full article

——————–

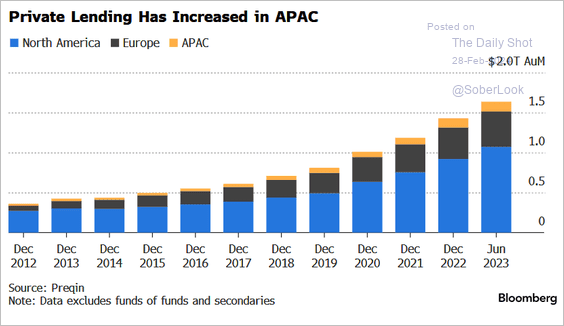

2. We are starting to see more private credit deals in Asia-Pacific.

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

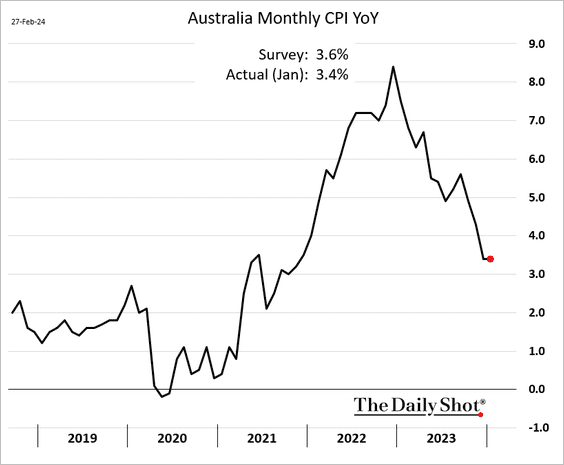

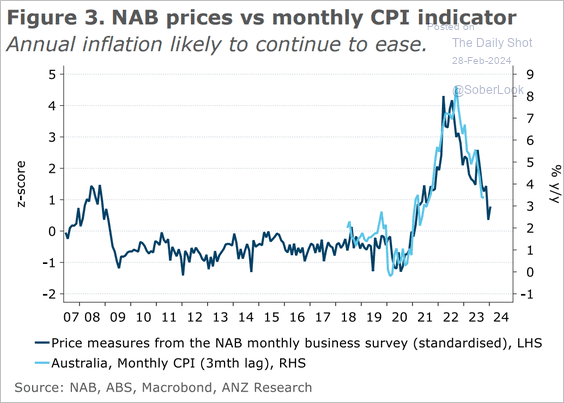

3. Australia’s monthly CPI estimate was lower than expected.

Source: Reuters Read full article

Source: Reuters Read full article

Business surveys point to further declines ahead.

Source: @ANZ_Research

Source: @ANZ_Research

——————–

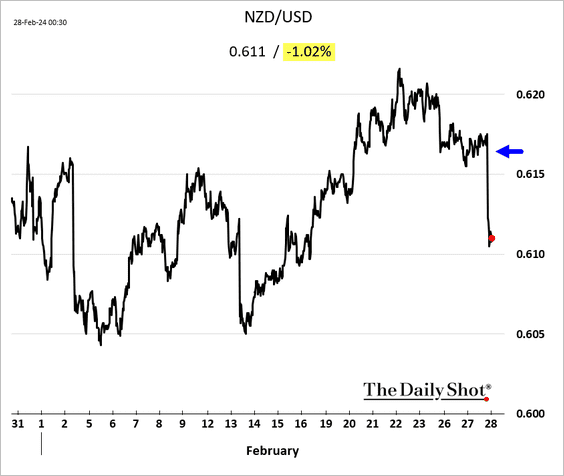

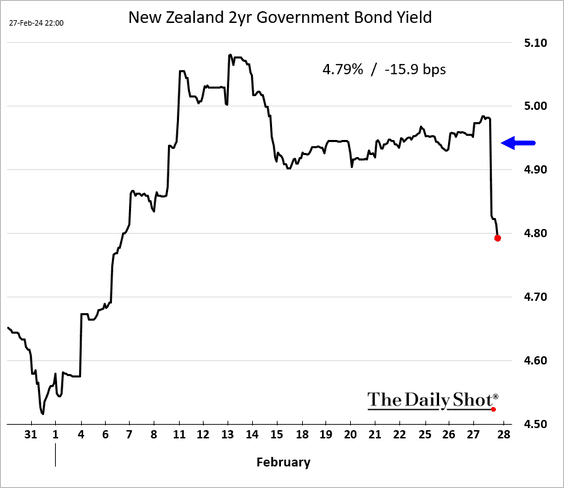

4. The RBNZ left rates unchanged. The market saw the central bank’s comments as a bit more dovish (a “softer” threat of a hike), sending the Kiwi dollar and bond yields sharply lower.

