The Daily Shot: 29-Feb-24

• The United States

• The Eurozone

• Europe

• Japan

• China

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

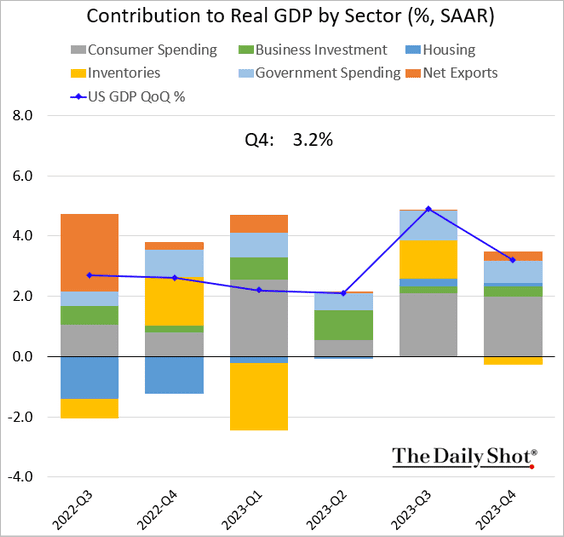

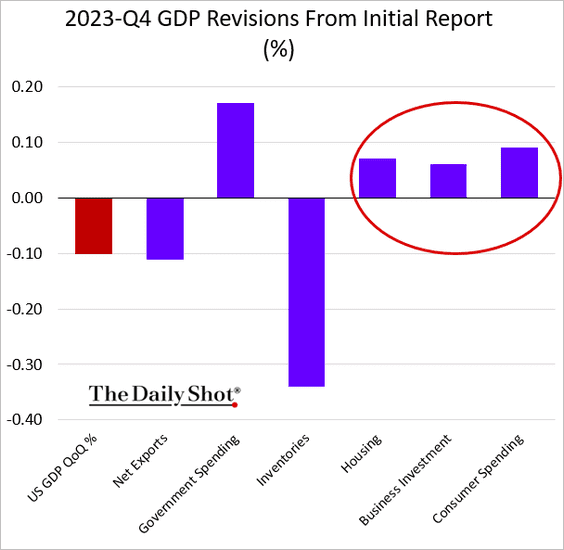

1. The Q4 GDP growth was revised slightly lower, …

… driven by inventories. Domestic demand was adjusted upwards.

Here are a couple of trends.

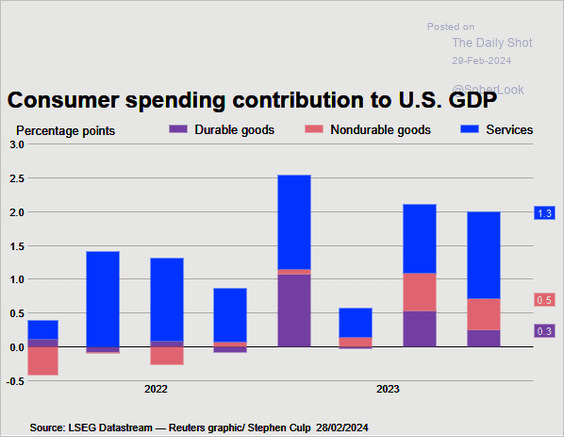

– Consumer spending contribution to GDP:

Source: Reuters Read full article

Source: Reuters Read full article

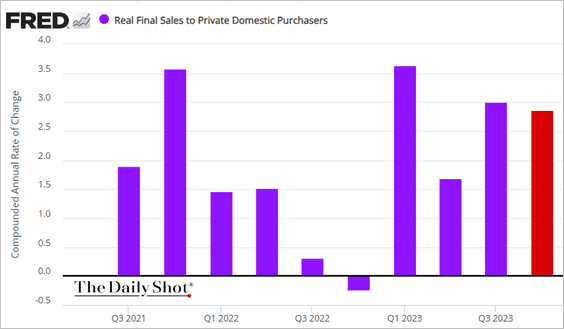

– Real final sales to private domestic purchasers (“core” GDP):

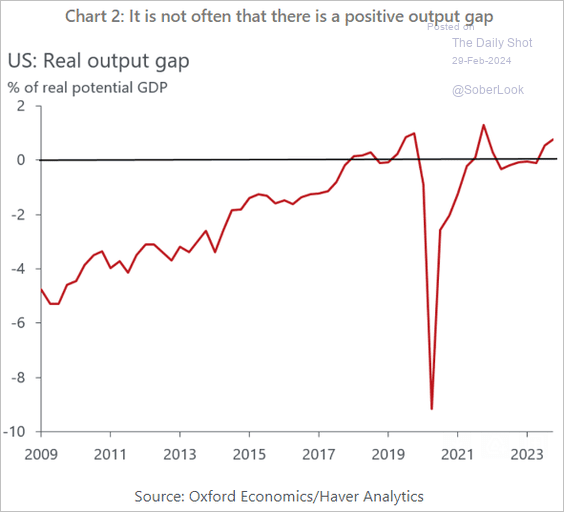

• The output gap is now firmly in positive territory.

Source: Oxford Economics

Source: Oxford Economics

——————–

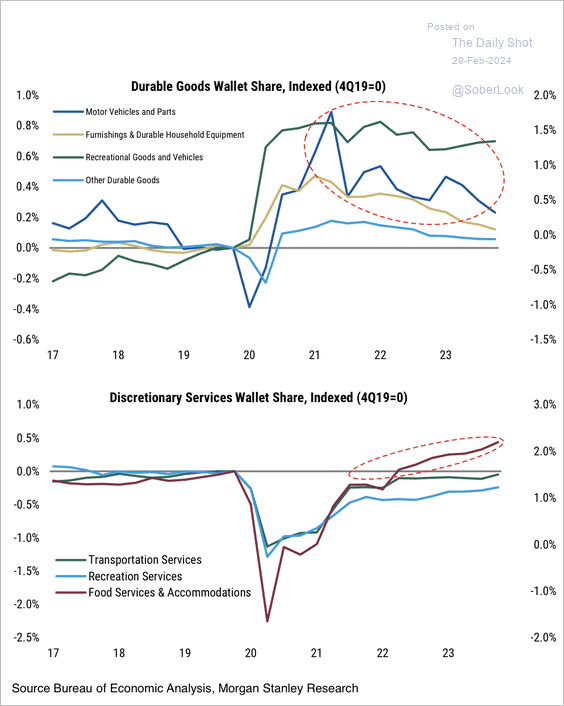

2. In consumer spending, goods are gradually ceding ground to services.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

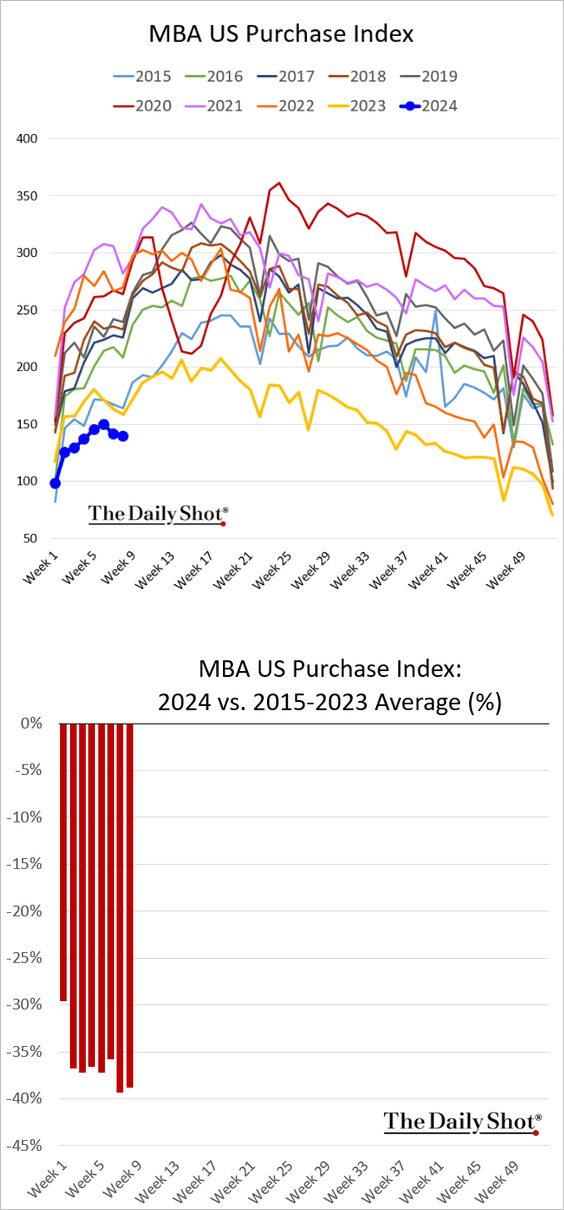

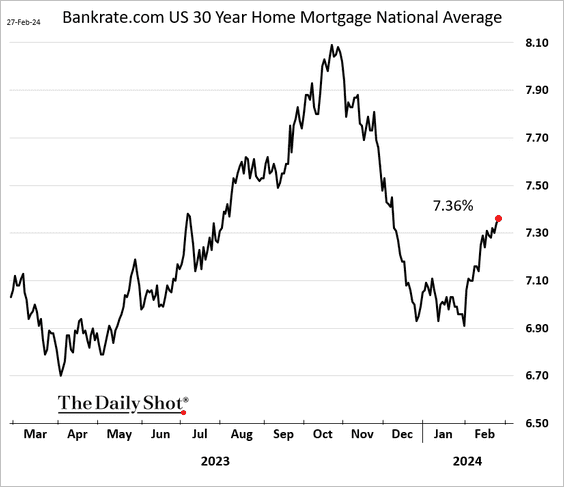

3. Next, we have some updates on the housing market.

• Mortage applications are holding at multi-year lows, …

… as rates climb.

Source: HousingWire Read full article

Source: HousingWire Read full article

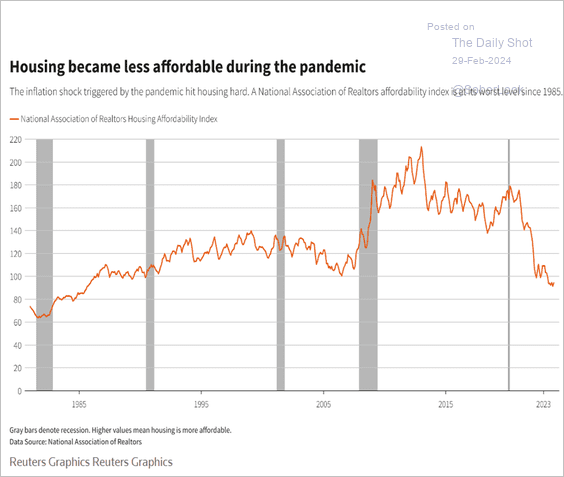

– Here is the affordability index.

Source: Reuters Read full article

Source: Reuters Read full article

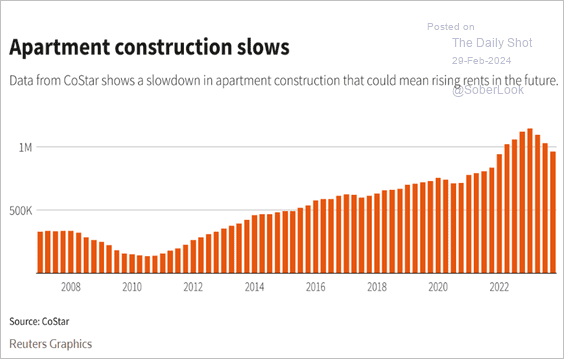

• Apartment construction has been slowing.

Source: Reuters Read full article

Source: Reuters Read full article

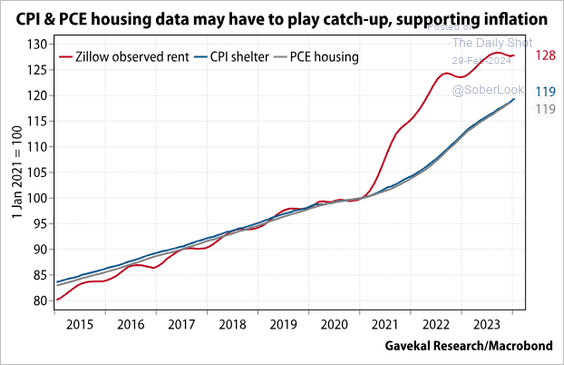

• Housing inflation may end up being stubbornly high for some time.

