The Daily Shot: 17-Aug-21

• The United States

• Canada

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

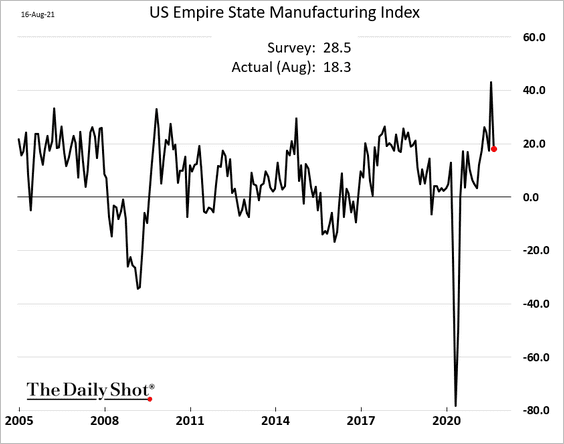

1. The first regional Fed manufacturing survey of the month (from the NY Fed) showed some moderation in factory activity.

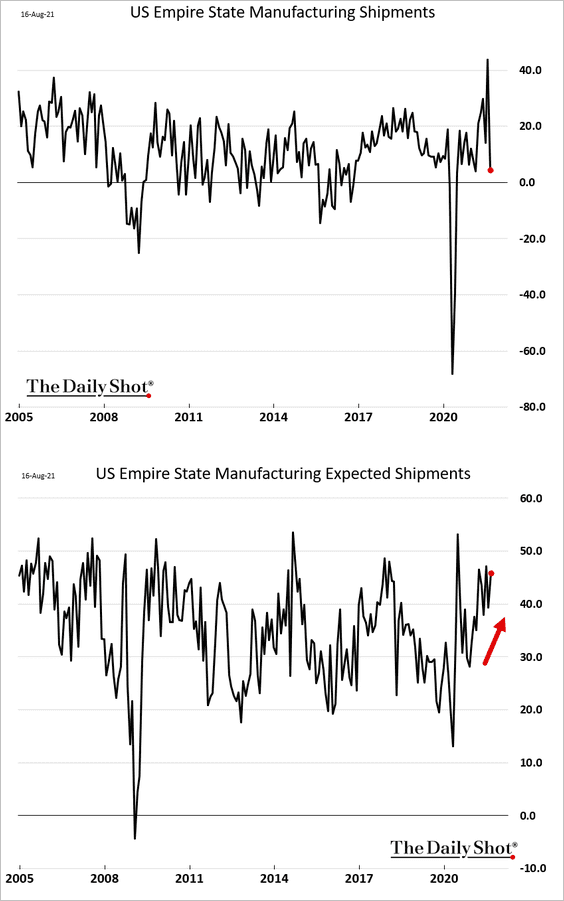

• Shipments eased, but expectations remain strong (2nd chart).

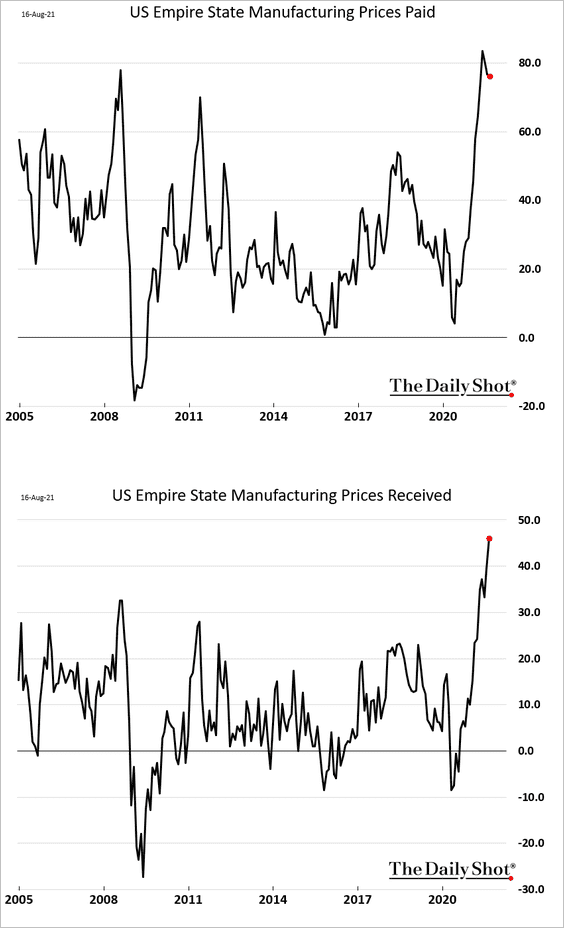

• Price pressures persist. The prices paid index is off the highs, but the prices received indicator hit a new record.

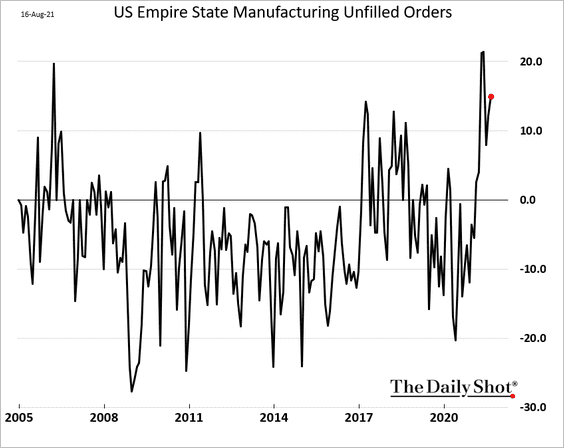

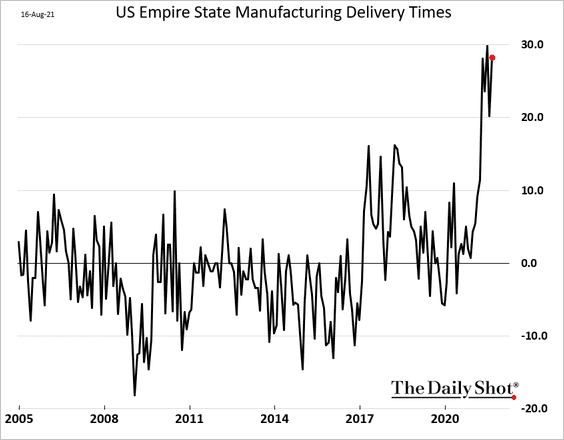

• Supply-chain bottlenecks continue to bedevil the region’s manufacturers.

– Unfilled orders:

– Delivery times:

——————–

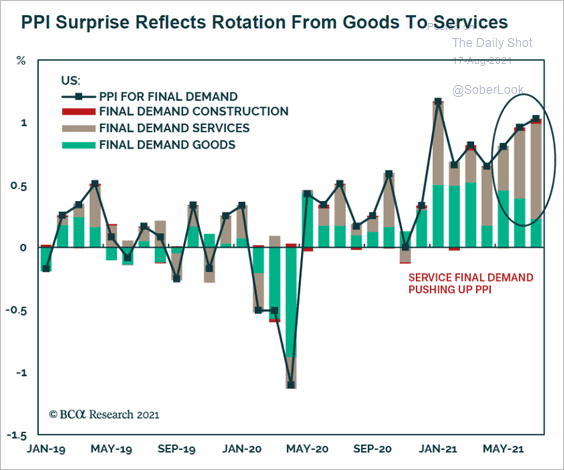

2. The July PPI surprise points to rotation from goods to services, according to BCA Research.

Source: BCA Research

Source: BCA Research

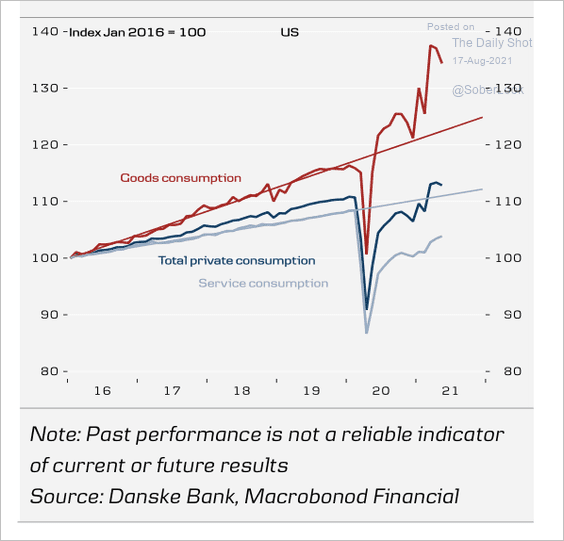

Going forward, reduced goods consumption and increased service consumption will likely relieve pressure on commodity inflation, according to Danske Bank.

Source: Danske Bank

Source: Danske Bank

——————–

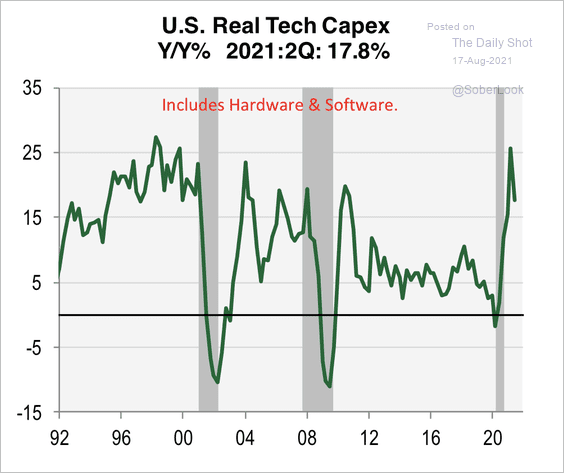

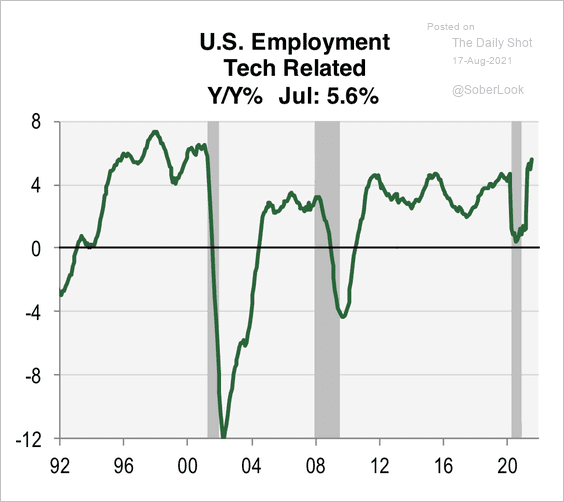

3. Tech led the latest CapEx recovery, as companies prioritized digitization.

Source: Cornerstone Macro

Source: Cornerstone Macro

That trend contributed to higher tech-related employment.

