The Daily Shot: 07-Mar-24

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

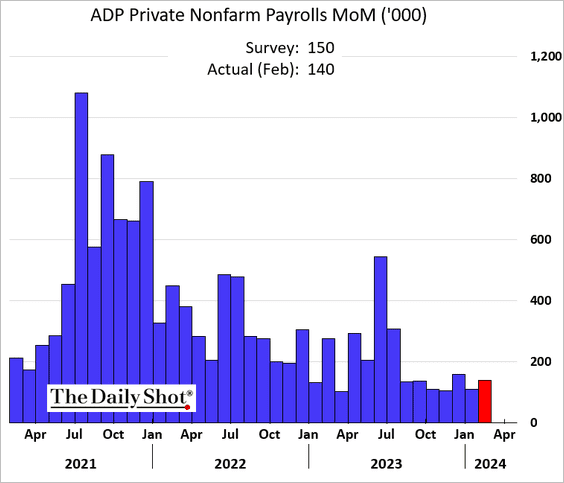

1. The ADP private payrolls estimate showed 140k jobs created in February, which was slightly below expectations.

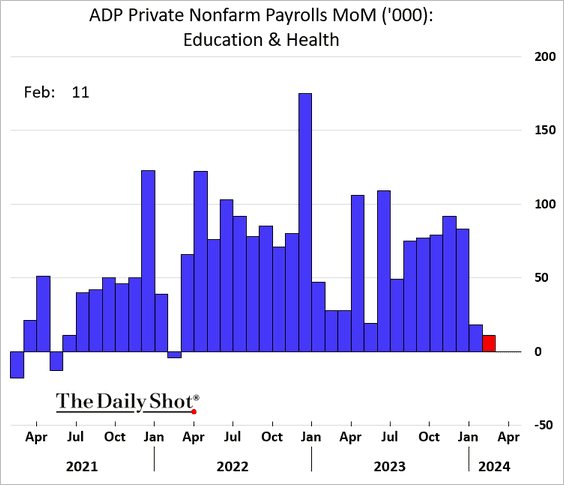

Job creation in healthcare, a key contributor to US employment in recent years, saw its smallest increase in two years.

——————–

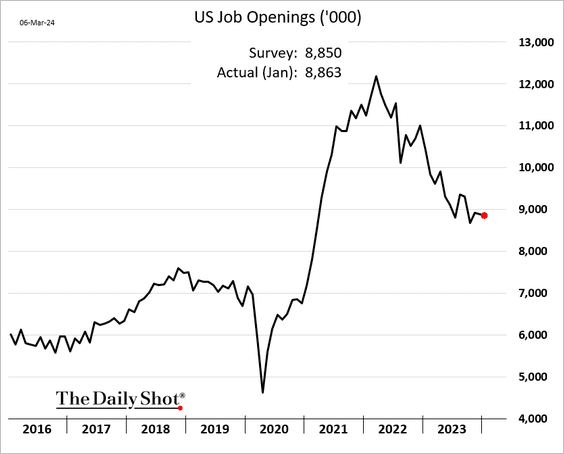

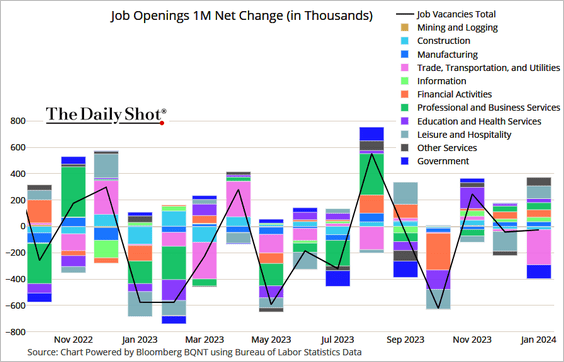

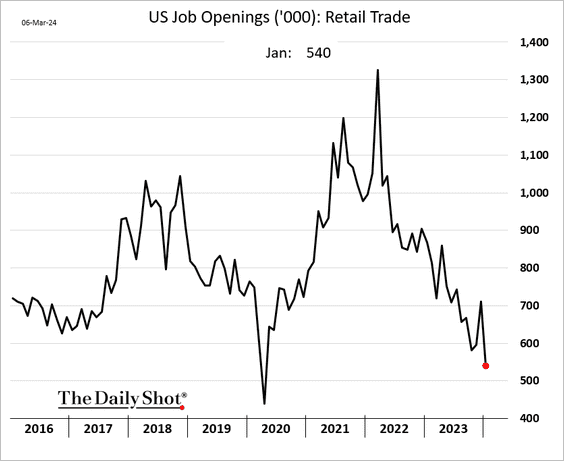

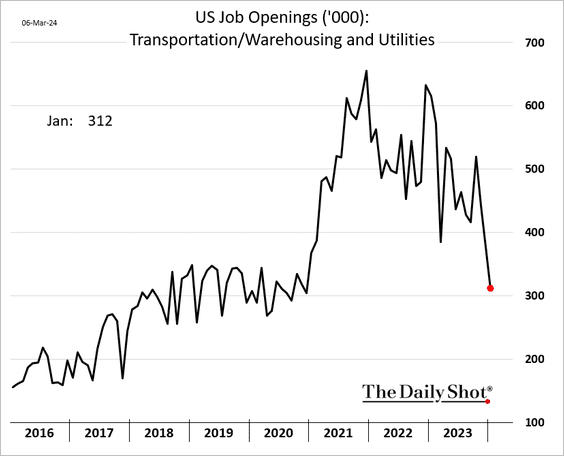

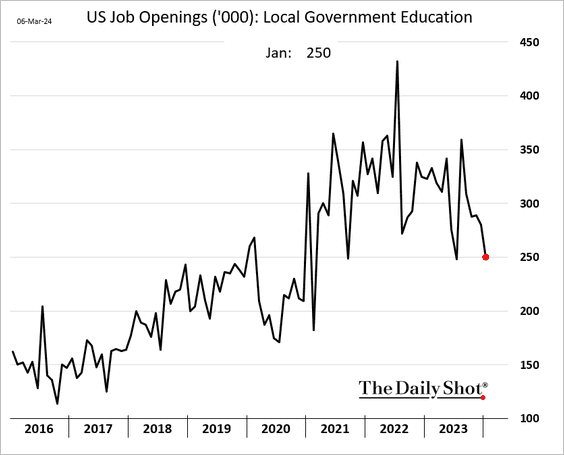

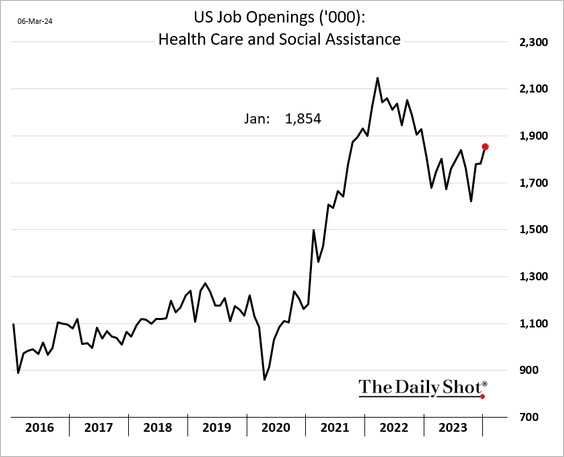

2. January’s job openings were slightly lower than those reported in December.

• Job openings in retail, logistics, and government sectors, particularly among public school teachers, were factors that negatively impacted the overall job openings tally.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

– Retail:

– Logistics:

– Public school teachers:

Other sectors saw gains in vacancies.

– Healthcare:

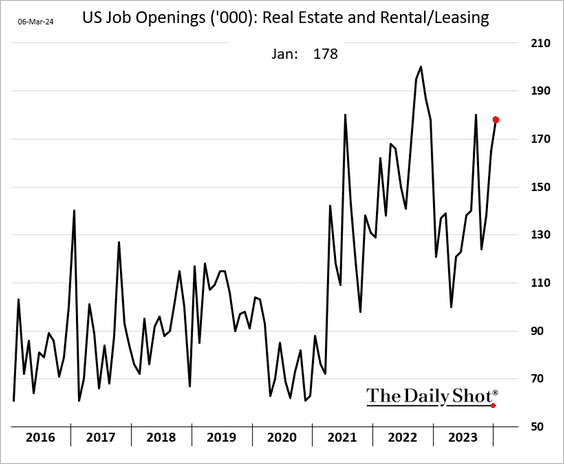

– Real estate:

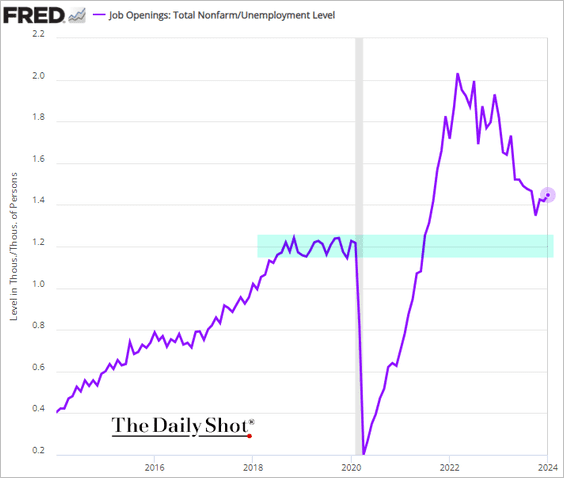

• This chart shows job openings per unemployed person.

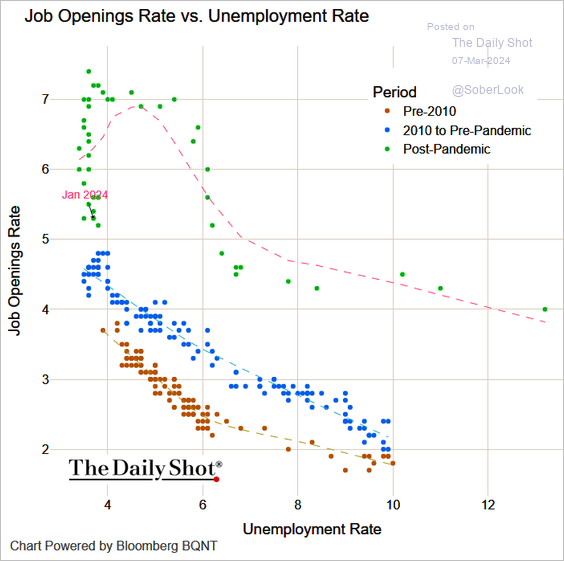

And here is the Beveridge curve. Both indicators suggest that the labor market is still tight.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

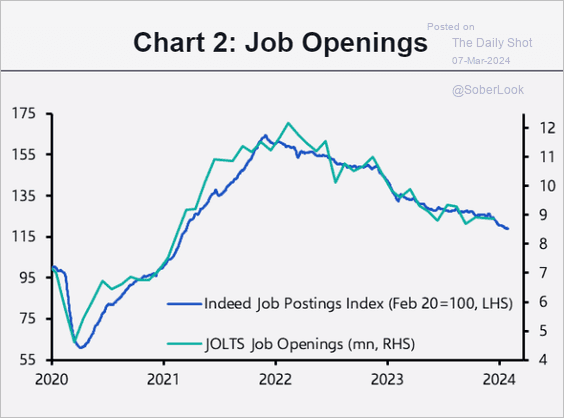

• Job postings on Indeed signal further easing in job openings ahead.

Source: Capital Economics

Source: Capital Economics

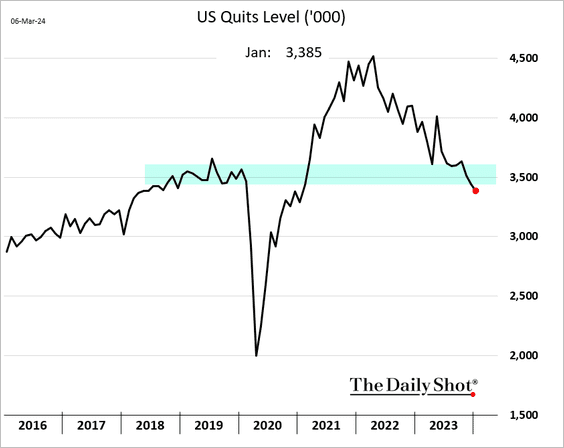

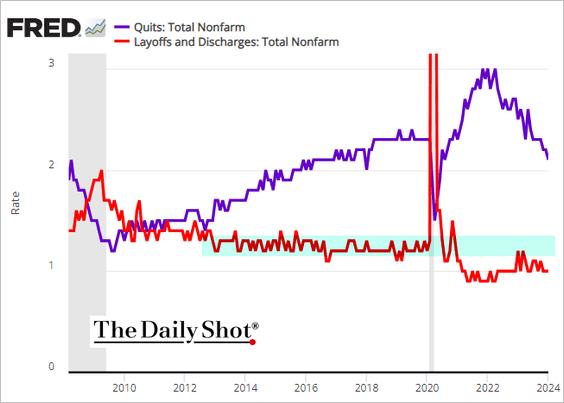

• A key indicator for the Fed was the trend in voluntary resignations (quits), which are now below pre-COVID levels.