Source: Gavekal Research

Source: Gavekal Research

——————–

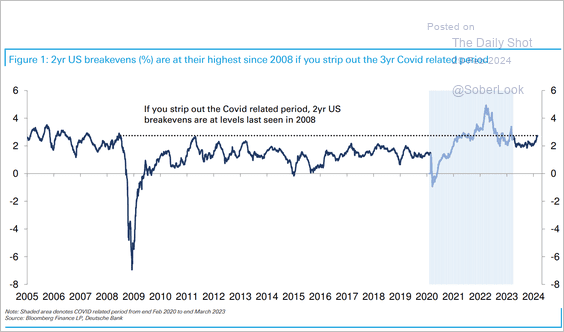

4. There has been a notable uptick in market expectations of near-term inflation.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

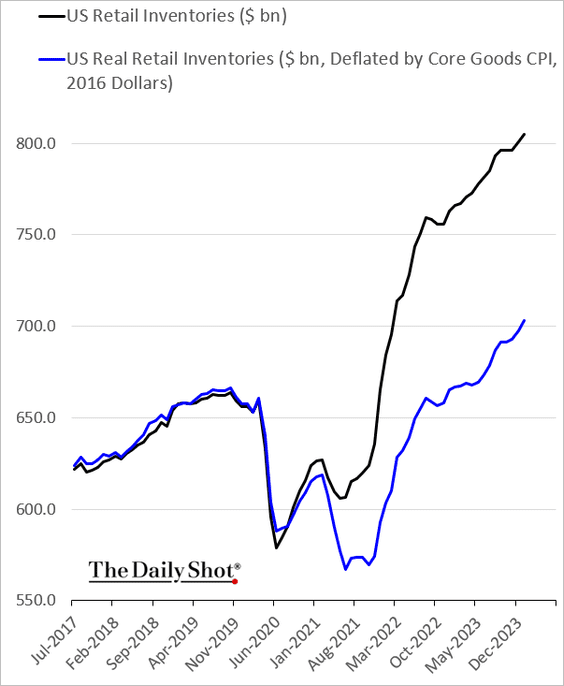

5. Retail inventories are now well above pre-COVID levels, even when adjusted for inflation.

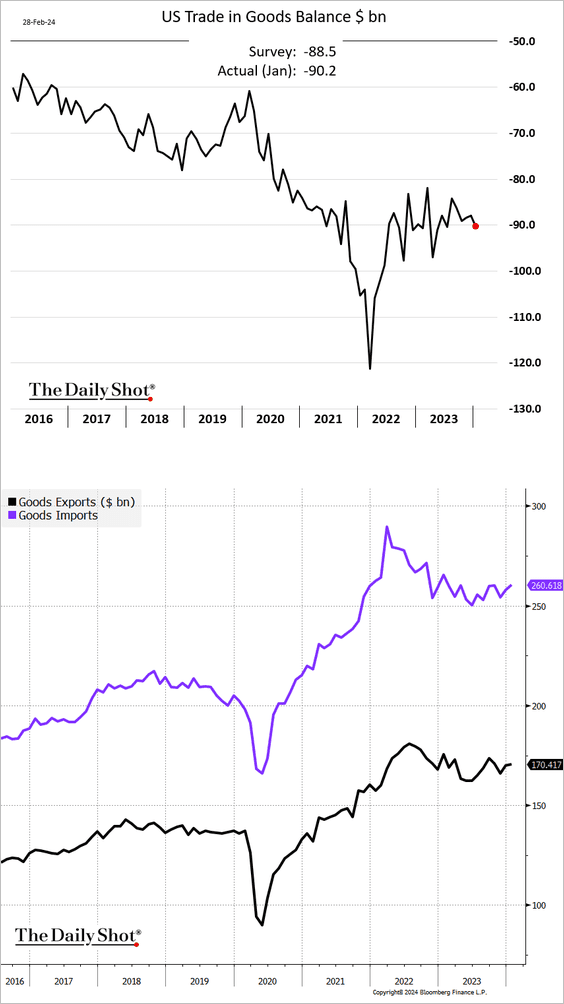

6. Finally, we have some updates on international trade.

• The US trade deficit in goods expanded in January.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

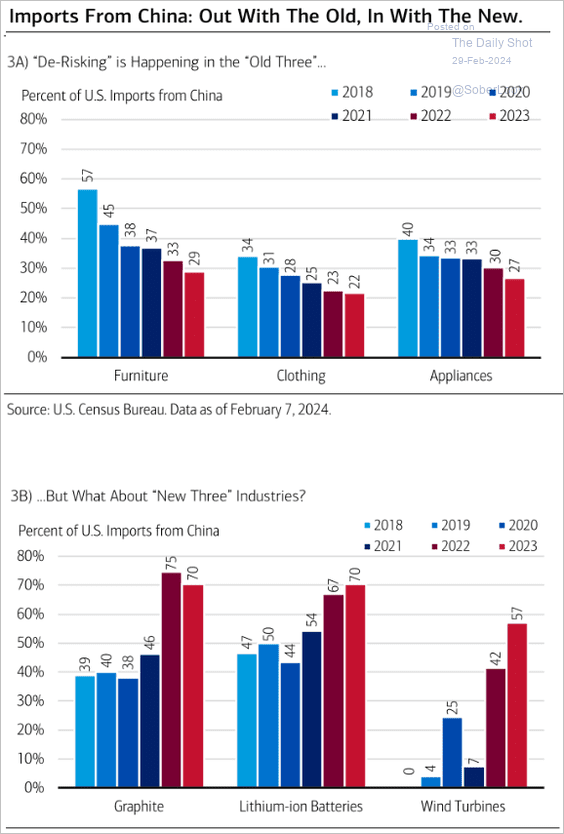

• Here is a look at US imports from China.

Source: Merrill Lynch

Source: Merrill Lynch

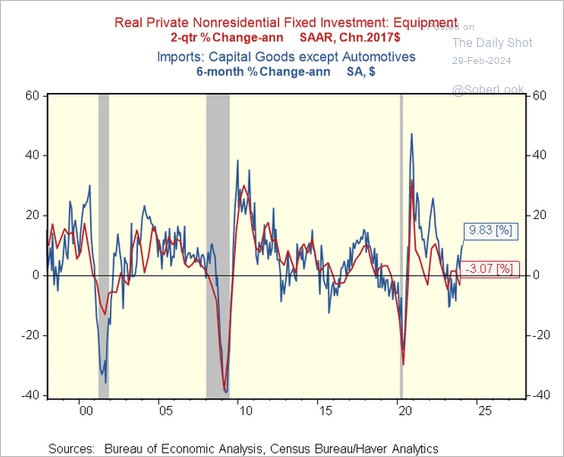

• Stronger capital goods imports signal improving business investment.

Source: @RenMacLLC

Source: @RenMacLLC

Back to Index

The Eurozone

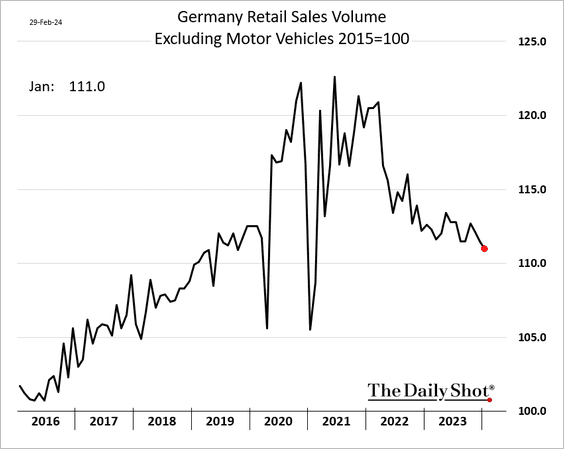

1. German retail sales deteriorated further in January.

Source: Markets Insider Read full article

Source: Markets Insider Read full article

——————–

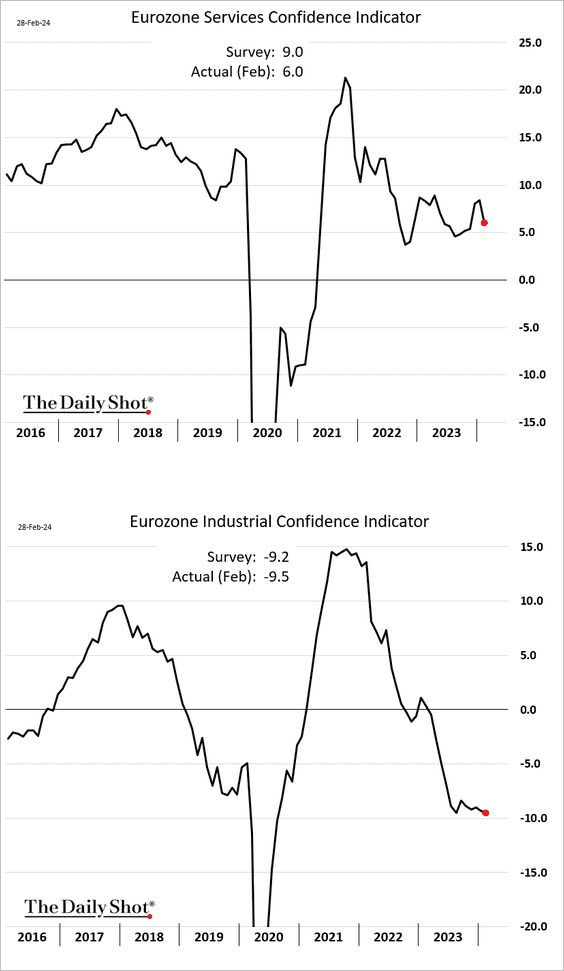

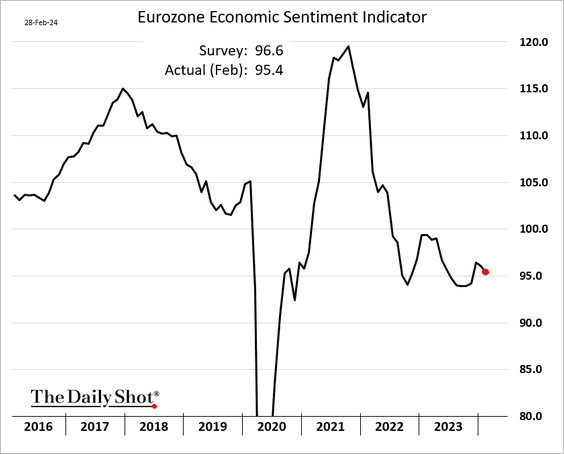

2. Euro-area business confidence declined in February.

– Below is the Eurozone Economic Sentiment Index, which includes consumer confidence.

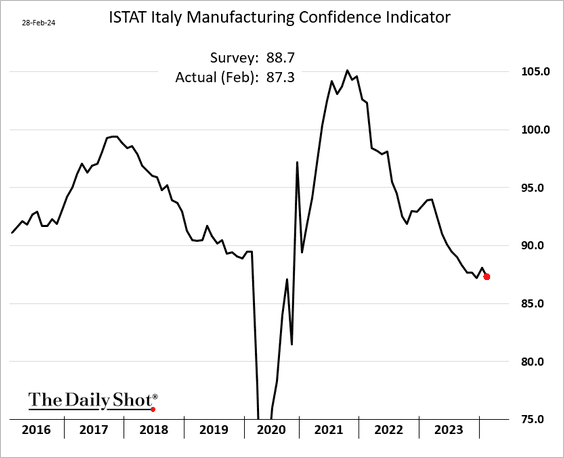

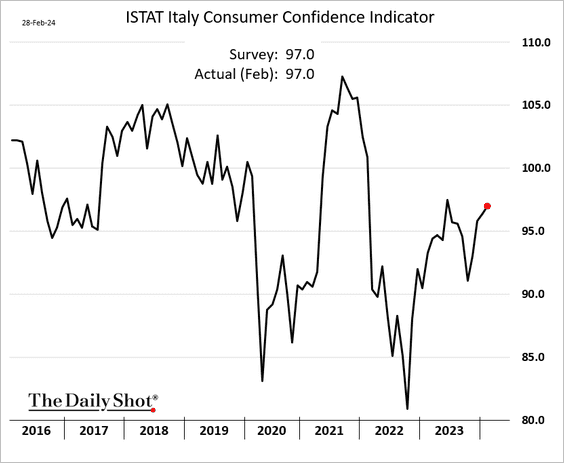

• Here is Italy’s manufacturing confidence.

