The Daily Shot: 04-Mar-24

• The United States

• Canada

• The Eurozone

• Europe

• Japan

• Asia-Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

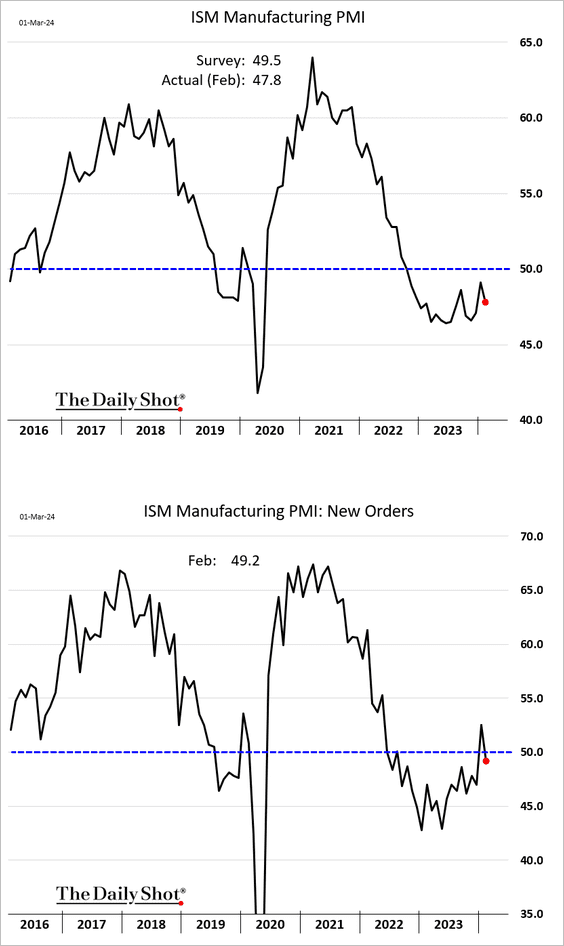

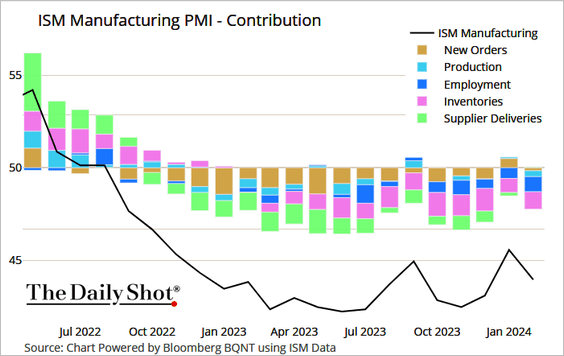

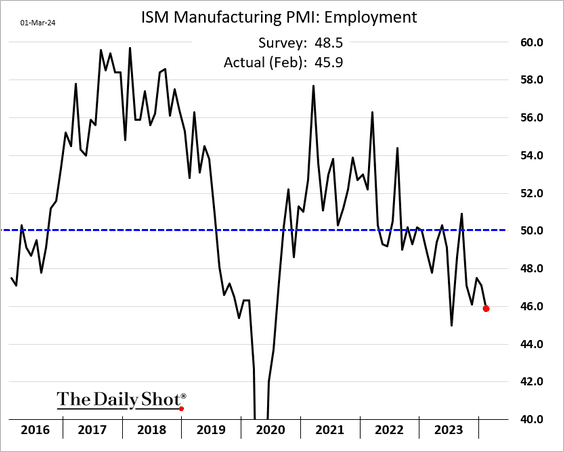

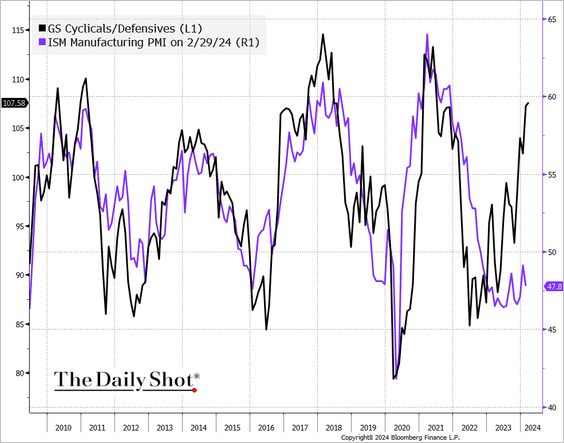

1. The ISM manufacturing PMI unexpectedly moved deeper into contraction territory last month, …

… dragged lower by inventories and employment.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

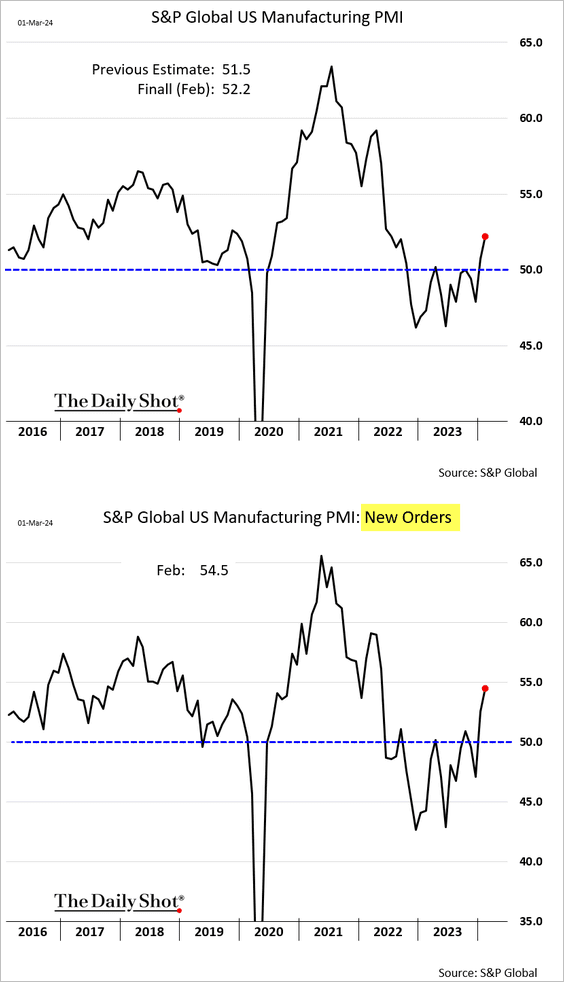

However, a similar report from S&P Global paints a very different picture.

Why such a disconnect? The ISM data tends to concentrate on larger multinationals, while S&P Global surveys encompass a more representative mix of companies across various sizes.

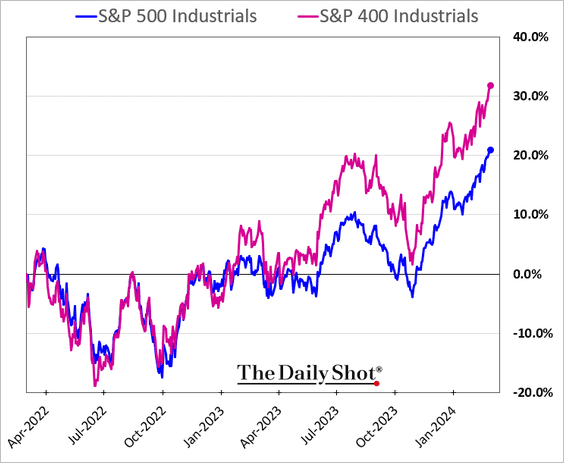

Amid slower growth in China and Europe, multinationals are encountering more obstacles compared to domestic industrial companies. Shares of small- and mid-cap industrials have outpaced both their benchmarks and larger-cap counterparts. The ISM manufacturing PMI weakness, therefore, is not representative of the broader US economic activity.

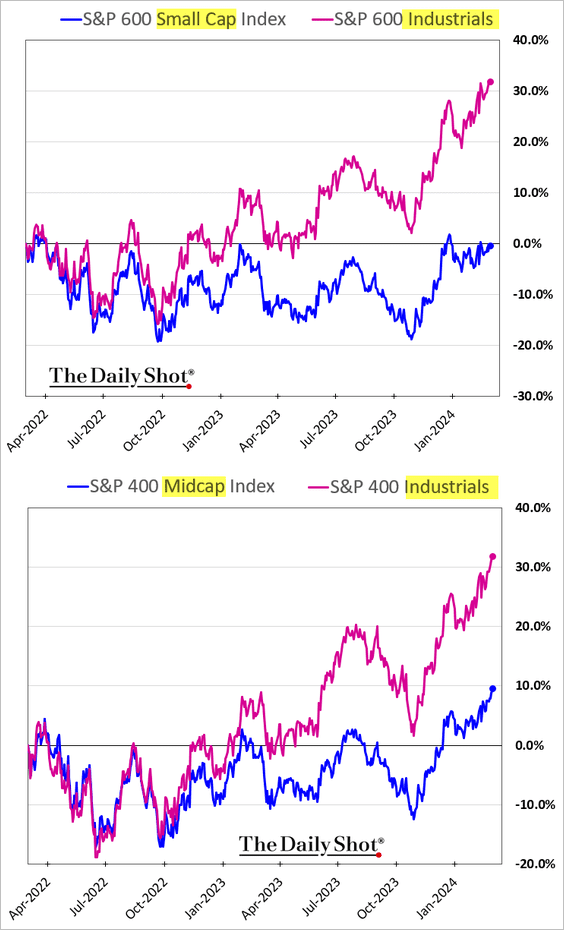

Moreover, leading indicators continue to signal stronger US manufacturing activity.

Source: BofA Global Research

Source: BofA Global Research

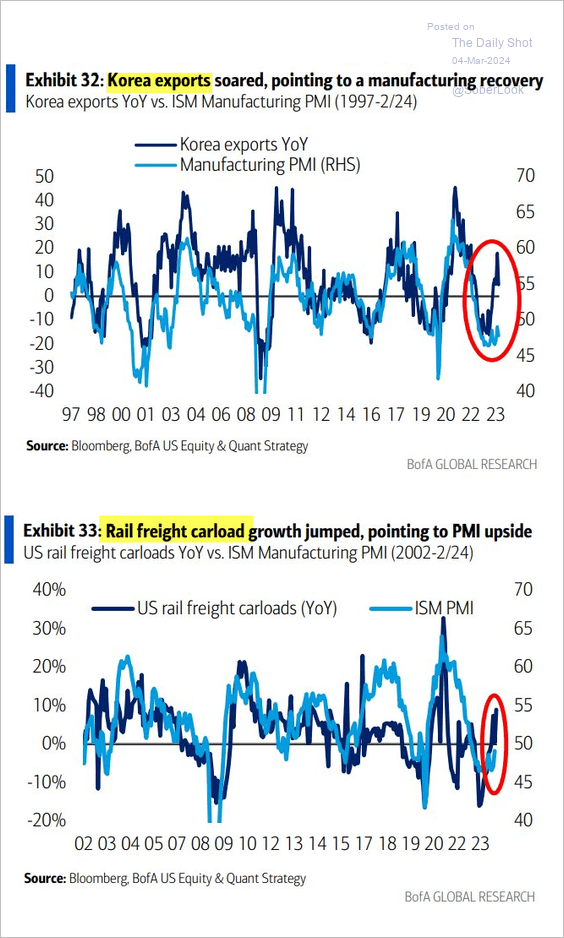

Here is the ratio of cyclical to defensive sectors.