Back to Index

Emerging Markets

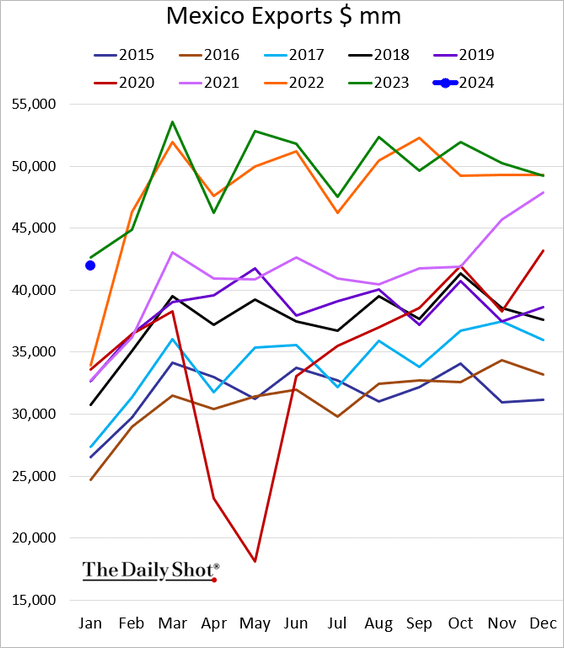

1. Mexican exports last month were slightly softer than in January of 2023.

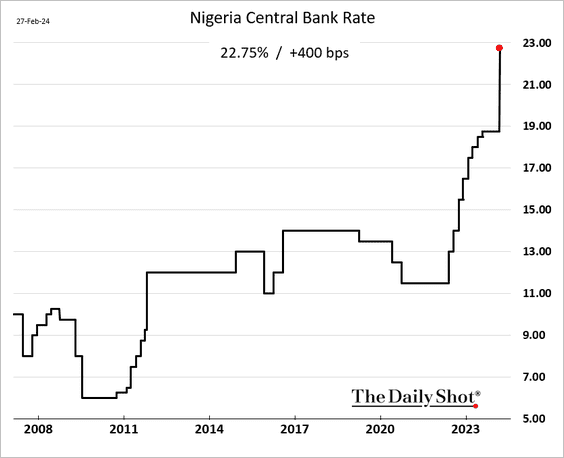

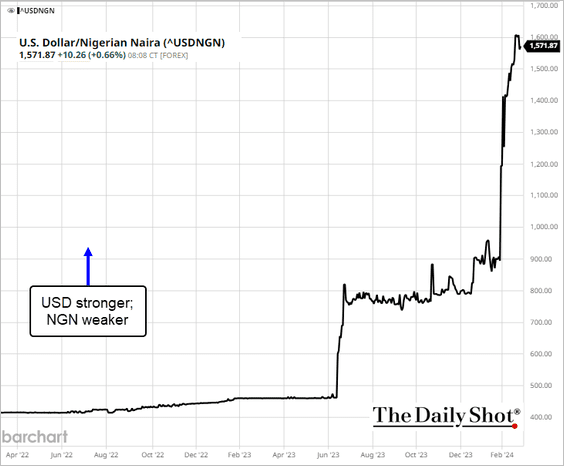

2. Nigeria’s central bank delivered an aggressive rate hike, …

… after the nation’s massive currency devaluation.

Back to Index

Equities

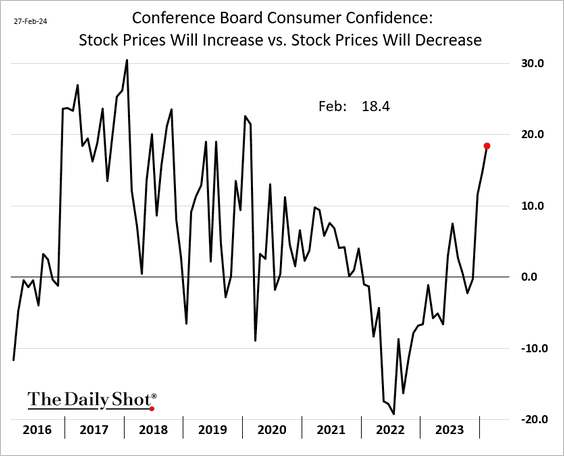

1. The Conference Board’s consumer sentiment report shows growing bullish sentiment among US households.

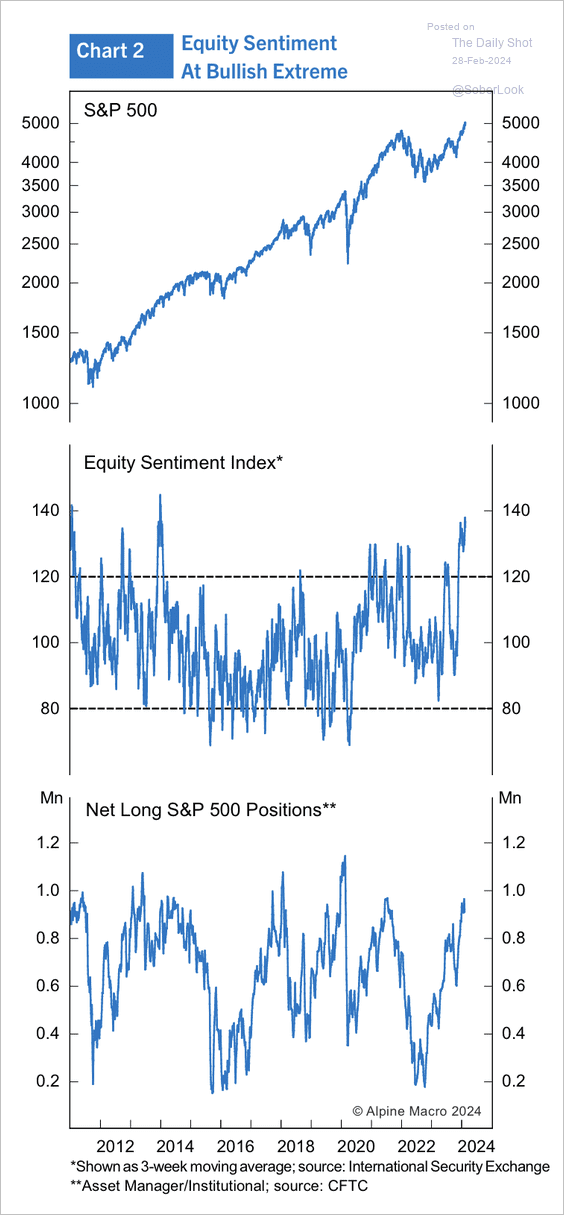

• S&P 500 sentiment appears stretched.