Source: Cornerstone Macro

Source: Cornerstone Macro

——————–

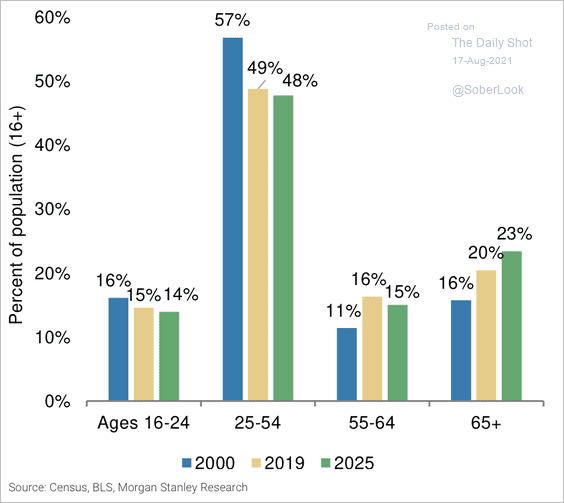

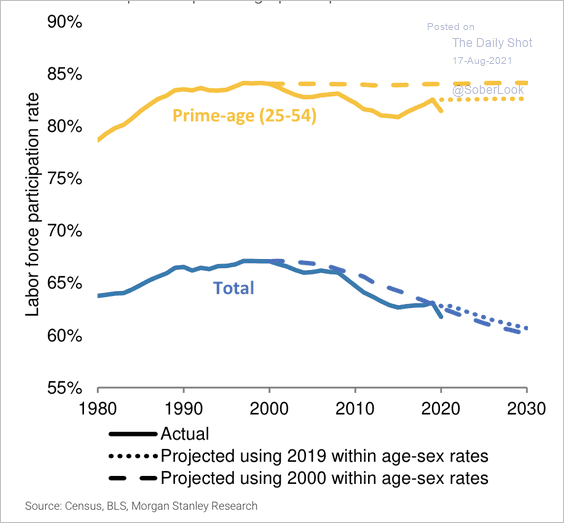

4. The share of the population aged 65 and higher is expected to rise, which will be a drag on labor force participation (2 charts).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

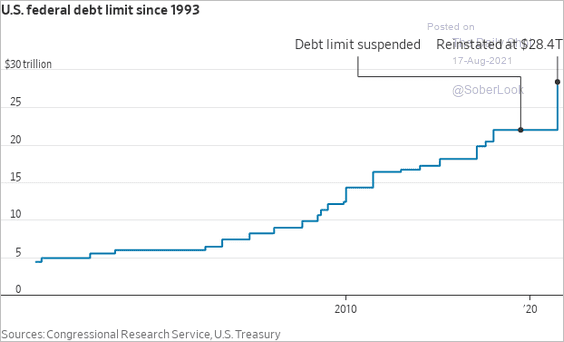

5. Will the looming debt ceiling battle in Congress be a non-event, or will we get a repeat of 2011 (which resulted in a US debt downgrade)?

Source: @WSJ Read full article

Source: @WSJ Read full article

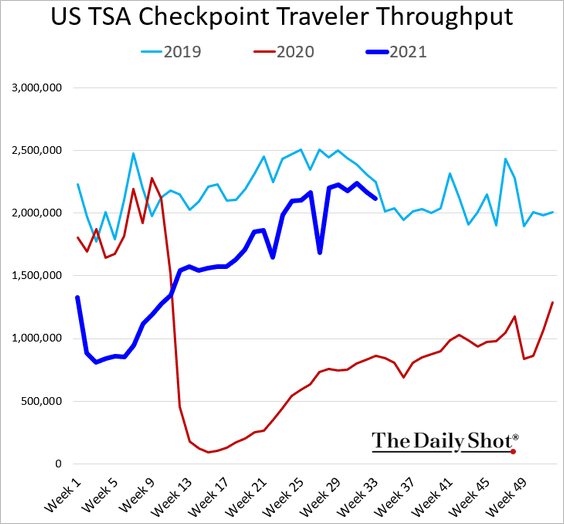

6. US air travel has been resilient and is now near 2019 levels (for this time of the year).

Back to Index

Canada

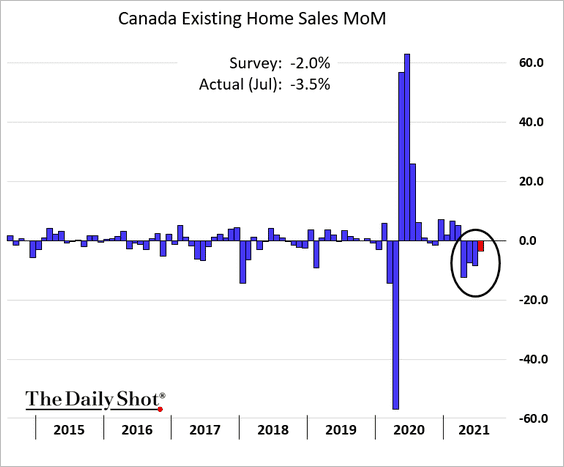

1. Existing-home sales declined for the fourth month in a row.

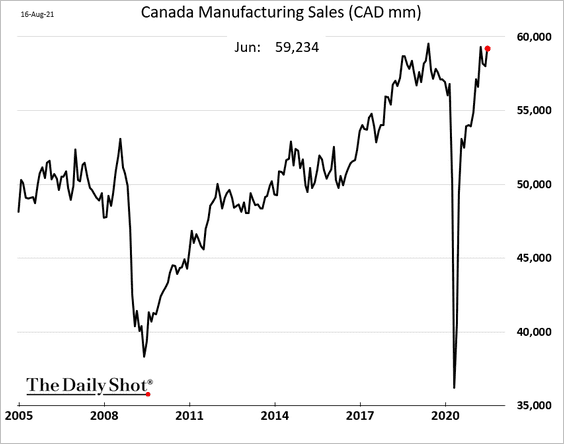

2. Factory sales remain near record highs.

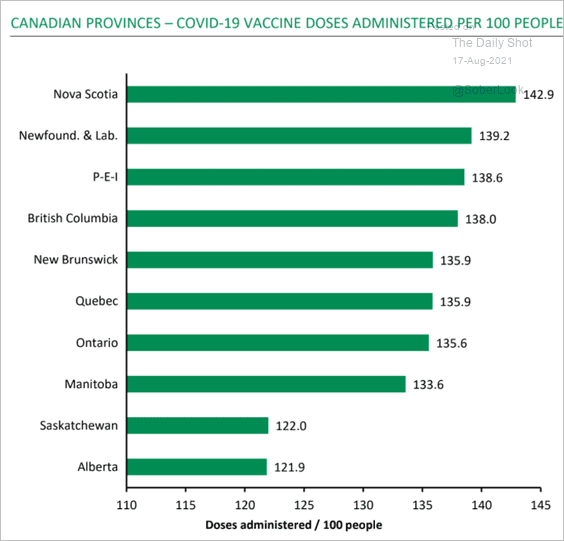

3. Here is a look at regional vaccination rates.

Source: Desjardins

Source: Desjardins

Back to Index

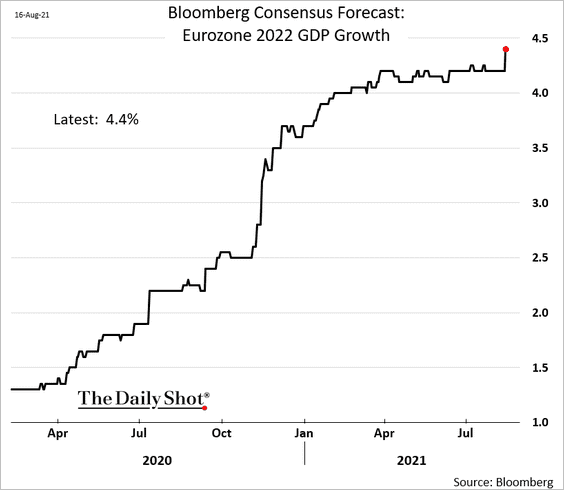

The Eurozone

1. Economists boosted their forecasts for next year’s GDP growth in the Eurozone.

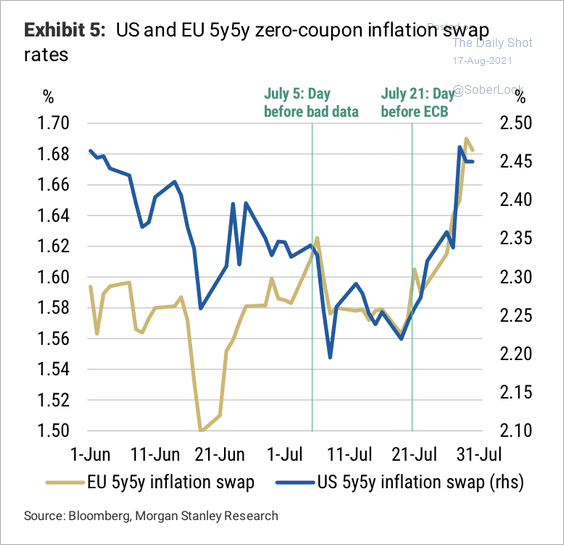

2. The bounce in oil prices alongside dovish ECB guidance contributed to higher European breakeven inflation rates, similar to the US.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