– Italian consumer sentiment is recovering.

——————–

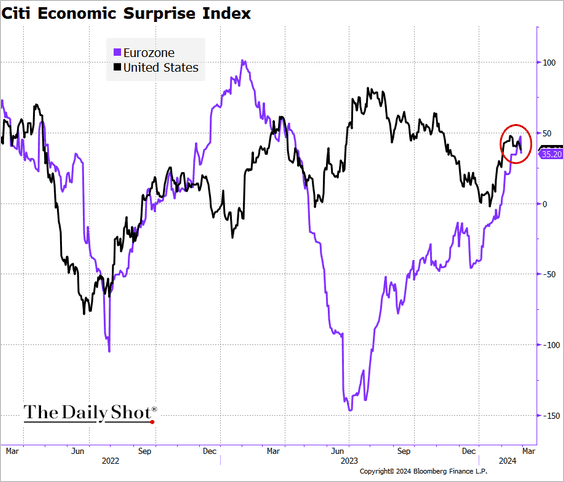

3. The euro-area economic surprise index has rebounded, aligning with that of the US.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

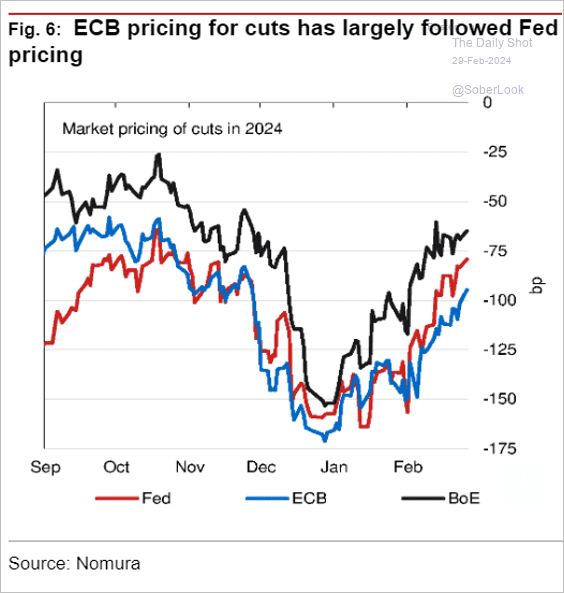

4. The market is scaling back ECB rate cut expectations, following a similar trend in the US.

Source: Nomura Securities

Source: Nomura Securities

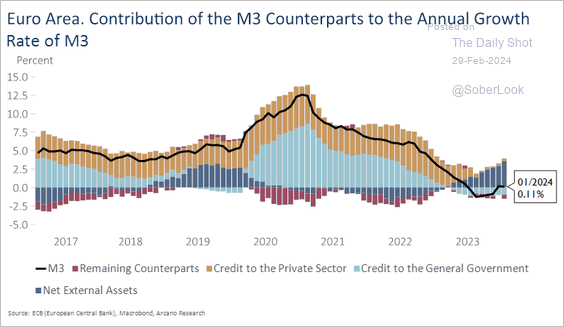

5. This chart shows the drivers of money supply growth.

Source: Arcano Economics

Source: Arcano Economics

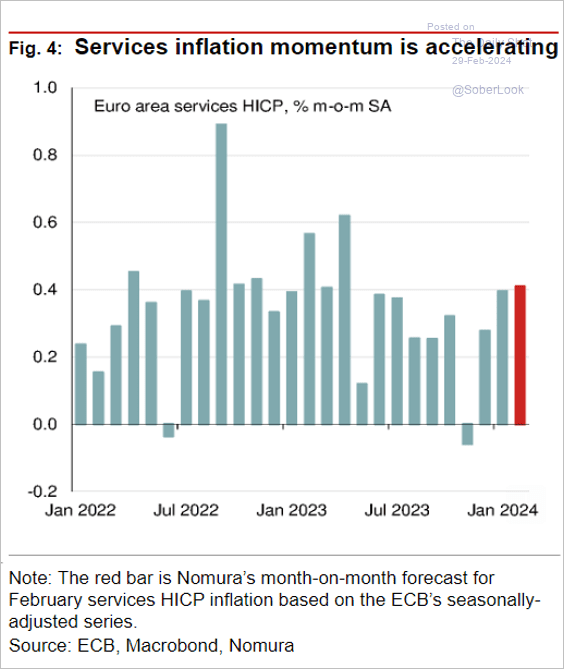

6. Services inflation has been accelerating.

Source: Nomura Securities

Source: Nomura Securities

Back to Index

Europe

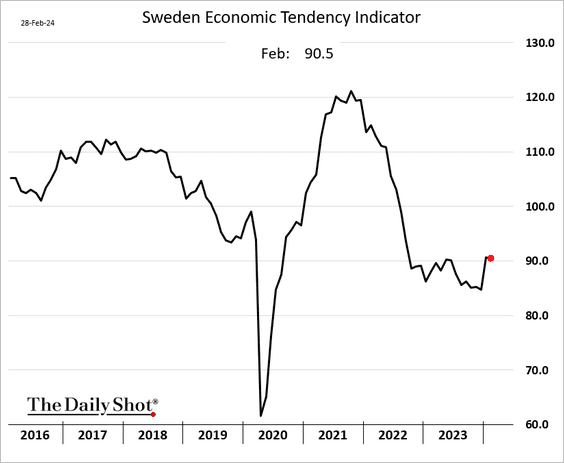

1. Let’s begin with Sweden.

• The aggregate sentiment indicator was flat this month.

• The nation’s trade surplus surged in January.

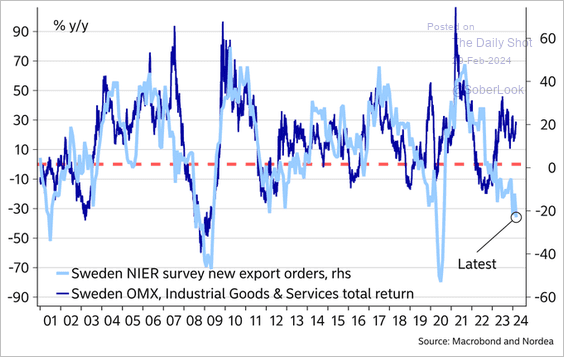

• Sweden’s industrial shares are not reflecting weak export orders.

Source: @MikaelSarwe

Source: @MikaelSarwe

——————–

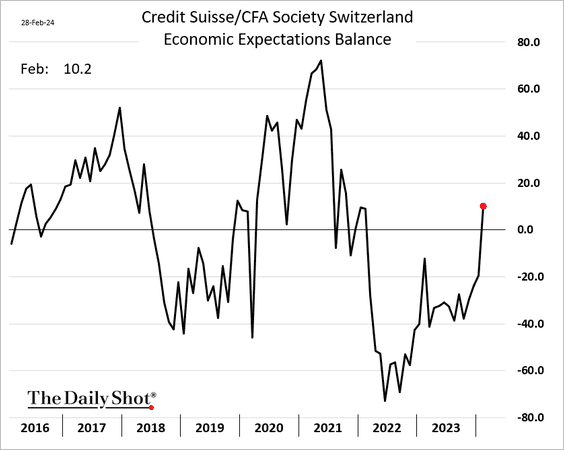

2. Swiss economic sentiment is rebounding.

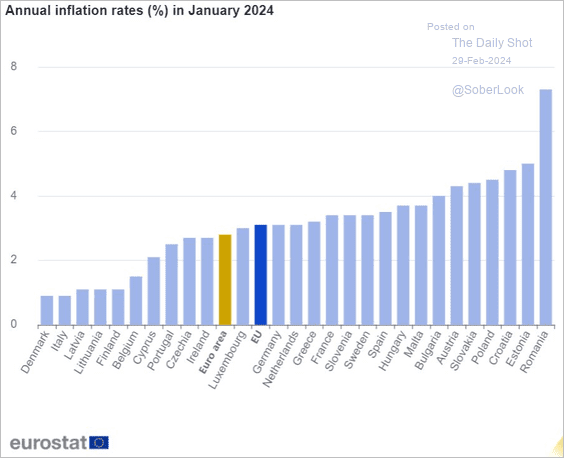

3. This chart shows inflation rates across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

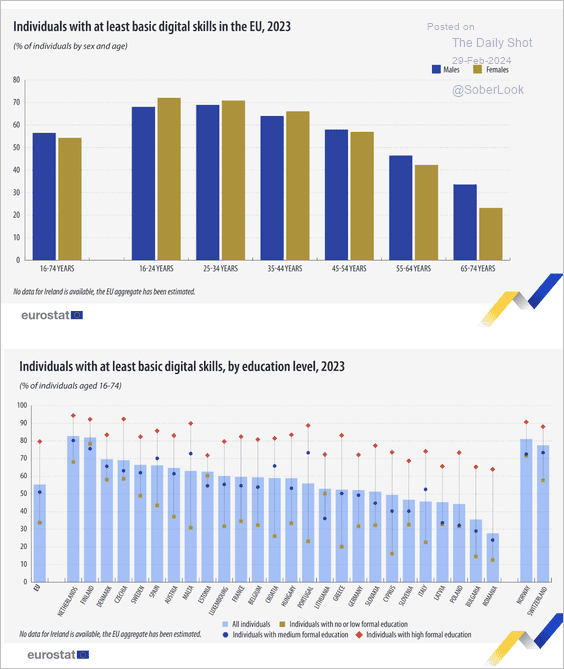

4. Here is a look at digital skill levels by age, gender, and education in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

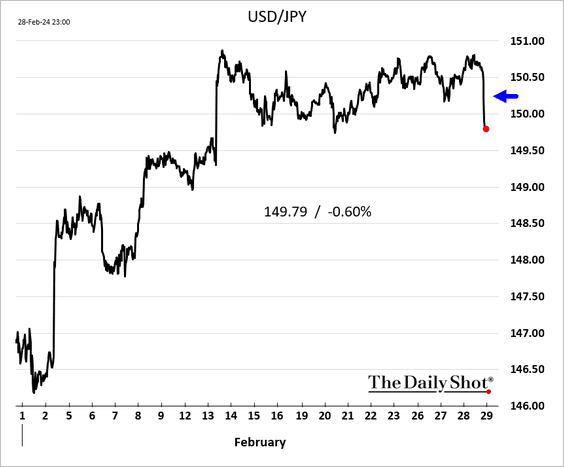

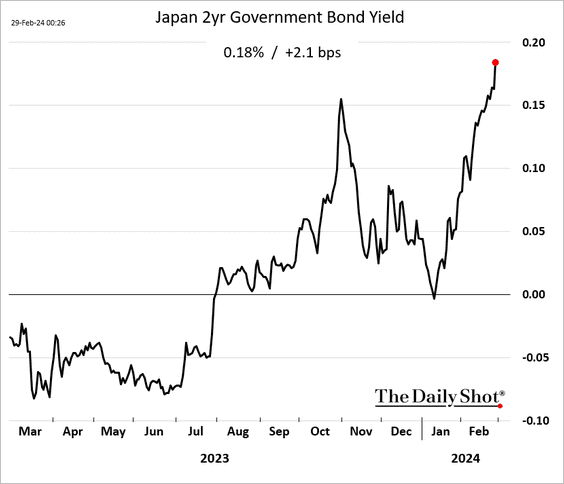

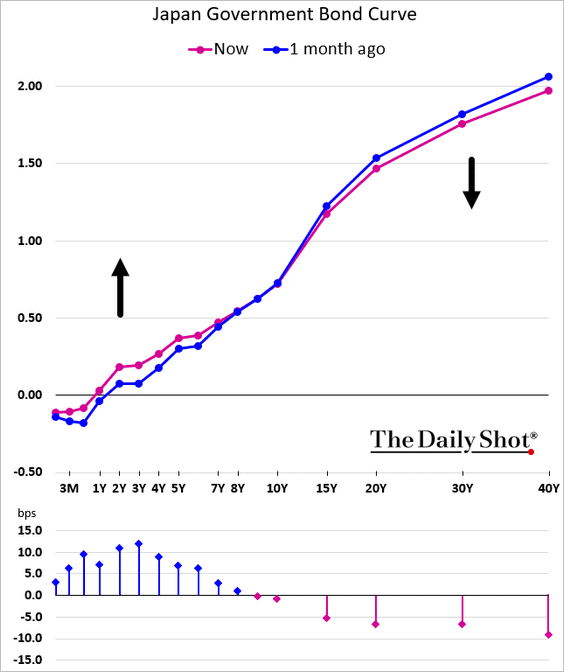

1. The BoJ is starting to prepare the market for rate hikes.

Source: @economics Read full article

Source: @economics Read full article

• The yen and short-term JGB yields jumped.