Source: Alpine Macro

Source: Alpine Macro

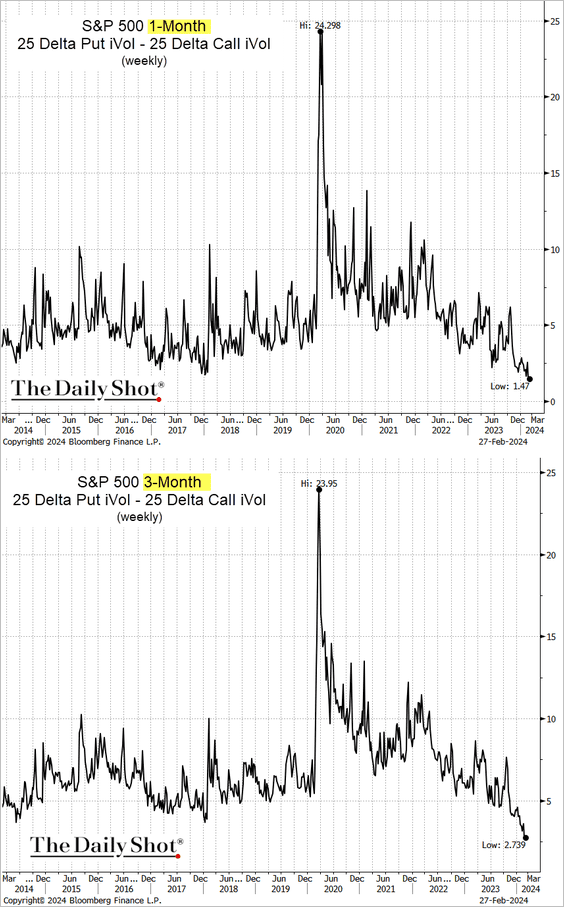

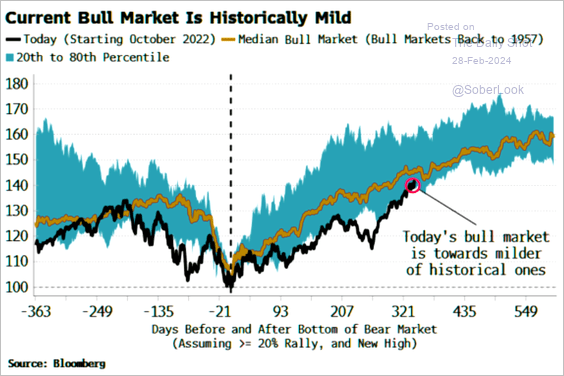

• Market sentiment looks particularly stretched in the options market, with traders increasingly betting on asymmetric outcomes. Complacency is setting in.

– S&P 500 skew (lowest in at least a decade):

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Nasdaq 100 skew:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

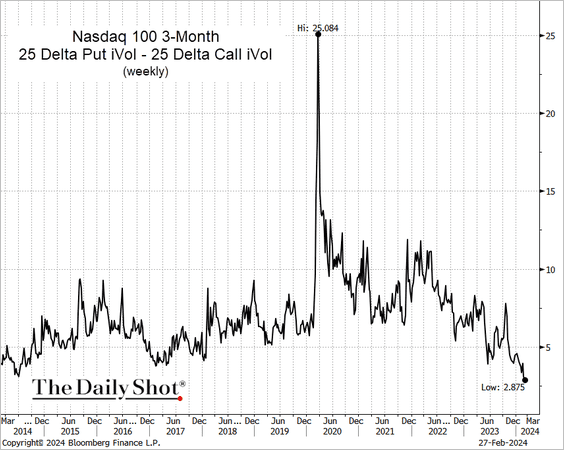

• Russell 2000 skew:

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• ARK Innovation ETF skew:

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

——————–

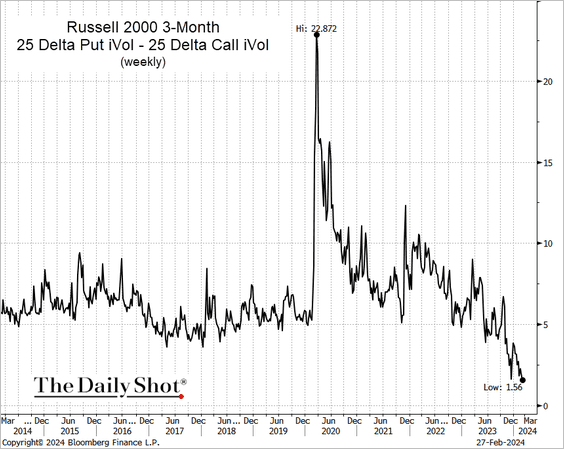

2. The current bull market remains below the median trajectory.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

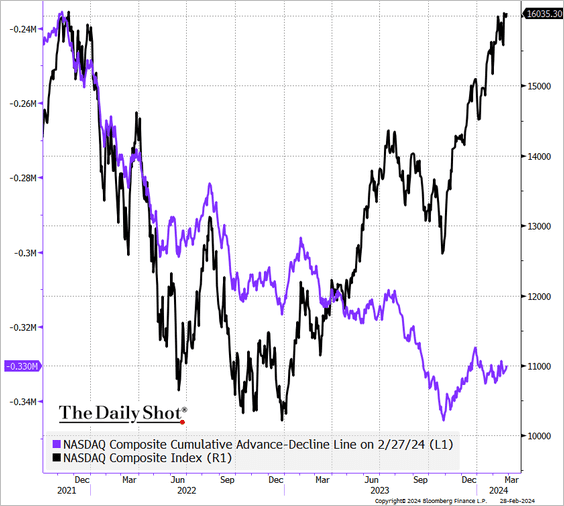

3. The Nasdaq Composite breadth has been weak.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

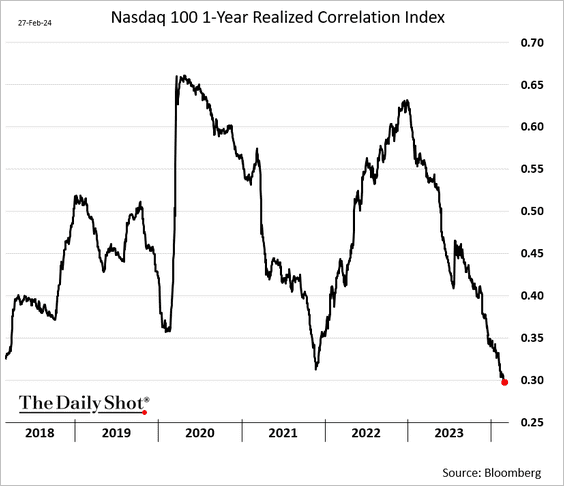

4. The correlation among Nasdaq 100 stocks has been trending lower.

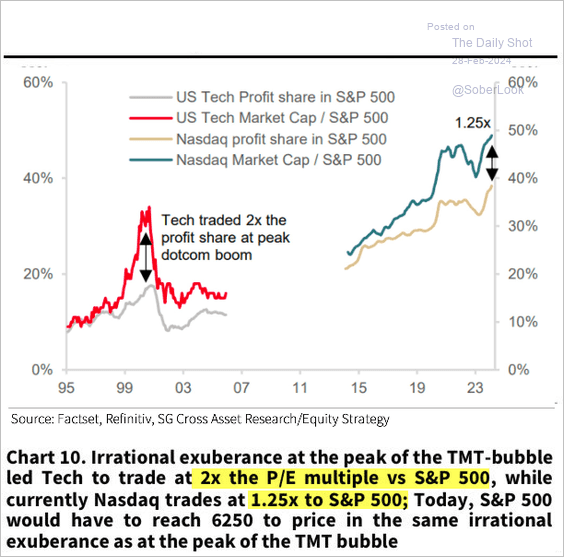

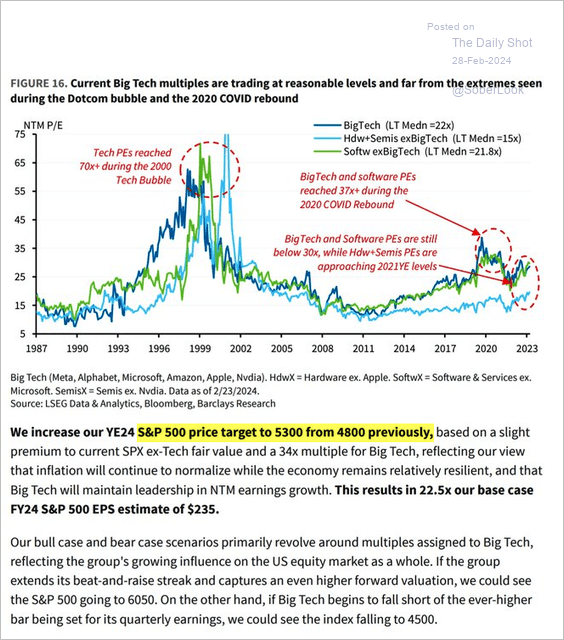

5. Tech valuations are not nearly as stretched as they were at the height of the dot-com rally (2 charts).

Source: Societe Generale Cross Asset Research; @Marlin_Capital

Source: Societe Generale Cross Asset Research; @Marlin_Capital

Source: Barclays Research; @WallStJesus

Source: Barclays Research; @WallStJesus

——————–

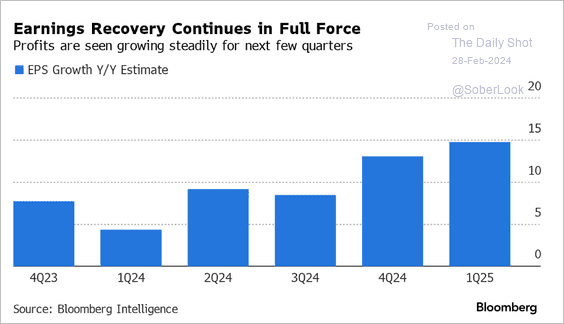

6. The market expects earnings growth to keep climbing over the next few quarters.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

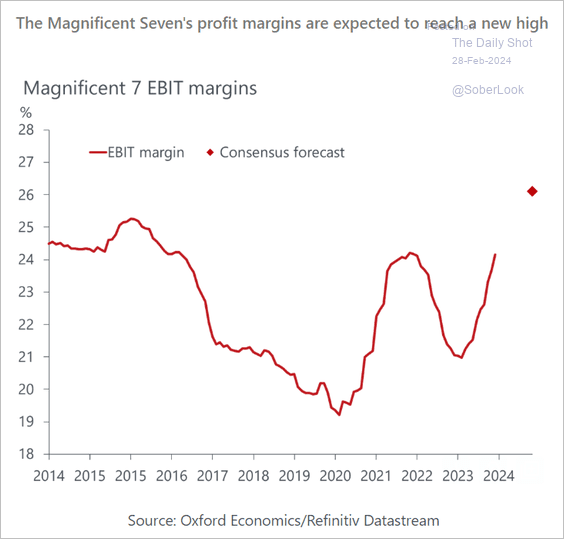

7. Is the expected margin growth for the Magnificent 7 firms becoming stretched?

Source: Oxford Economics

Source: Oxford Economics

8. Here is a look at the year-to-date performance across dividend strategies.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

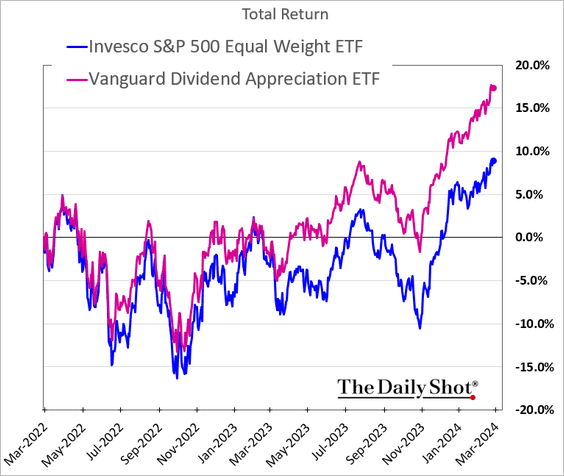

• Although dividend strategies have underperformed the S&P 500 overall, some are outperforming the average stock within the index. Below is the dividend growers ETF versus the S&P 500 equal-weight ETF.