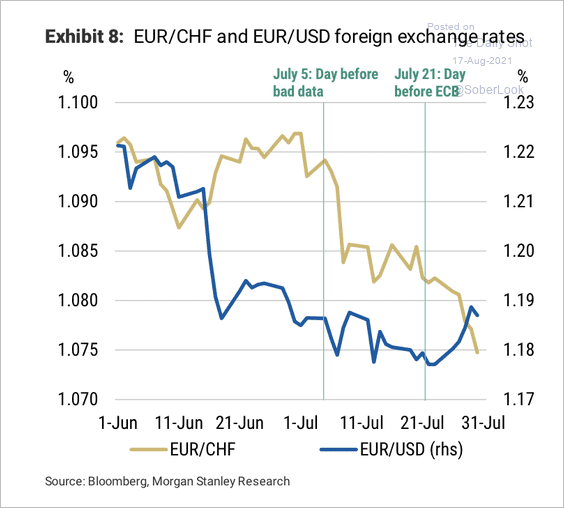

On a related note, the euro fell throughout July as real yields declined.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

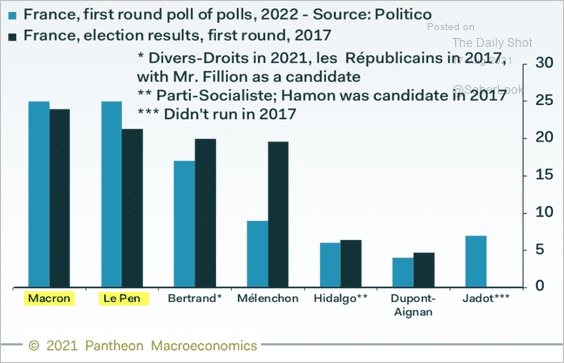

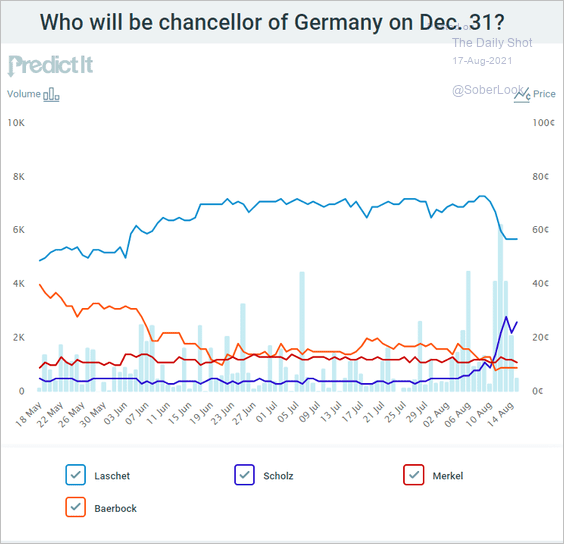

3. Next, we have a couple of updates on politics.

• French polls:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• German election odds in the betting markets:

Source: @PredictIt

Source: @PredictIt

Back to Index

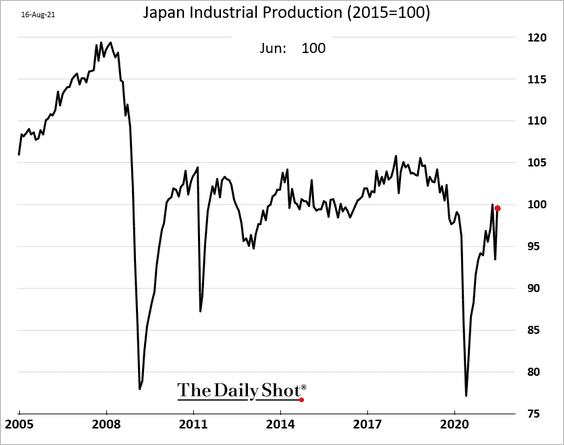

Japan

1. Industrial production is back at pre-COVID levels.

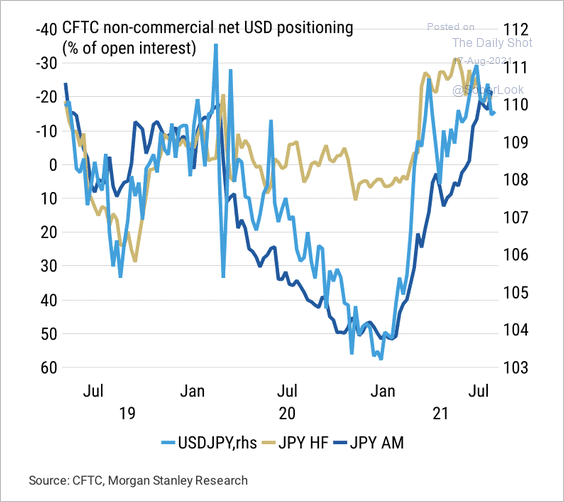

2. Asset managers and leveraged funds are significantly net-short yen.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

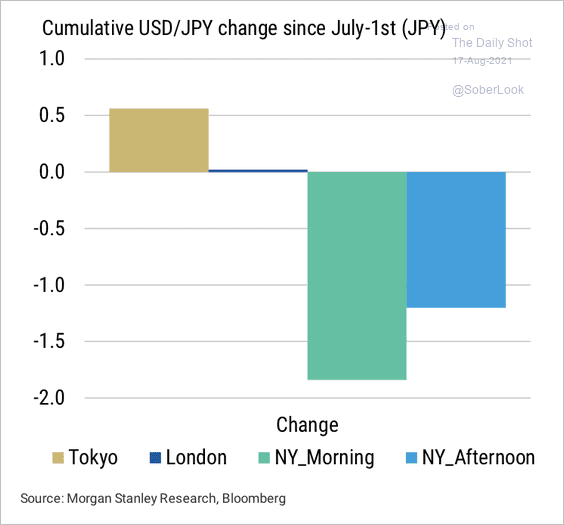

Separately, USD/JPY has traded lower during NY hours.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Asia – Pacific

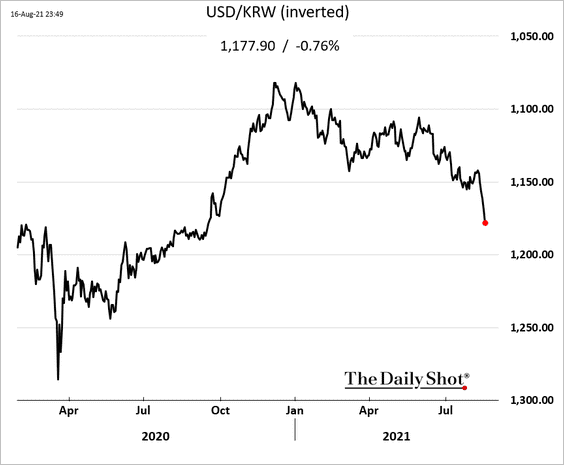

1. The South Korean won has been under pressure amid capital outflows.

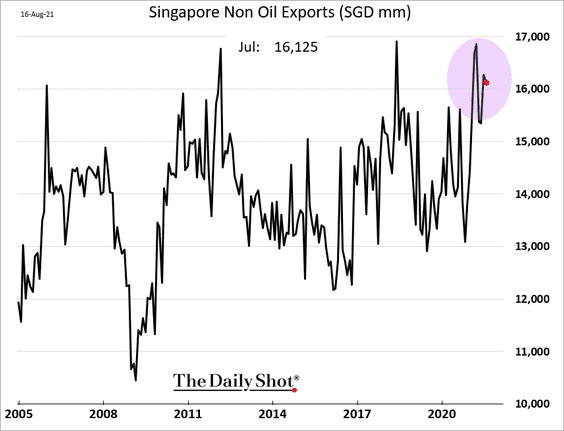

2. Singapore’s exports remain robust.

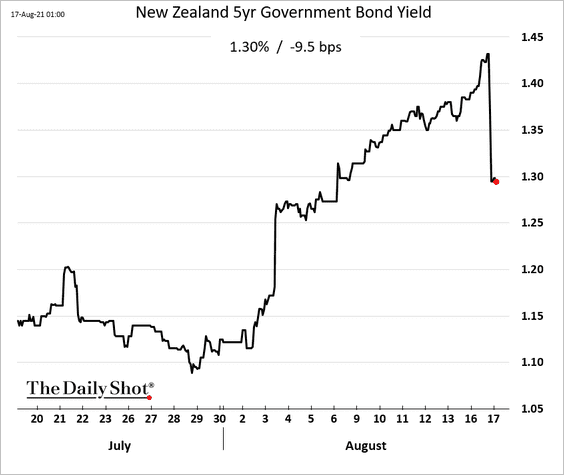

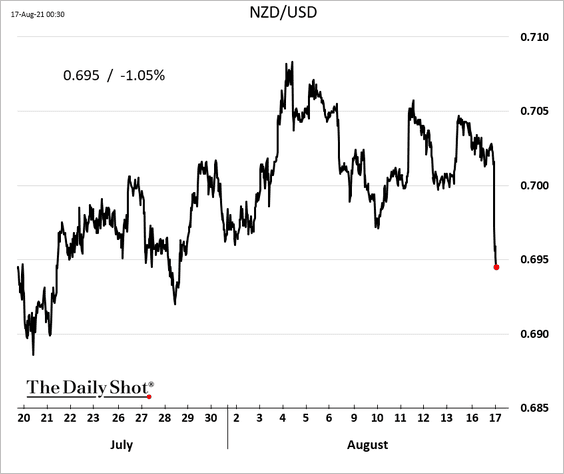

3. New Zealand’s health officials are looking into a new community transmission of COVID in Auckland. Markets were pricing in a series of RBNZ rate hikes, but the pandemic risk could derail these plans.

Source: RNZ Read full article

Source: RNZ Read full article

Bond yields and the Kiwi dollar tumbled.