——————–

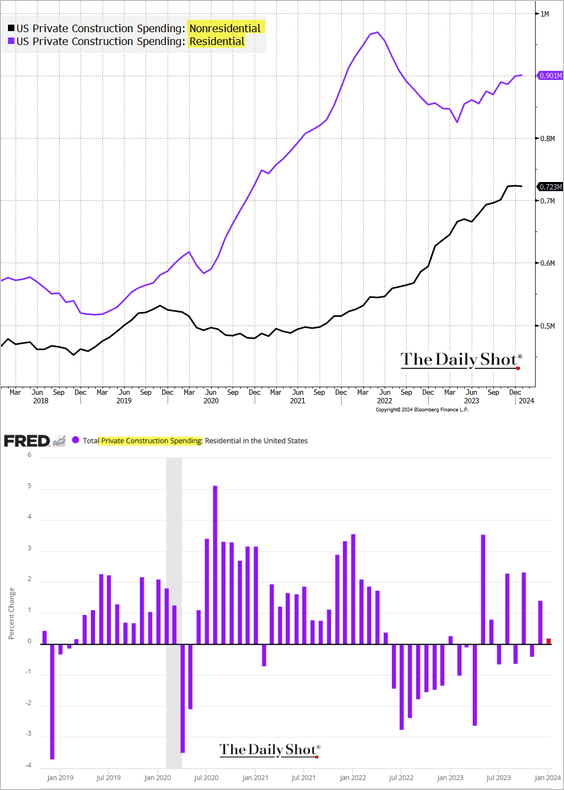

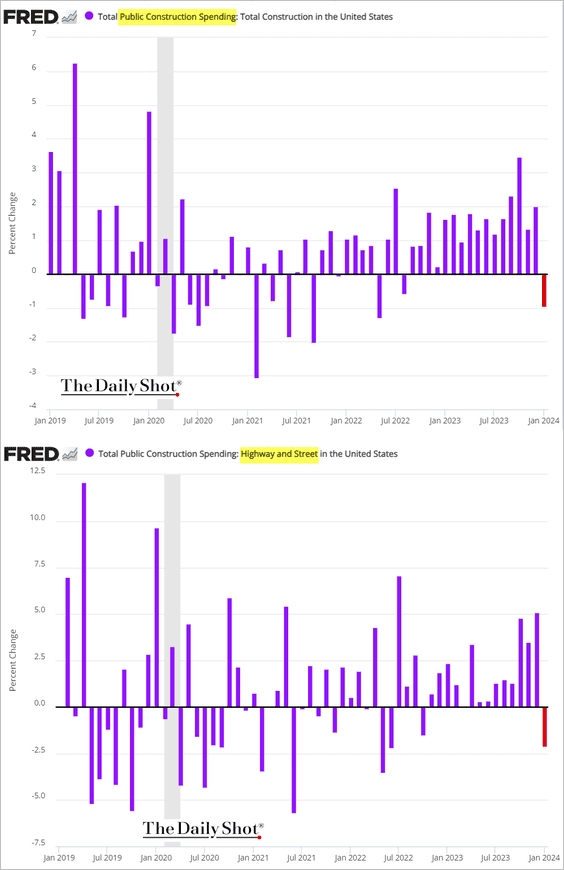

2. US construction spending declined for the first time in 13 months in January.

Source: Reuters Read full article

Source: Reuters Read full article

• Private construction spending edged higher.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• The weakness was in public construction expenditures, which was partly attributed to unfavorable weather conditions.

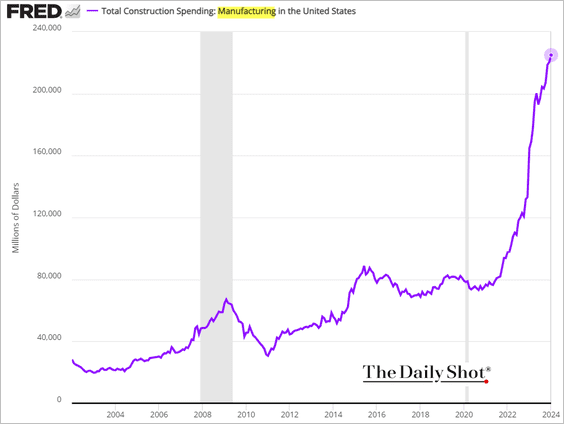

• Manufacturing construction spending continues to climb.

——————–

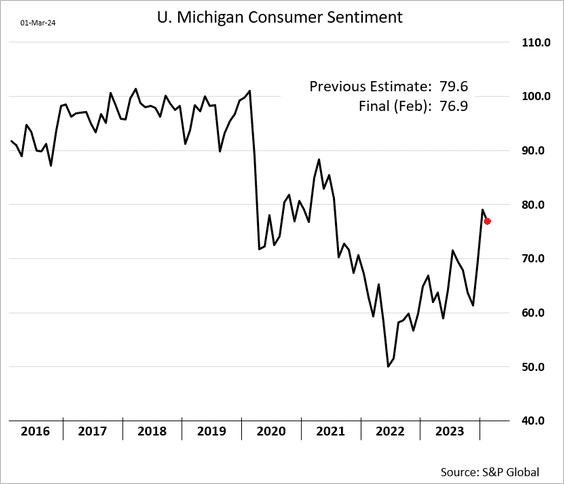

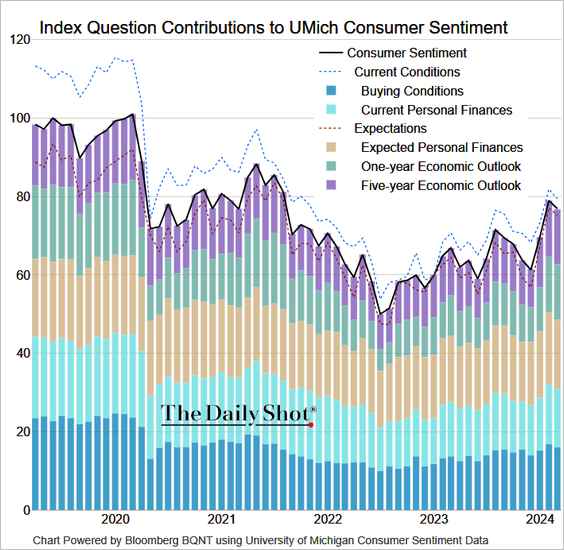

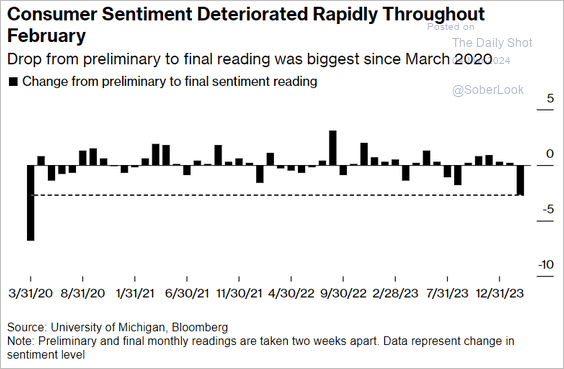

3. The updated consumer sentiment from the University of Michigan registered an unexpected decline, …

… indicating a weakening in sentiment during the latter half of February.

Source: @economics Read full article

Source: @economics Read full article

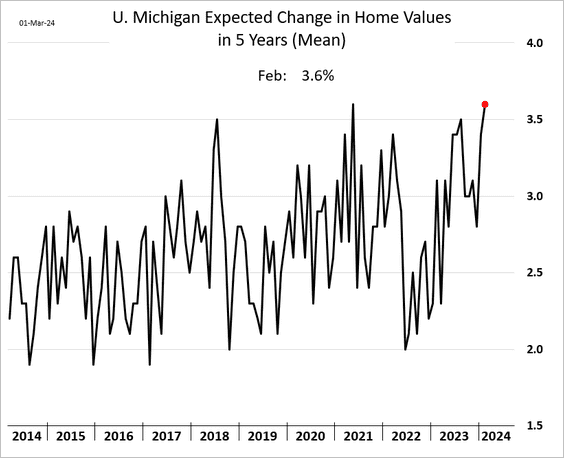

• Consumers are upbeat on longer-term home price appreciation.

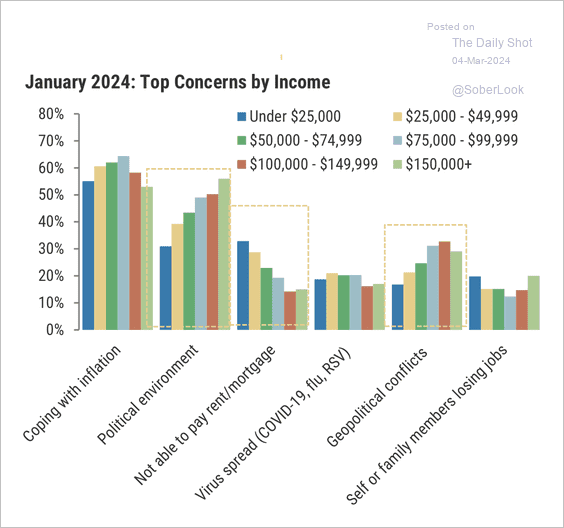

• Separately, higher-income households are more concerned about the political environment, while lower-income households are concerned about their ability to pay rent/mortgages.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

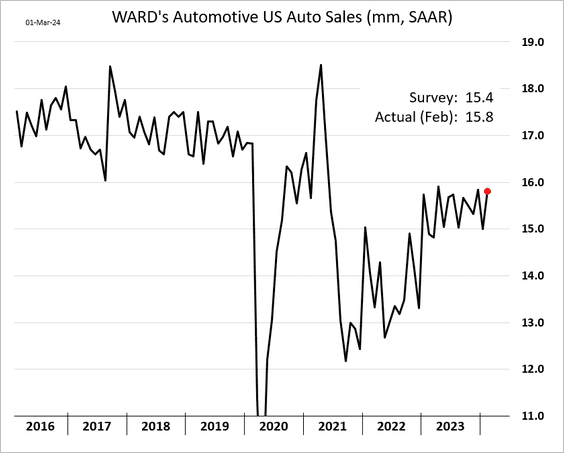

4. Automobile sales saw an uptick last month, rebounding from a downturn in January.

Back to Index

Canada

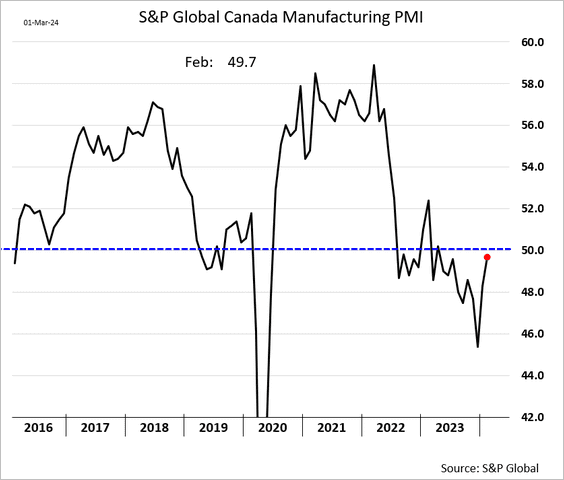

1. Factory activity has almost stabilized, according to the February PMI report.

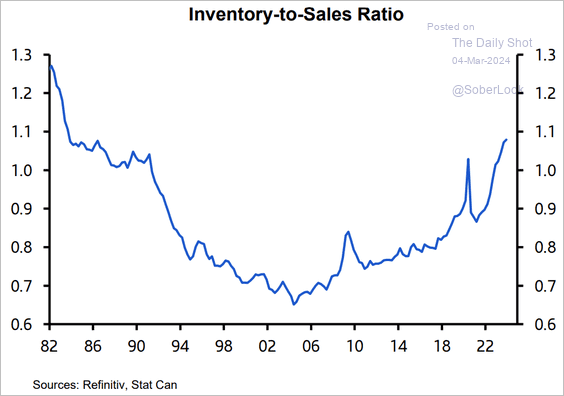

2. Inventories look bloated.

Source: Capital Economics

Source: Capital Economics

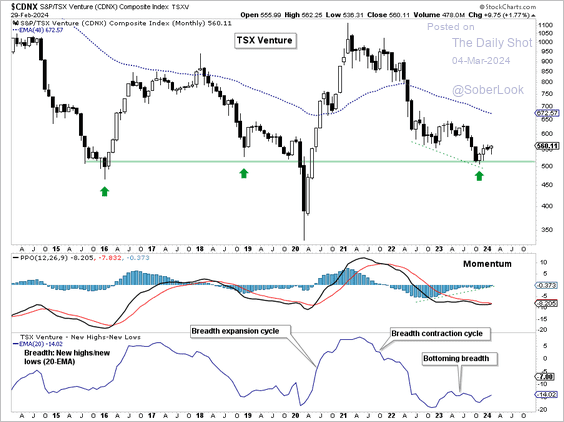

3. The TSX Venture Composite Index (microcaps) is holding support with improving momentum and breadth.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