——————–

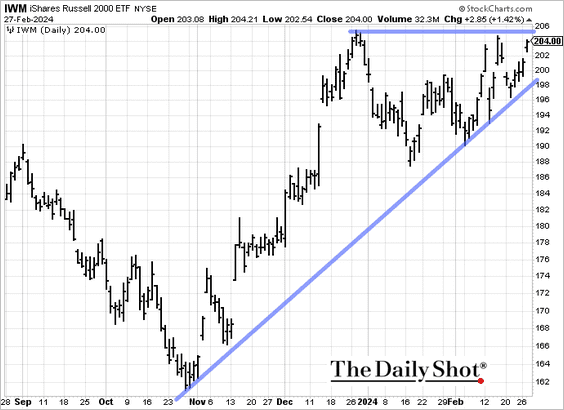

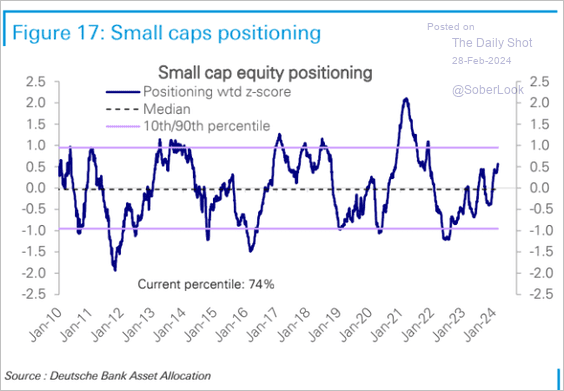

9. Next, we have some updates on small caps.

• A breakout ahead for Russell 2000?

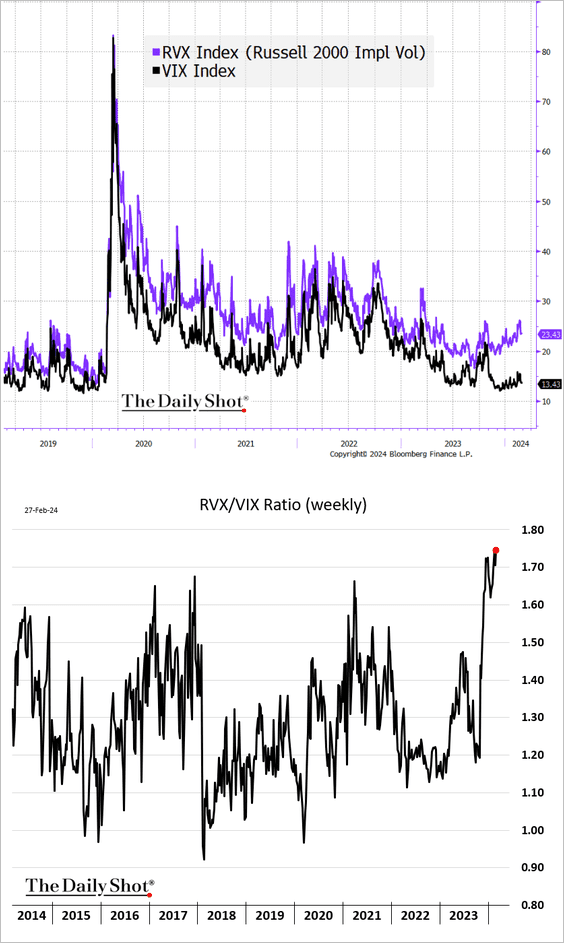

• The Russel 2000 implied volatility index (RVX) remains elevated relative to VIX.

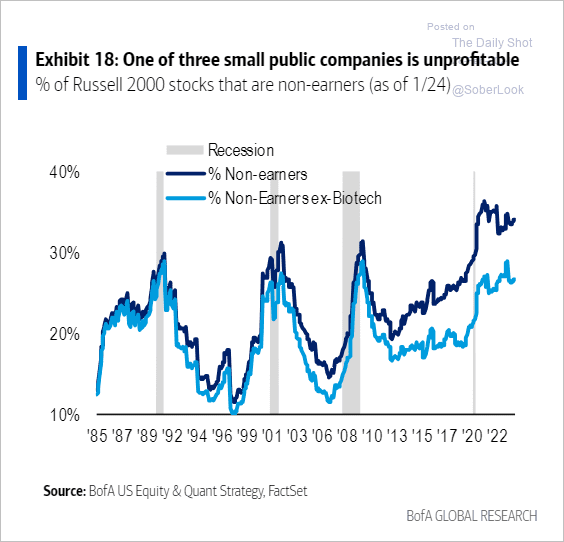

• There are a lot of unprofitable companies in the index.