——————–

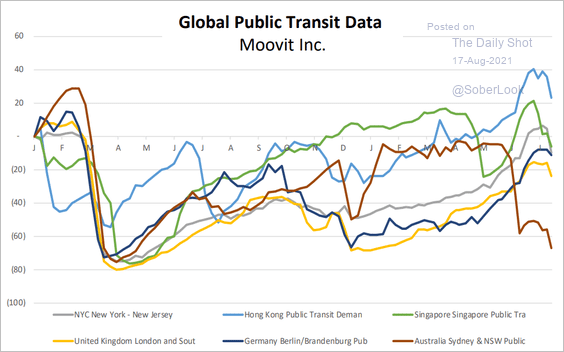

4. Australia’s public transit trend stands out.

Source: Cornerstone Macro

Source: Cornerstone Macro

Back to Index

China

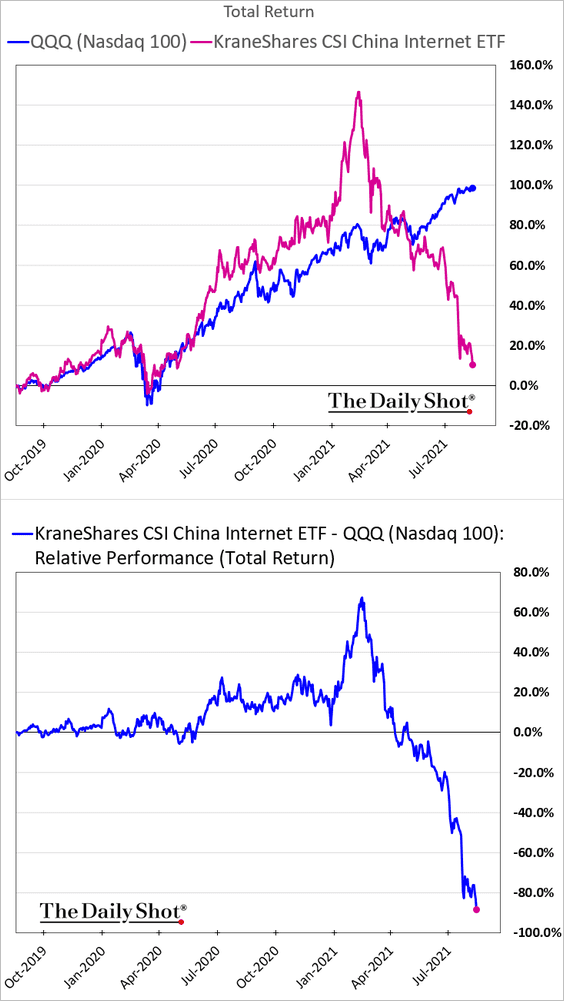

1. Tech stocks remain under pressure.

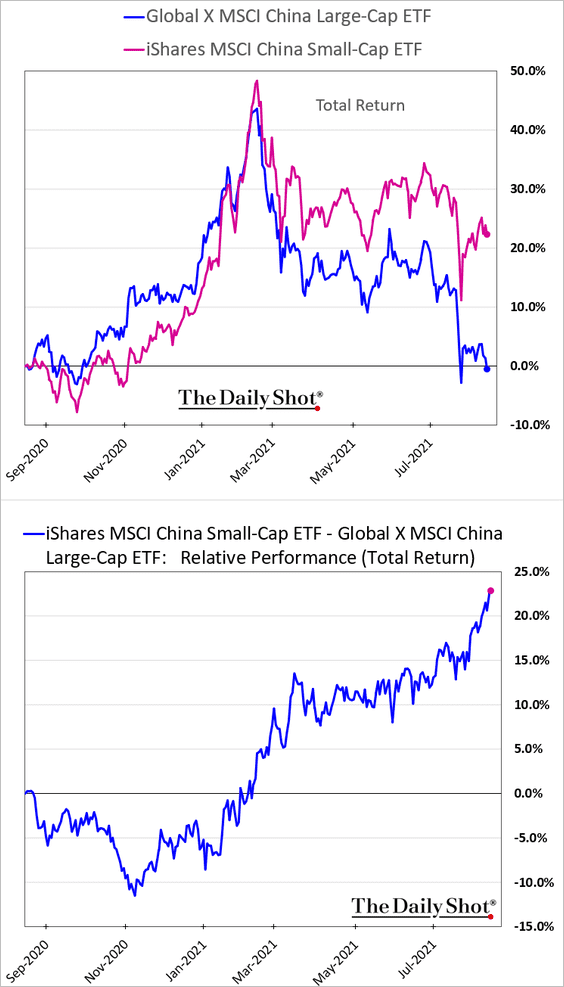

2. China’s small caps have been outperforming as Bejing targets some industry leaders.

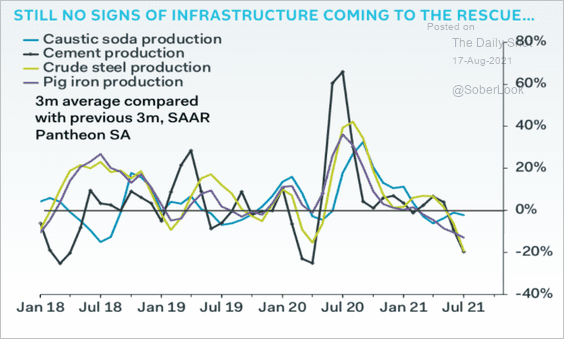

3. For now, there are no signs of an infrastructure boost to reverse the current economic slowdown.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

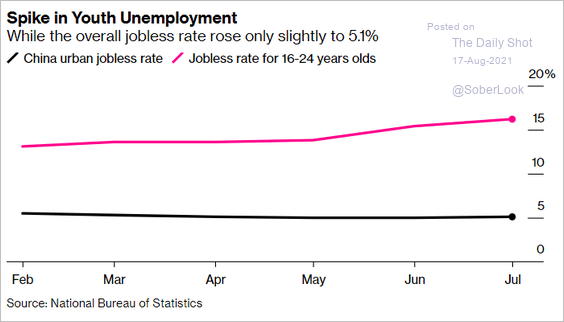

4. Youth unemployment has risen.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

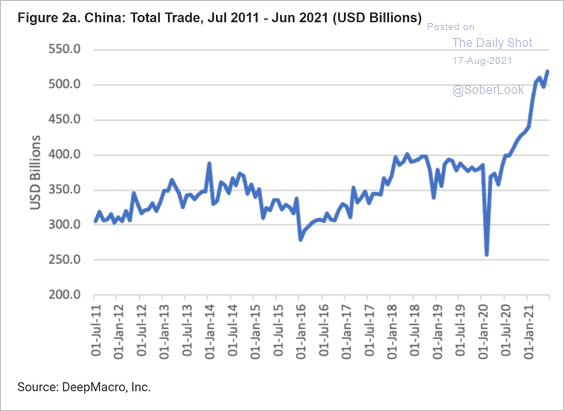

5. China’s total trade surged over the past year.

Source: DeepMacro

Source: DeepMacro

Back to Index

Emerging Markets

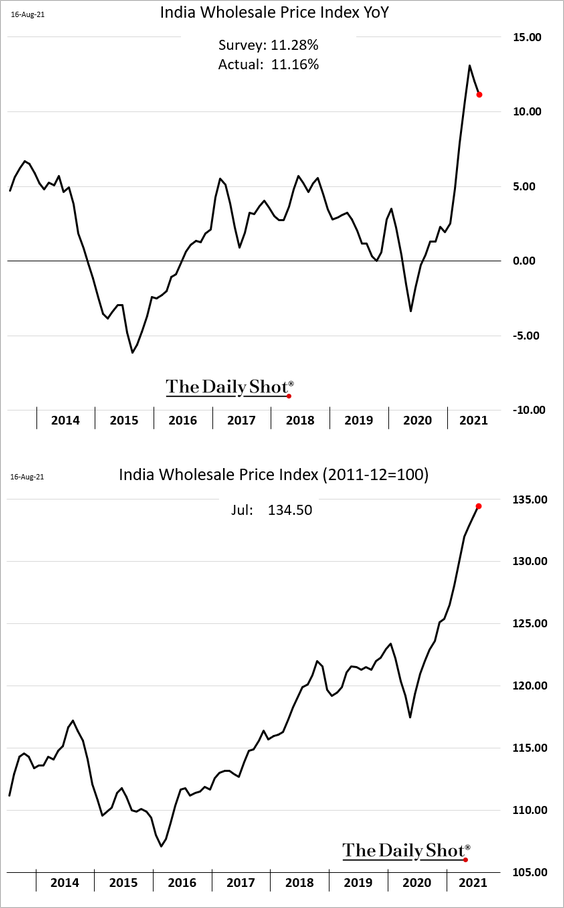

1. India’s wholesale prices are rising at a slower pace.

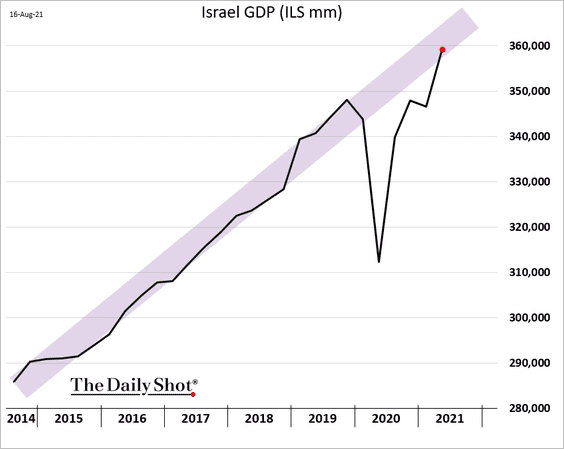

2. Israel’s GDP is back inside the multi-year range.

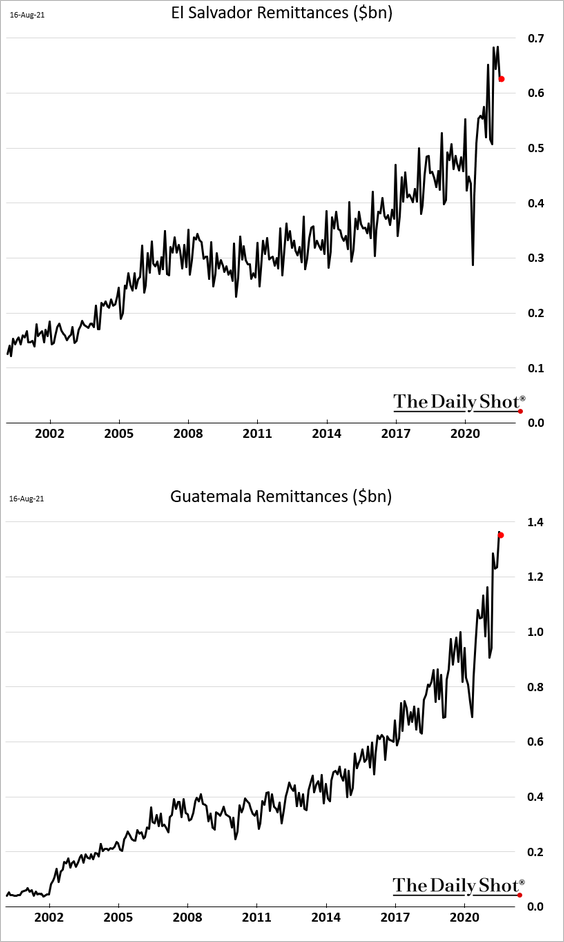

3. Governments in the Northern Triangle countries have zero incentive to curtail migration to the US. Remittances increasingly provide much-needed dollars to the nations’ struggling economies. To put this into perspective, Guatemala’s coffee exports are worth $0.65 billion per year. Banana exports are $0.94 bn/year. On the other hand, migrant labor “exports” now deliver $1.35 billion – per month. Remittances totaled $11.34 billion in 2020, representing 14.7% of the GDP. The figure will be even higher this year.