• The JGB curve continues to flatten.

——————–

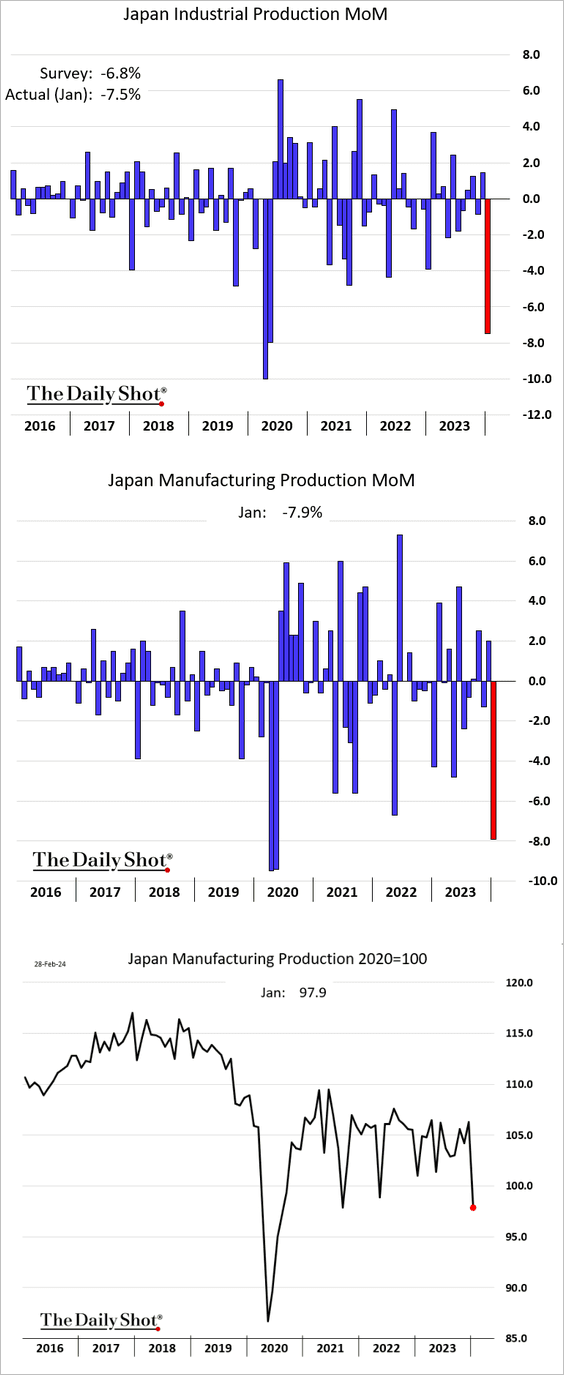

2. Industrial production tumbled in January.

Source: BNN Read full article

Source: BNN Read full article

——————–

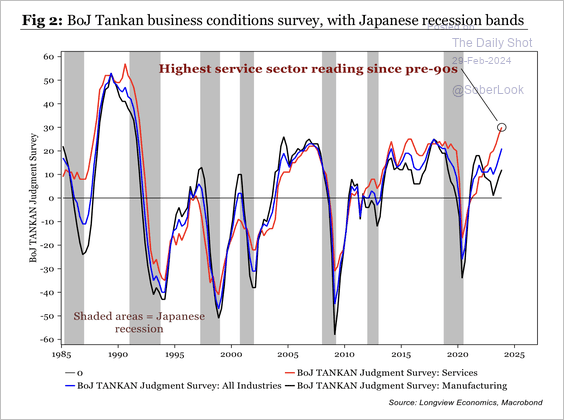

3. Business sentiment has been improving.

Source: Longview Economics

Source: Longview Economics

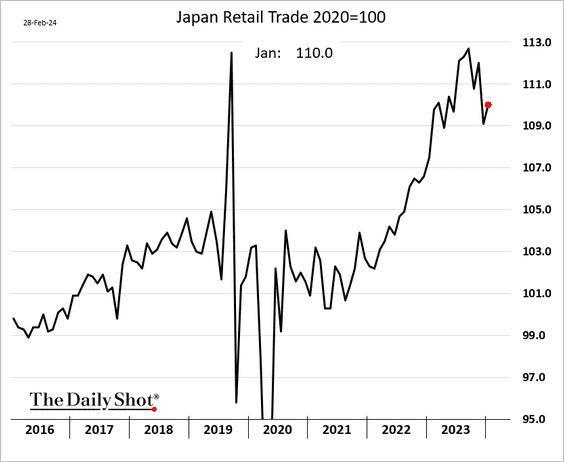

4. Retail sales climbed last month.

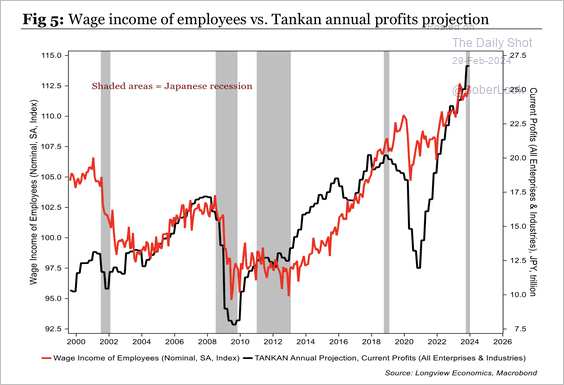

5. Stronger profit projections could support further wage growth.

Source: Longview Economics

Source: Longview Economics

Back to Index

China

1. The stock market rebound continues.

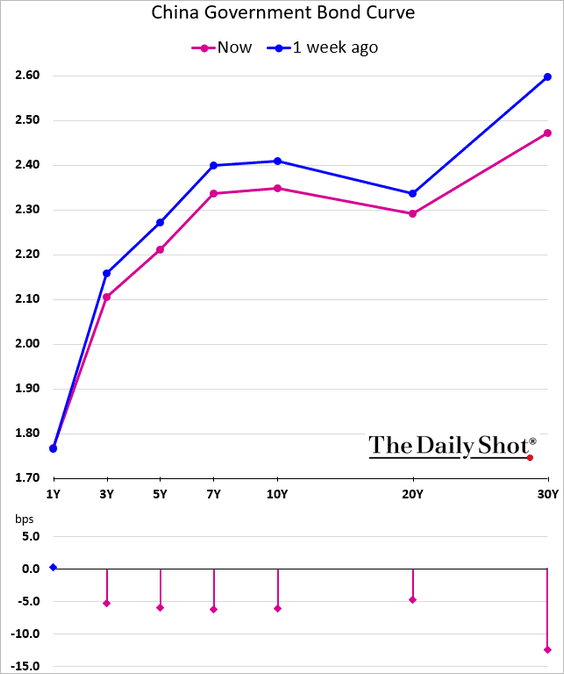

2. Longer-dated bond yields keep sinking.

The yield curve has been flattening.

——————–

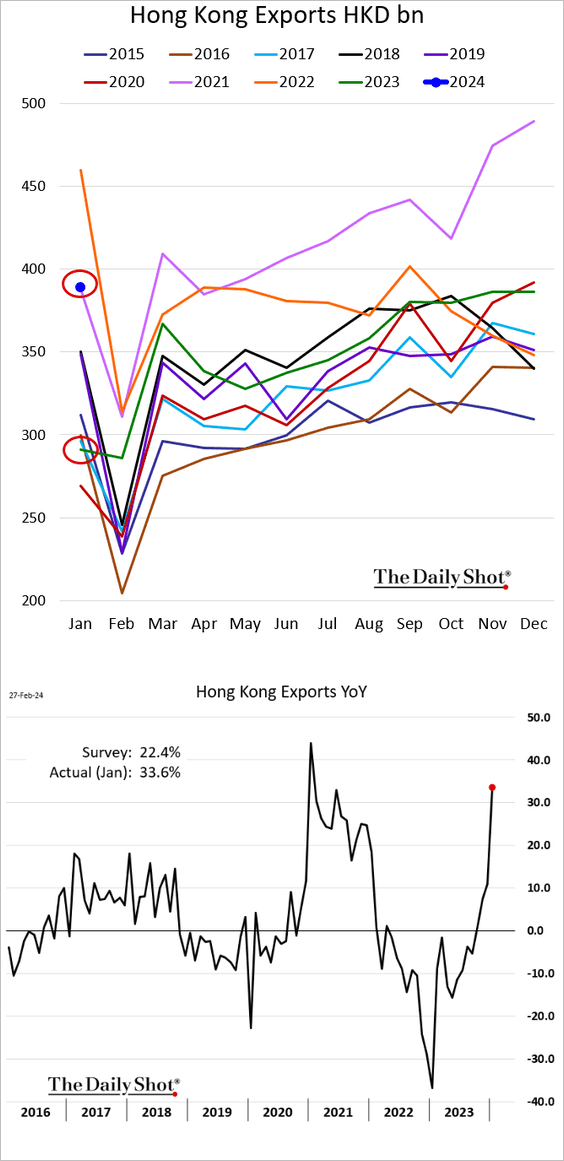

3. Hong Kong’s exports climbed back to 2021 levels in January.

Source: South China Morning Post Read full article

Source: South China Morning Post Read full article

Back to Index

Cryptocurrency

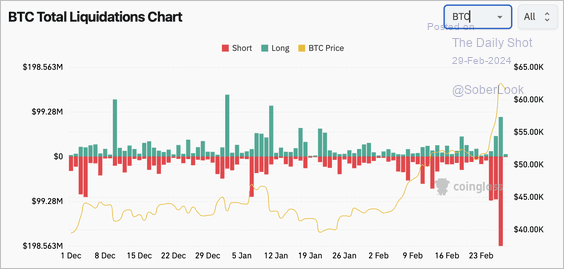

1. Bitcoin blasted past $60k on Wednesday.

• BTC/USD’s rise above $60K triggered a spike in short liquidations.