Back to Index

The Eurozone

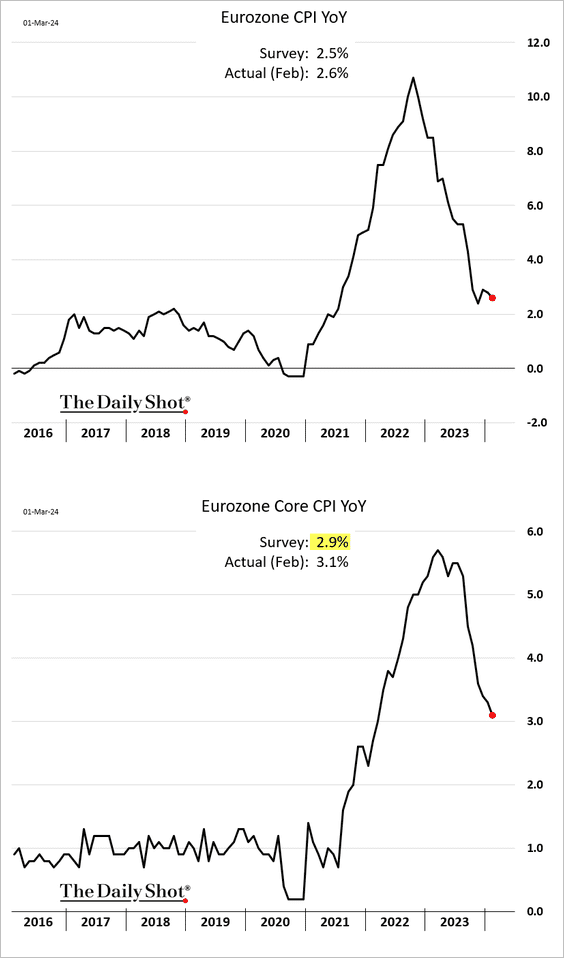

1. Euro-area inflation is moderating, but the February figure was above forecasts.

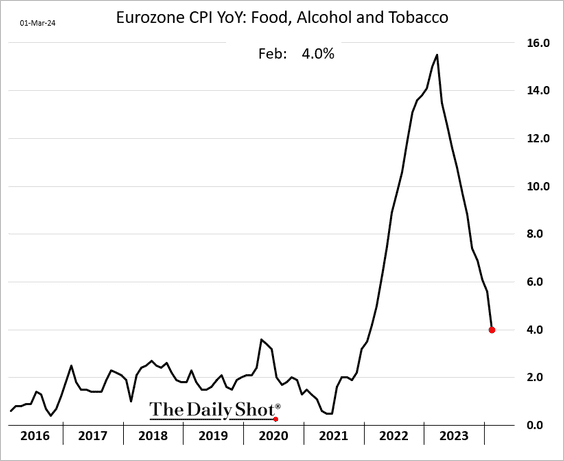

• Food inflation is falling quickly.

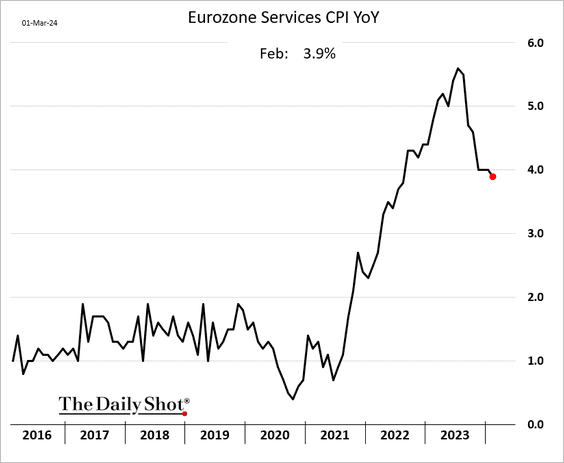

• Services inflation has been elevated.

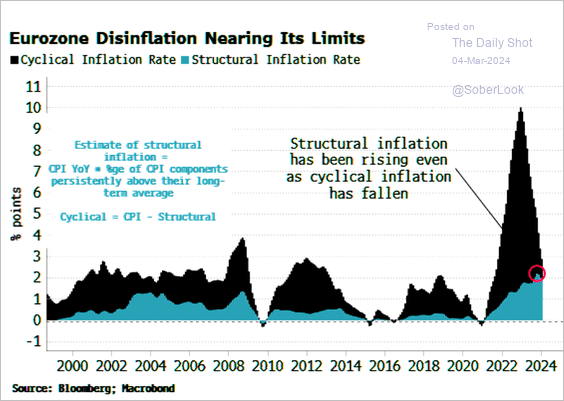

• The structural elements of inflation within the euro area are expected to require a more extended period to decelerate.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

——————–

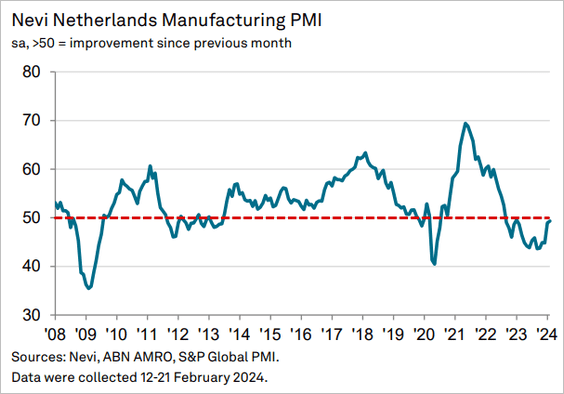

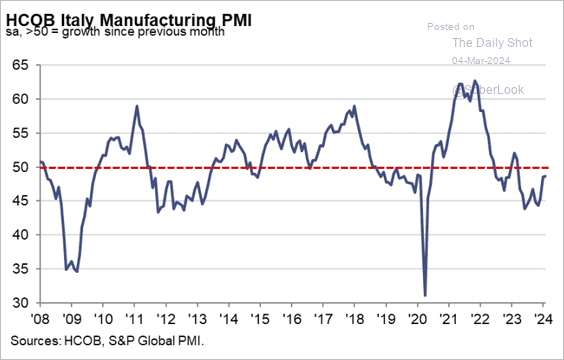

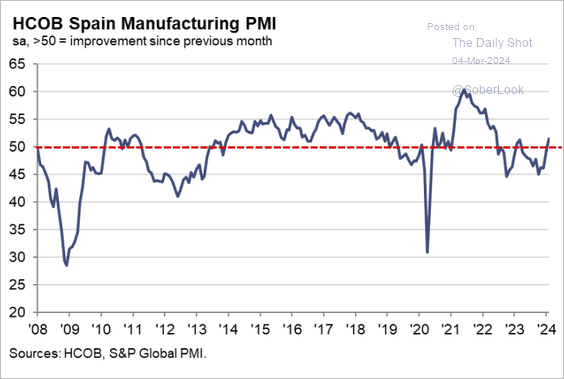

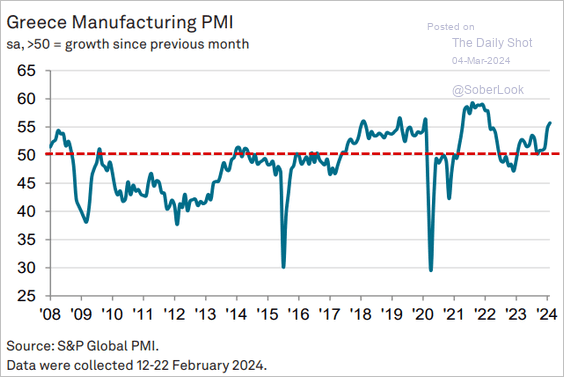

2. The PMI reports show manufacturing improvement last month.

• The Netherlands (stabilizing):

• Italy (still in contraction, but improving):

Source: S&P Global PMI

Source: S&P Global PMI

• Spain (growing again):

Source: S&P Global PMI

Source: S&P Global PMI

• Greece (accelerating):

Source: S&P Global PMI

Source: S&P Global PMI

——————–

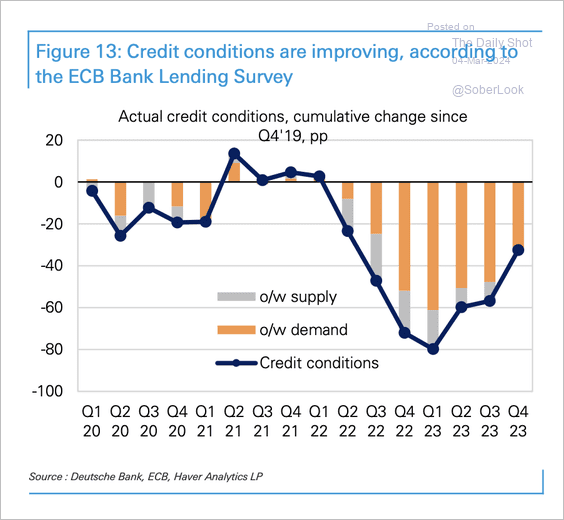

3. Euro area credit conditions are improving.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Europe

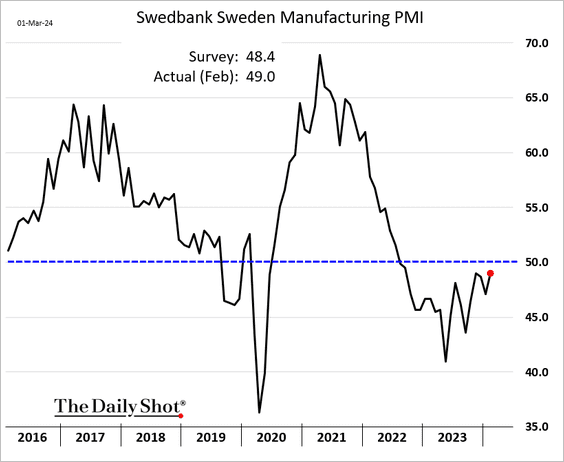

1. The slump in Sweden’s factory activity continues to ease.

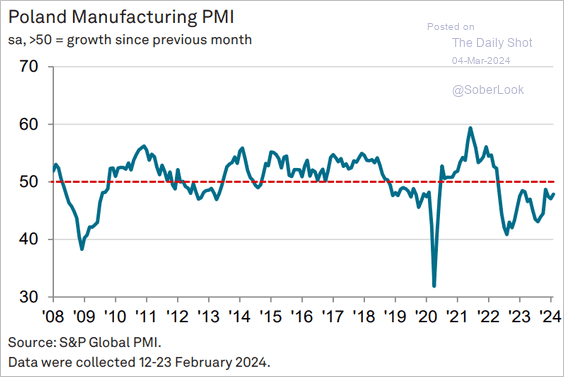

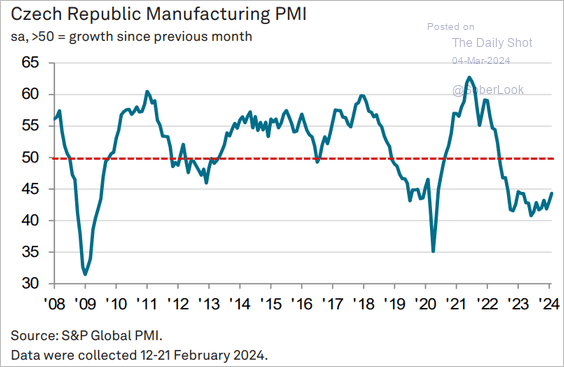

2. Central European manufacturing hubs report ongoing contraction.

• Poland:

Source: S&P Global PMI

Source: S&P Global PMI

• Czech Republic:

Source: S&P Global PMI

Source: S&P Global PMI

——————–

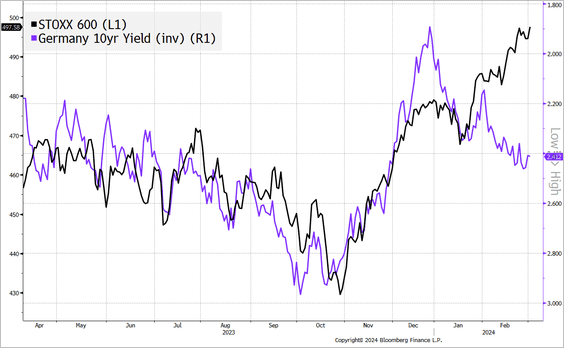

3. European stocks have been climbing despite higher bond yields.

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @NoorAlAli

Source: @TheTerminal, Bloomberg Finance L.P.; h/t @NoorAlAli

Back to Index

Japan

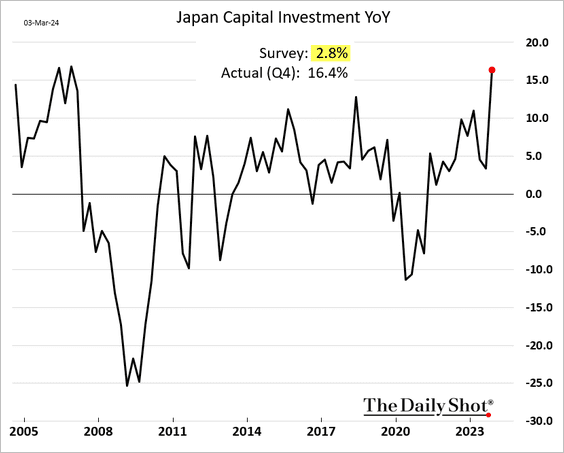

1. Japan’s capital expenditure witnessed an unexpected surge last quarter, indicating the potential for an upward revision in GDP.