Back to Index

Commodities

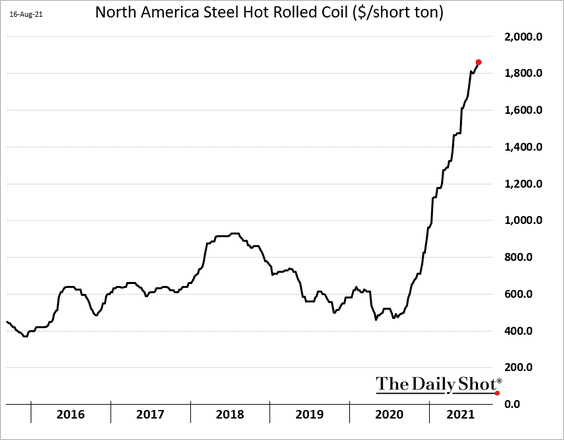

1. North American steel prices continue to surge.

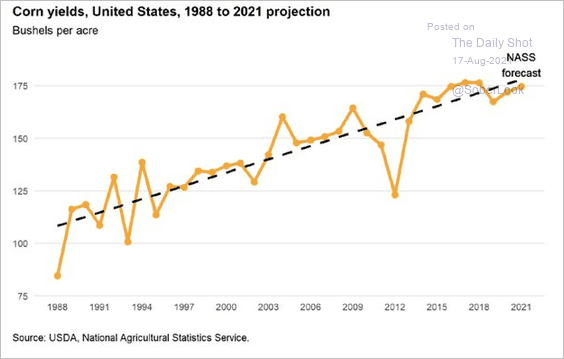

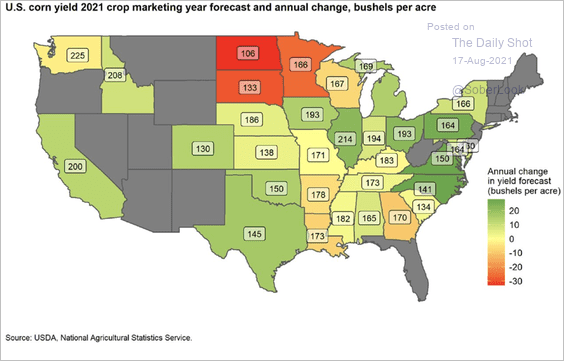

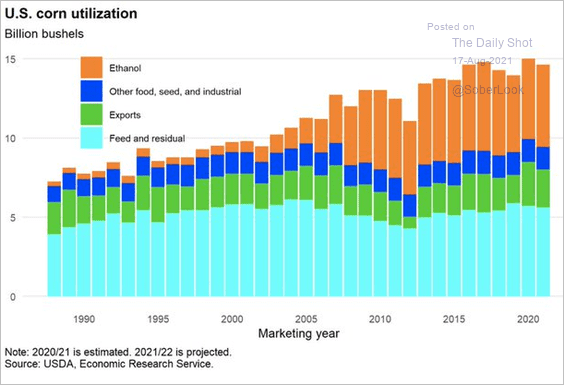

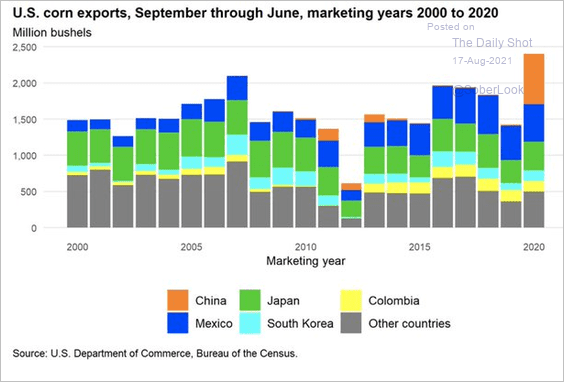

2. Next, we have some updates on the US corn market.

• Crop yields over time:

Source: @FarmPolicy, @USDA_ERS Read full article

Source: @FarmPolicy, @USDA_ERS Read full article

• Yield changes by state:

Source: @FarmPolicy, @USDA_ERS Read full article

Source: @FarmPolicy, @USDA_ERS Read full article

• Corn utlization:

Source: @FarmPolicy, @USDA_ERS Read full article

Source: @FarmPolicy, @USDA_ERS Read full article

• Exports:

Source: @FarmPolicy, @USDA_ERS Read full article

Source: @FarmPolicy, @USDA_ERS Read full article

——————–

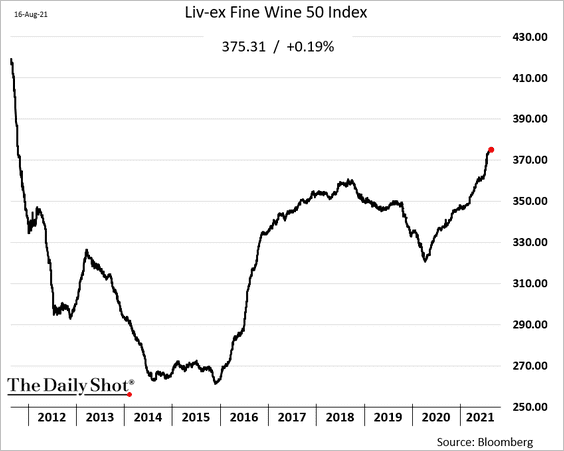

3. Wine prices continue to climb.

Back to Index

Energy

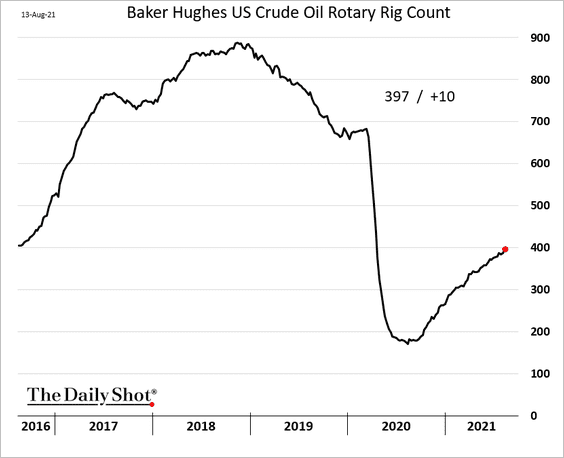

1. The US rig count is nearing 400.

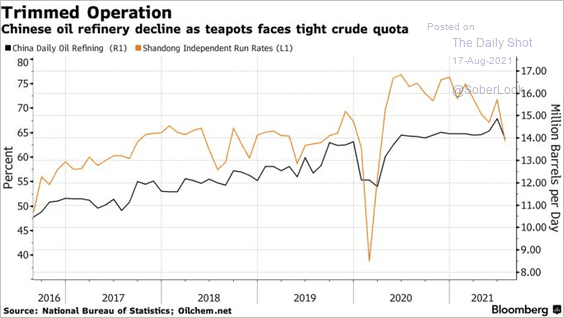

2. China’s refinery demand has slowed.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

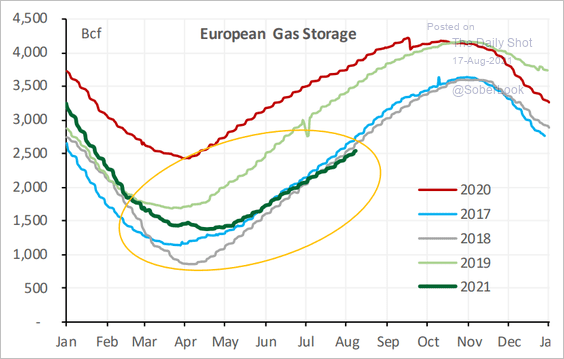

3. Next, we have some updates on natural gas markets.

• European natural gas inventories are running below 2018 levels.

Source: Cornerstone Macro

Source: Cornerstone Macro

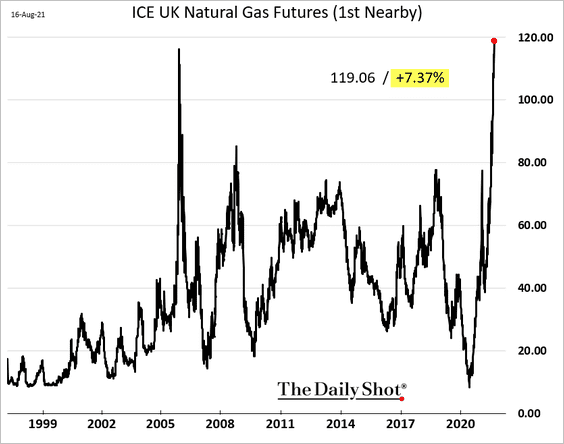

• UK natural gas futures hit a record high.