Source: Coinglass

Source: Coinglass

——————–

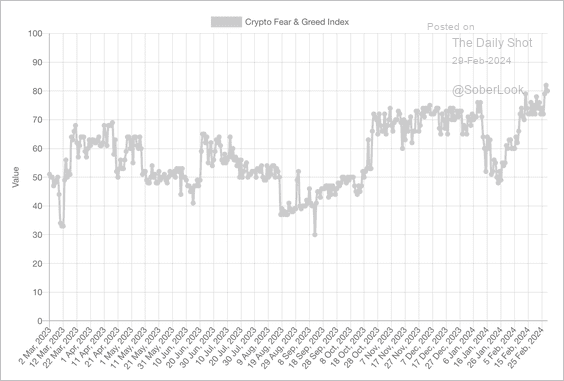

2. The Crypto Fear & Greed Index rose to “extreme greed” territory.

Source: Alternative.me

Source: Alternative.me

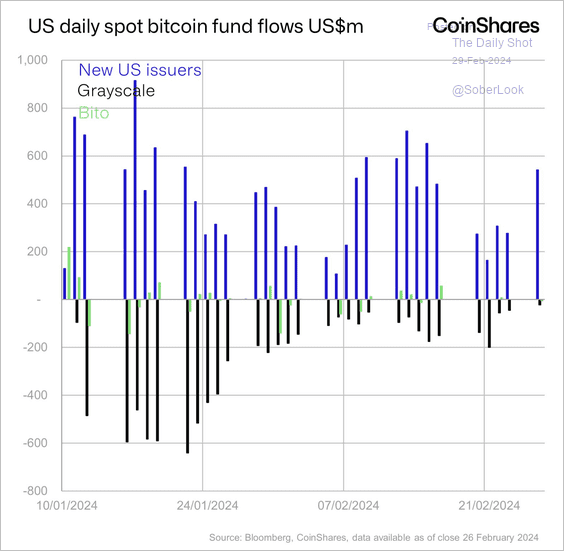

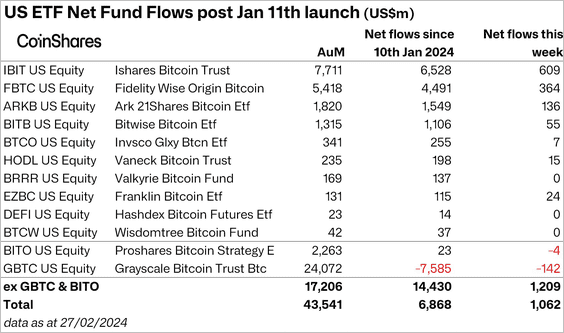

3. US bitcoin ETF inflows remain robust, particularly for new issuers. (2 charts)

Source: CoinShares

Source: CoinShares

Source: CoinShares

Source: CoinShares

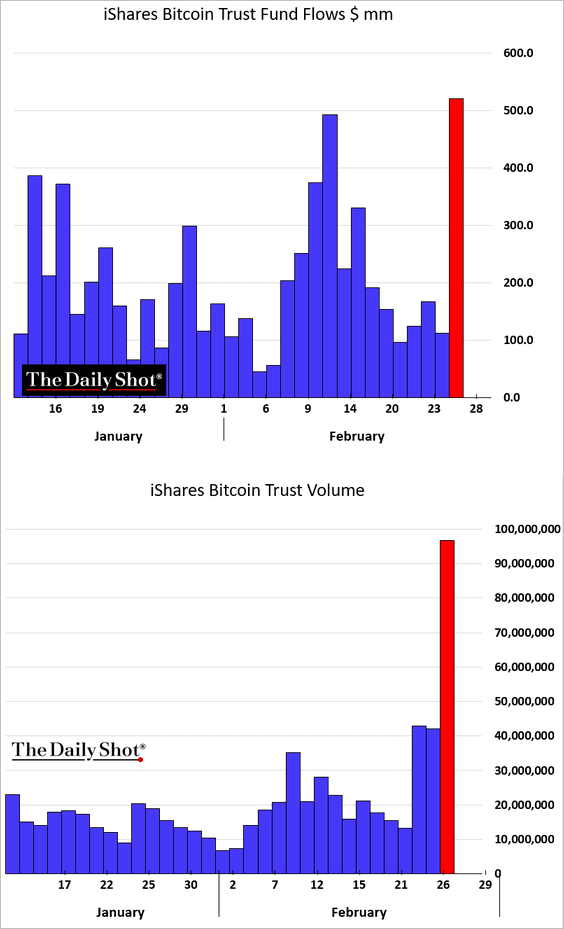

• The iShares Bitcoin Trust fund flows and trading volume surged this week.

Back to Index

Commodities

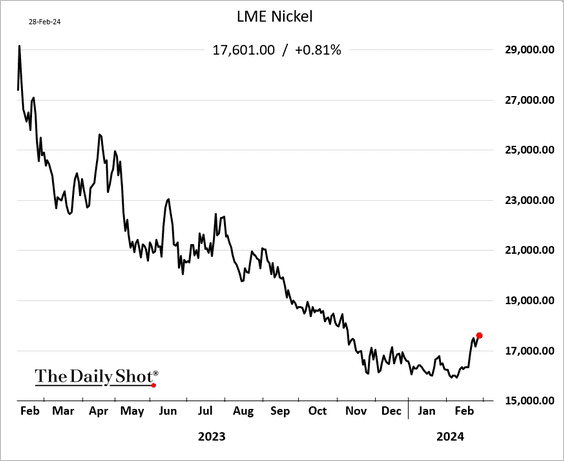

1. Nickel is coming back to life.

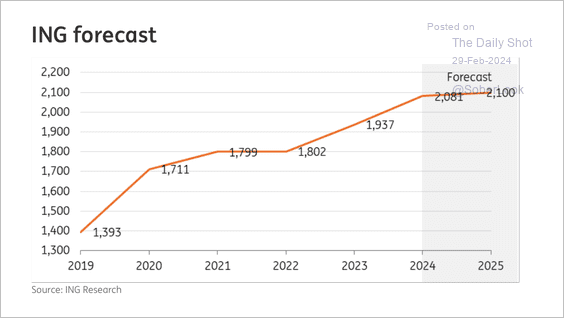

2. ING expects gold to reach new highs this year.

Source: ING

Source: ING

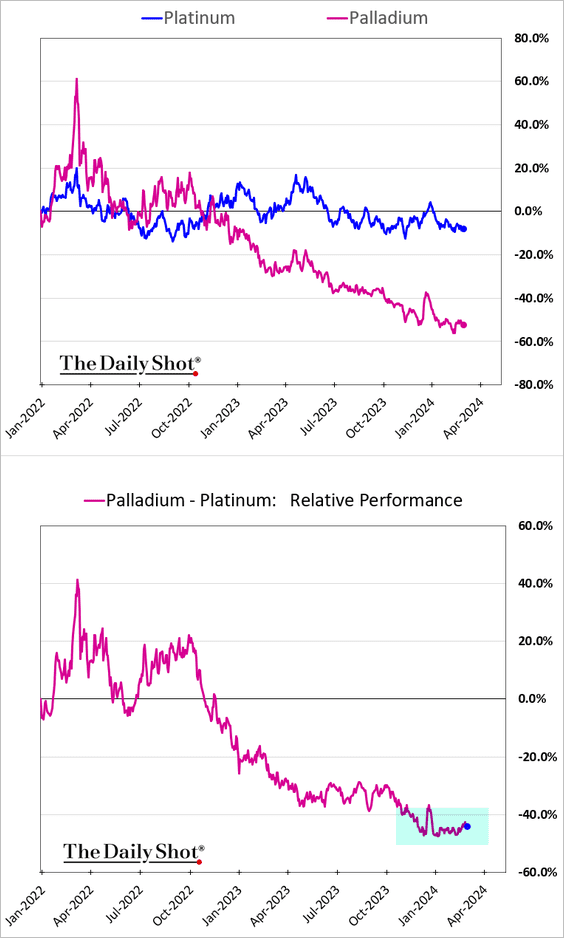

3. Is palladium’s underperformance finally over?

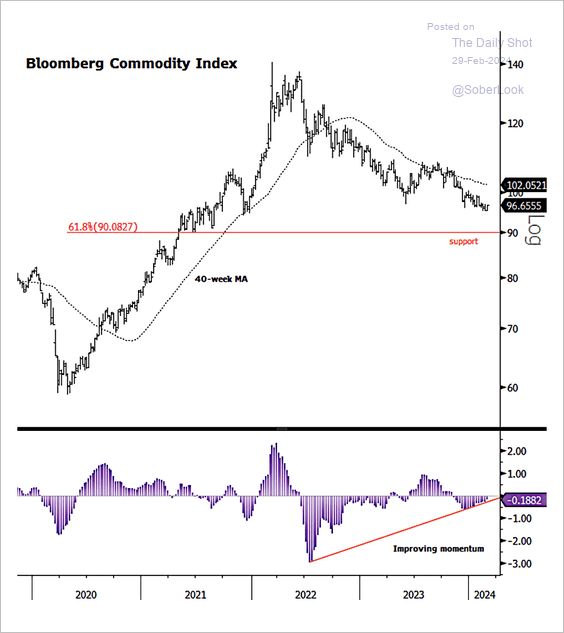

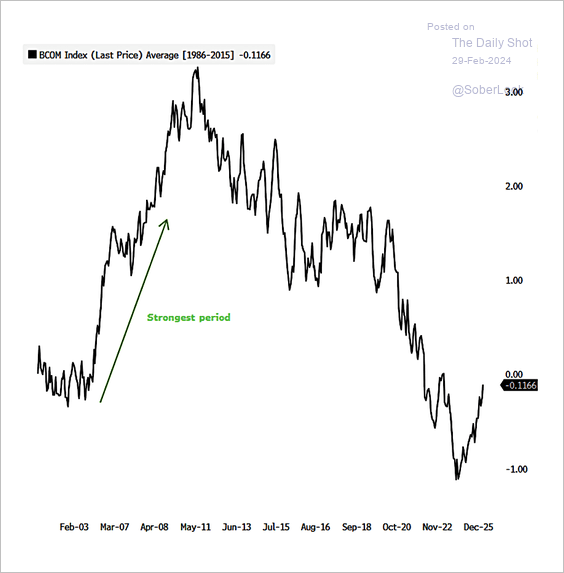

4. Downside momentum has slowed for the Bloomberg Commodity Index ahead of a seasonally strong period. (2 charts)

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

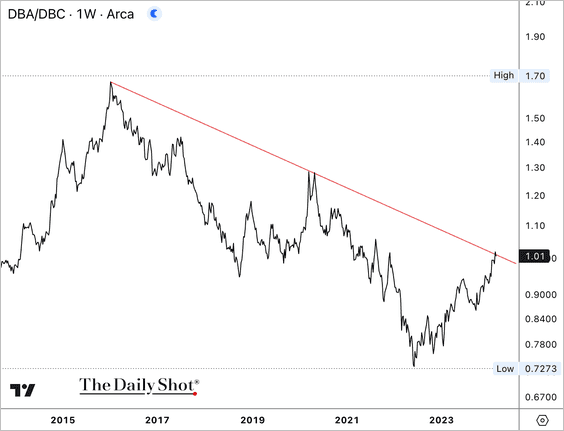

5. The Invesco Agriculture ETF (DBA), which has a high weighting to cocoa, is approaching downtrend resistance relative to the Invesco Commodity ETF (DBC), which has substantial exposure to gasoline and oil.

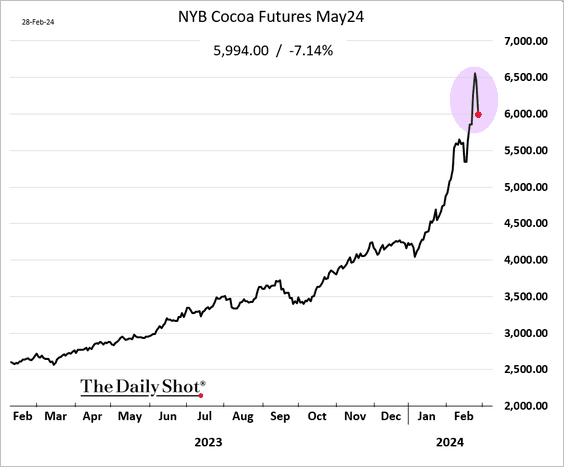

6. Cocoa finally saw a sharp pullback on Wednesday.

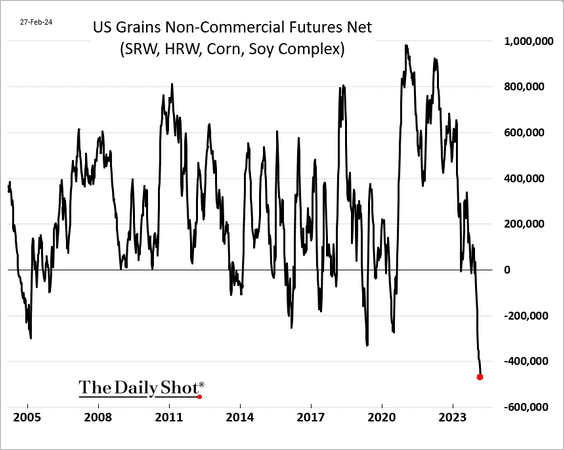

7. The bearish positioning in grains looks stretched.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

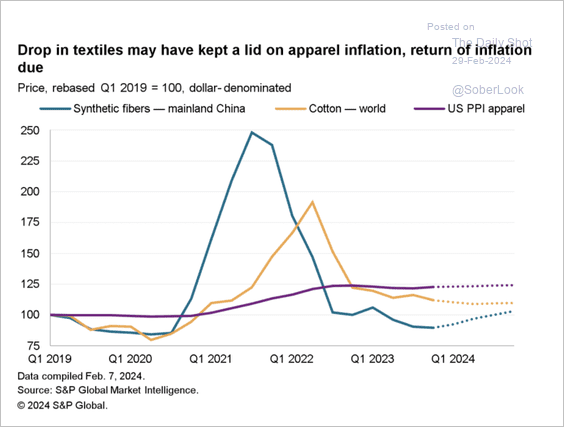

8. Generally, prices of apparel materials have declined, although synthetic fiber prices are expected to rise this year.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Energy