Source: BofA Global Research

Source: BofA Global Research

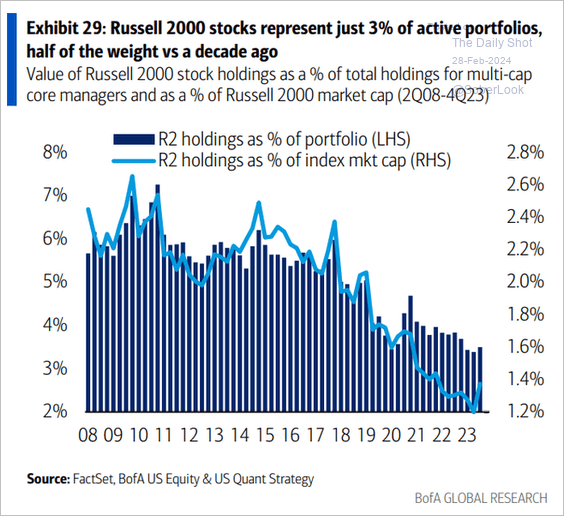

• Allocations to small caps have been trending lower.

Source: BofA Global Research

Source: BofA Global Research

But positioning in small caps has been rebounding recently.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

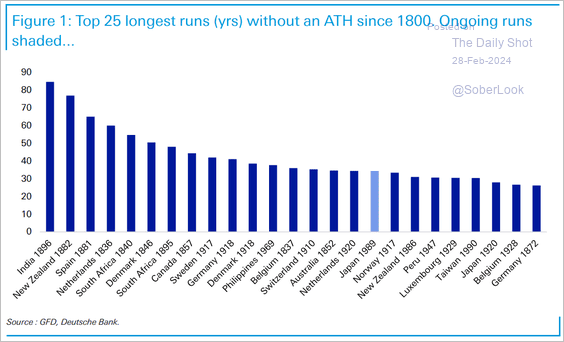

10. This chart shows the longest equity market runs without an all-time high. (Japan’s TOPIX is shown here, which is still slightly below its high from 1989)

Source: Deutsche Bank Research

Source: Deutsche Bank Research

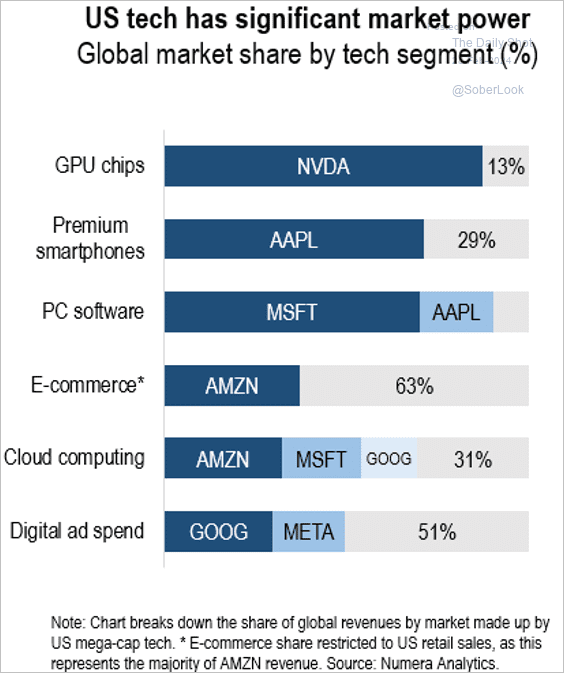

11. US companies have significant market power across major global tech segments.

Source: Numera Analytics (@NumeraAnalytics)

Source: Numera Analytics (@NumeraAnalytics)

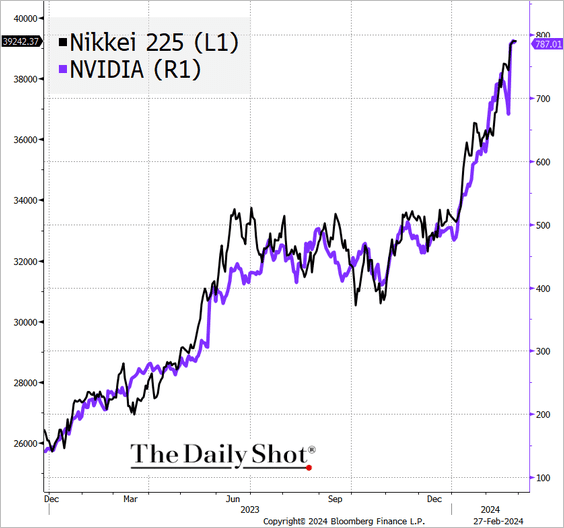

12. A remarkable correlation …

Source: @TheTerminal, Bloomberg Finance L.P.; h/t BofA Global Research

Source: @TheTerminal, Bloomberg Finance L.P.; h/t BofA Global Research

Back to Index

Credit

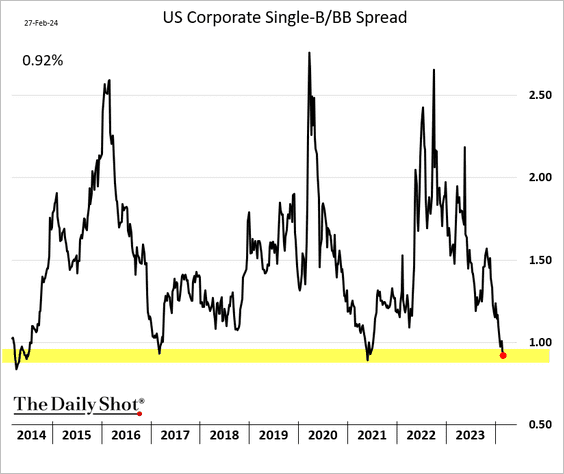

1. The B-BB spread is in “stretched” territory as risk appetite grows.

h/t @jtcrombie

h/t @jtcrombie

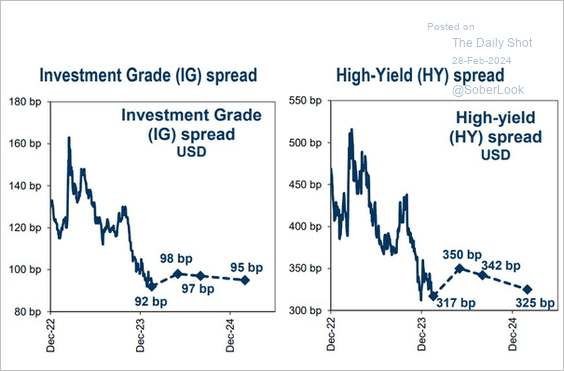

• Credit spreads are near cycle tights, according to Goldman.