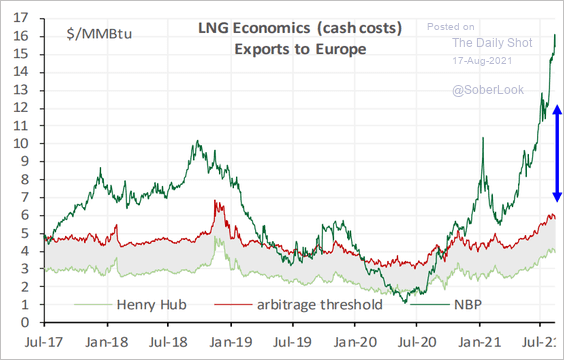

• Exporting US LNG to Europe is increasingly profitable.

Source: Cornerstone Macro

Source: Cornerstone Macro

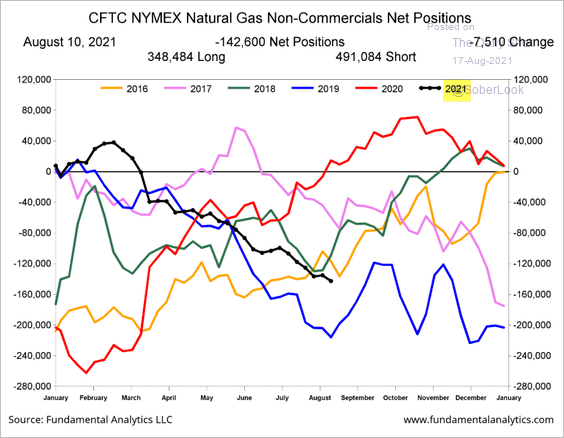

• Speculative accounts continue to increase their bets against US natural gas.

Source: Fundamental Analytics Read full article

Source: Fundamental Analytics Read full article

——————–

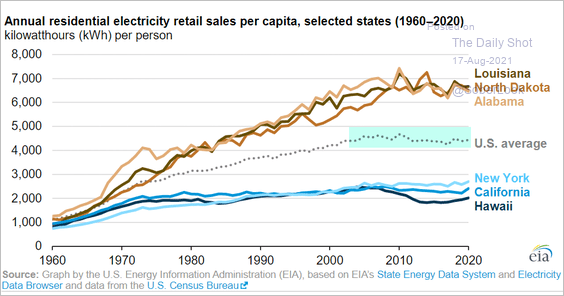

4. US residential electricity consumption per capita has been flat for over a decade.

Source: EIA

Source: EIA

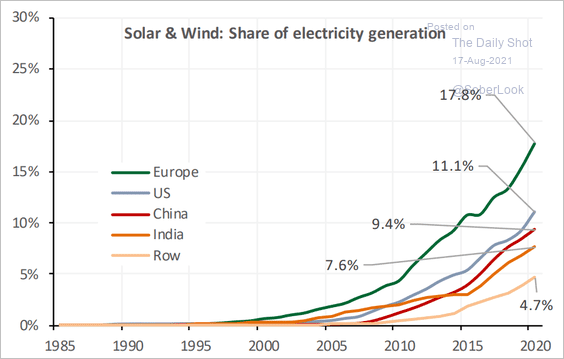

5. This chart shows solar and wind share of electricity generation for select economies (Row = “rest of the world”).

Source: Cornerstone Macro

Source: Cornerstone Macro

Back to Index

Equities

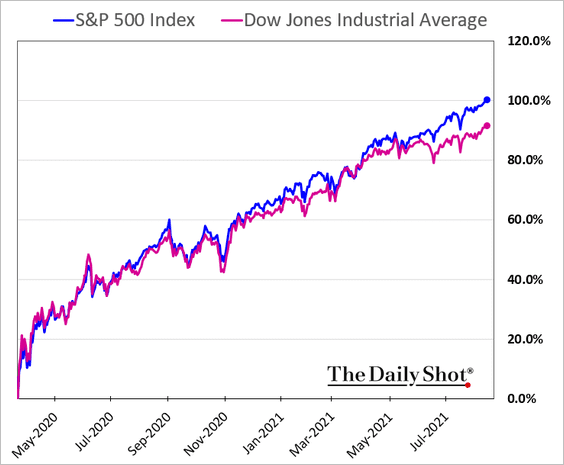

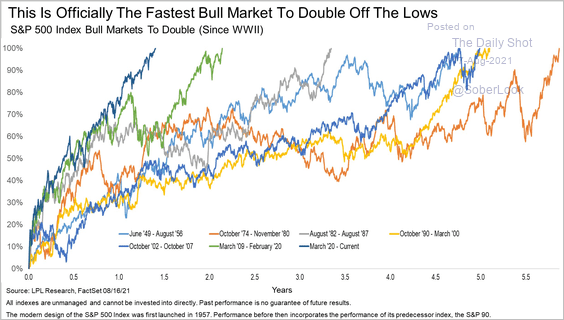

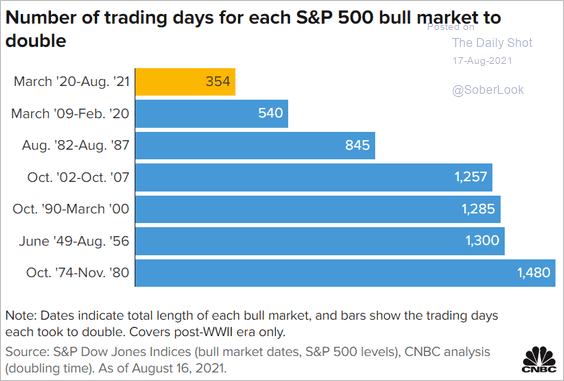

1. The S&P 500 has doubled from the pandemic lows (3/23/2020).

h/t Sophie Caronello

h/t Sophie Caronello

The rise has been remarkably fast.

Source: @RyanDetrick

Source: @RyanDetrick

Source: CNBC Read full article

Source: CNBC Read full article

——————–

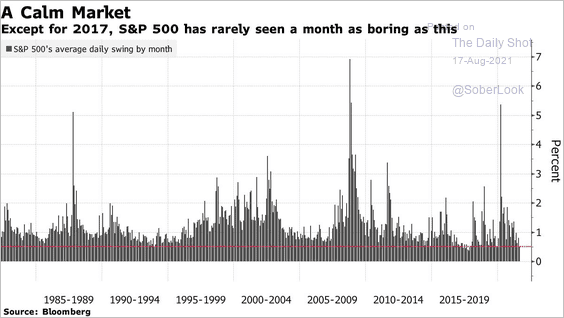

2. The stock market has been exceptionally quiet this month.

Source: @markets Read full article

Source: @markets Read full article

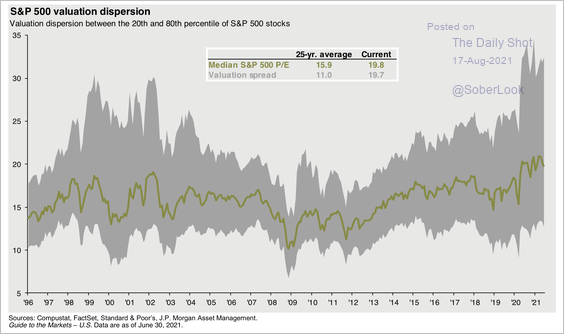

3. The S&P 500’s valuation dispersion is far above the 25-year average.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

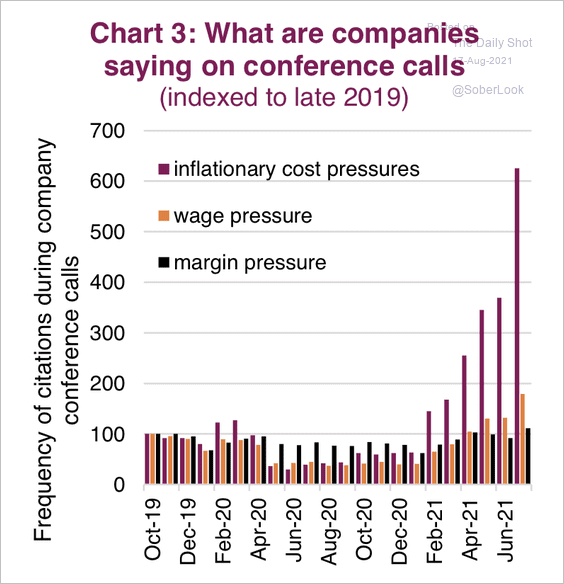

4. Companies are talking more about inflation and wage pressures on earnings calls, although mentions of margin pressure have been relatively low.