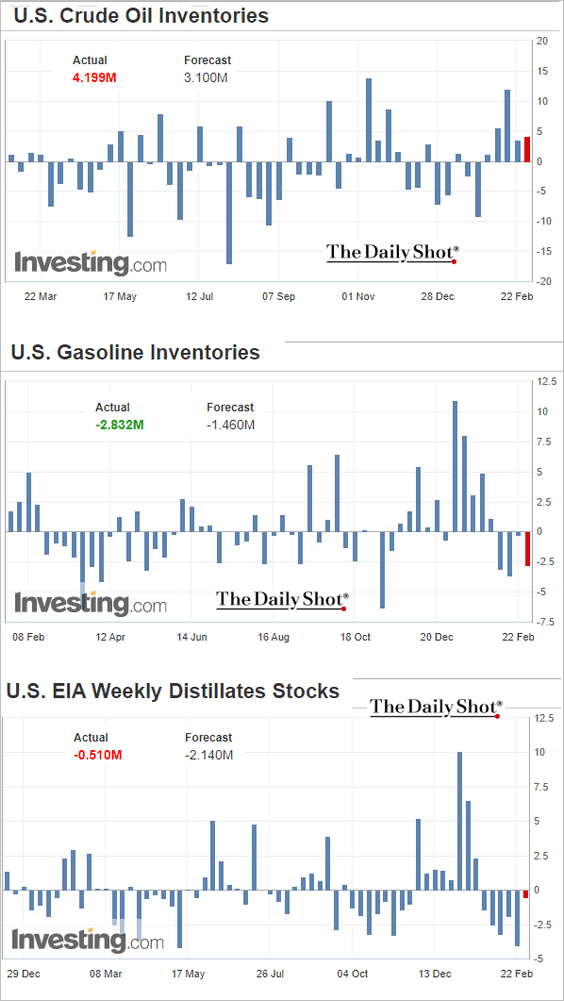

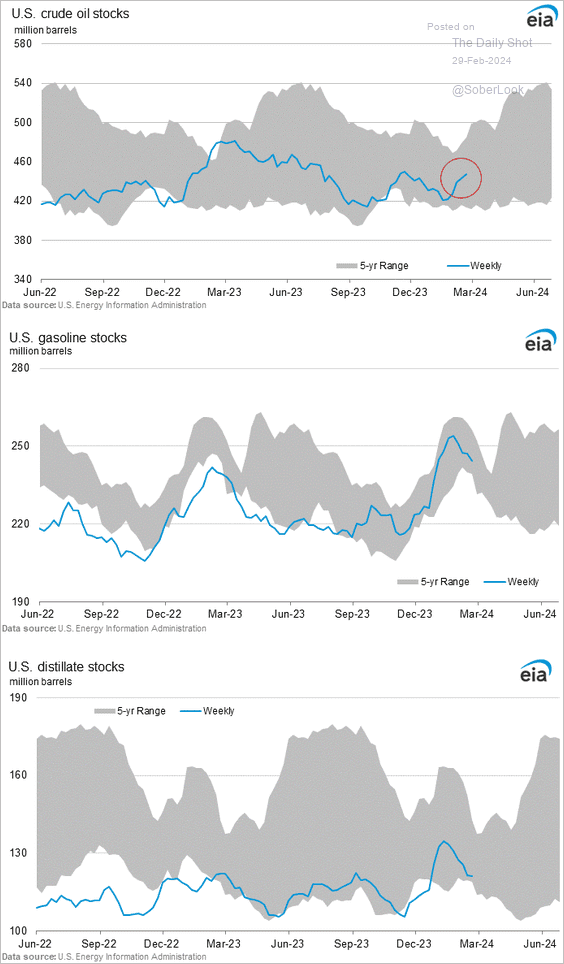

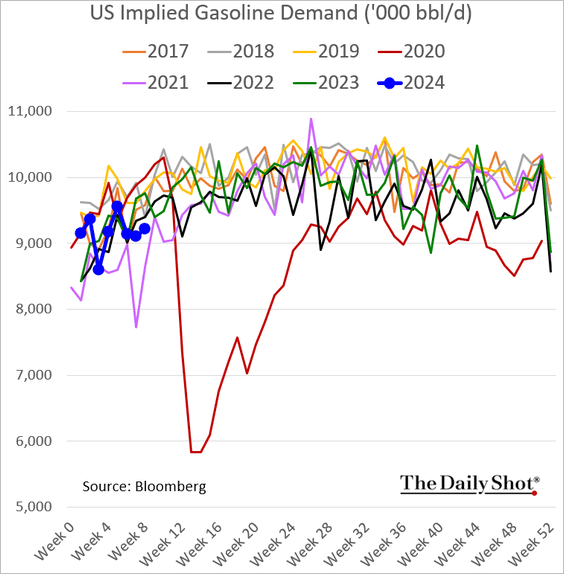

1. US oil inventories climbed again last week while refined product stockpiles continued to ease.

– Weekly changes:

– Levels:

• Gasoline demand appears to rebounding.

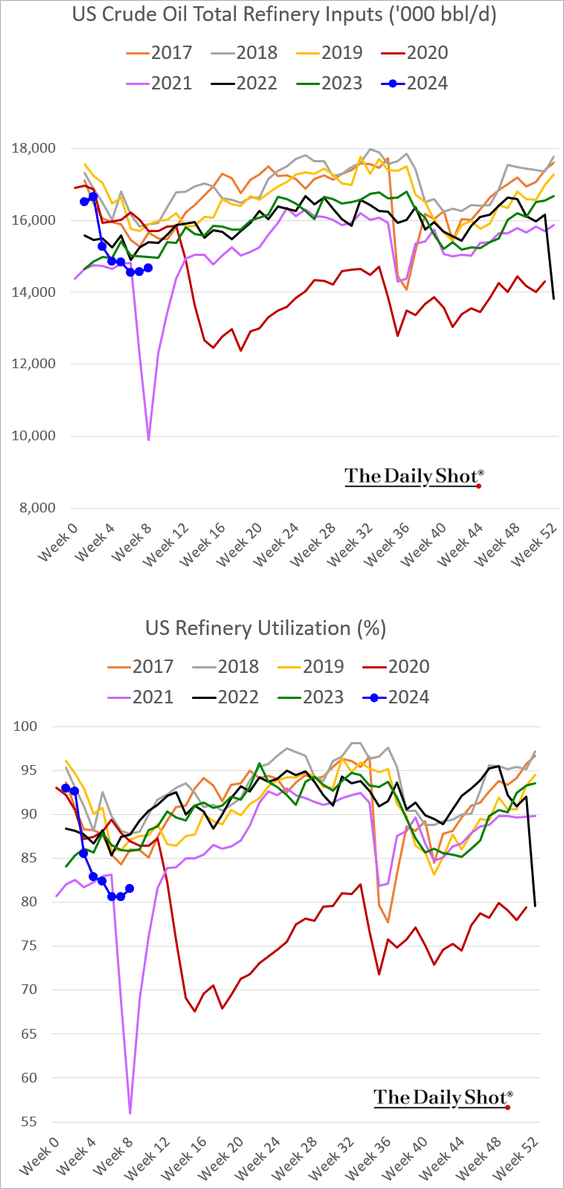

• Refinery runs and utilization rates continue to be subdued.

——————–

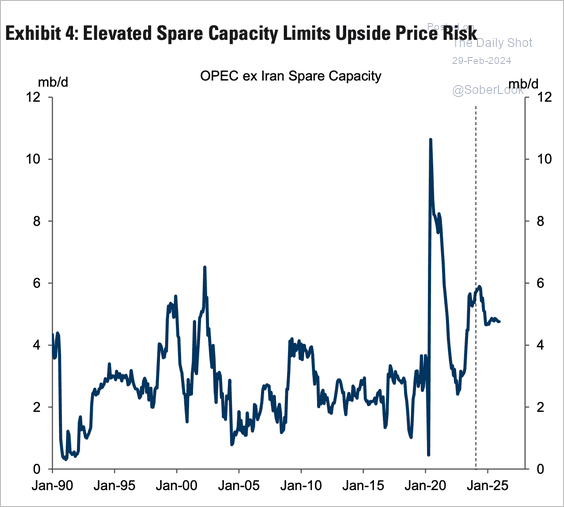

2. OPEC’s substantial spare capacity is a constraint on potential increases in oil prices.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

Back to Index

Equities

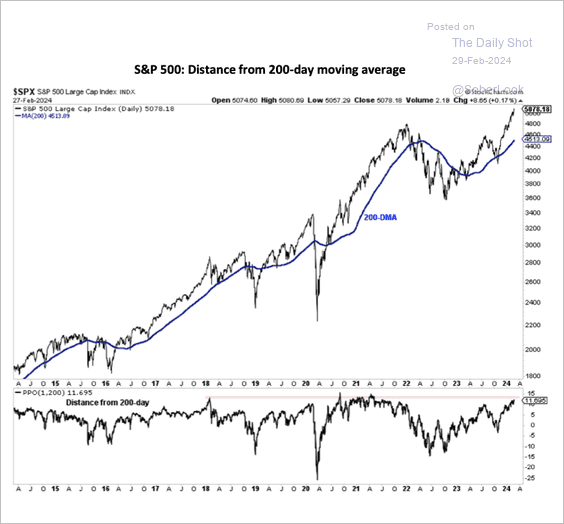

1. The S&P 500’s distance above its 200-day moving average is stretched.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