Source: Reuters Read full article

Source: Reuters Read full article

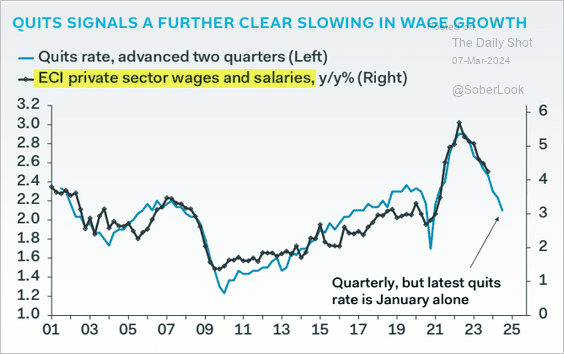

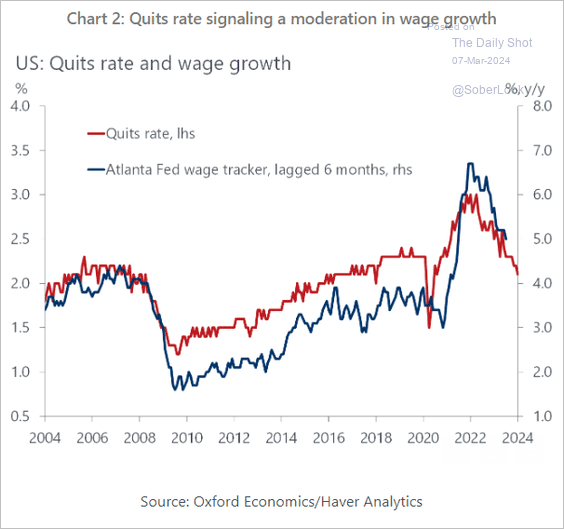

This index is crucial as it is a leading indicator for wage growth trends. (2 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Oxford Economics

Source: Oxford Economics

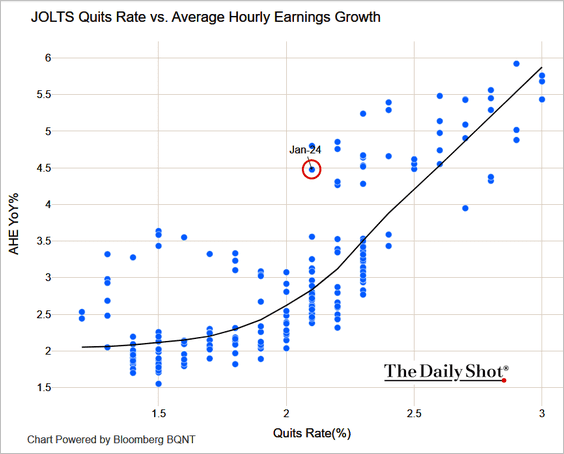

This scatterplot shows that wage growth is elevated, given the current quits rate.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

• Layoffs remain low.

——————–

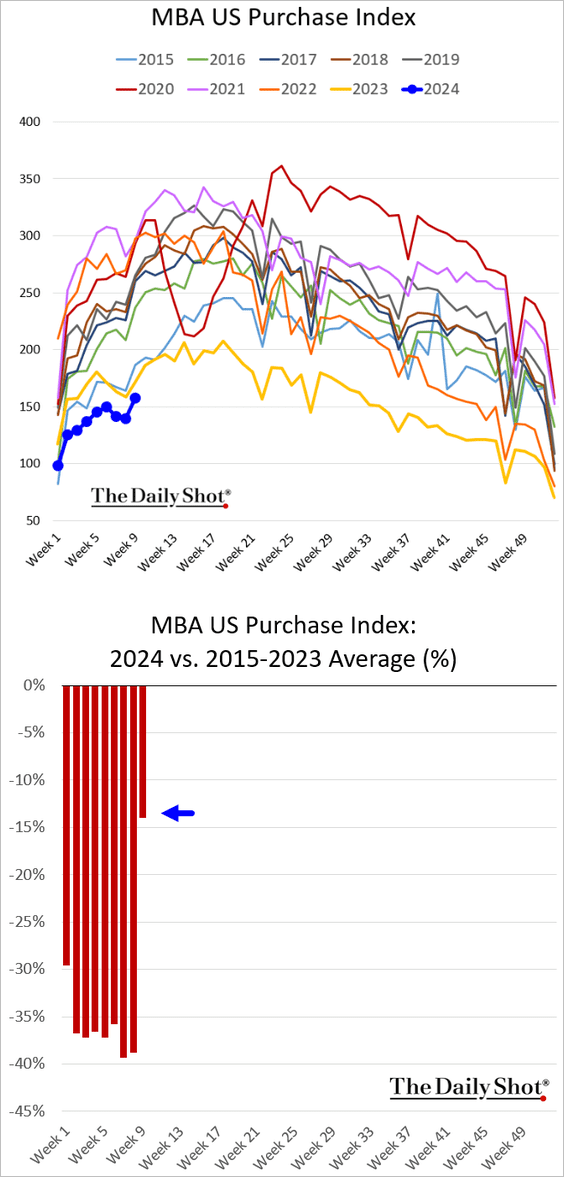

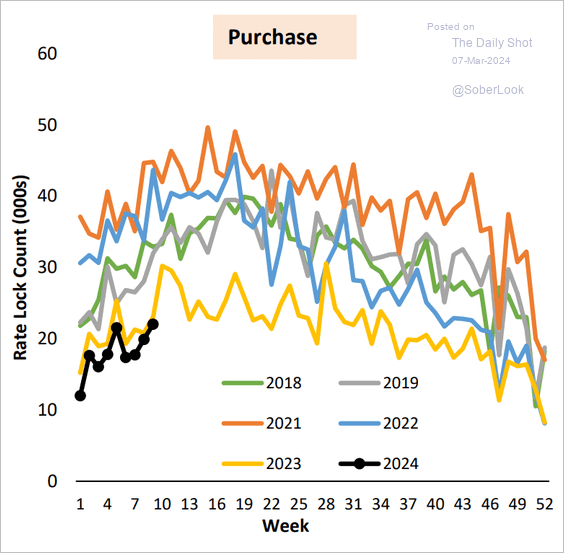

3. Mortgage applications showed some improvement last week.

Here is the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

——————–

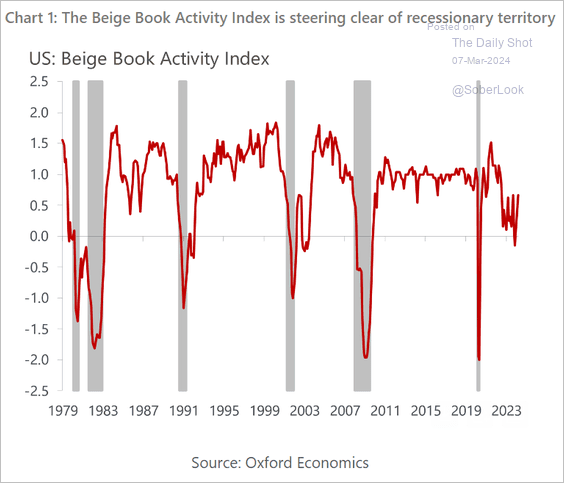

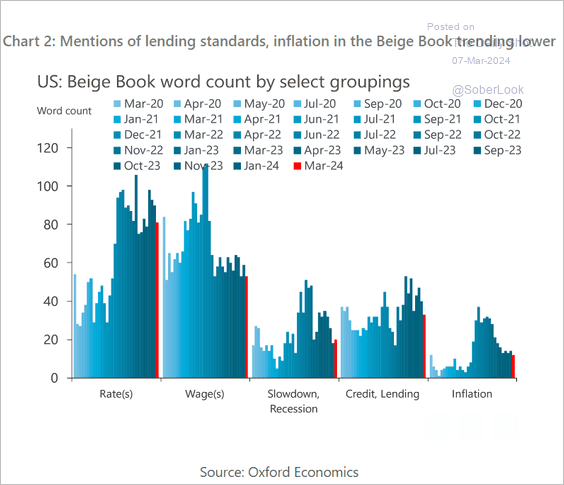

4. The Fed’s Beige Book report indicated a trend of modest economic growth. Here is the Oxford Economics Beige Book Activity Index.

Source: Oxford Economics

Source: Oxford Economics

Source: @economics Read full article

Source: @economics Read full article

• Mentions of credit concerns and inflation declined.

Source: Oxford Economics

Source: Oxford Economics

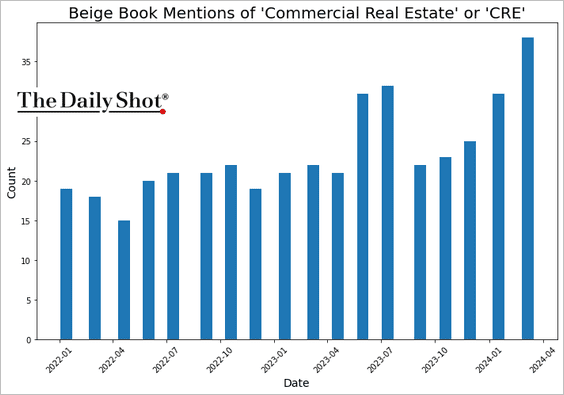

• But worries about commercial real estate surged.

Back to Index

Canada

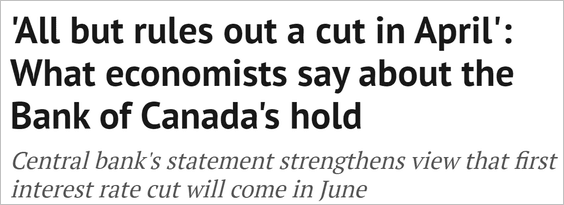

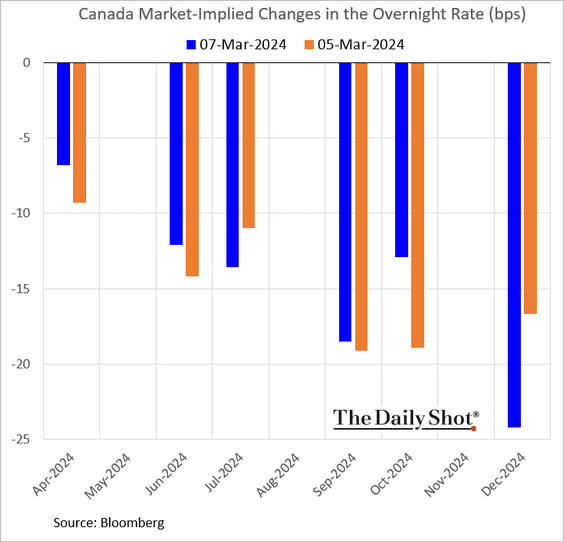

1. The BoC left rates unchanged, with the markets viewing the central bank’s comments as somewhat hawkish.

Source: Financial Post Read full article

Source: Financial Post Read full article

• Near-term rate cut expectations eased.

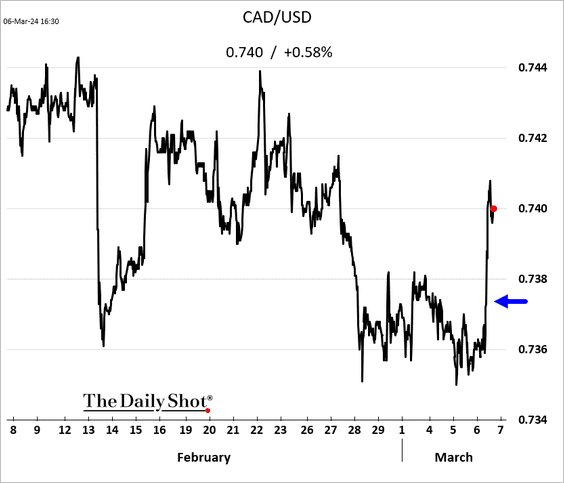

• The loonie jumped.