Source: The Mainichi Read full article

Source: The Mainichi Read full article

——————–

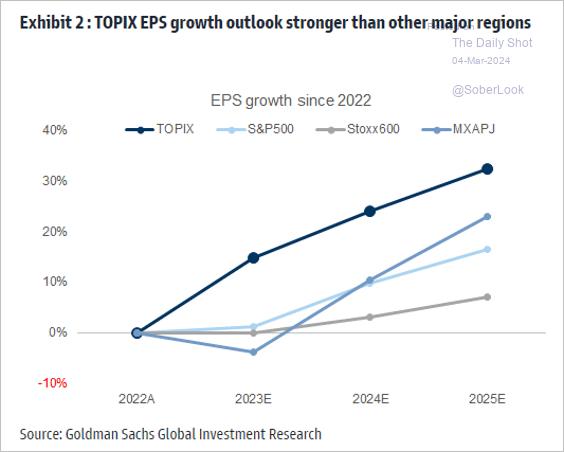

2. TOPIX EPS growth estimates are surpassing those of other markets.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

Asia-Pacific

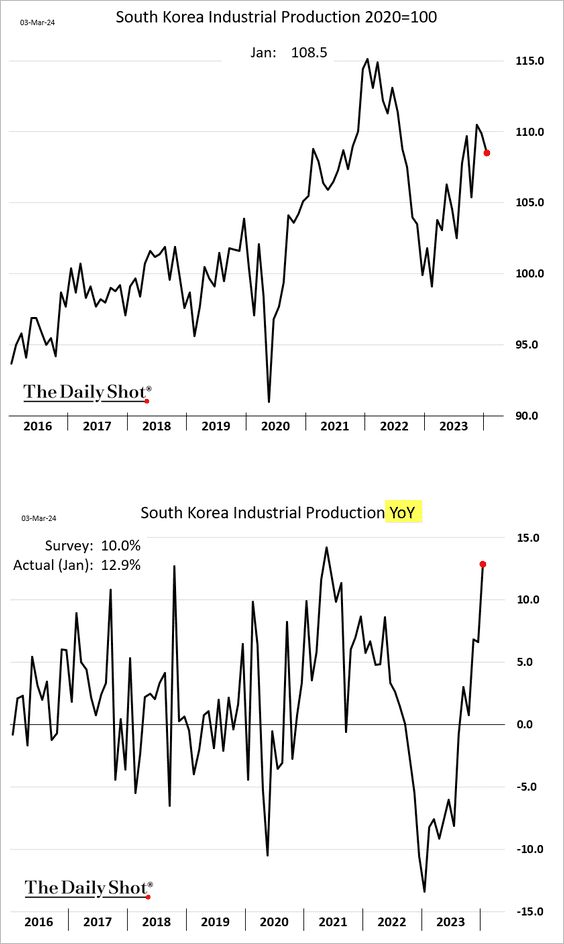

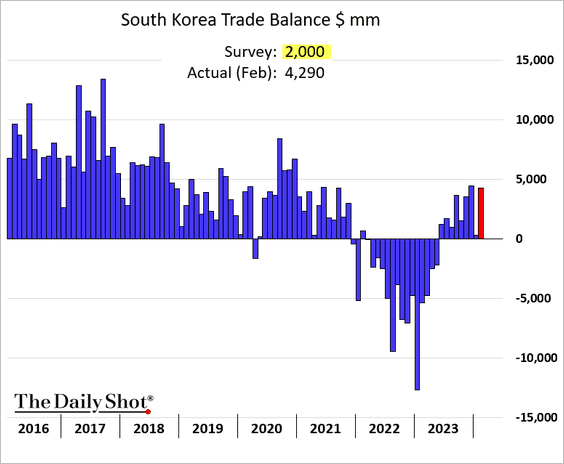

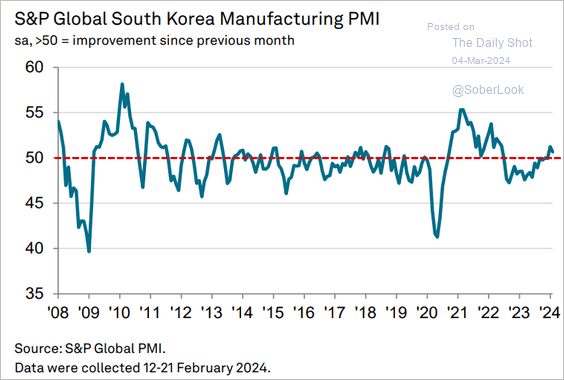

1. Let’s begin with South Korea.

• Industrial production continues to improve.

• The trade balance topped expectations.

• Manufacturing activity grew at a slower pace last month.

Source: S&P Global PMI

Source: S&P Global PMI

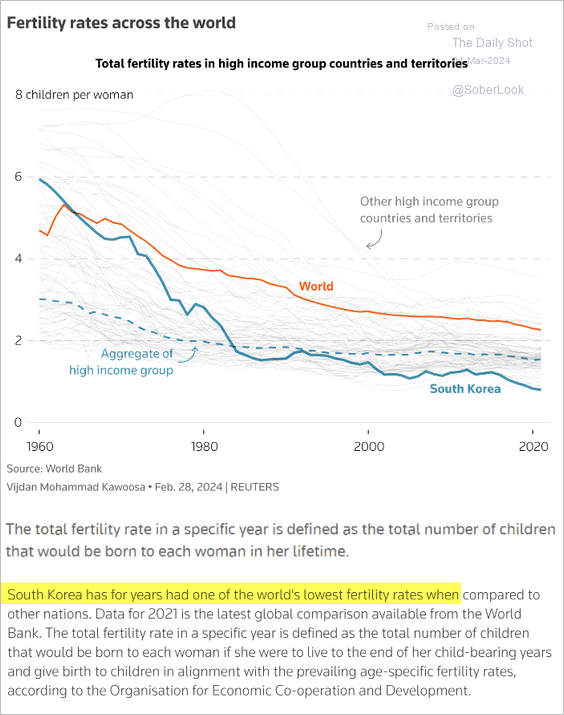

• South Korea faces demographic challenges.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

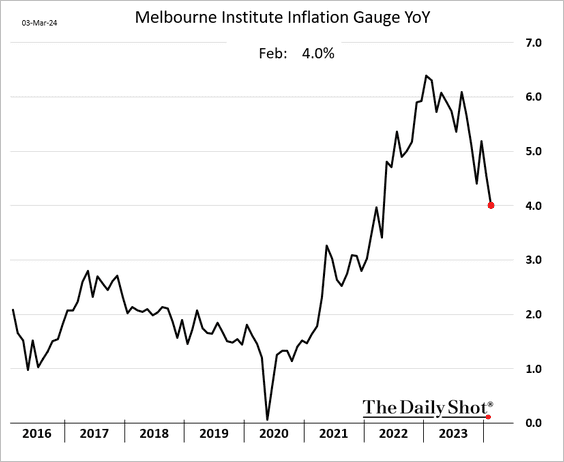

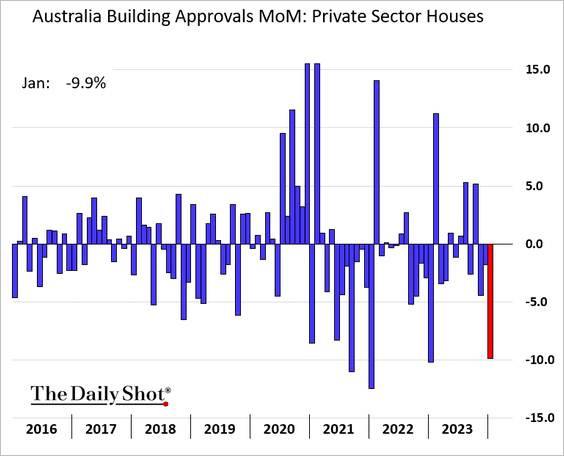

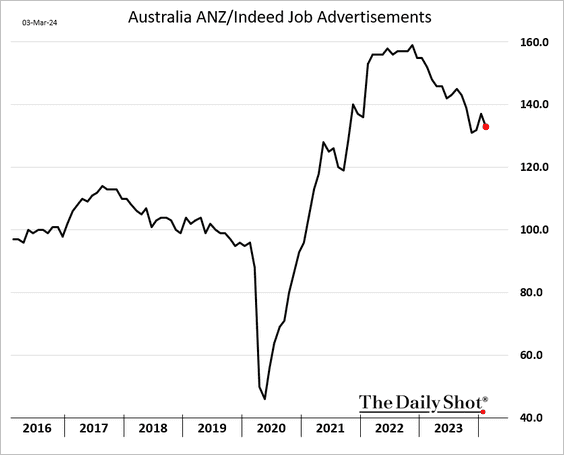

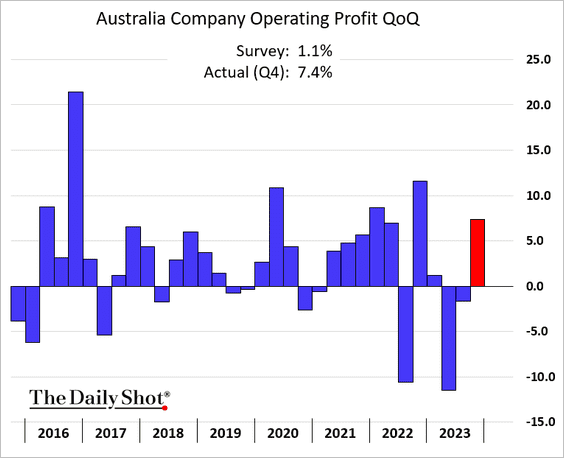

2. Next, we have some updates on Australia.

• Inflation eased further last month, according to an estimate from the Melbourne Institute.

• Building approvals for private-sector houses tumbled in January.

• Job openings are trending lower.

• Corporate operating profits jumped last quarter.

Back to Index

China

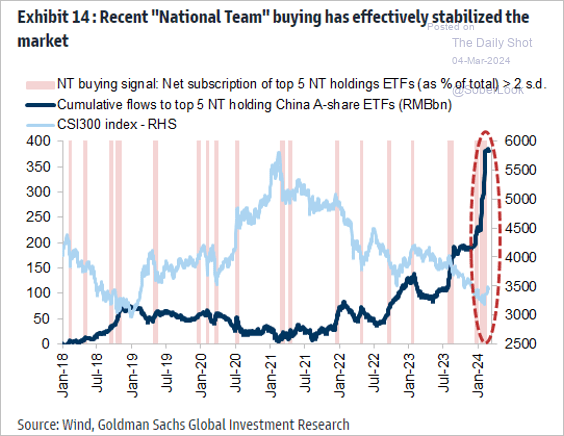

1. Beijing has stabilized the equity market.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

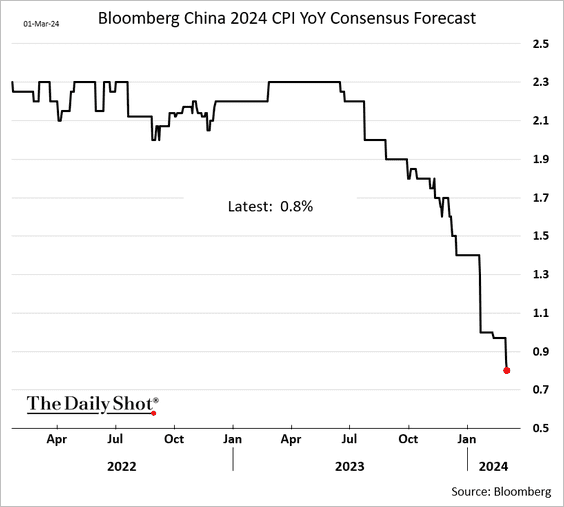

2. Economists continue to downgrade their forecasts for China’s inflation this year.

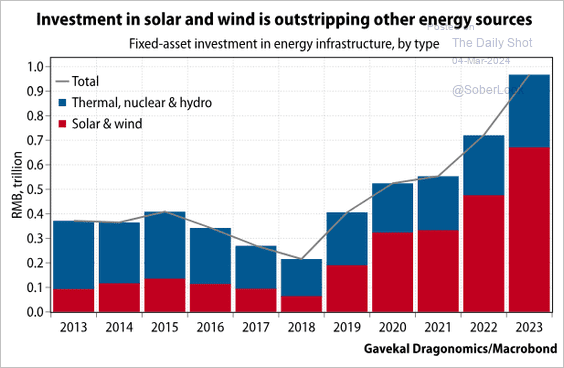

3. Here is a look at China’s investment in solar and wind energy.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

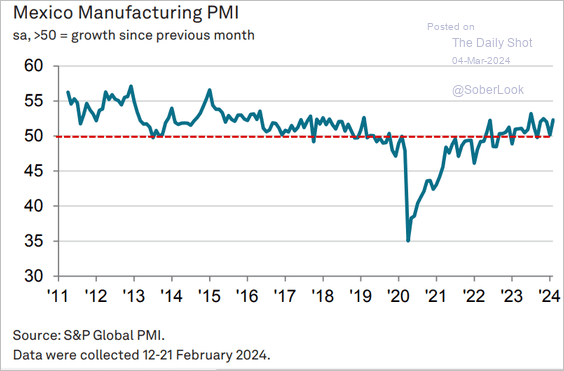

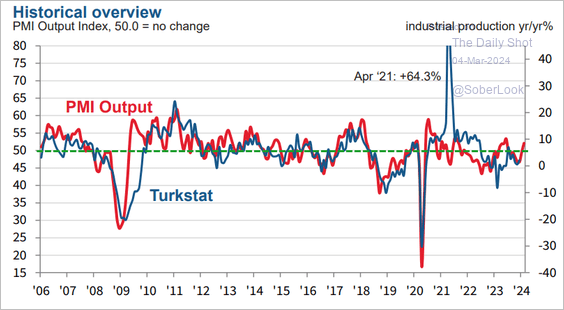

1. Let’s run through some manufacturing PMI reports for February.

• Mexico (growth improved):