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

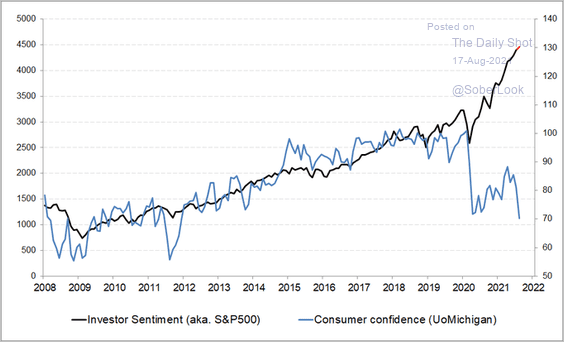

5. Investor sentiment has diverged from consumer sentiment.

Source: @Callum_Thomas, @takis2910

Source: @Callum_Thomas, @takis2910

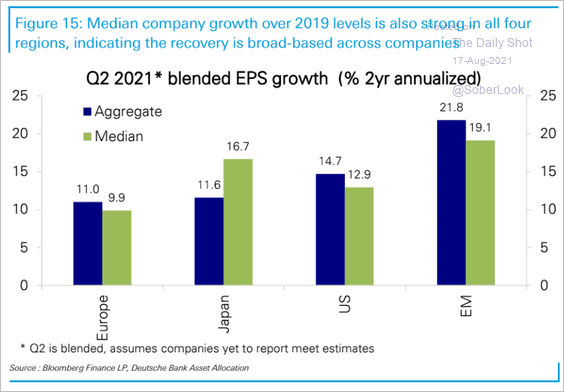

6. Earnings growth over 2019 levels has been strong globally.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

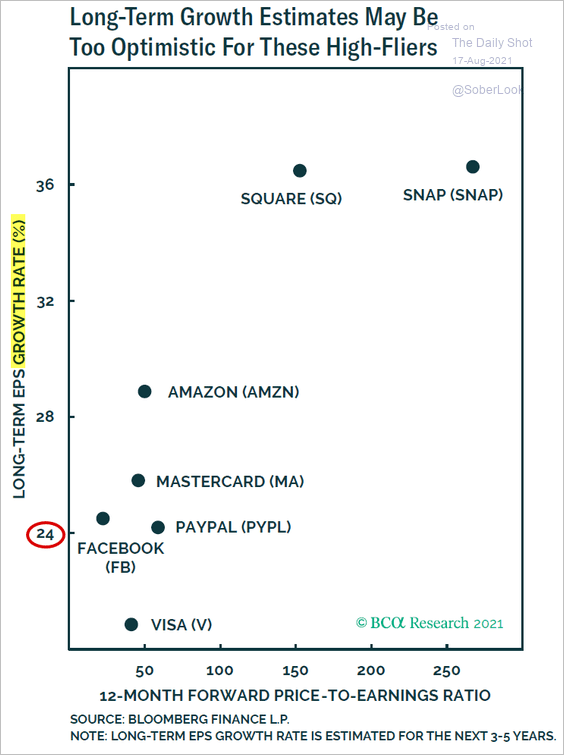

7. Tech long-term growth estimates seem too optimistic.

Source: BCA Research

Source: BCA Research

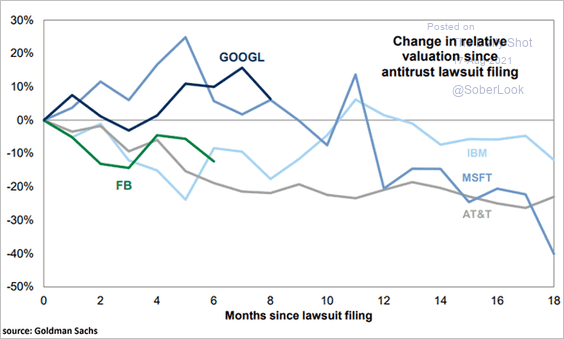

Antitrust lawsuits could put pressure on tech valuations.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

——————–

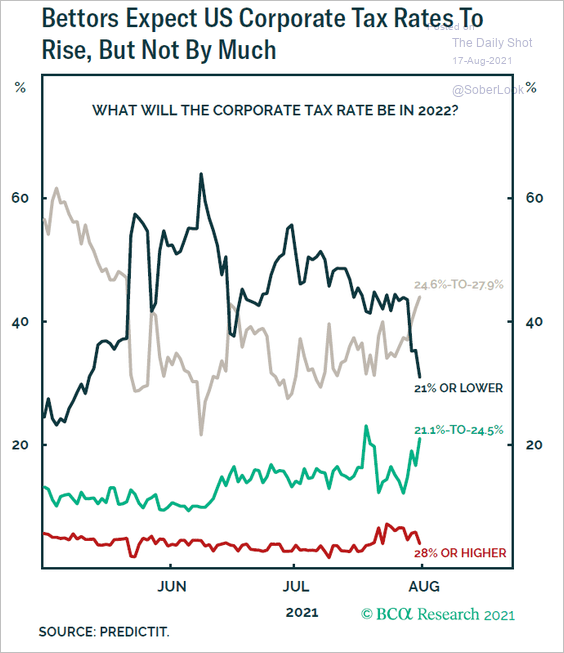

8. The betting markets don’t expect substantial corporate tax hikes in the US.

Source: BCA Research

Source: BCA Research

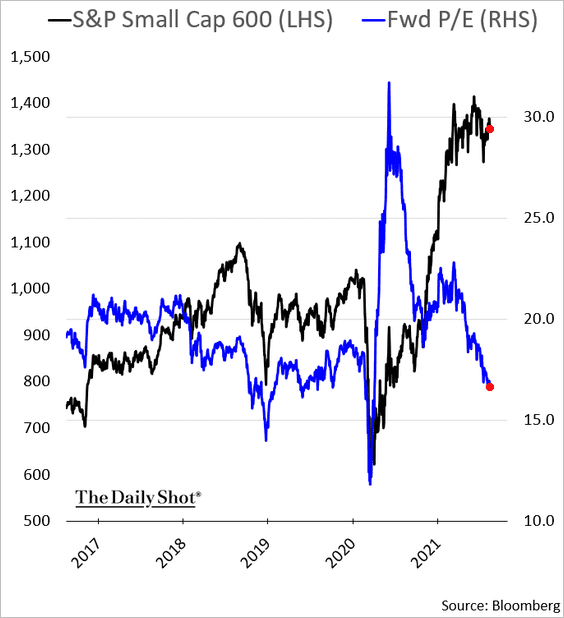

9. Small-cap valuations continue to improve, with the forward P/E ratio dipping below pre-COVID levels.

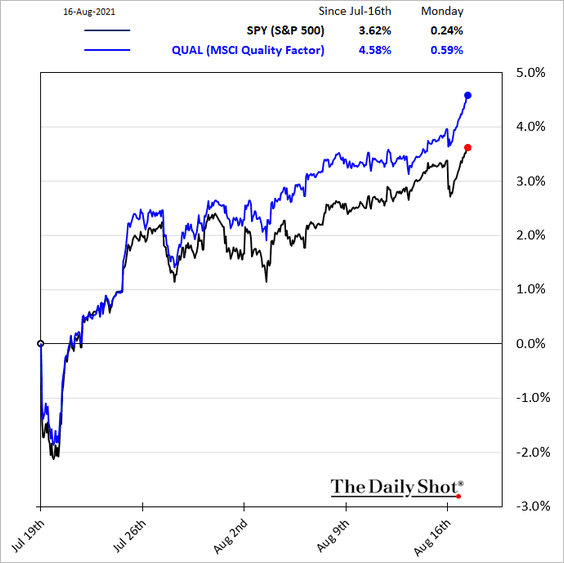

10. The quality factor has outperformed the S&P 500 over the past month.

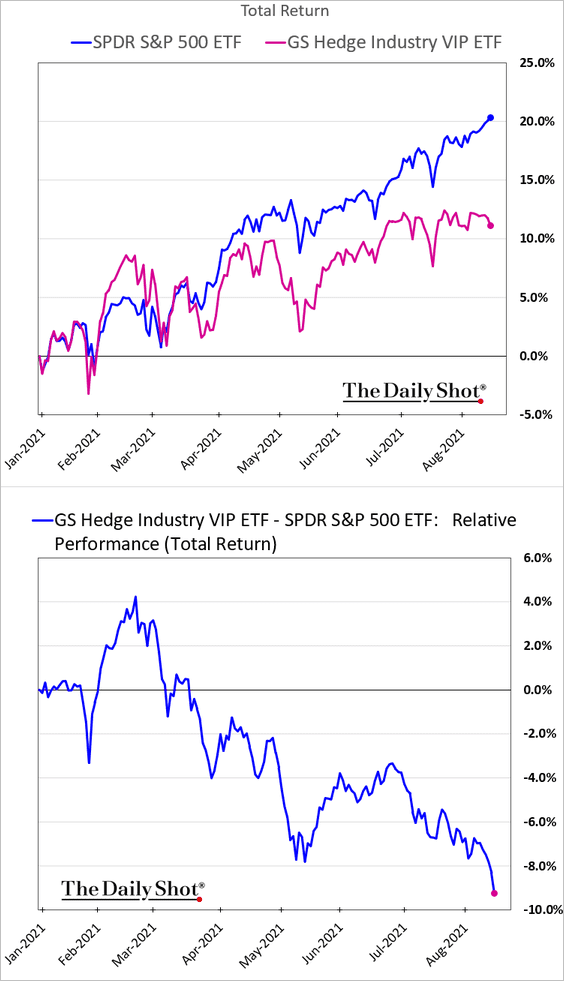

11. Hedge funds’ most popular stock picks have underperformed sharply this year.

Back to Index

Credit

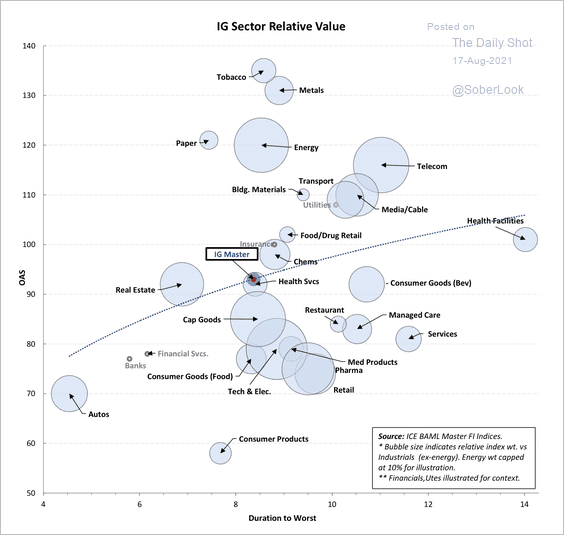

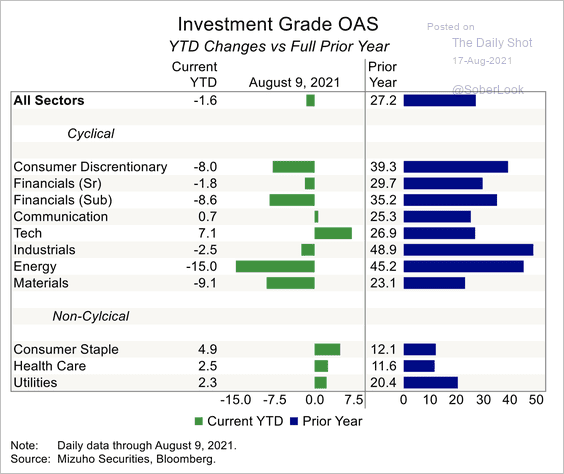

1. Here is a look at relative value across the US investment-grade sector.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Investment-grade spreads have contracted in several cyclical sectors this year.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