——————–

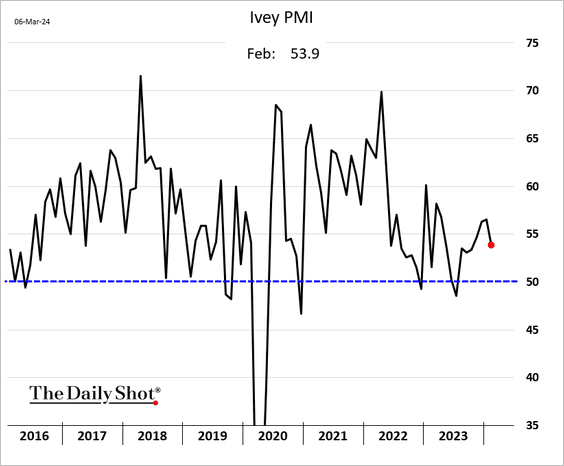

2. The Ivey PMI, which covers both private and public organizations, remains in growth territory.

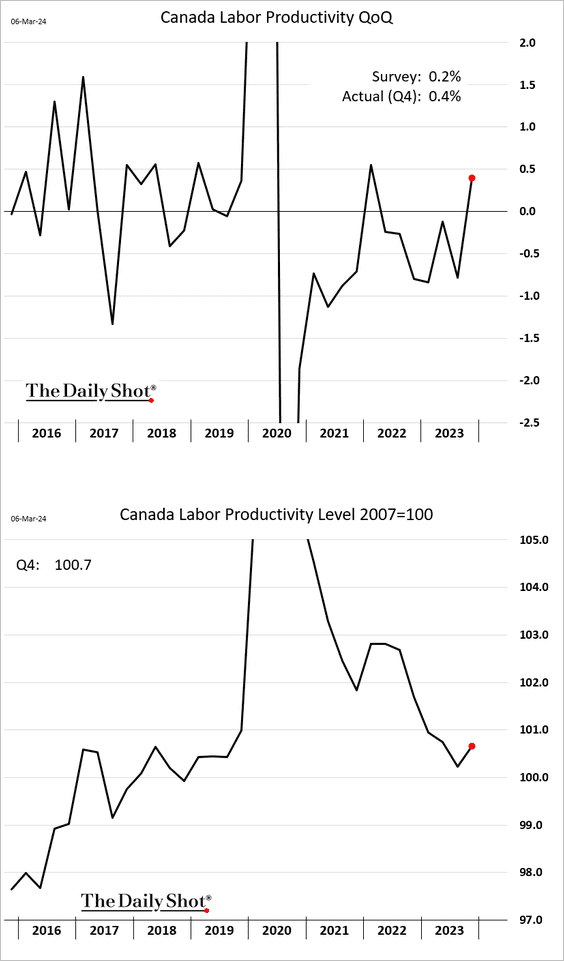

3. Labor productivity improved last quarter.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

Back to Index

The United Kingdom

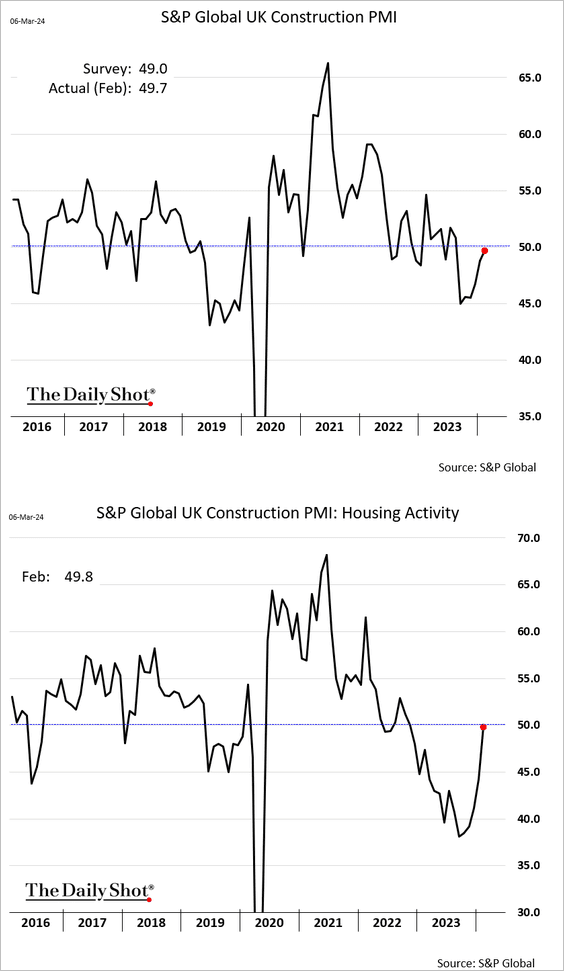

1. Construction activity has almost stabilized (PMI near 50).

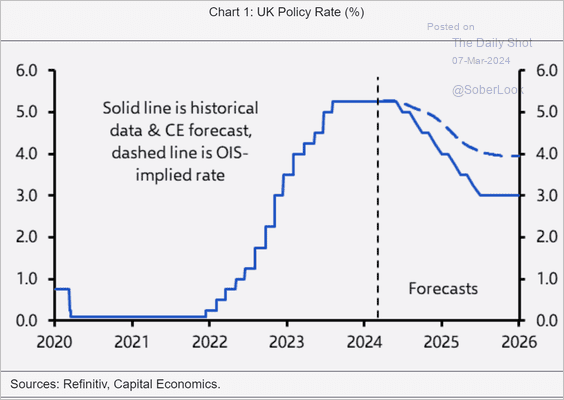

2. Capital Economics expects a steeper BoE rate cut trajectory than the market.

Source: Capital Economics

Source: Capital Economics

Back to Index

The Eurozone

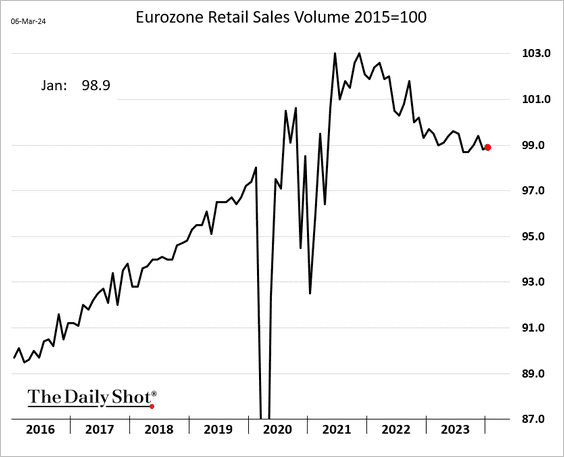

1. Retail sales edged higher in January.

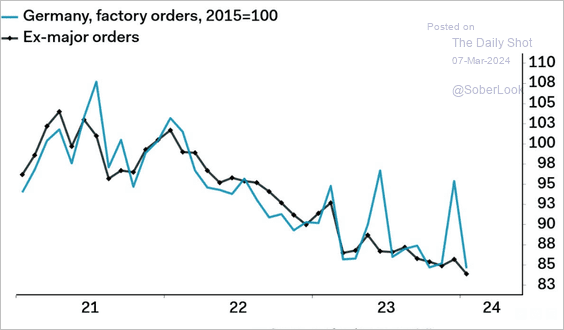

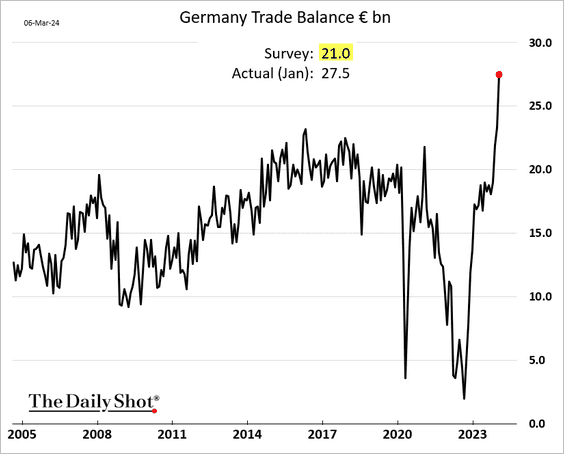

2. Next, we have some updates on Germany.

• Factory orders continue to trend lower.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

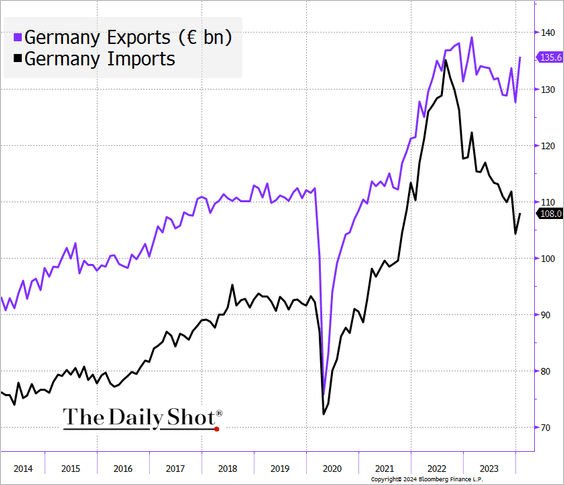

• The trade surplus surged to new highs, …

… es exports jumped.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @economics Read full article

Source: @economics Read full article

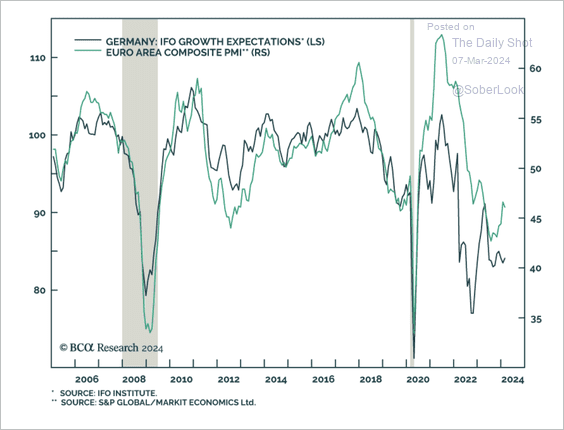

• Germany’s economic growth expectations are starting to improve.

Source: BCA Research

Source: BCA Research

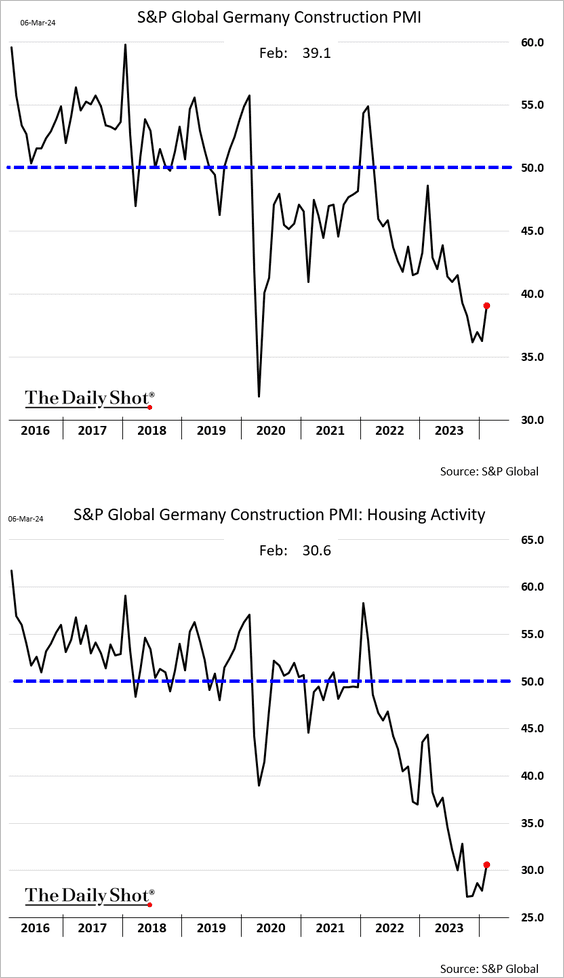

• Germany’s construction sector remains in deep recession.

Back to Index

Europe

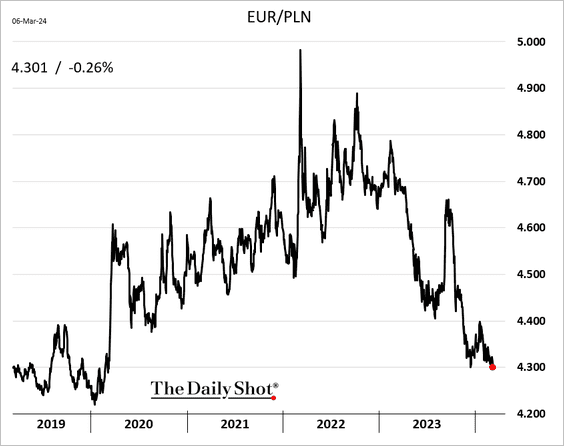

1. Poland’s central bank kept rates unchanged again.

Source: @economics Read full article

Source: @economics Read full article

The Polish zloty has been surging vs. the euro.

——————–

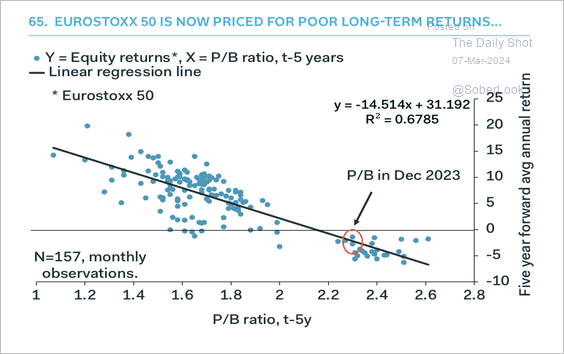

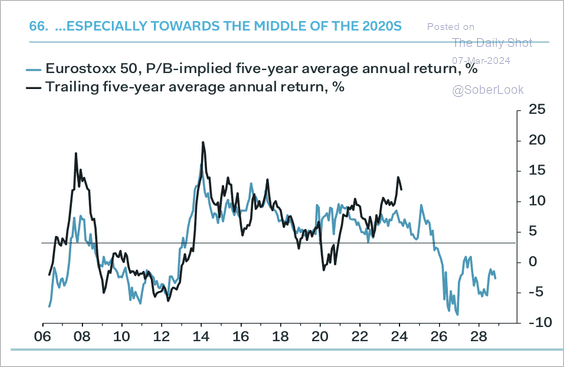

2. Similar to the US, current valuations indicate a period of low returns for the Euro Stoxx 50 index. (2 charts)

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

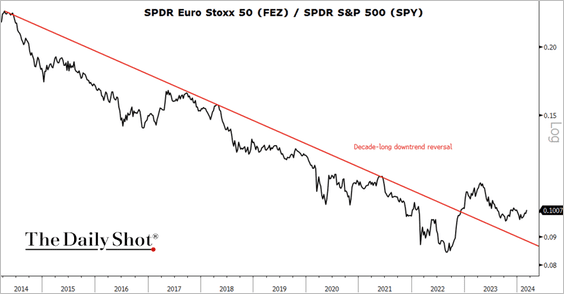

• European stocks (mostly France and Germany) broke above long-term downtrend relative to US stocks. Could we see a period of outperformance?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

Japan

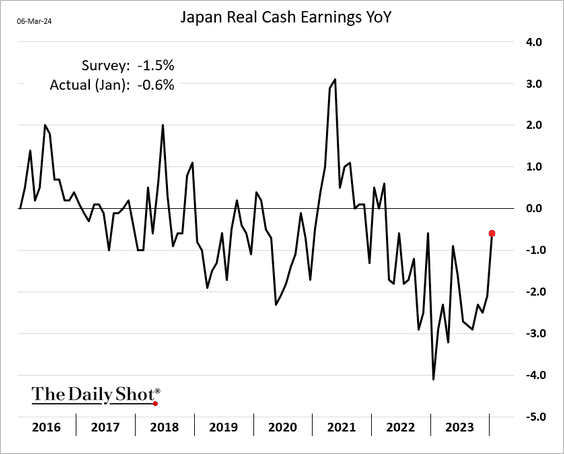

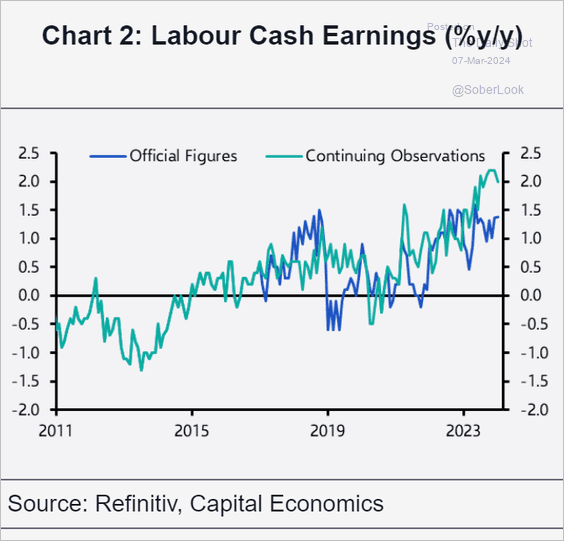

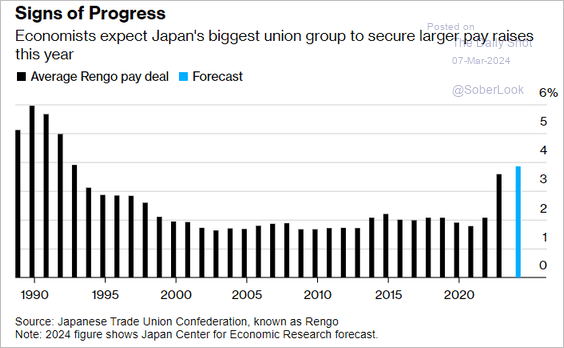

1. Wage growth surprised to the upside, …

… with more gains expected ahead.