Source: S&P Global PMI

Source: S&P Global PMI

• Turkey (back in growth territory):

Source: S&P Global PMI

Source: S&P Global PMI

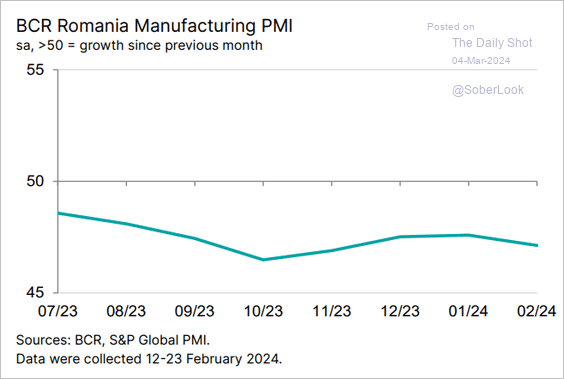

• Romania (struggling):

Source: S&P Global PMI

Source: S&P Global PMI

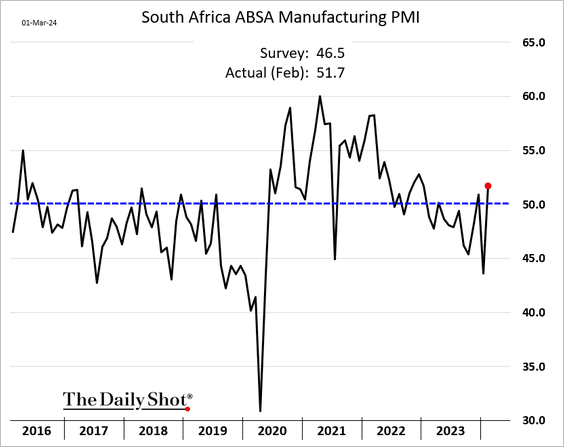

• South Africa (back in expansion mode):

——————–

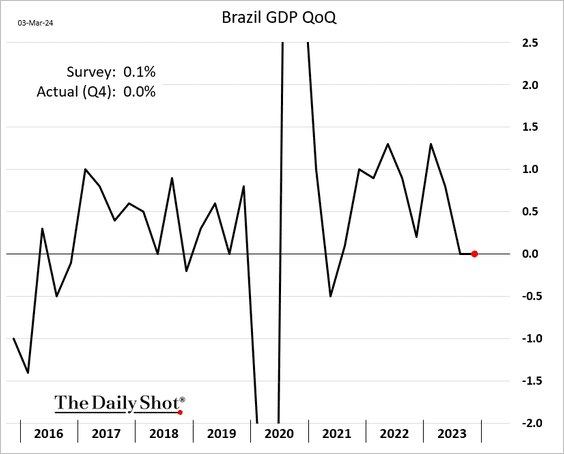

2. Brazil’s economic growth stalled last quarter.

Source: @economics Read full article

Source: @economics Read full article

——————–

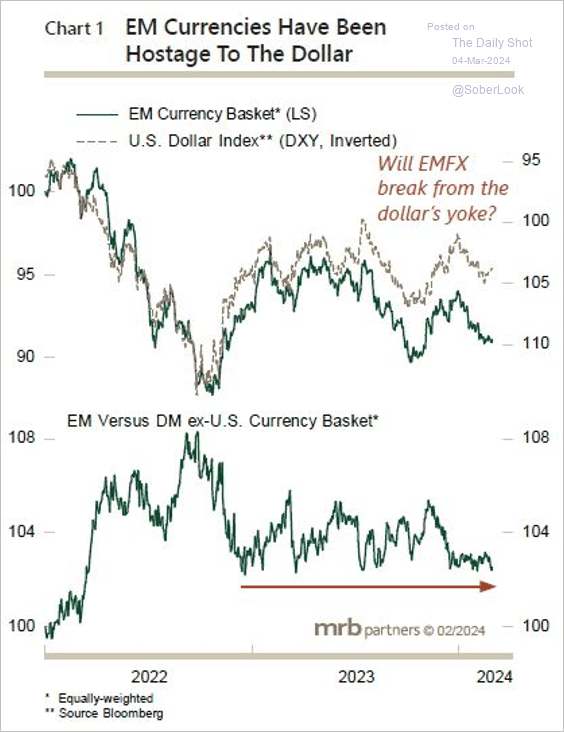

3. EM currencies have traded in a tight range relative to the DM-ex US currency basket over the past year.

Source: MRB Partners

Source: MRB Partners

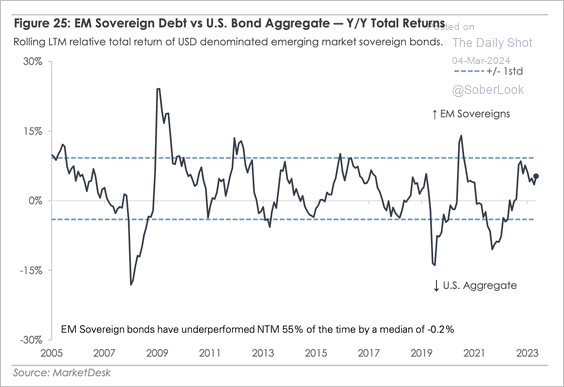

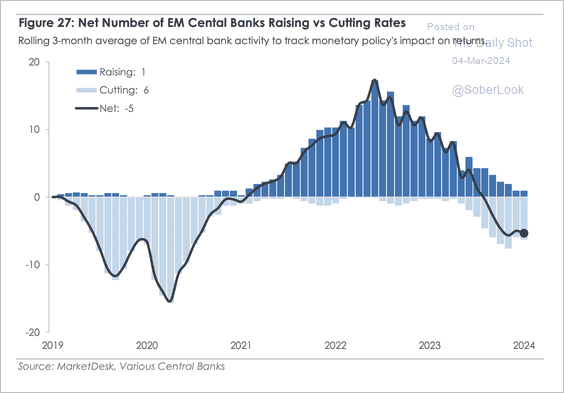

4. EM sovereign bonds continue to outperform US bonds as more central banks cut rates. (2 charts)

Source: MarketDesk Research

Source: MarketDesk Research

Source: MarketDesk Research

Source: MarketDesk Research

Back to Index

Cryptocurrency

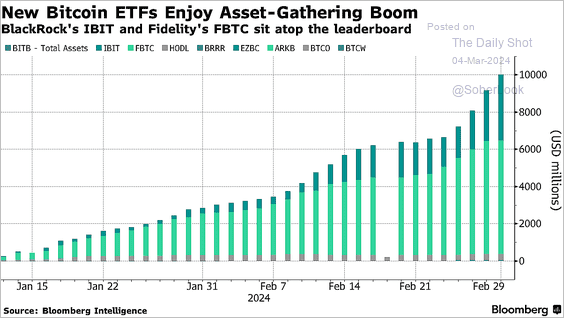

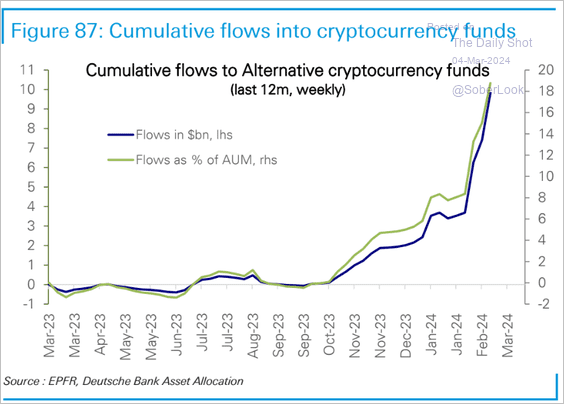

1. Bitcoin ETFs’ AUM is surging (2 charts).

Source: @business Read full article

Source: @business Read full article

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

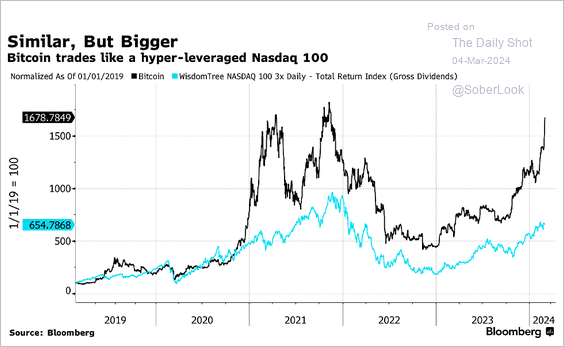

2. Bitcoin trades like a very leveraged Nasdaq 100 instrument.

Source: @5thrule Read full article

Source: @5thrule Read full article

Back to Index

Commodities

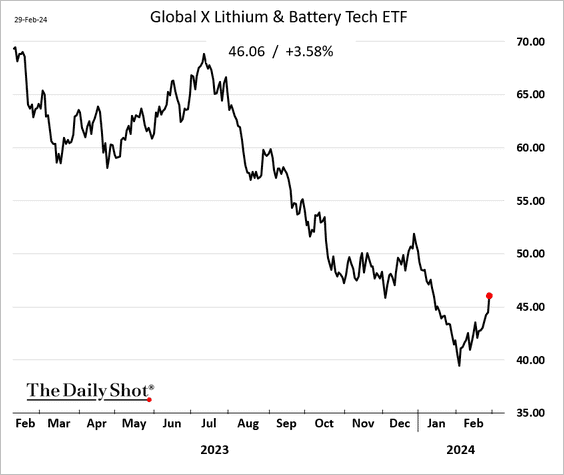

1. Shares of lithium miners and battery manufacturers are rebounding.

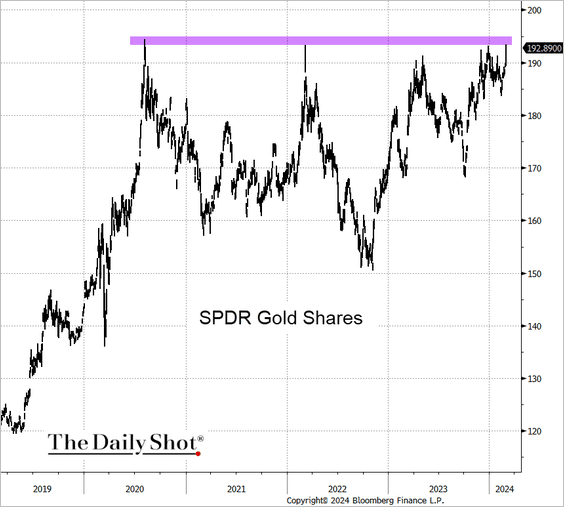

2. GLD (largest gold ETN) is at resistance.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

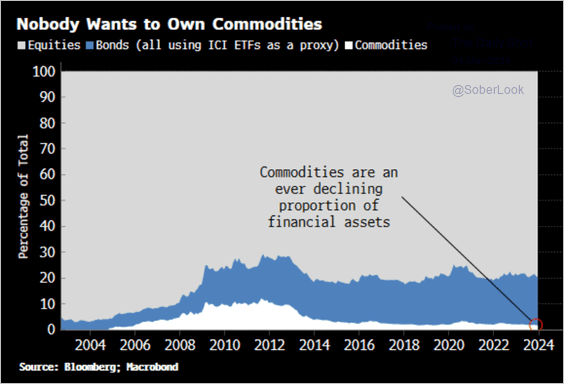

3. Allocations to commodities have been depressed over the past decade.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