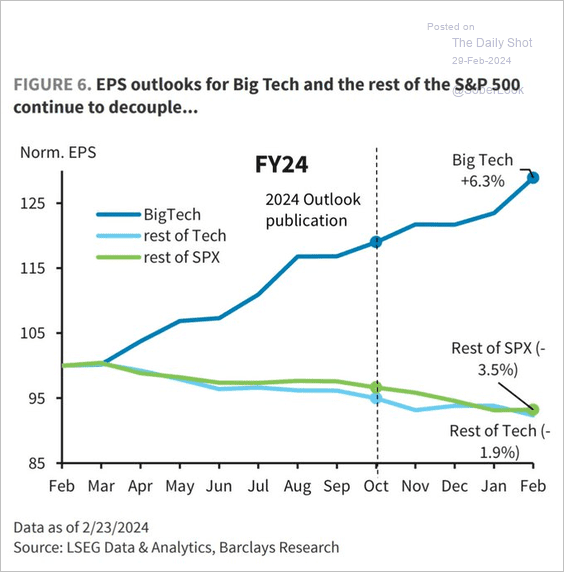

2. This year’s earnings projections for tech mega-caps continue to diverge from the rest of the S&P 500.

Source: Barclays Research

Source: Barclays Research

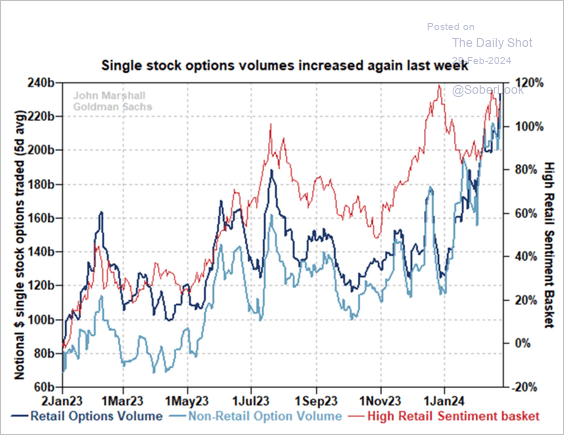

3. Options activity keeps rising.

Source: Goldman Sachs; @dailychartbook

Source: Goldman Sachs; @dailychartbook

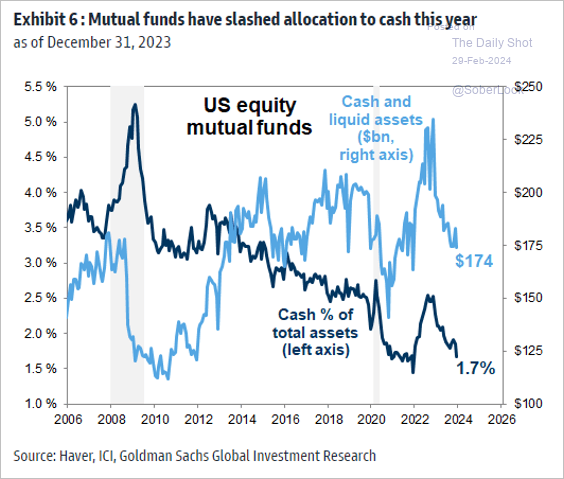

4. Mutual funds are holding less cash.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

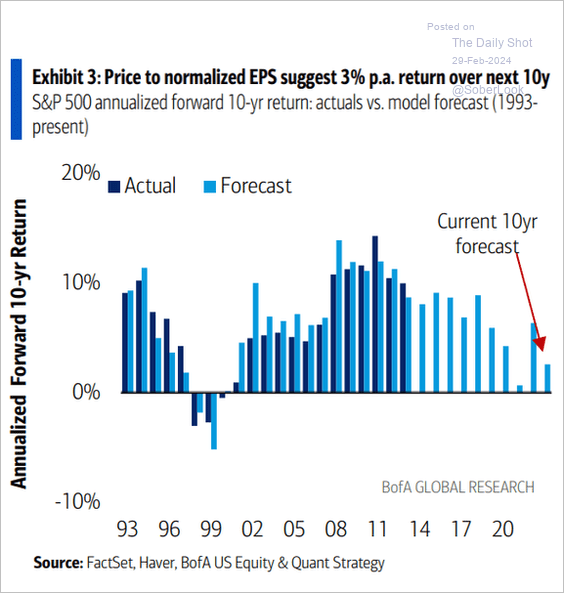

5. Current valuations point to sub-5% returns over the next decade.

Source: BofA Global Research

Source: BofA Global Research

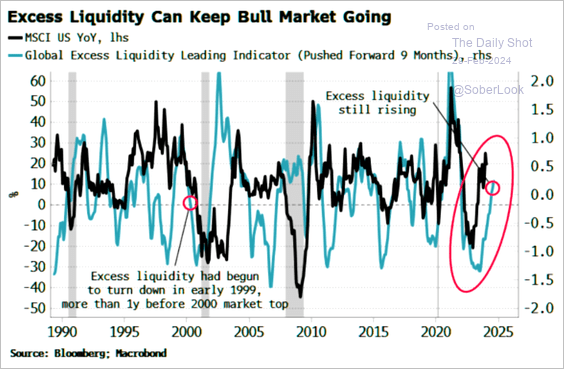

6. Will improving global excess liquidity continue to support the rally?

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

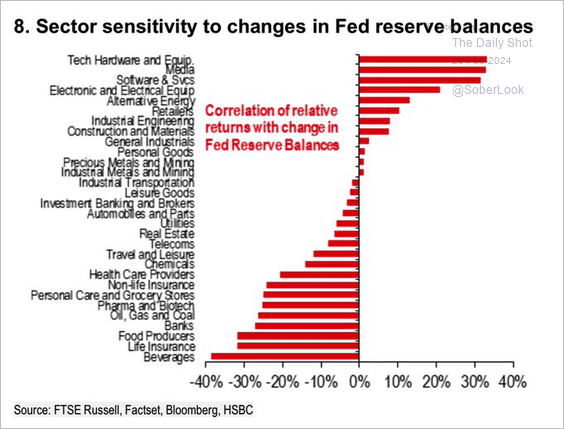

7. Here is a look at sector correlations to reserve balances (liquidity banks hold at the Fed).

Source: HSBC; @WallStJesus

Source: HSBC; @WallStJesus

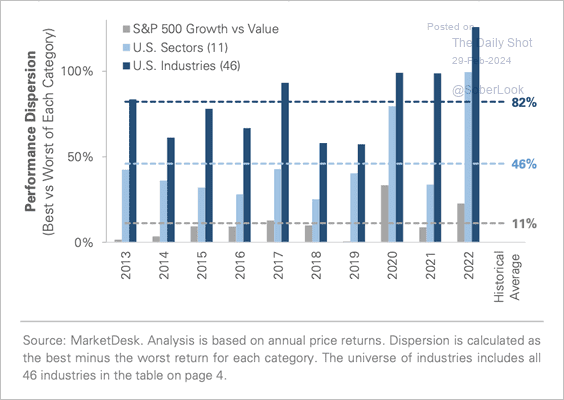

8. S&P 500 sectors and industries have a higher potential for return dispersion than growth vs. value factors.

Source: MarketDesk Research

Source: MarketDesk Research

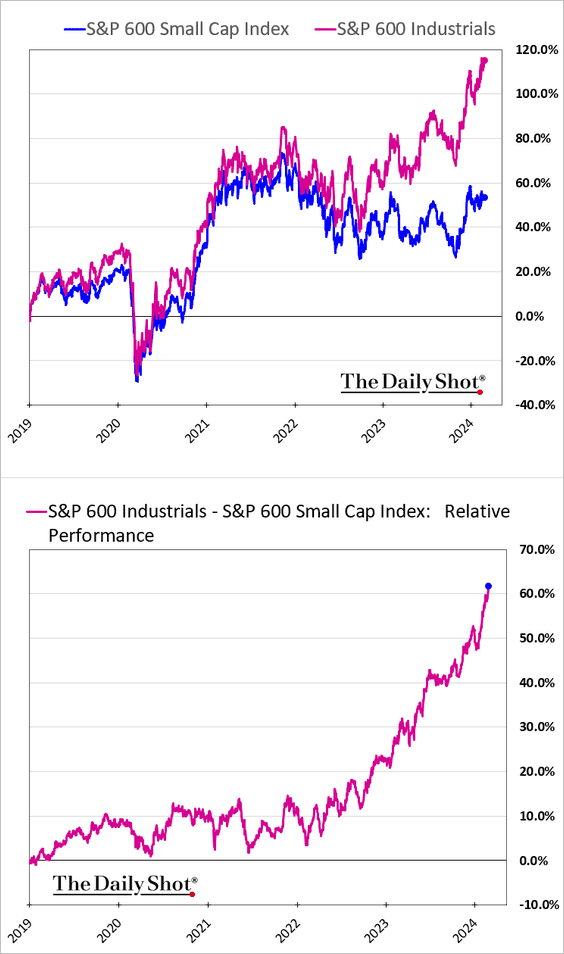

9. Smaller firms are driving the US manufacturing renaissance.

h/t @meanstoatrend

h/t @meanstoatrend

Back to Index

Credit

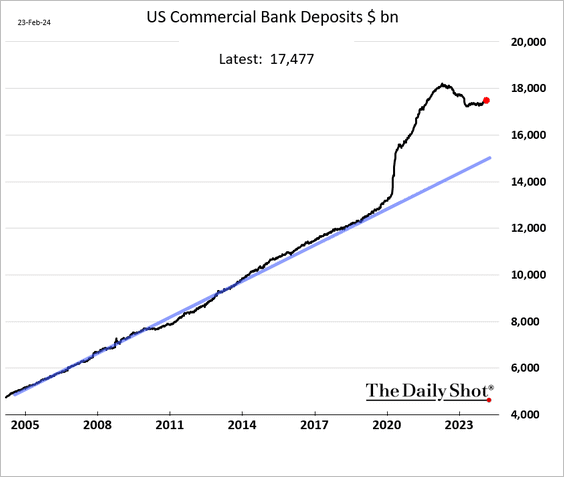

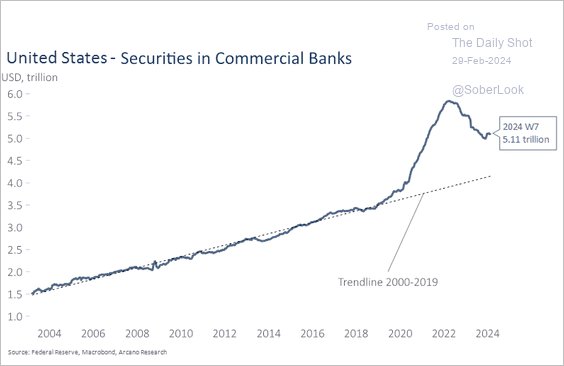

1. The COVID-era surge in bank deposits …

… forced commercial banks to buy bonds. Some smaller banks bought a lot of long-dated securities, creating an asset-liability mismatch.

Source: Arcano Economics

Source: Arcano Economics

——————–

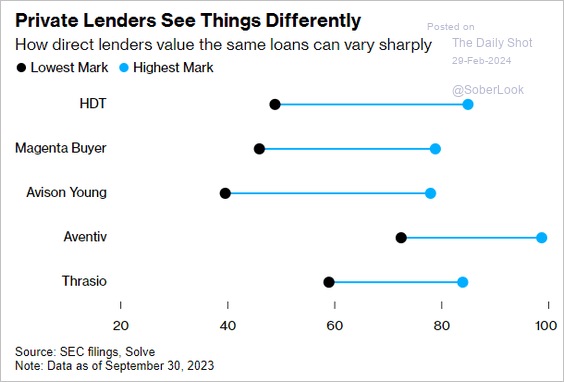

2. Valuations of direct loans vary substantially across private credit managers.

Source: @markets Read full article

Source: @markets Read full article

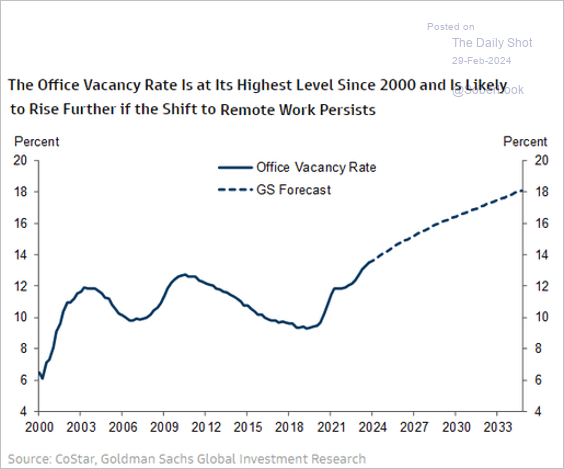

3. Office vacancy rates are expected to keep climbing.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Global Developments