Source: Capital Economics

Source: Capital Economics

Source: @economics Read full article

Source: @economics Read full article

——————–

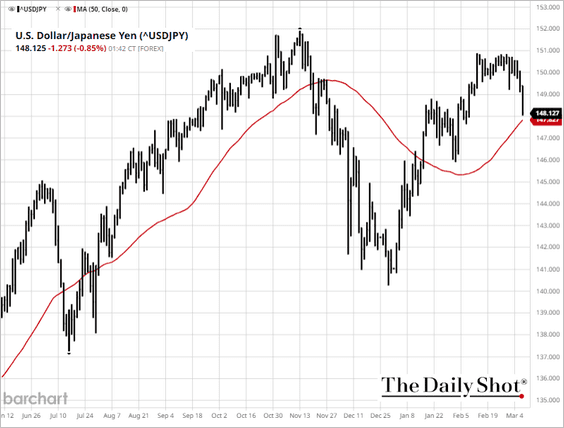

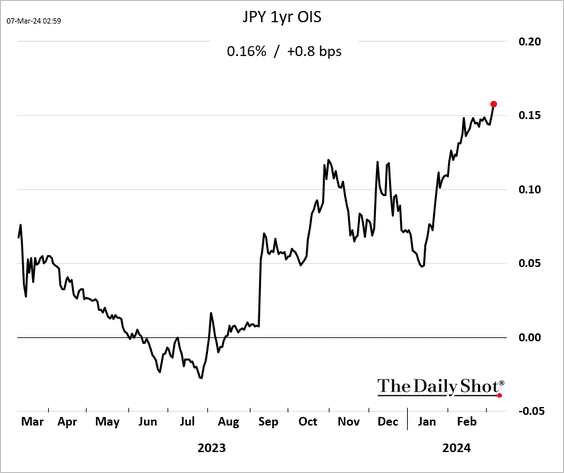

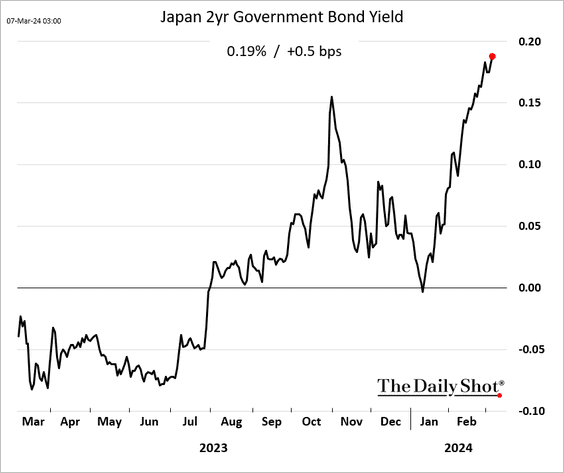

2. The yen is rallying as market speculation grows about potential BoJ tightening, spurred by the latest wage growth data.

Source: Reuters Read full article

Source: Reuters Read full article

Short-term rates are surging.

——————–

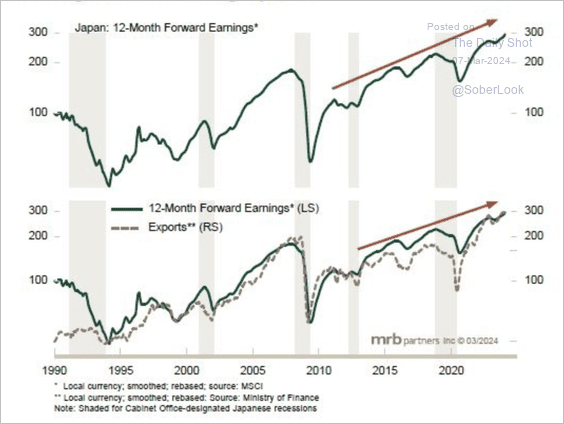

3. Earnings are in a strong uptrend alongside rising exports.

Source: MRB Partners

Source: MRB Partners

Back to Index

China

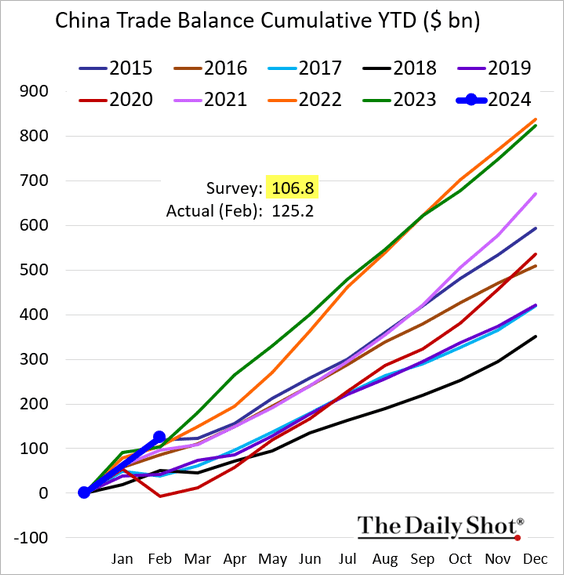

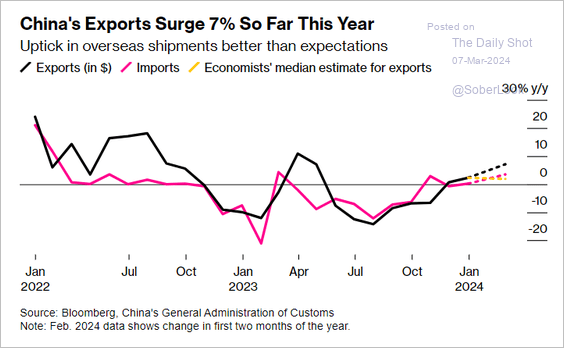

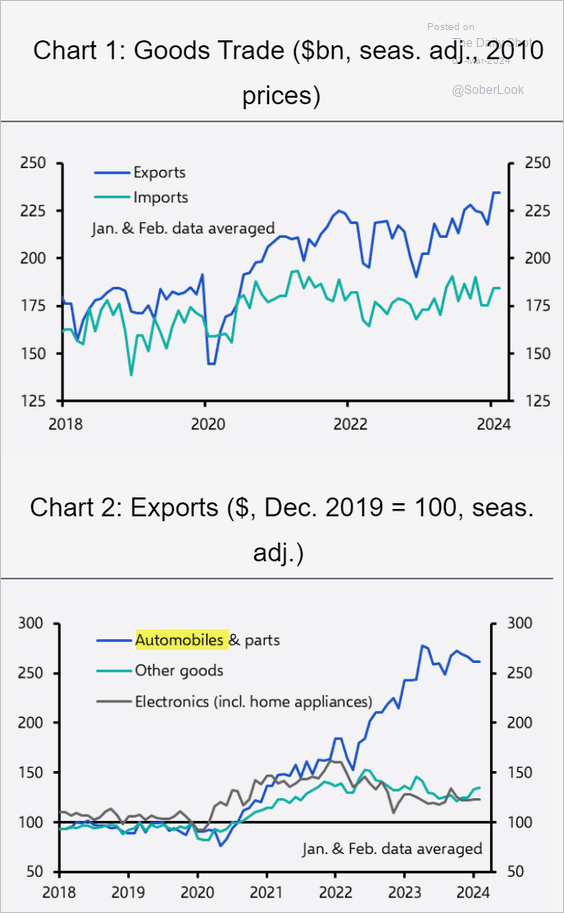

1. The trade surplus hit a new high for this time of the year, topping expectations.

Exports jumped this year (2 charts).

Source: @economics Read full article

Source: @economics Read full article

Source: Capital Economics

Source: Capital Economics

——————–

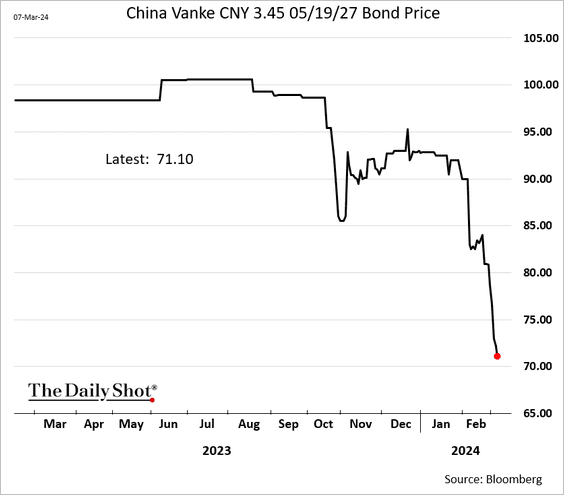

2. China Vanke’s bonds remain under pressure.

Source: Reuters Read full article

Source: Reuters Read full article

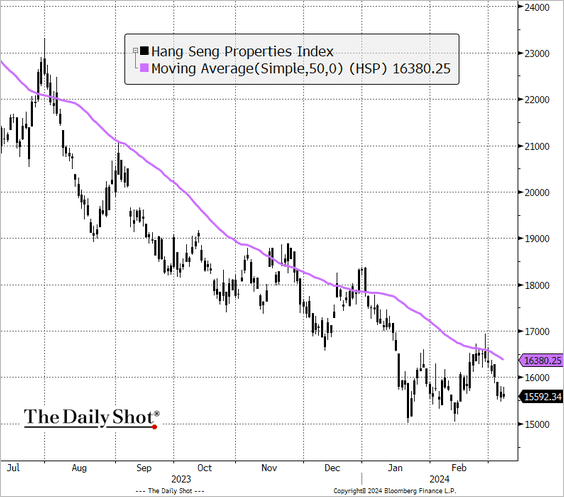

• Hong Kong-listed property stocks are struggling.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

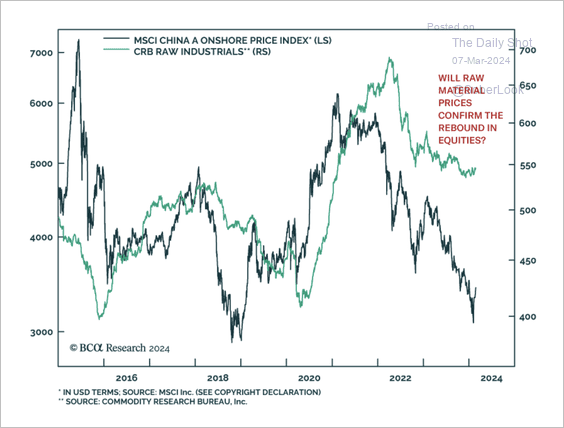

3. So far, raw material prices have not confirmed the rebound in Chinese equities.

Source: BCA Research

Source: BCA Research

Back to Index

Emerging Markets

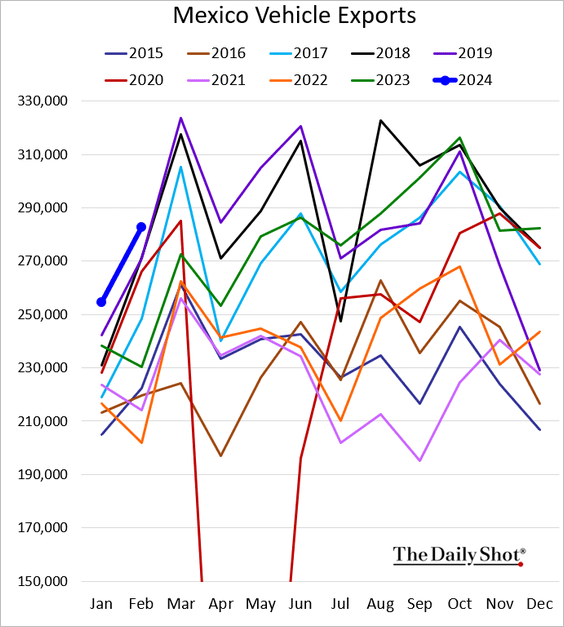

1. Mexico’s vehicle exports are holding at record highs.

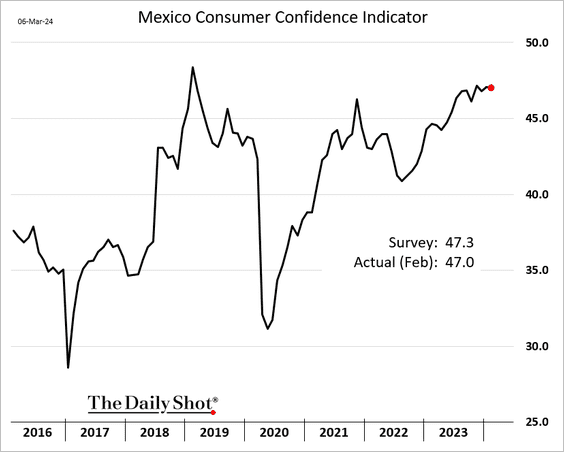

• Consumer sentiment remains robust.