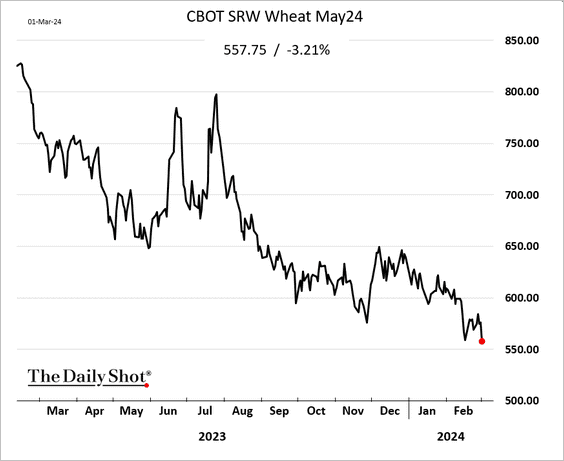

4. US wheat futures are under pressure.

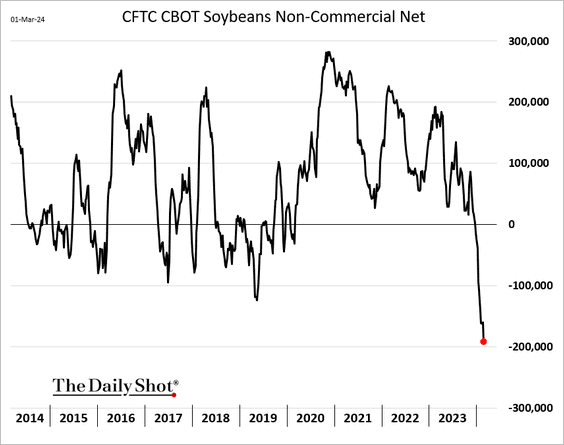

5. Speculative accounts continue to press their bets against the soy complex.

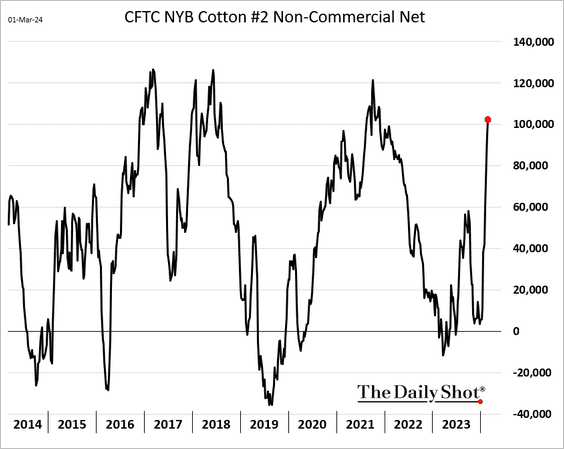

6. Traders are boosting their bets on cotton.

Back to Index

Energy

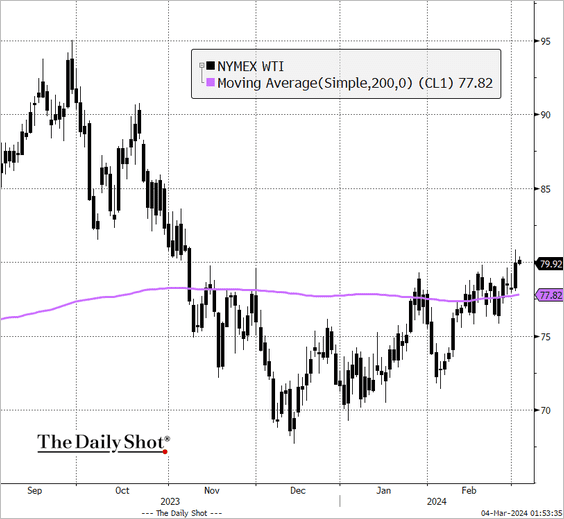

1. OPEC+ extended its oil output cuts.

Source: Reuters Read full article

Source: Reuters Read full article

NYMEX crude hit the highest level since November.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

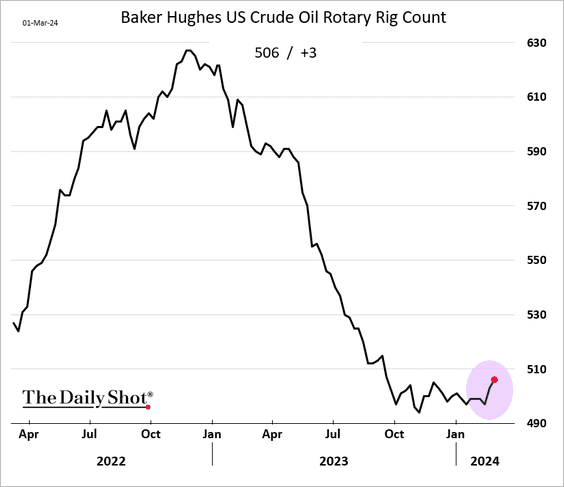

2. The US oil rig count has been moving higher.

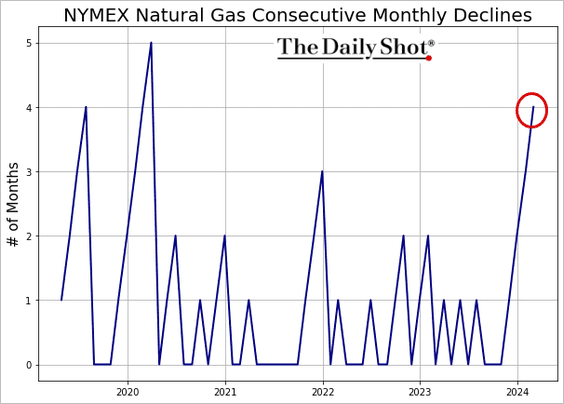

3. US natural gas prices have declined for four consecutive months.

Back to Index

Equities

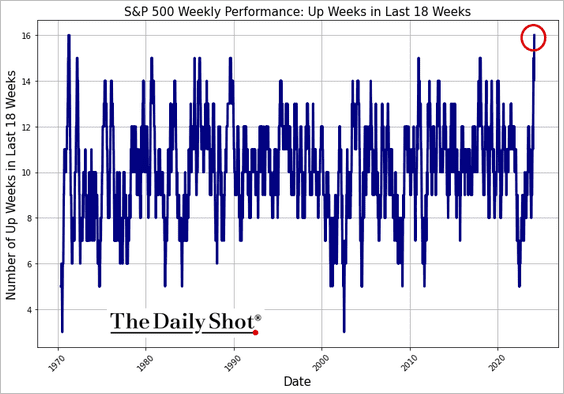

1. It’s been over half a century since the S&P 500 was up 16 out of 18 weeks.

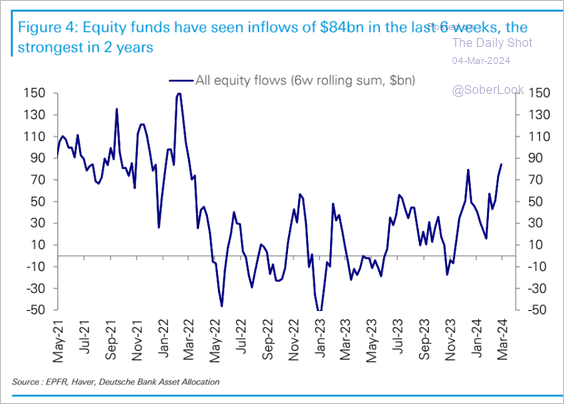

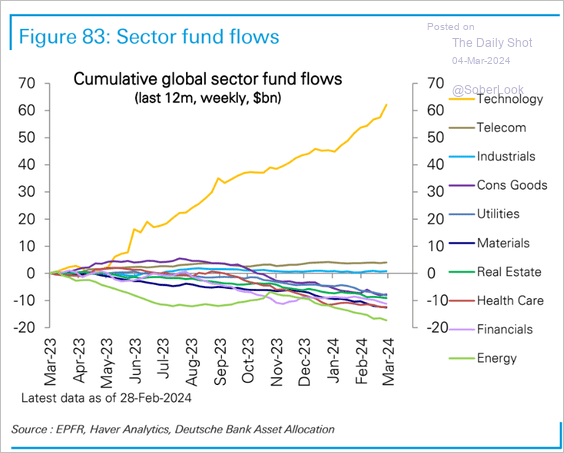

2. Fund inflows remain robust, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

… with flows into tech funds reaching extreme levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

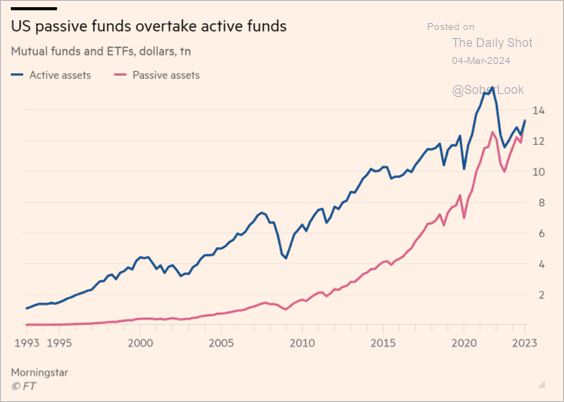

• Passive fund assets have overtaken active funds.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

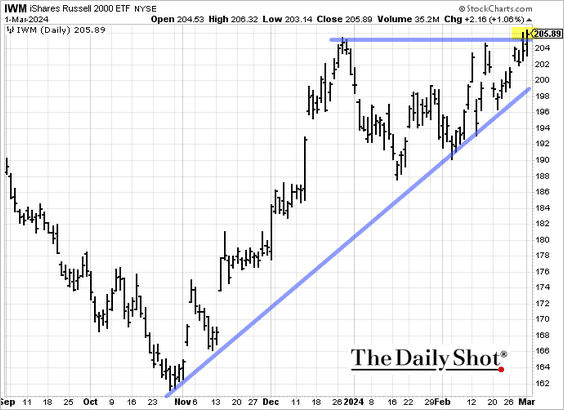

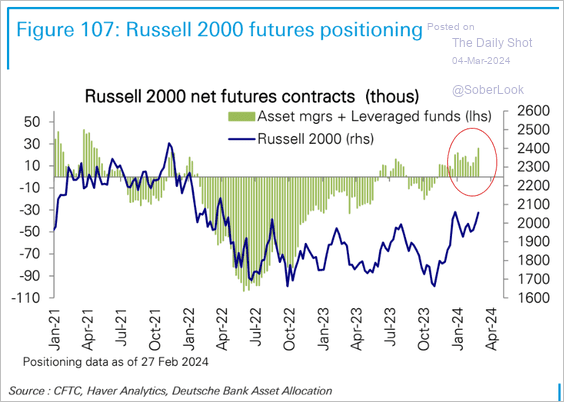

3. Will we see a breakout in the Russell 2000 index?

Positioning has been improving.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

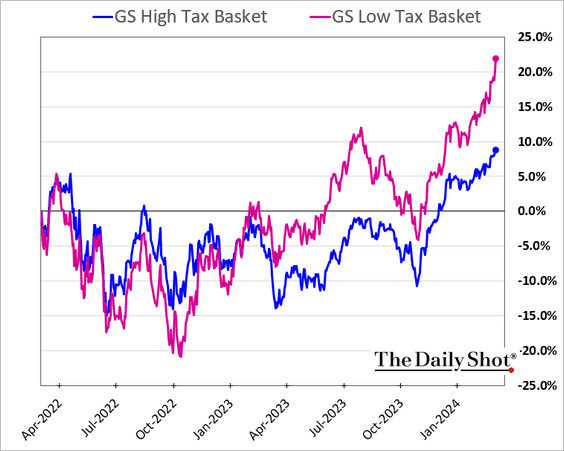

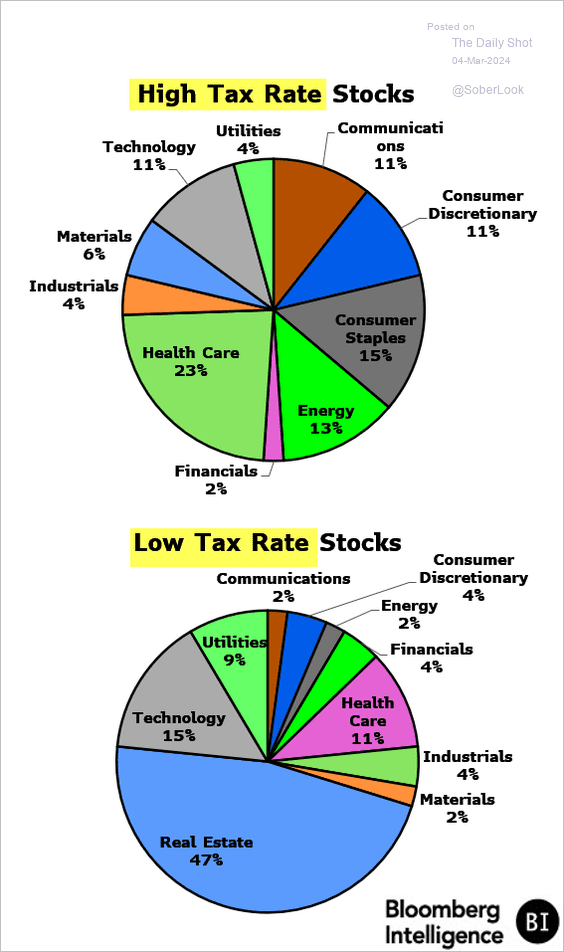

4. Companies with low tax rates have been outperforming.

Here is a look at low- and high-tax sectors.