Source: Goldman Sachs; @MikeZaccardi Read full article

Source: Goldman Sachs; @MikeZaccardi Read full article

——————–

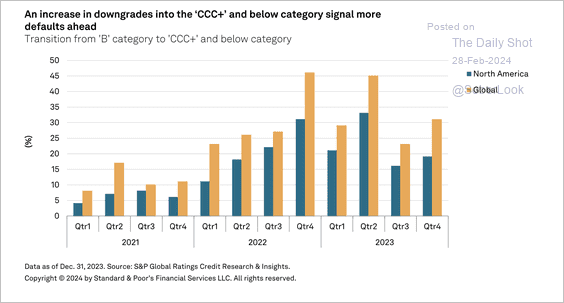

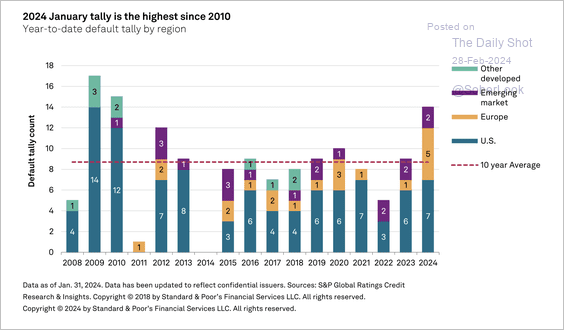

2. The increase in downgrades could signal more defaults to come. (2 charts)

Source: S&P Global Ratings

Source: S&P Global Ratings

Source: S&P Global Ratings

Source: S&P Global Ratings

——————–

Global Developments

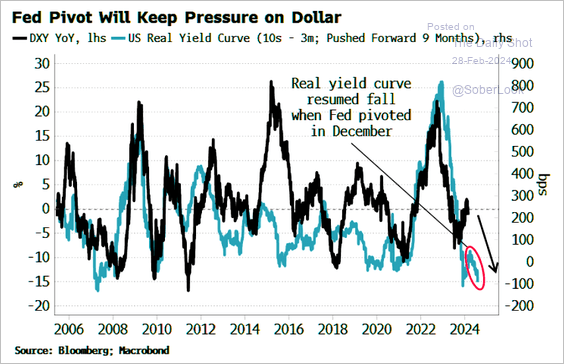

1. The US real curve inversion is a drag on the dollar.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

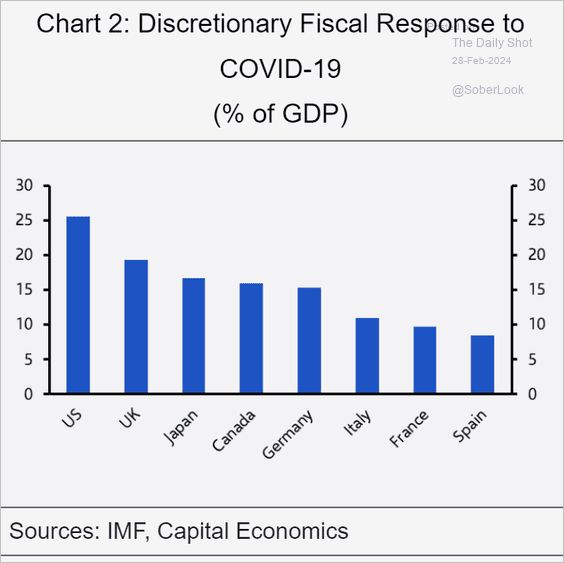

2. Here is a look at the fiscal response to COVID in advanced economies.

Source: Capital Economics

Source: Capital Economics

——————–

Food for Thought

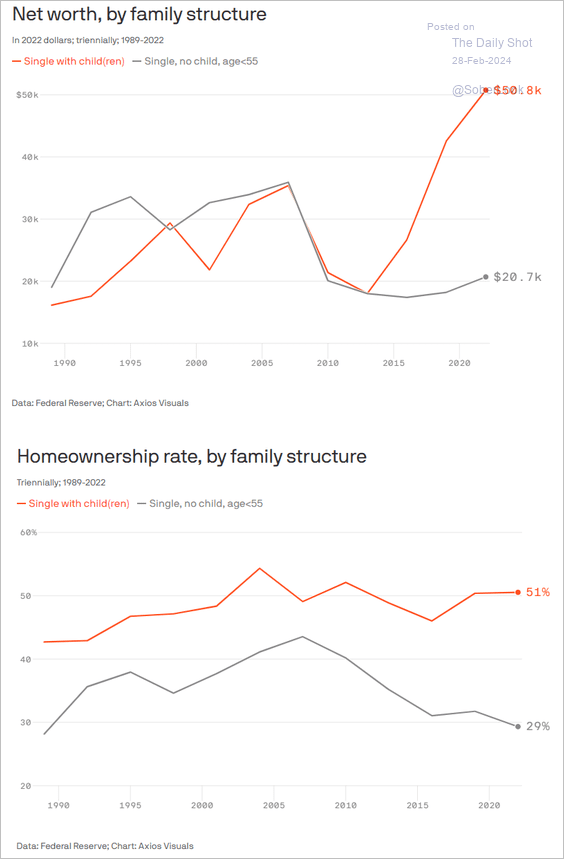

1. Single Americans with and without children:

Source: @axios Read full article

Source: @axios Read full article

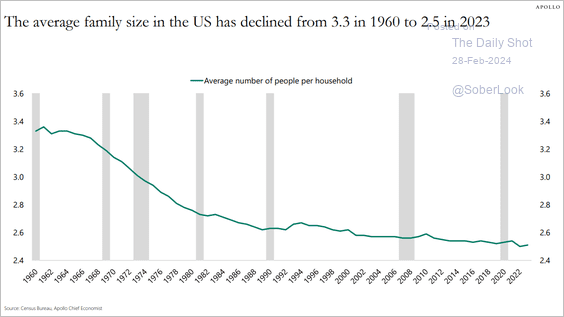