——————–

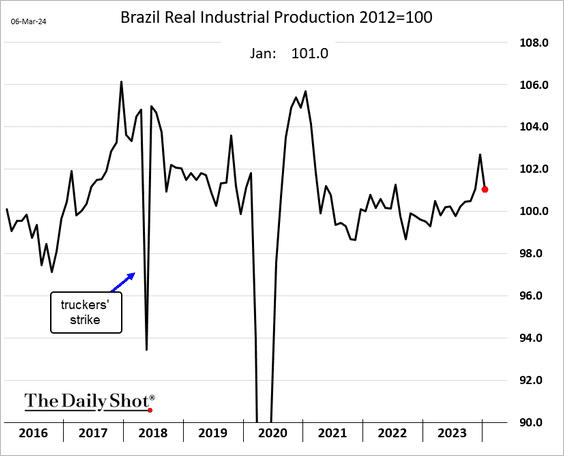

2. Brazil’s industrial production saw a pullback in January.

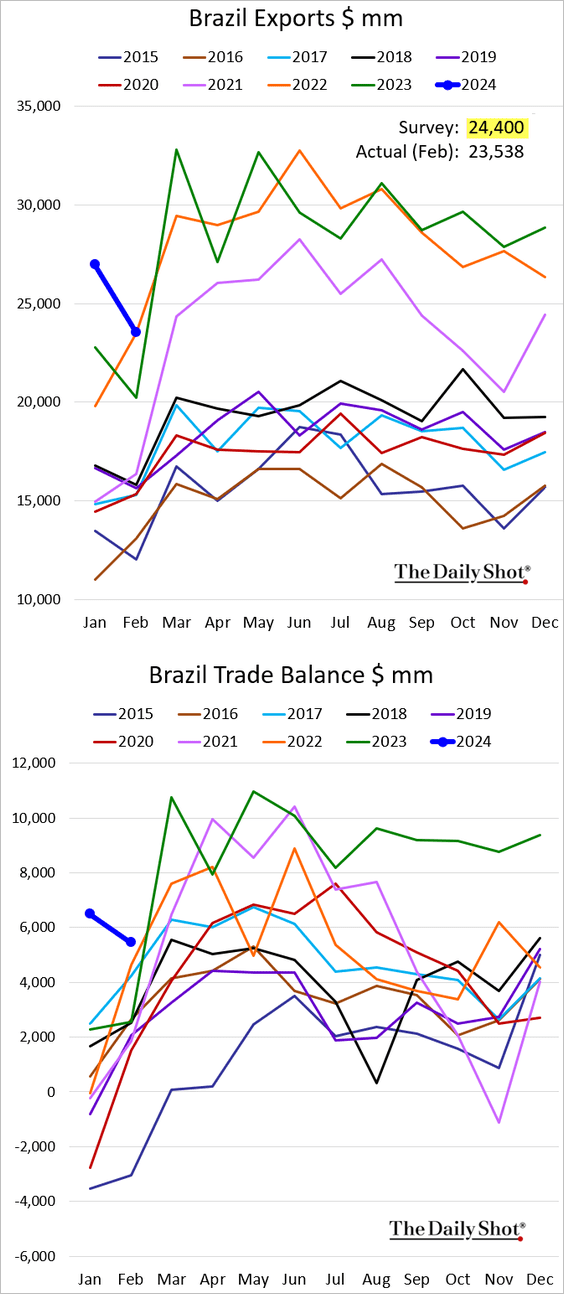

• Exports slowed.

——————–

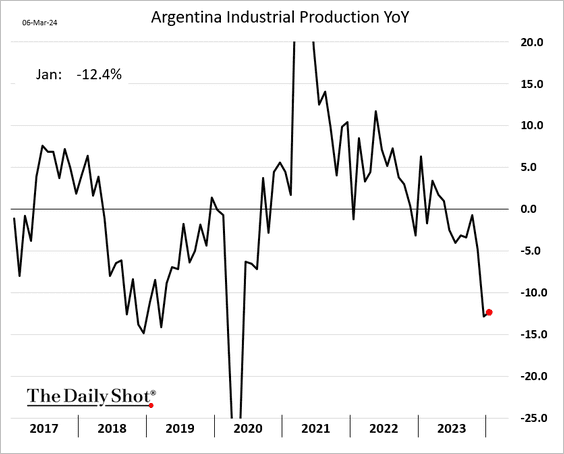

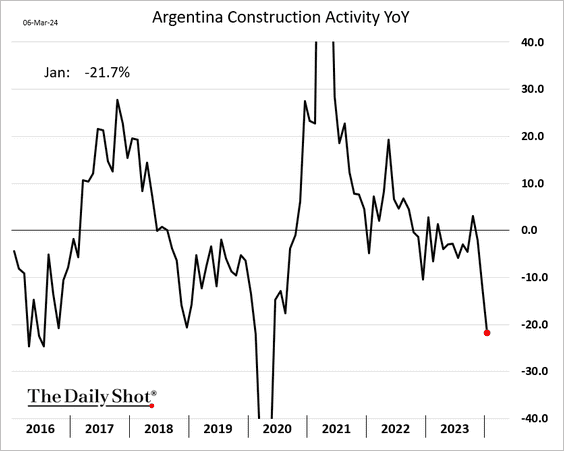

3. Argentina’s economy continues to face significant challenges.

• Industrial production:

• Construction:

——————–

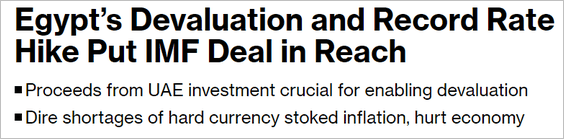

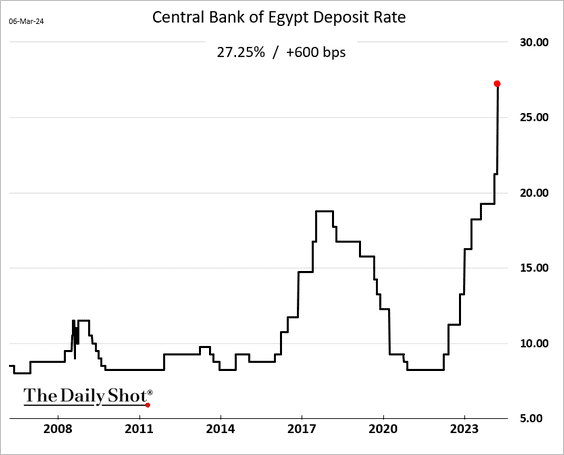

4. Egypt swallowed a bitter pill to access the IMF funds. Immediately following a massive devaluation and a sharp 600-basis-point interest rate increase, the nation secured $8 billion in financing.

Source: @economics Read full article

Source: @economics Read full article

• Rate hike:

• The Egyptian pound:

Back to Index

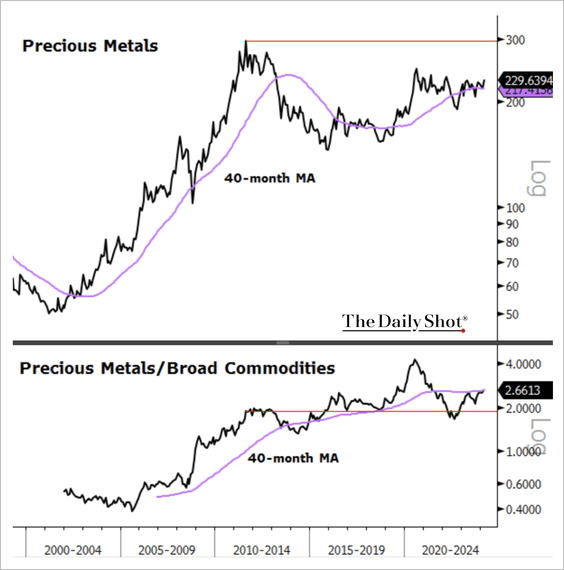

Commodities

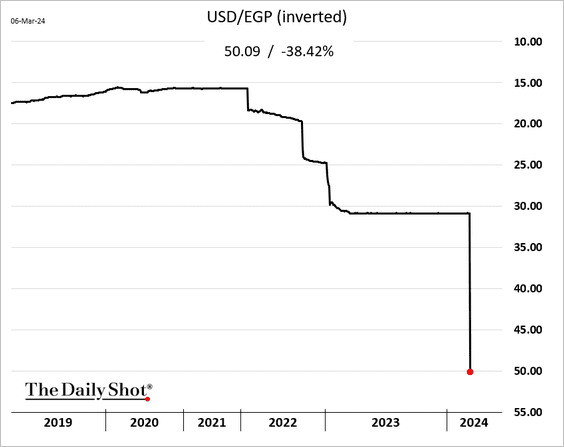

1. Let’s begin with some updates on precious metals.

• Gold hit a record high.

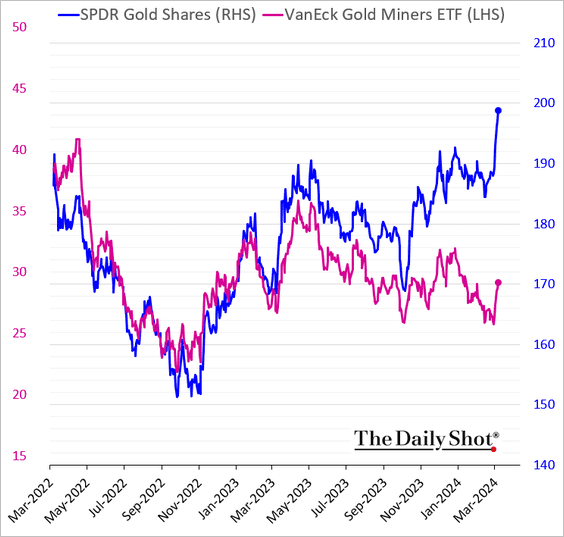

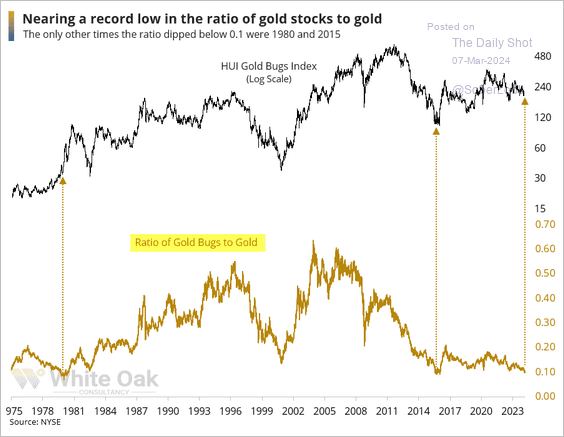

• Gold miners’ shares are falling further behind gold prices (2 charts).

Source: @jasongoepfert

Source: @jasongoepfert

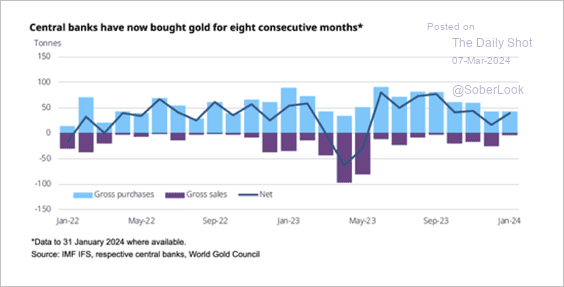

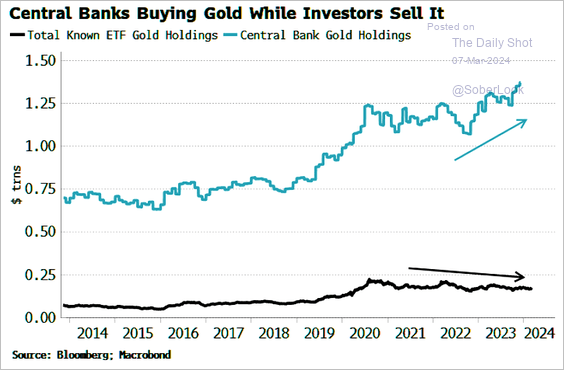

• Central banks have been increasing their gold reserves, …

Source: World Gold Council

Source: World Gold Council

… even as investors cut exposure.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

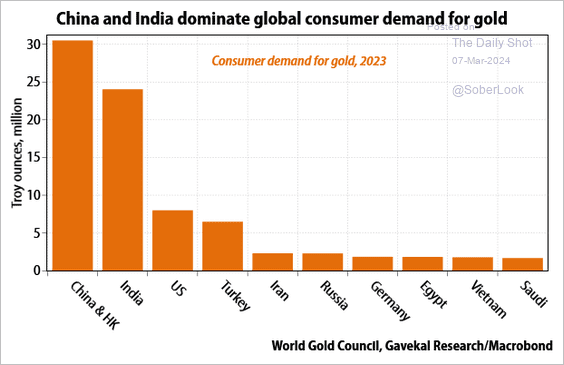

• Here is a look at gold demand by country.

Source: Gavekal Research

Source: Gavekal Research

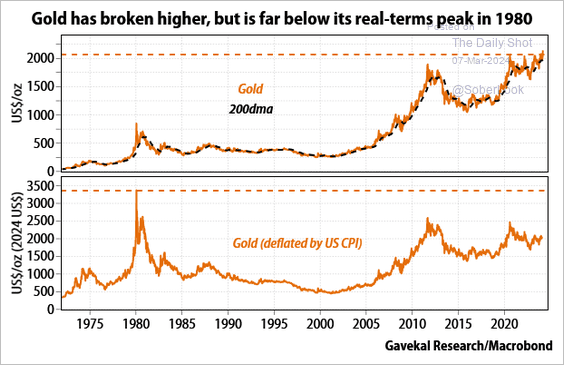

• Real gold prices are well below the 1980 peak.