Source: @markets Read full article

Source: @markets Read full article

——————–

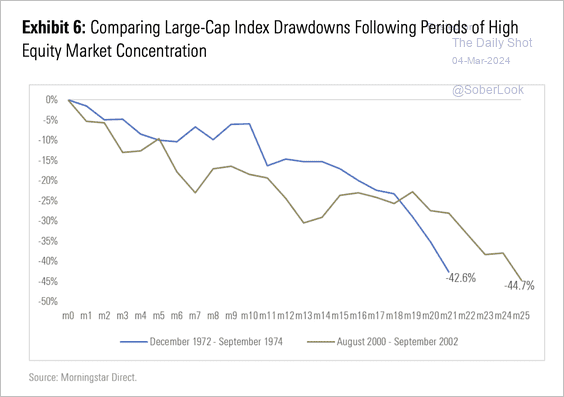

5. Prior periods of extreme market concentration have preceded significant drawdowns.

Source: Morningstar Read full article

Source: Morningstar Read full article

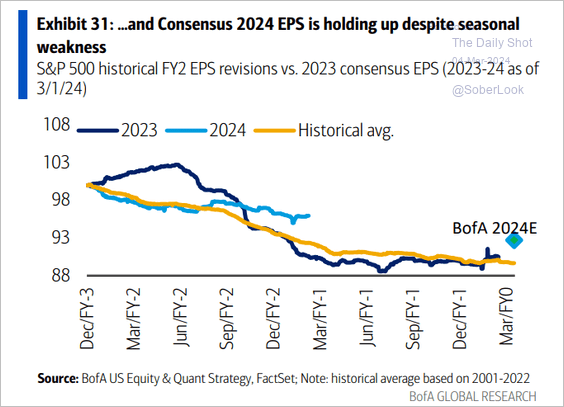

6. The S&P 500 2024 EPS estimates are holding up well.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

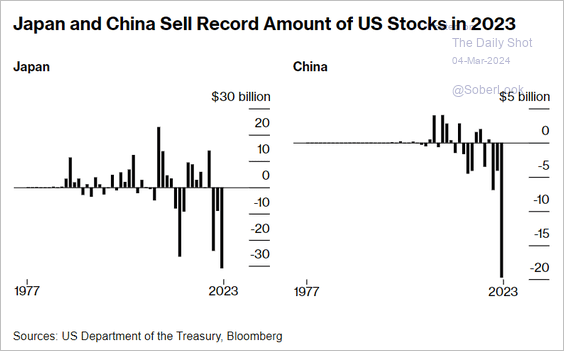

7. Japan and China sold a lot of US shares last year.

Source: @markets Read full article

Source: @markets Read full article

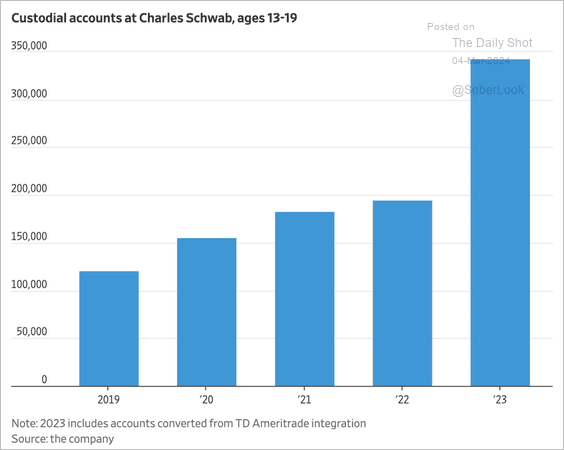

8. Teens are getting into stock investing/trading. Custodial accounts for minors at brokerages surged last year.

Source: @GunjanJS, @WSJmarkets, @hannahmiao_ Read full article

Source: @GunjanJS, @WSJmarkets, @hannahmiao_ Read full article

Back to Index

Credit

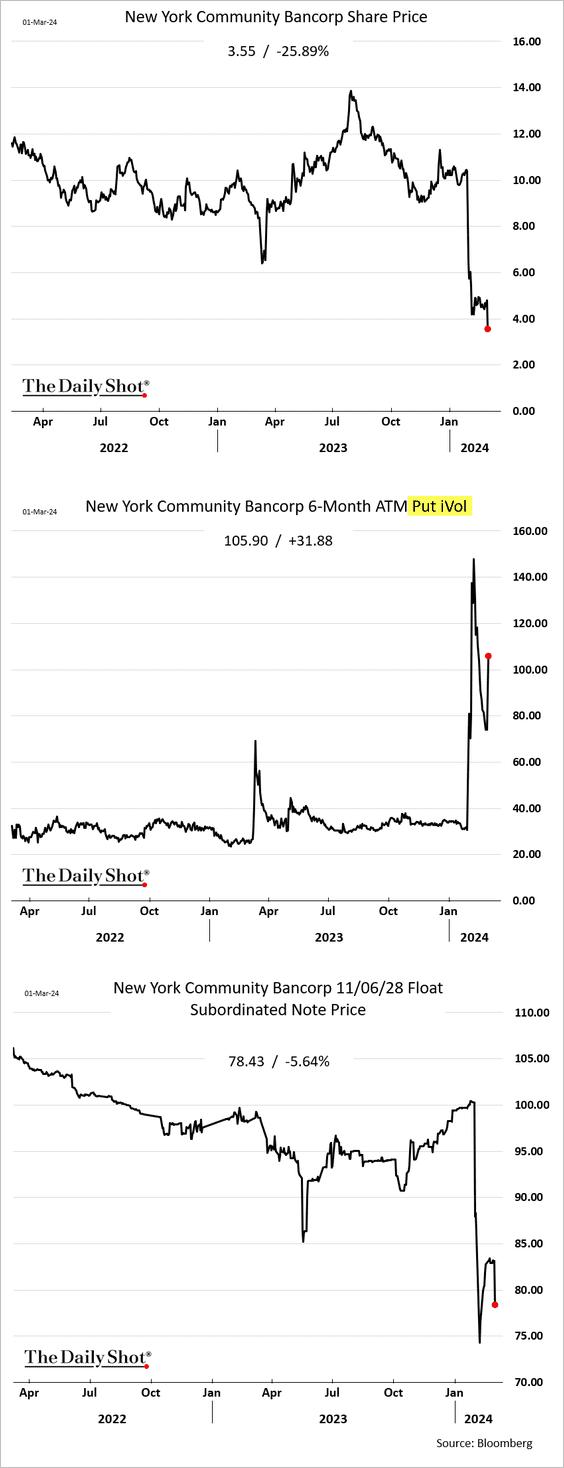

1. New York Community Bancorp’s stock and bonds were hammered again on Friday.

Source: CNBC Read full article

Source: CNBC Read full article

——————–

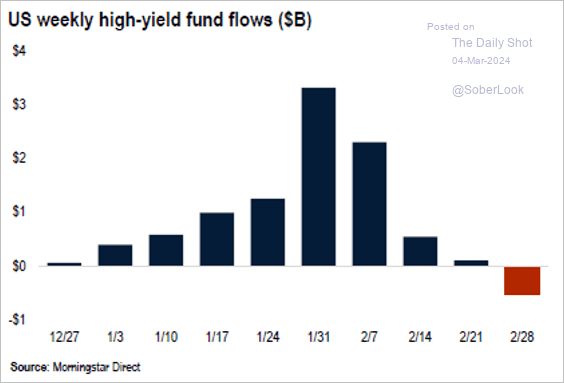

2. US high-yield retail funds saw outflows last week, halting a long streak of inflows.

Source: PitchBook

Source: PitchBook

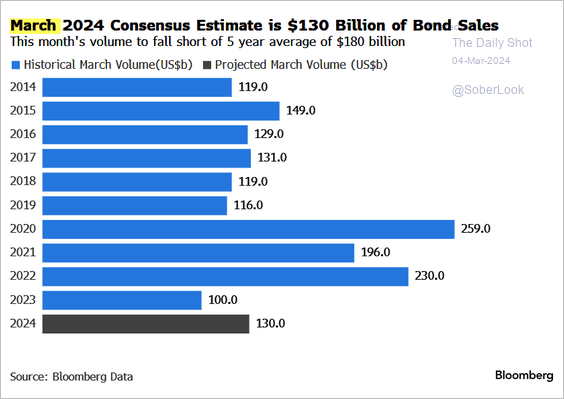

3. Slower corporate bond sales this month?

Source: Bloomberg Law Read full article

Source: Bloomberg Law Read full article

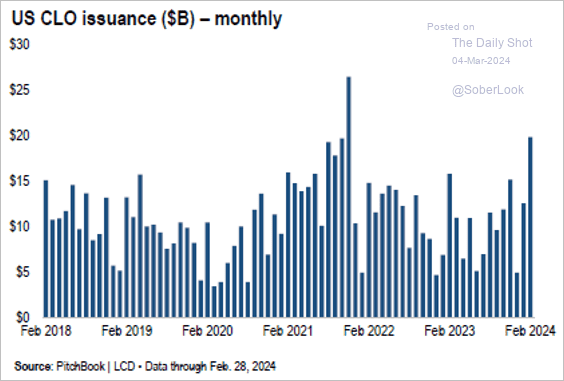

4. CLO issuance picked up last month.

Source: PitchBook

Source: PitchBook

Back to Index

Rates

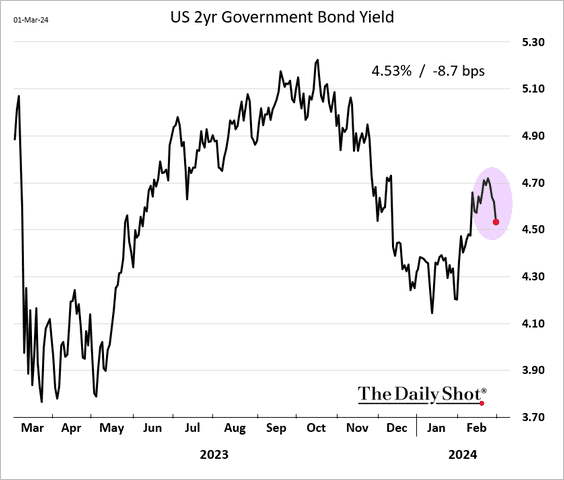

1. Short-term Treasury yields declined on Friday after Fed’s Waller suggested that the US central bank should hold a higher proportion of shorter-dated paper.