2. Number of people per household:

Source: Torsten Slok, Apollo

Source: Torsten Slok, Apollo

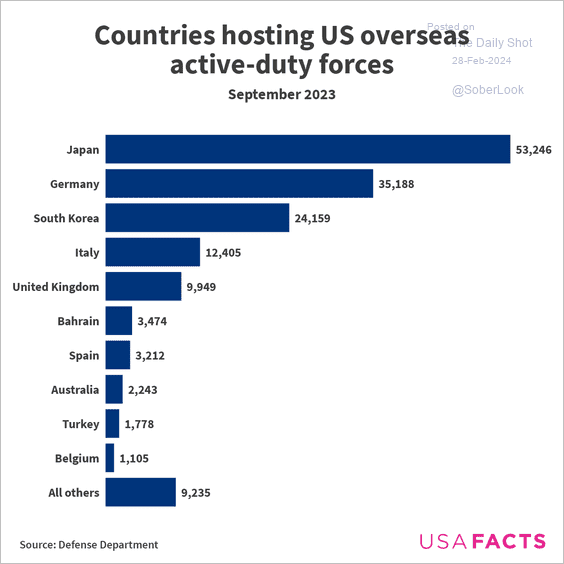

3. Where are US overseas forces stationed?

Source: USAFacts

Source: USAFacts

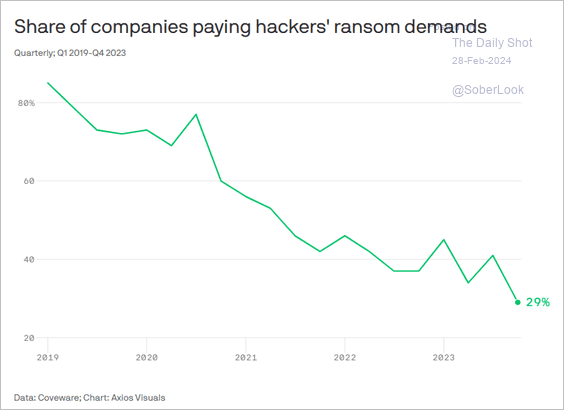

4. Companies paying hackers’ ransom demands:

Source: @axios Read full article

Source: @axios Read full article

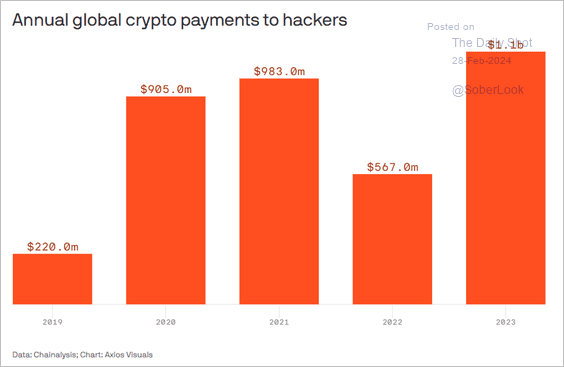

• Total crypto payments to hackers:

Source: @axios Read full article

Source: @axios Read full article

——————–

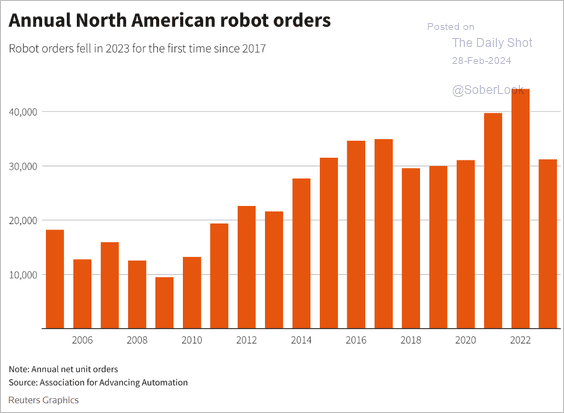

5. North American robot orders:

Source: Reuters Read full article

Source: Reuters Read full article

6. January non-alcoholic beer sales:

Source: @axios Read full article

Source: @axios Read full article

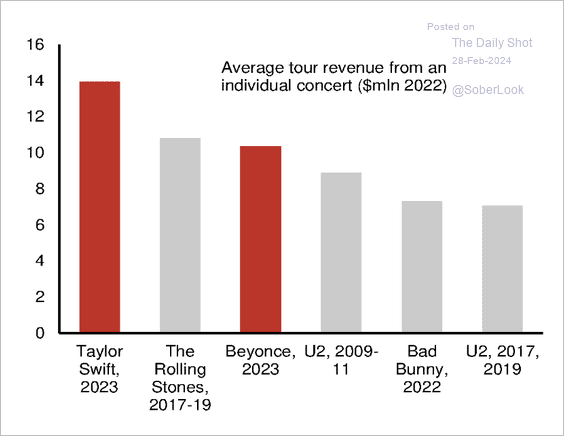

7. Average concert tour revenue:

Source: Nomura Securities

Source: Nomura Securities

——————–

Back to Index