Source: Gavekal Research

Source: Gavekal Research

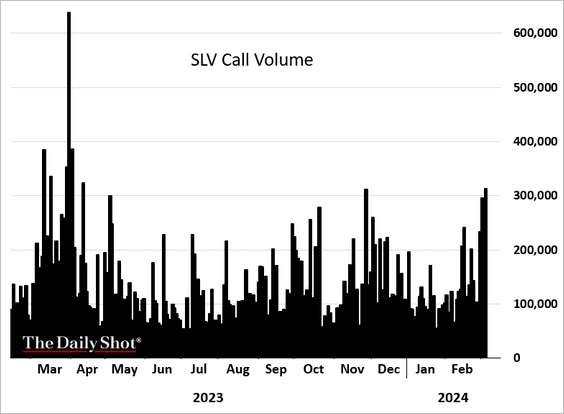

• Call option volumes in precious metals ETFs surged this week.

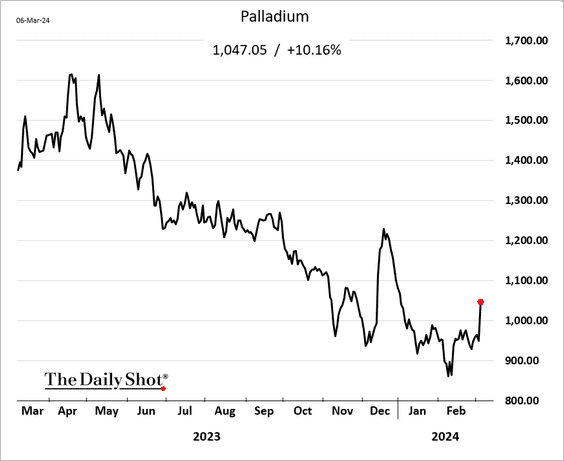

• Palladium had a big move on Wednesday.

• The Bloomberg precious metals index is holding long-term support and improving relative to broader commodities.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

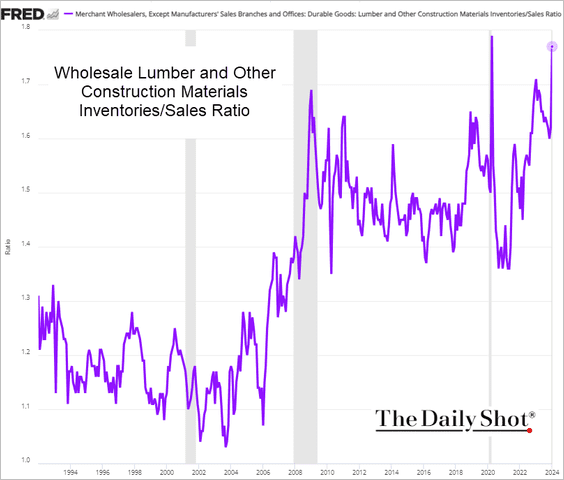

2. US lumber inventories are elevated.

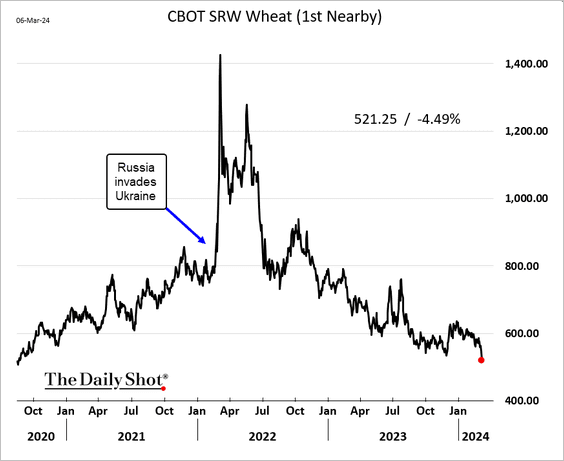

3. Wheat futures hit the lowest level since 2020.

Back to Index

Energy

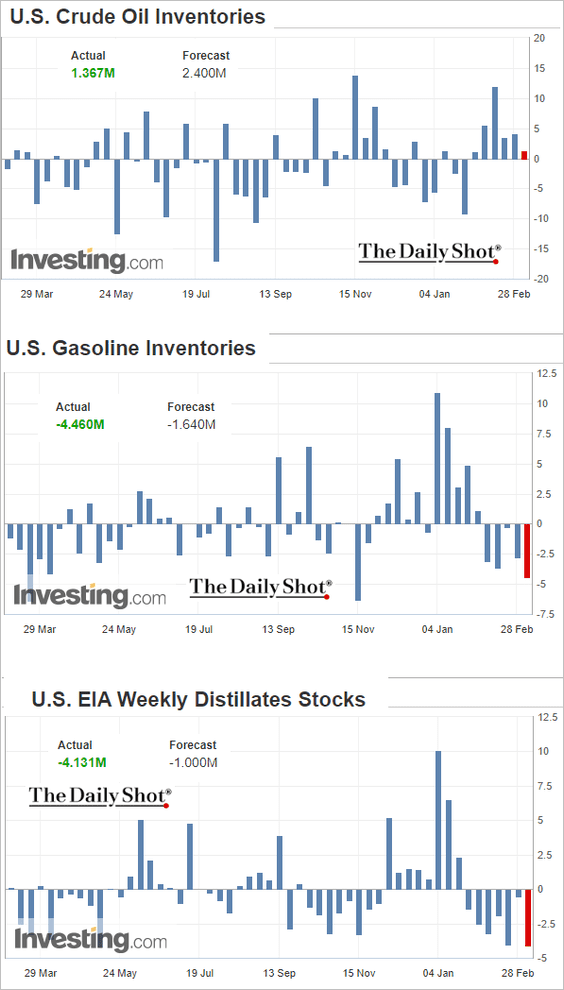

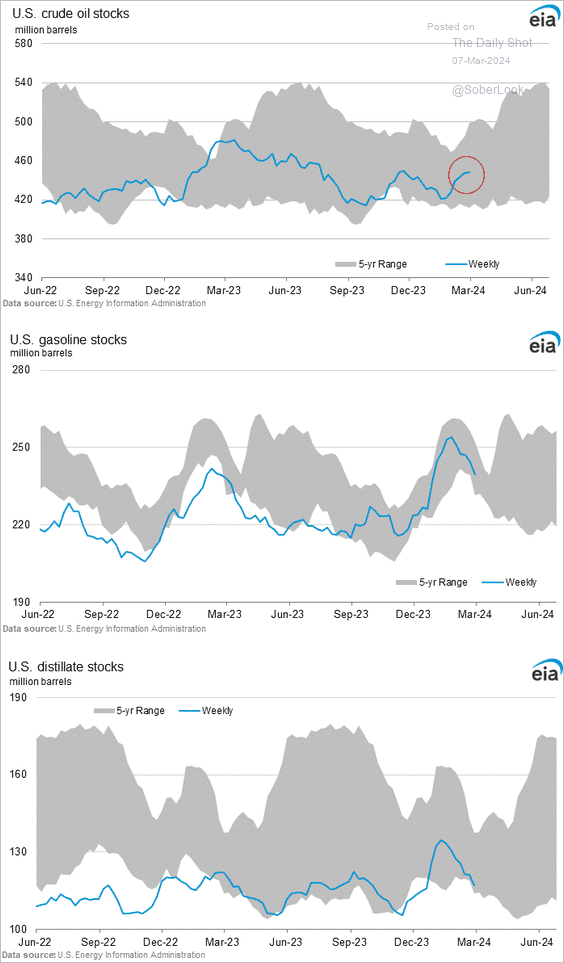

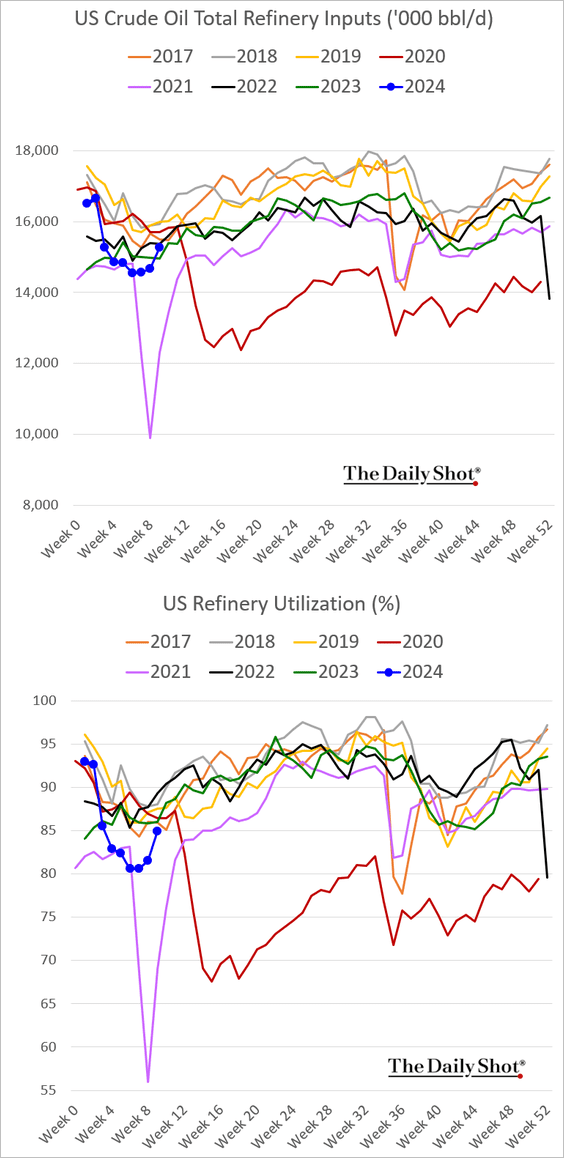

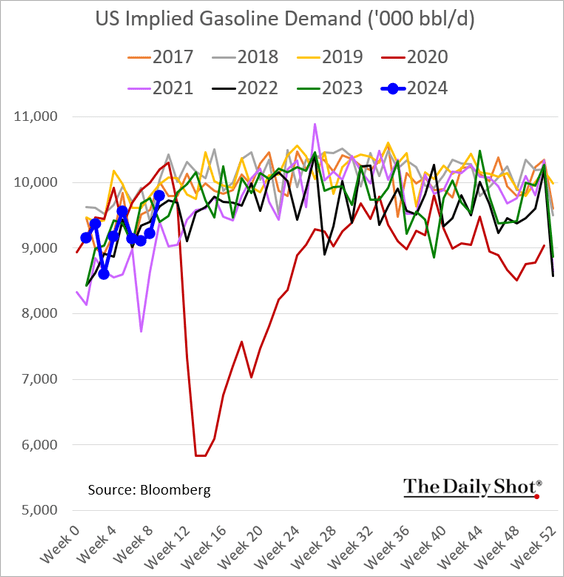

1. The EIA US inventory report was bullish, with a smaller-than-expected oil build and rapid declines in refined product stockpiles.

– Weekly changes:

– Levels:

• Refinery utilization is rebounding.

Source: Reuters Read full article

Source: Reuters Read full article

• Gasoline demand strengthened.

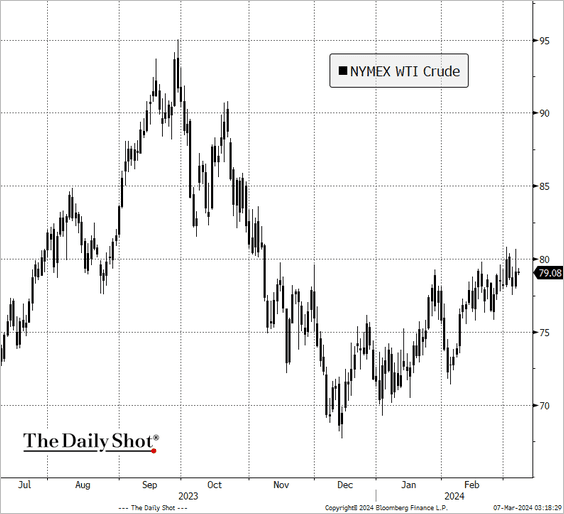

• Crude prices moved higher.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

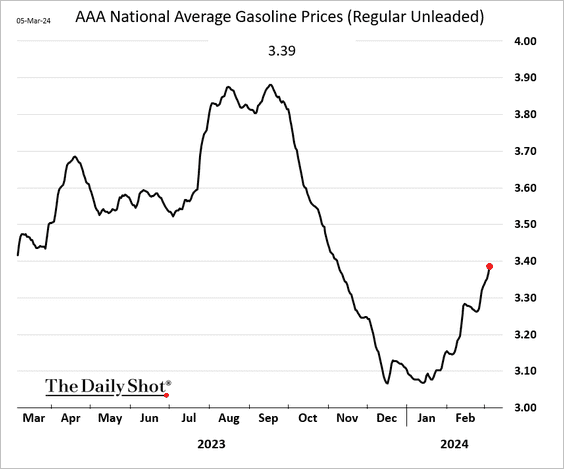

2. US prices at the pump are climbing.

Back to Index

Equities

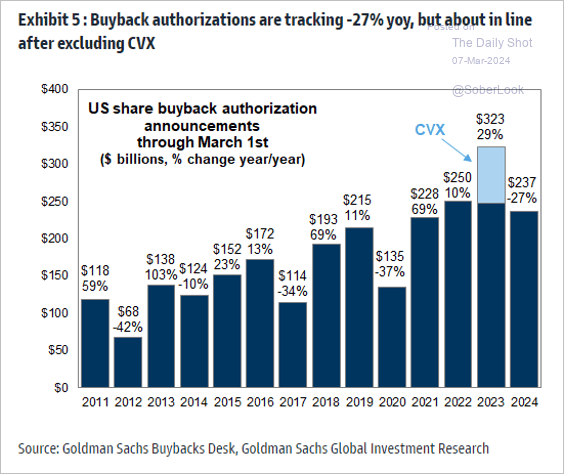

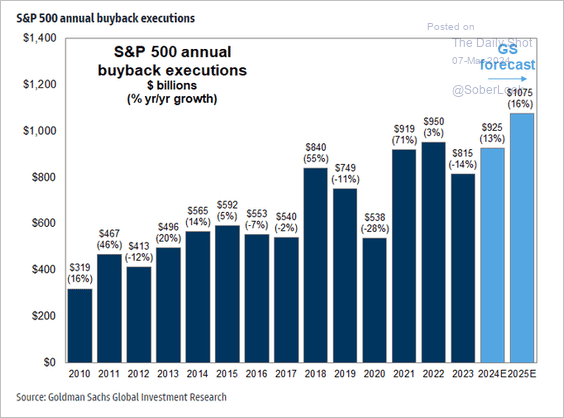

1. While share buyback activity remains well below the levels seen last year, when excluding Chevron’s massive buyback from the previous year’s data, the current figures align more closely with last year’s trend.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