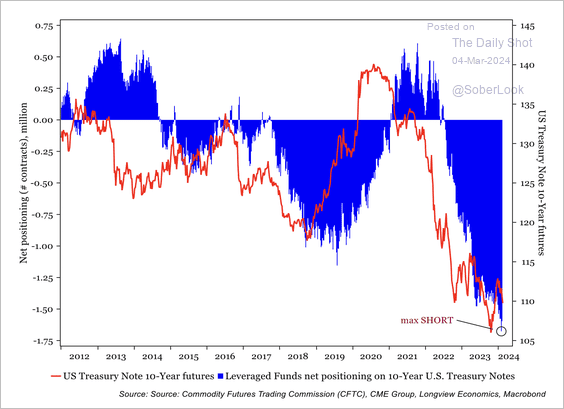

2. Short positioning in the 10-year Treasury futures is crowded as traders pile into the cash-futures arb trades.

Source: Longview Economics

Source: Longview Economics

Back to Index

Global Developments

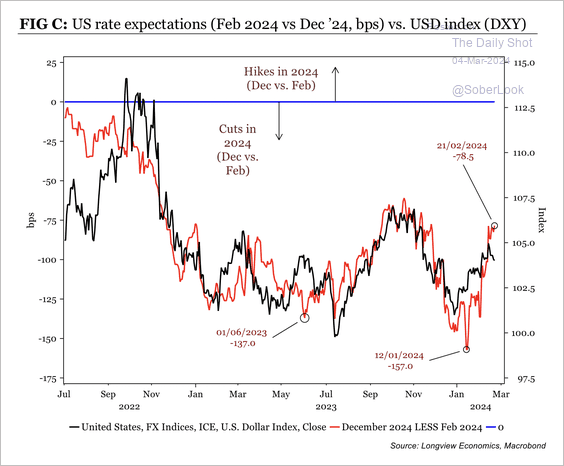

1. The dollar rose as markets rapidly scaled back US rate cut expectations.

Source: Longview Economics

Source: Longview Economics

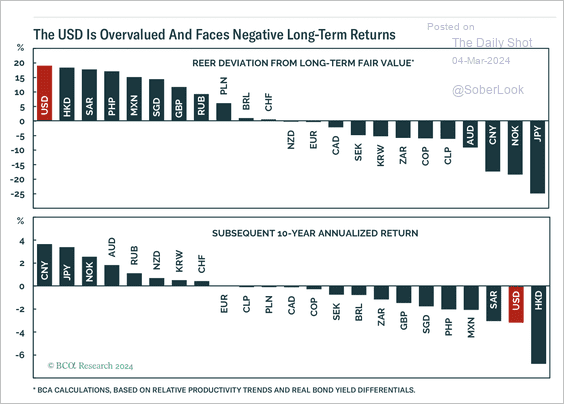

• The dollar appears overvalued, which could indicate a period of weakness ahead.

Source: BCA Research

Source: BCA Research

——————–

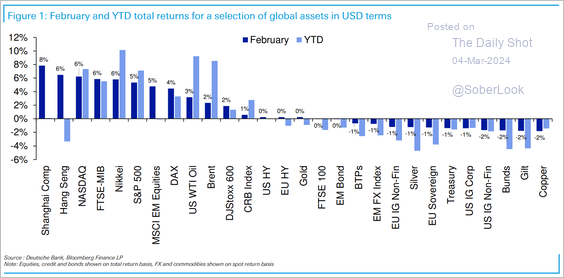

2. Equities, oil, and the dollar rose in February, while sovereign bonds lost ground.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

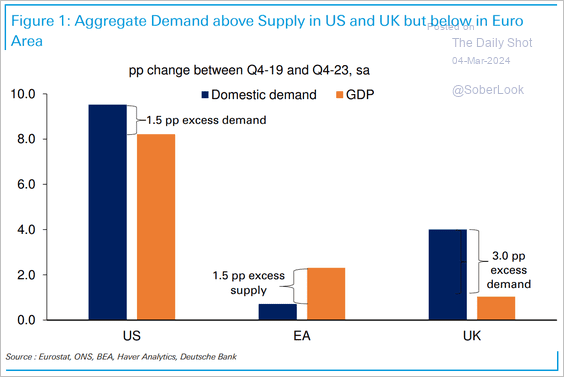

3. In the US and UK, domestic demand has risen faster than real GDP (a proxy for aggregate supply) since just before the pandemic, while the opposite is true for the Euro area. This suggests it could be harder for the Fed and BoE to get inflation closer to target than the ECB.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

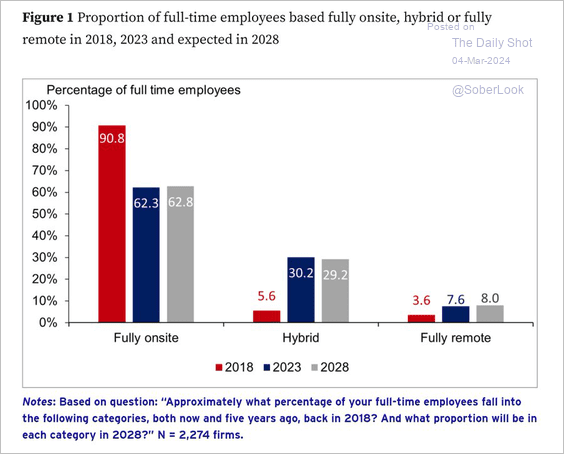

1. WFH is here to stay.

Source: @I_Am_NickBloom, @ESRC Read full article Further reading

Source: @I_Am_NickBloom, @ESRC Read full article Further reading

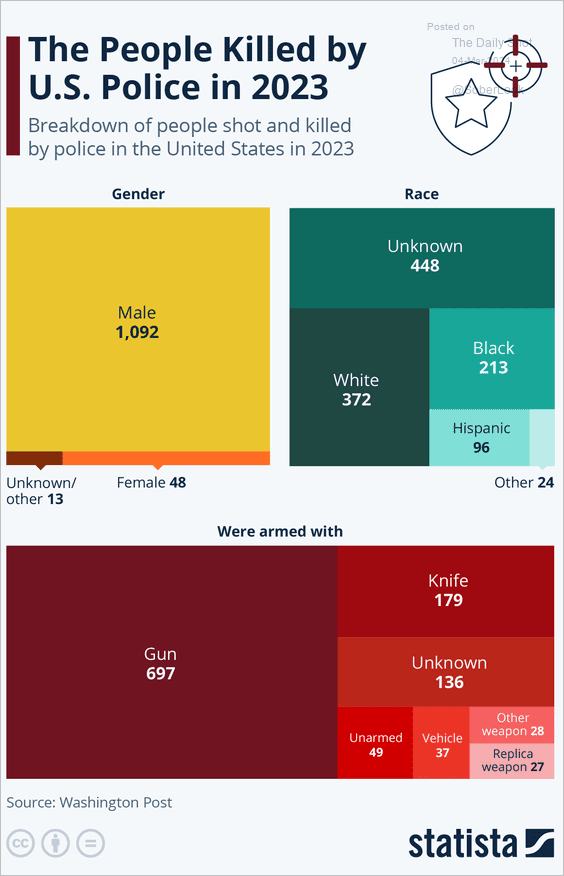

2. People killed by police in 2023:

Source: Statista

Source: Statista

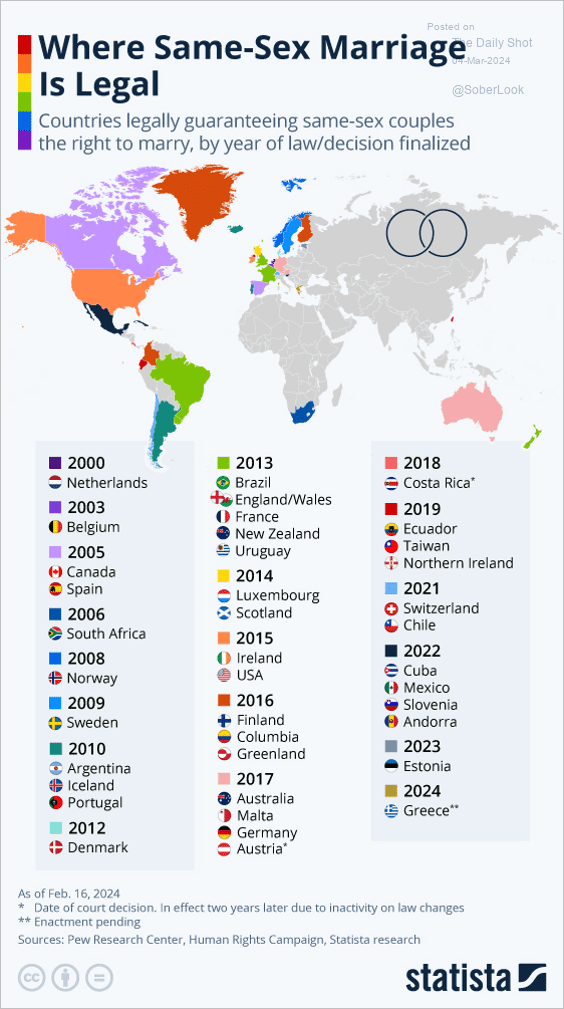

3. Countries where same-sex marriage is legal (color indicates the year it became legal):

Source: Statista

Source: Statista

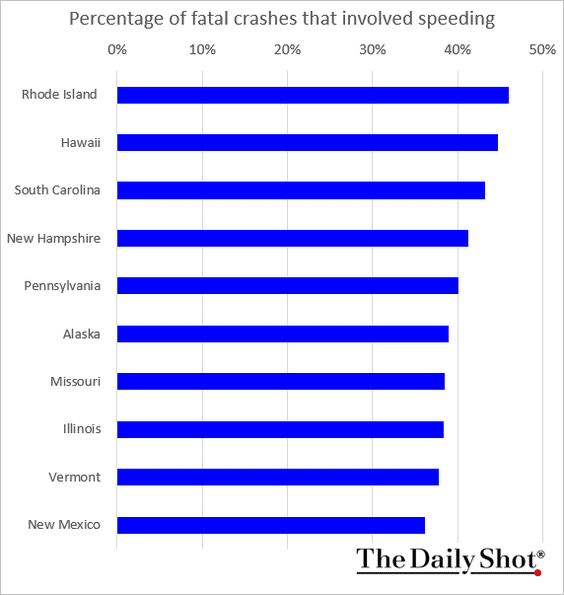

4. Percentage of fatal crashes that involved speeding:

Source: The Fitch Law Firm

Source: The Fitch Law Firm

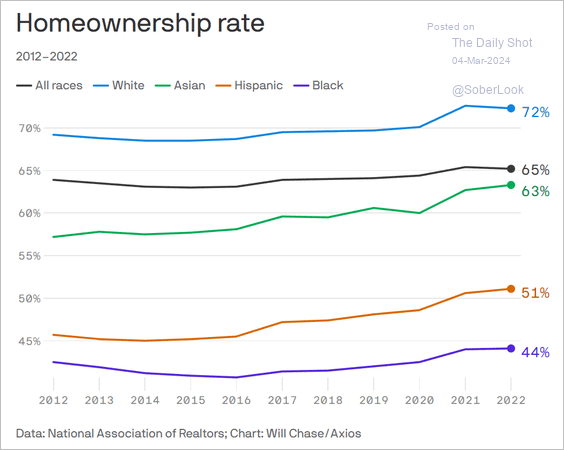

5. Homeownership rates:

Source: @axios Read full article

Source: @axios Read full article

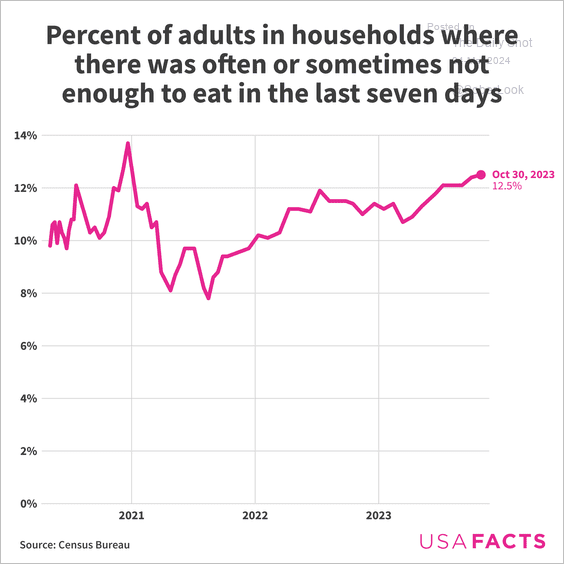

6. Food insecurity:

Source: USAFacts

Source: USAFacts

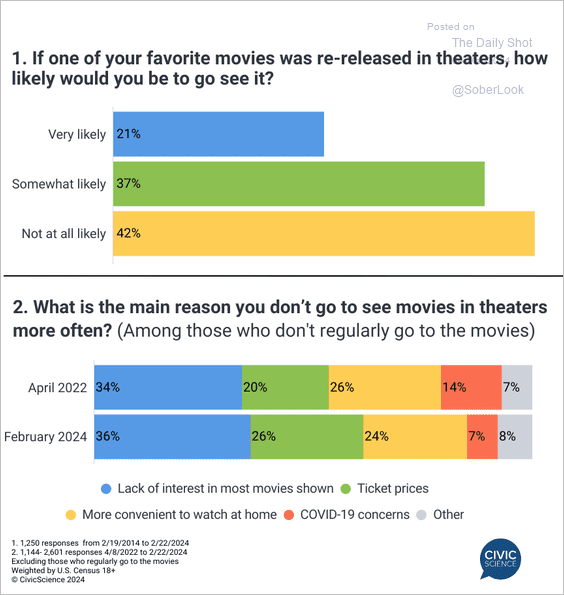

7. Interest in theatrical re-releases and reasons for avoiding movies in theaters:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–

Back to Index