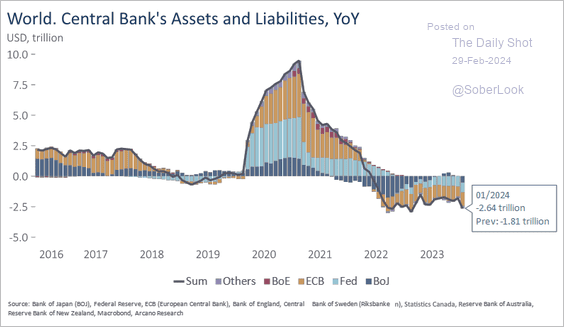

1. Central banks’ balance sheets continue to shrink.

Source: Arcano Economics

Source: Arcano Economics

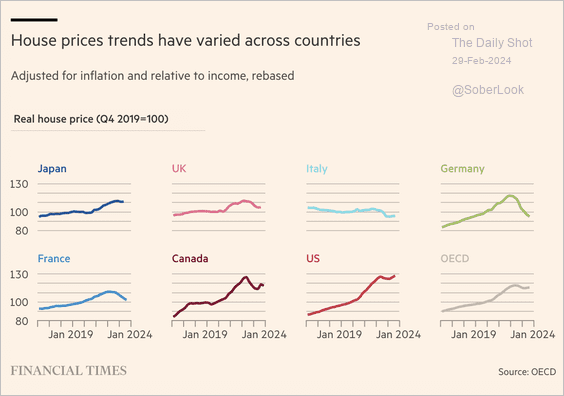

2. Here is a look at real house price trends in advanced economies.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

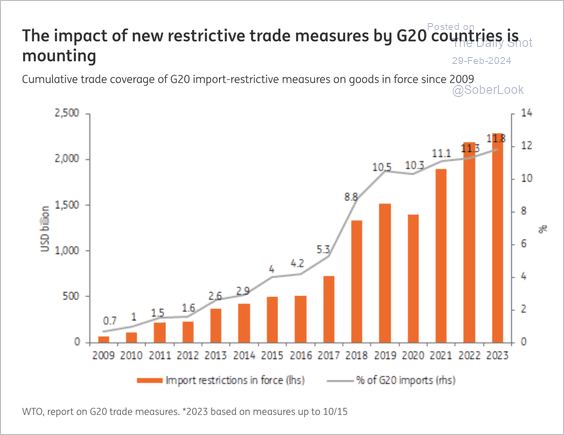

3. Import restrictions proliferate.

Source: ING

Source: ING

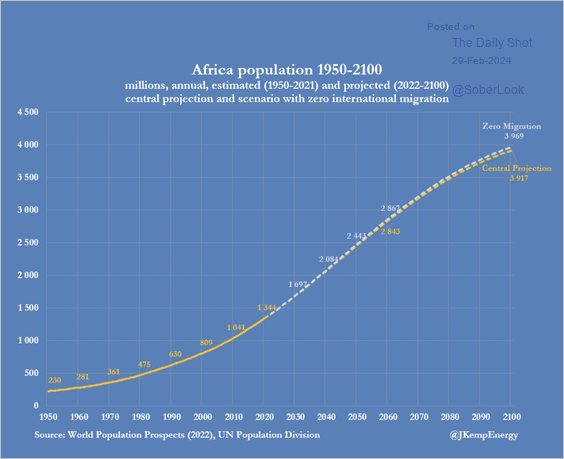

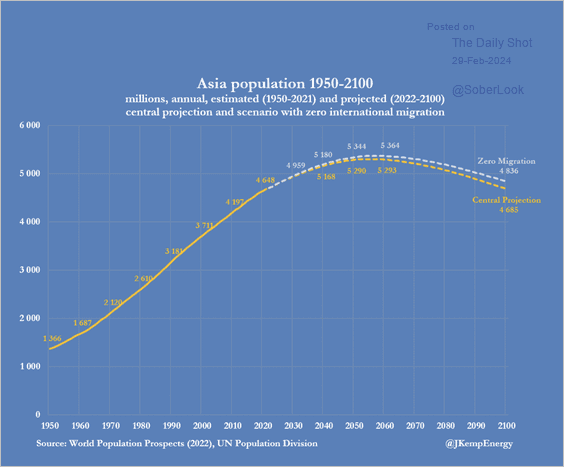

4. Africa’s population is expected to expand, while Asia could plateau in a few decades. (2 charts)

Source: @JKempEnergy

Source: @JKempEnergy

Source: @JKempEnergy

Source: @JKempEnergy

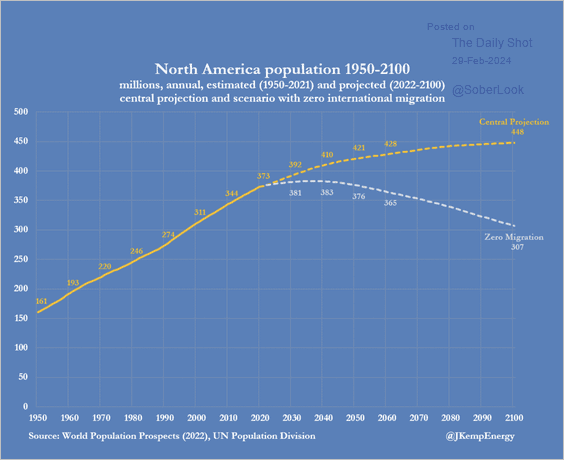

Absent immigration, North America’s population may reach its zenith in the near future.

Source: @JKempEnergy

Source: @JKempEnergy

——————–

Food for Thought

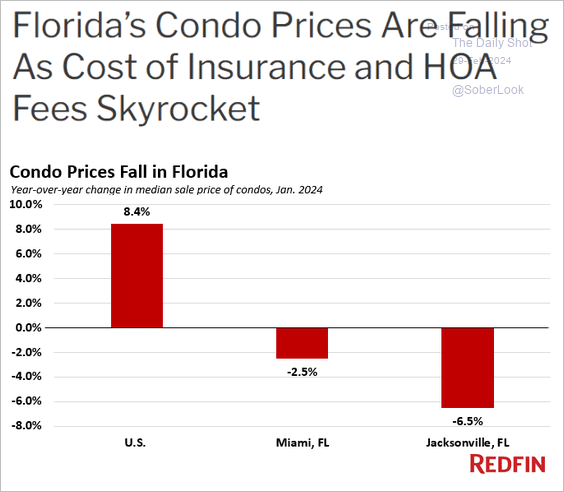

1. Florida condo prices:

Source: Redfin Read full article

Source: Redfin Read full article

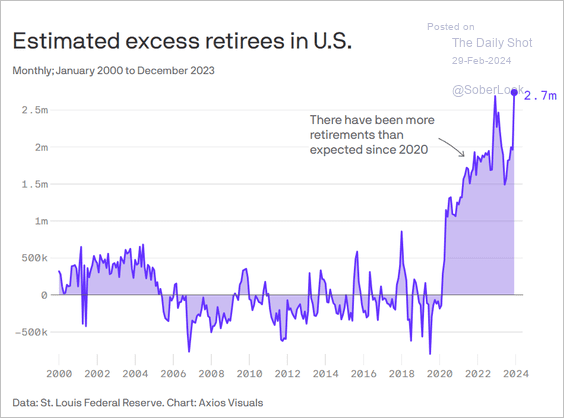

2. Excess retirees:

Source: @axios Read full article

Source: @axios Read full article

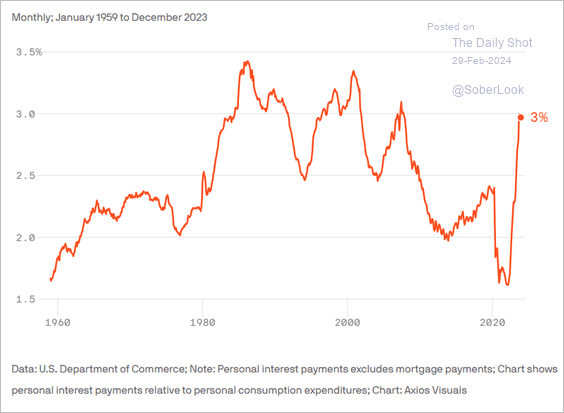

3. Interest payments as a share of consumer spending:

Source: @axios Read full article

Source: @axios Read full article

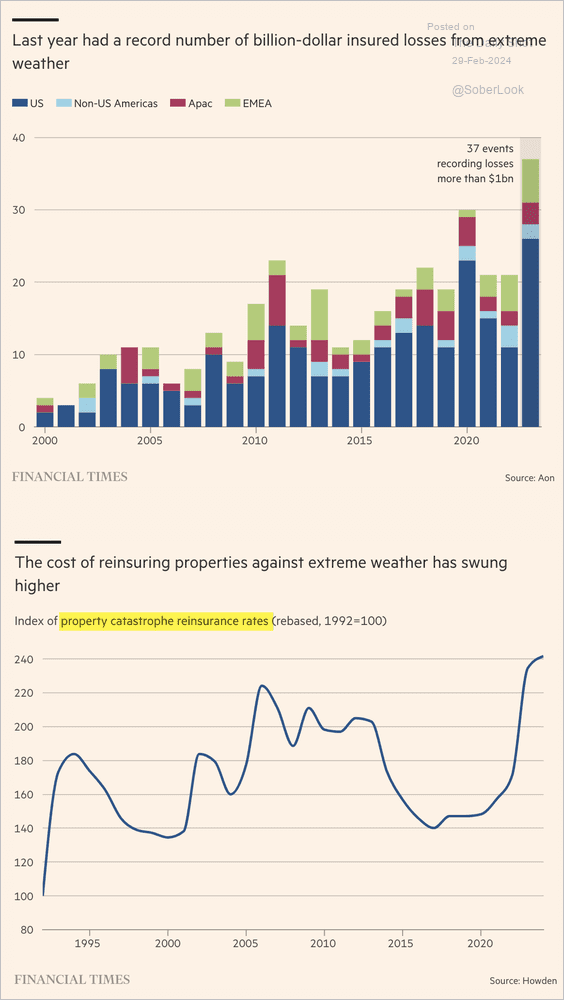

4. Extreme-weather insurance trends:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

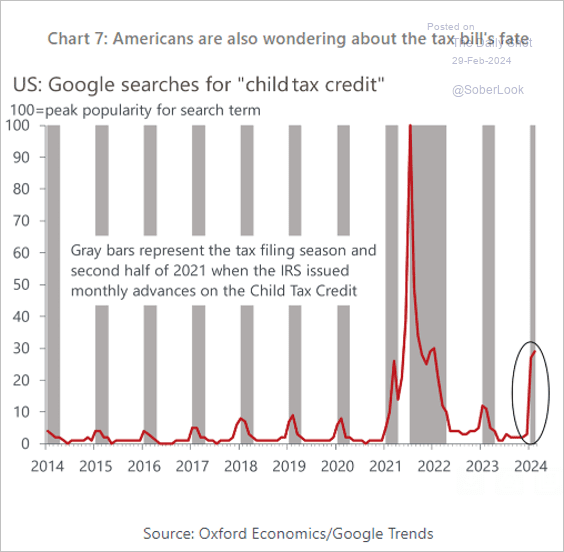

5. Google searches for “child tax credit”:

Source: Oxford Economics

Source: Oxford Economics

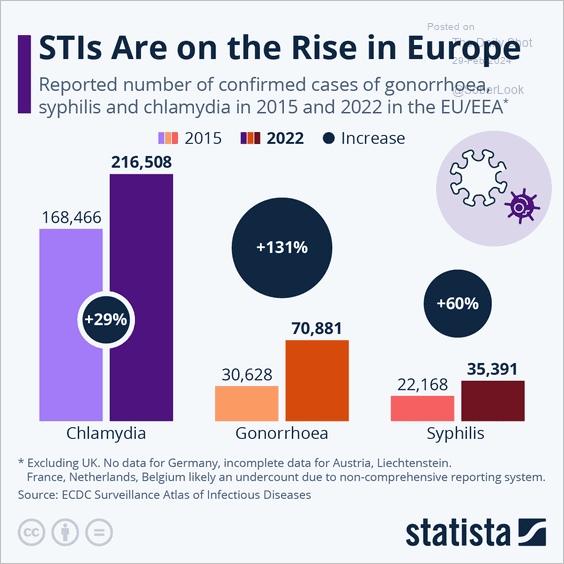

6. STIs on the rise in Europe:

Source: Statista

Source: Statista

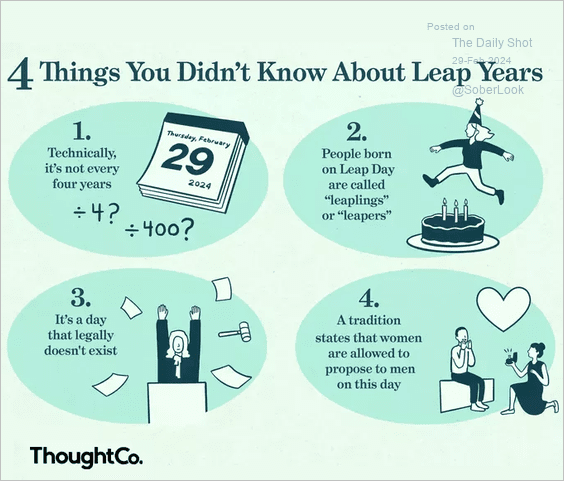

7. Facts about leap years:

Source: ThoughtCo Read full article

Source: ThoughtCo Read full article

——————–

Back to Index