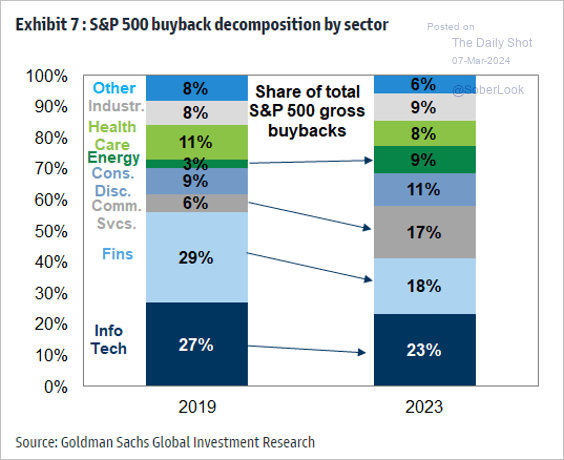

• Here is the decomposition of buybacks by sector.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

• Below is a forecast for S&P 500 buybacks (actual transactions) from Goldman.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

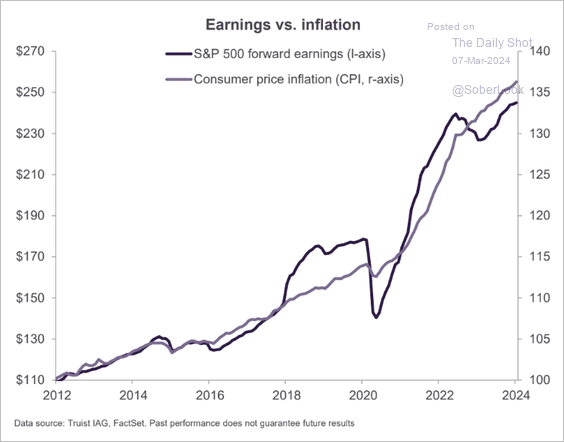

2. Corporate margins, and therefore earnings, are correlated with inflation.

Source: Truist Advisory Services

Source: Truist Advisory Services

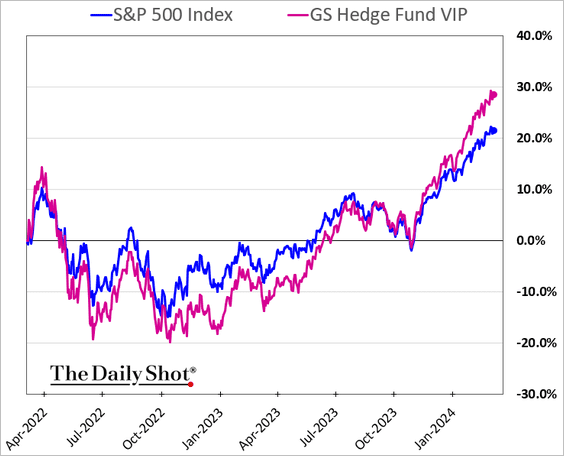

3. Hedge funds’ picks continue to outperform.

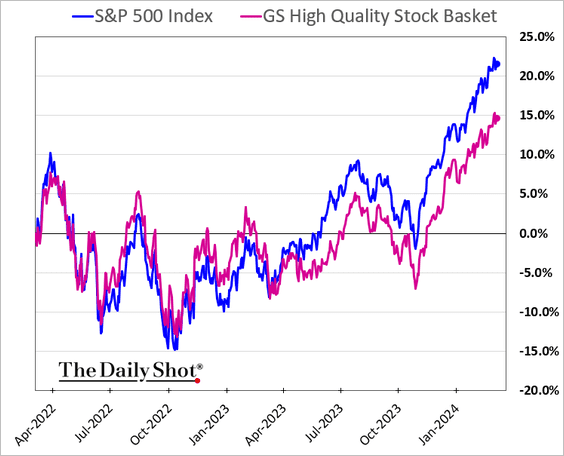

4. The quality factor has been lagging the S&P 500.

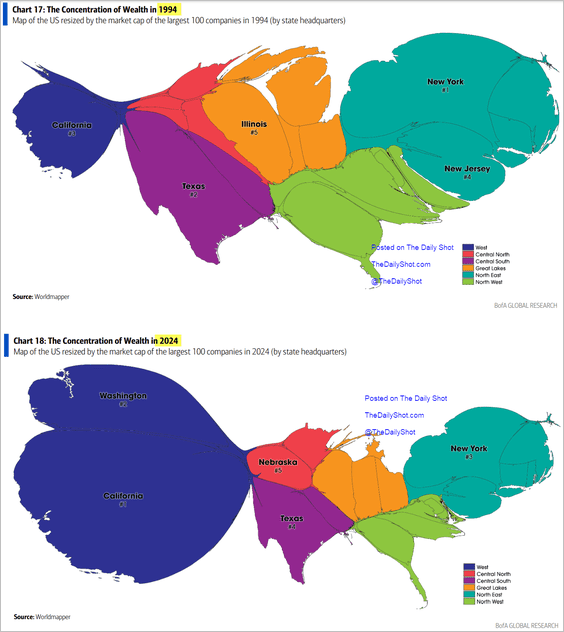

5. Below is the map of the US, resized by the market cap of the largest 100 companies.

Source: BofA Global Research

Source: BofA Global Research

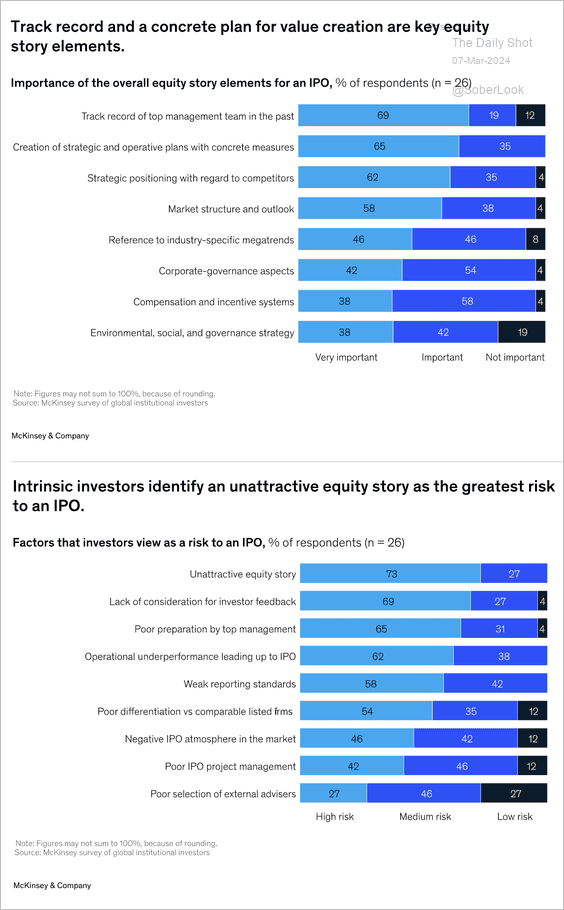

6. Here is a look at investor priorities and risks for IPO success.

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

Back to Index

Credit

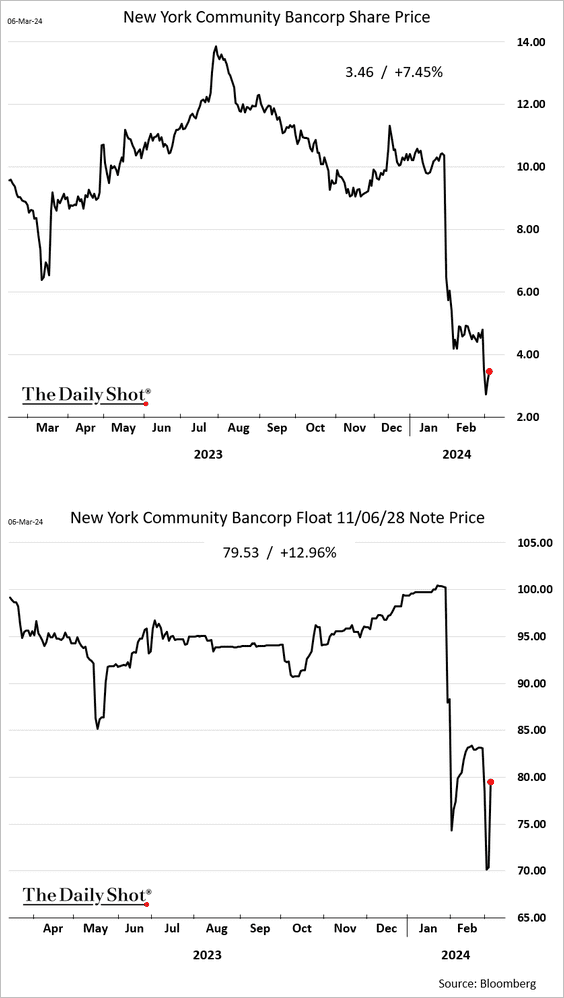

1. New York Community Bancorp’s assets bounced after the news of a capital injection.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

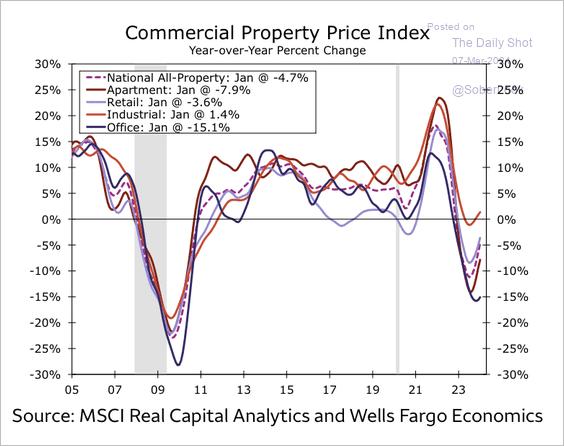

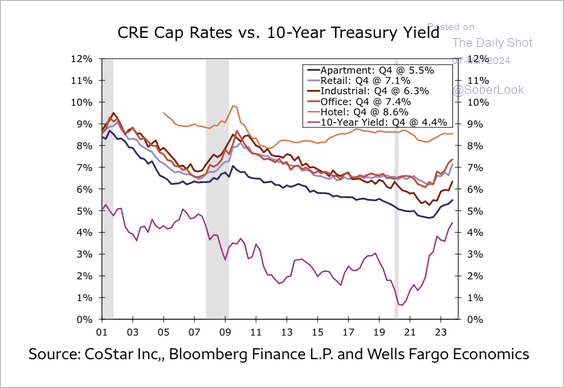

2. Commercial real estate prices are starting to stabilize.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

• Cap rates across property types have risen over the past year, especially office and retail.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

Rates

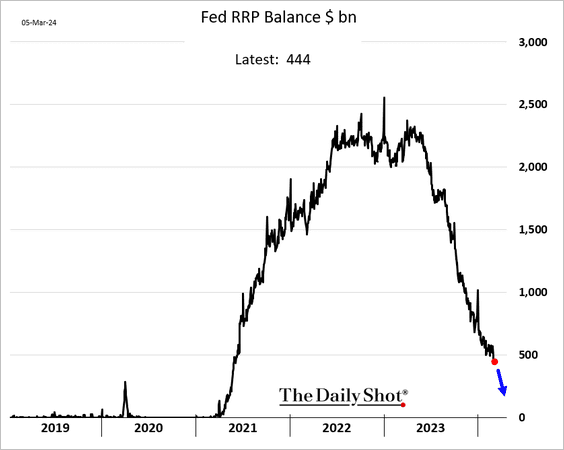

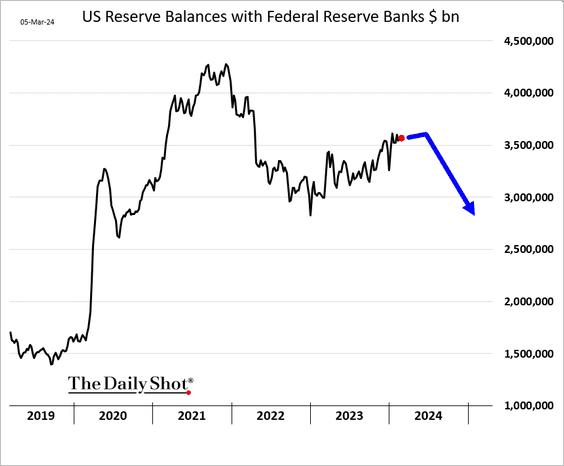

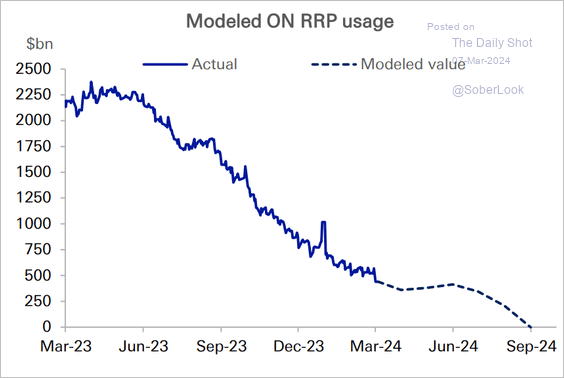

1. The reduction in the Reverse Repurchase Agreement (RRP) facility balance has kept reserves high, counteracting the Federal Reserve’s balance sheet contraction. Once RRP reductions stop, reserves are expected to decrease, prompting the Fed to scale back on quantitative tightening (QT).

Here is Deutsche Bank’s estimate for the RRP facility usage.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

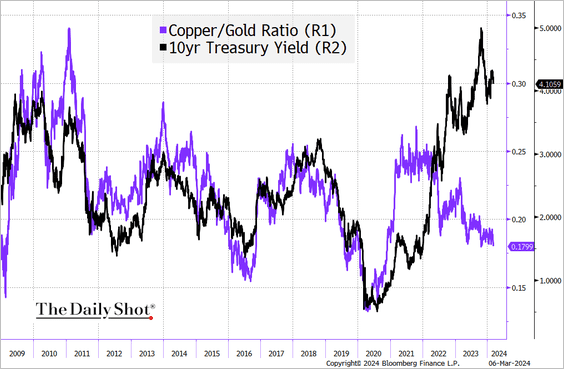

2. The copper-to-gold ratio suggests that Treasury yields should be lower.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

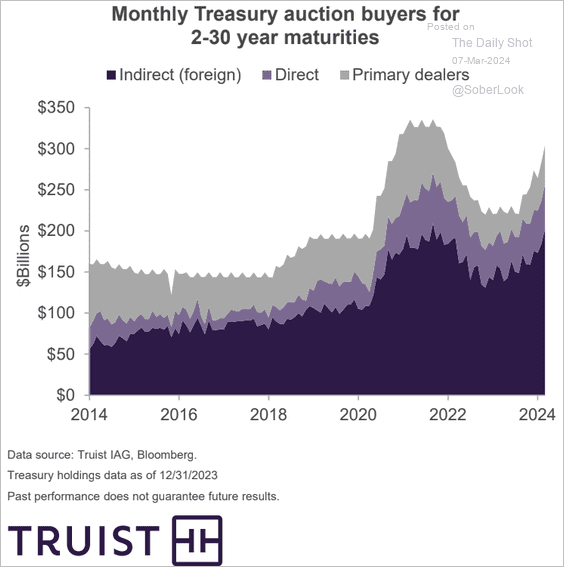

3. Here is a look at the evolution of coupon Treasury auction buyers.

Source: Truist Advisory Services

Source: Truist Advisory Services

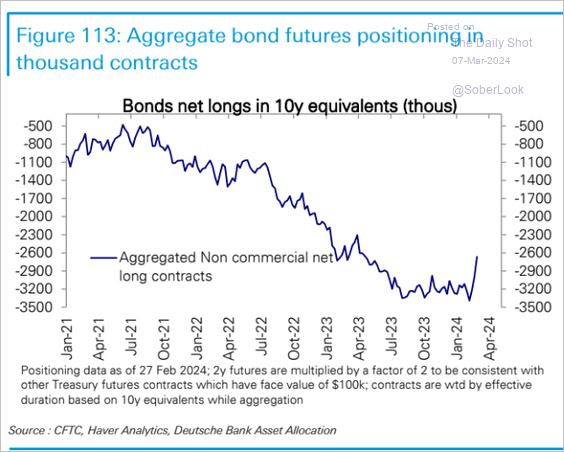

4. The Treasury cash/futures arb is starting to unwind.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

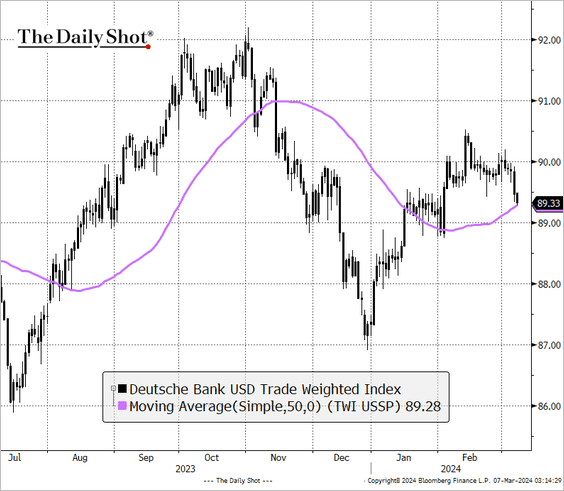

1. The dollar has been selling off, with the trade-weighted index back at its 50-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

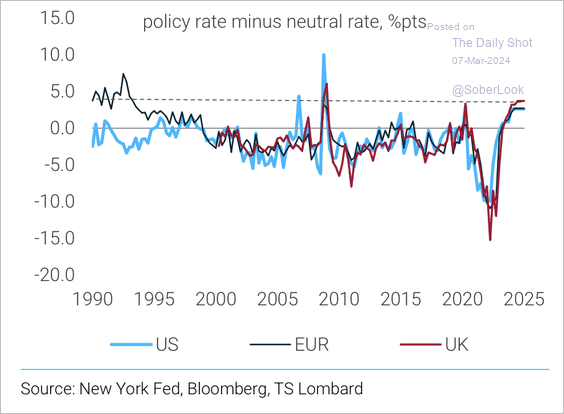

2. Monetary policy in the US, euro area, and UK is restrictive.

Source: TS Lombard

Source: TS Lombard

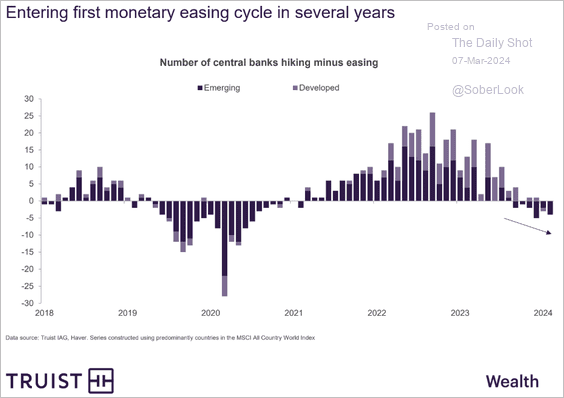

3. Central banks continue to ease.

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

Food for Thought

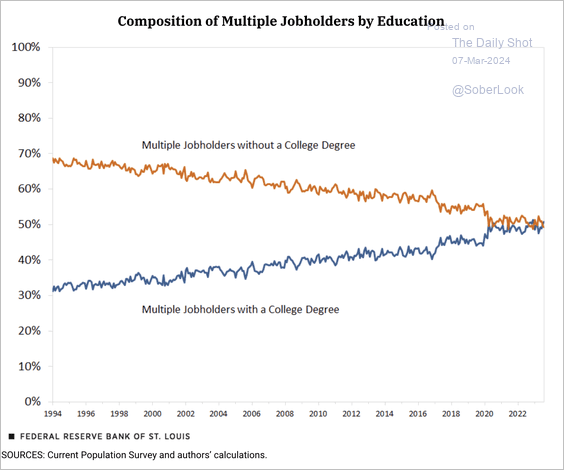

1. Multiple jobholders by education:

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

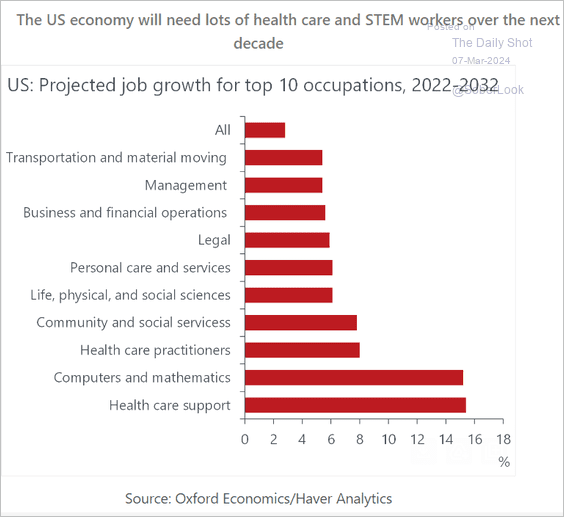

2. Projected job growth for top 10 occupations:

Source: Oxford Economics

Source: Oxford Economics

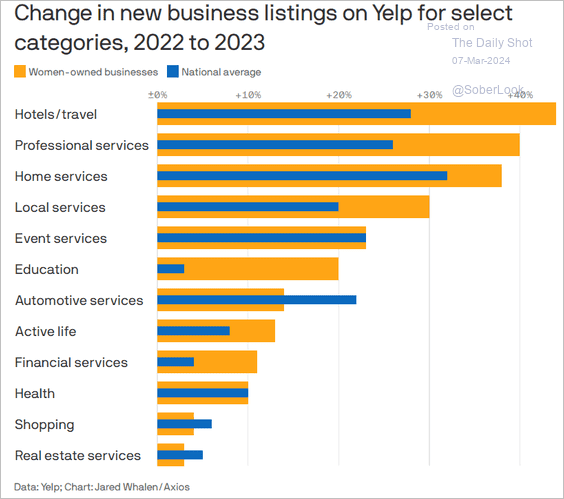

3. Growth in women-owned businesses:

Source: @axios Read full article

Source: @axios Read full article

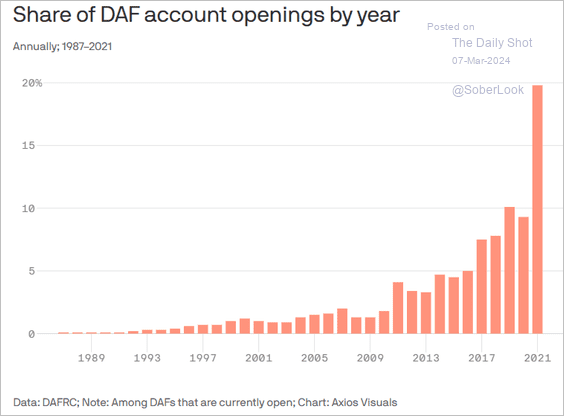

4. Account openings for donor-advised funds:

Source: @axios Read full article

Source: @axios Read full article

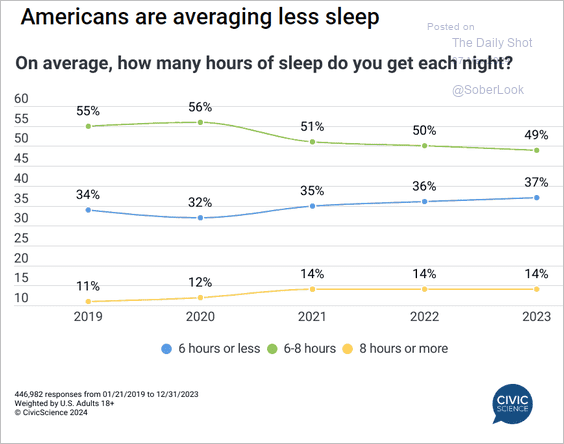

5. Getting less sleep

Source: @CivicScience Read full article

Source: @CivicScience Read full article

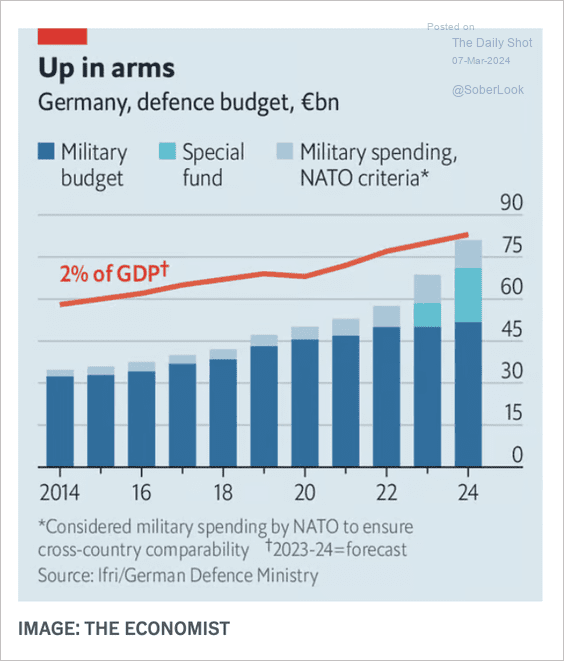

6. Germany’s defense budget:

Source: The Economist Read full article

Source: The Economist Read full article

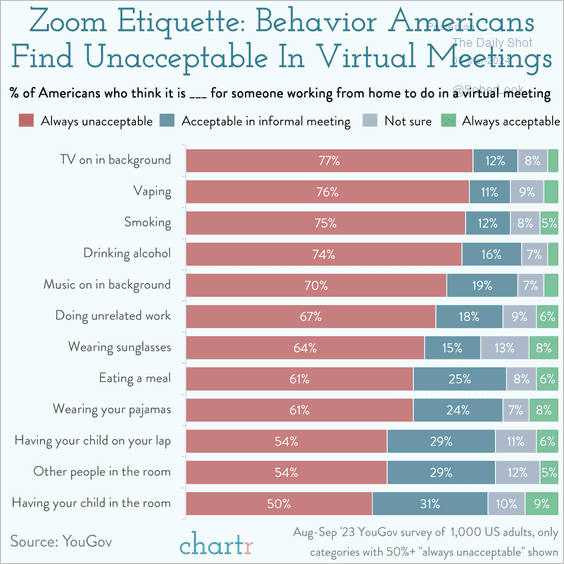

7. Zoom etiquette:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index