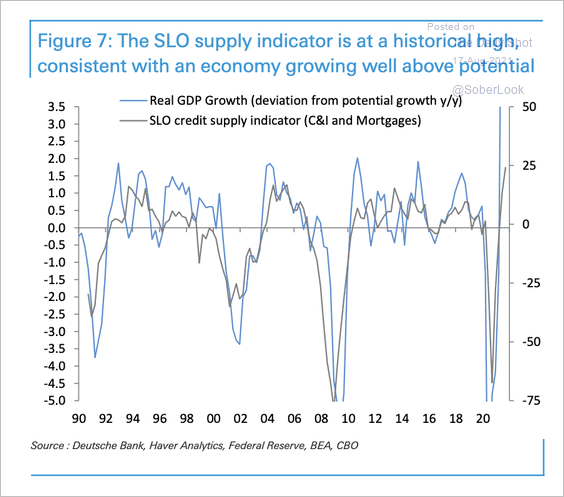

2. US banks’ lending standards are the easiest in decades.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

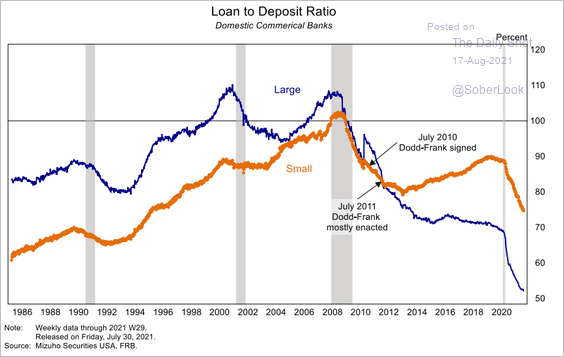

3. The loan-to-deposit ratio decline at small banks has been much less severe than at large firms,

Source: Mizuho Securities USA

Source: Mizuho Securities USA

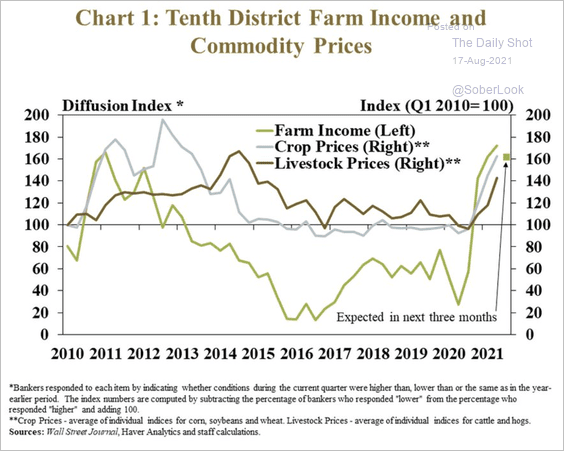

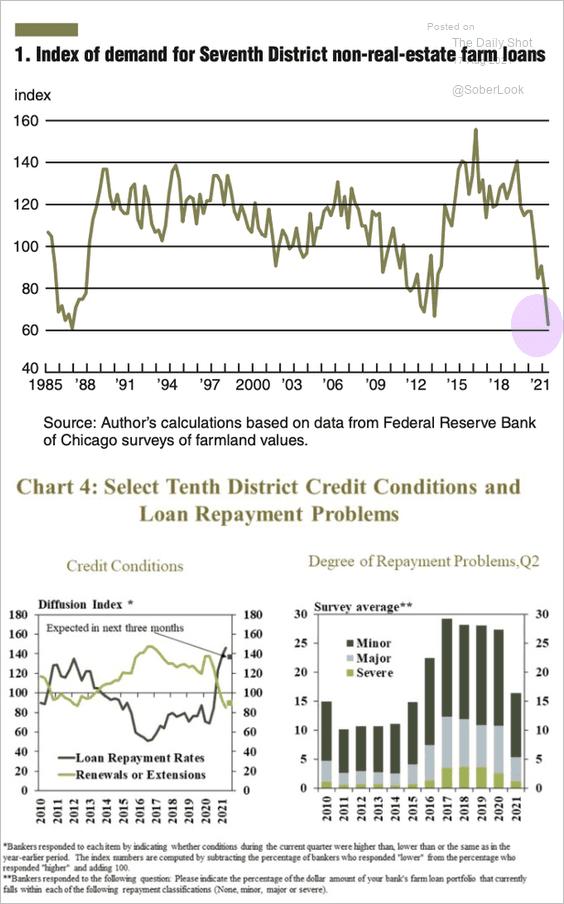

4. Massive gains in agricultural commodity prices boosted US farm income.

Source: @KansasCityFed, @FarmPolicy Read full article

Source: @KansasCityFed, @FarmPolicy Read full article

As a result, demand for farm loans has collapsed.

Source: @KansasCityFed, @FarmPolicy Read full article

Source: @KansasCityFed, @FarmPolicy Read full article

Back to Index

Rates

1. A rapid taper?

Source: @WSJ Read full article

Source: @WSJ Read full article

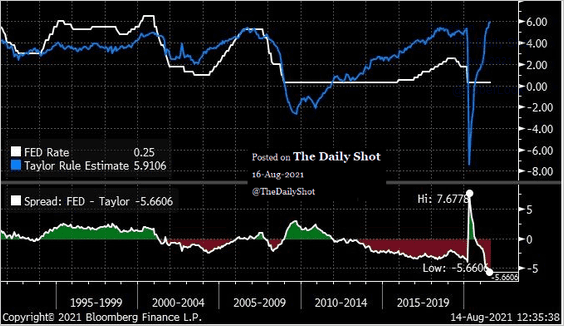

2. The Taylor Rule suggests that the current monetary policy is too accommodative.

Source: Christof Leisinger

Source: Christof Leisinger

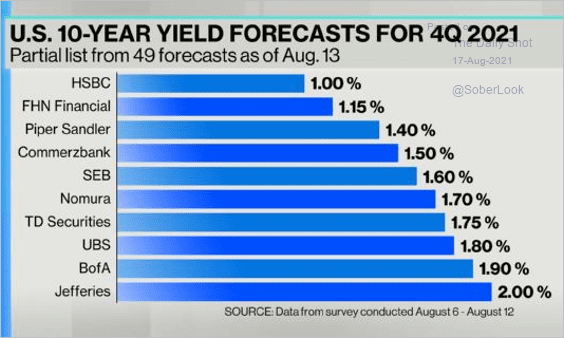

3. This chart shows 10yr Treasury yield forecasts for the fourth quarter (an impressive dispersion).

Source: @DavidInglesTV

Source: @DavidInglesTV

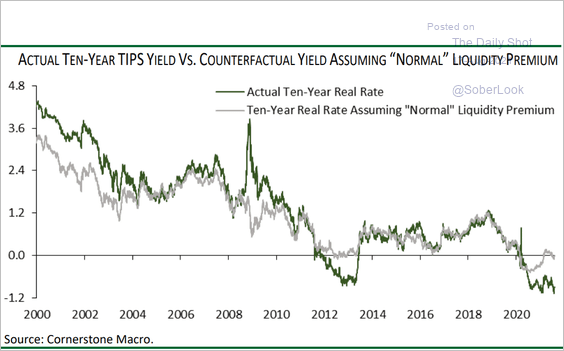

4. Adjusting for the liquidity premium puts the 10yr TIPS yield near zero.

Source: Cornerstone Macro

Source: Cornerstone Macro

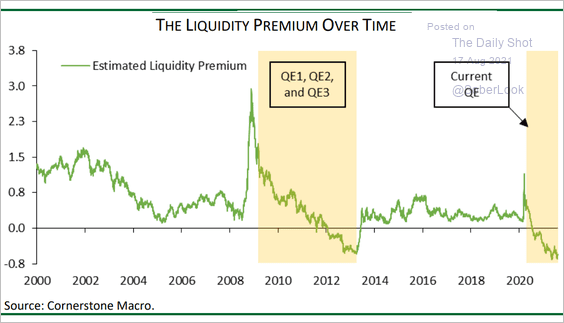

Here is an estimate of the liquidity premium over time (from Cornerstone Macro).

Source: Cornerstone Macro

Source: Cornerstone Macro

——————–

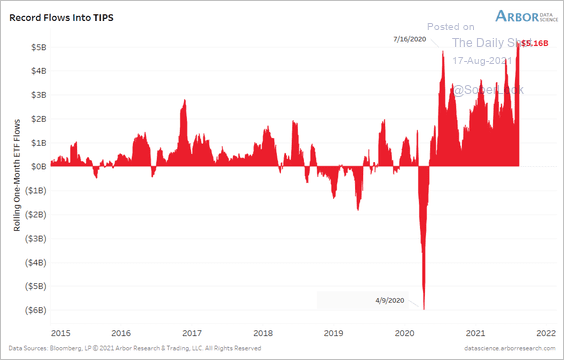

5. TIPS inflows have been unprecedented.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Back to Index

Global Developments

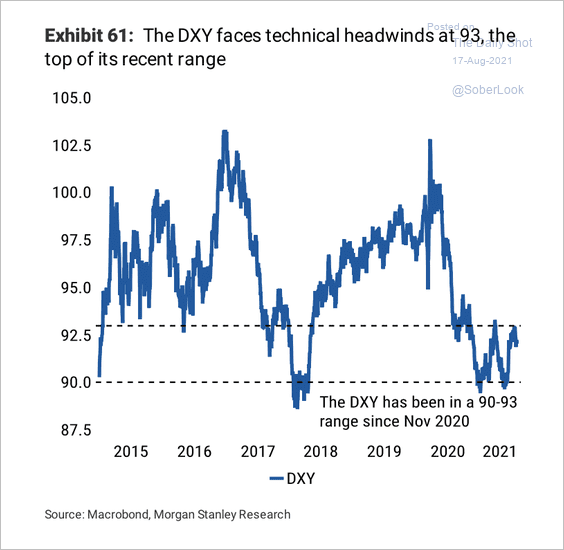

1. The dollar index (DXY) has been stuck in a range since Q4 and faces resistance at 93.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

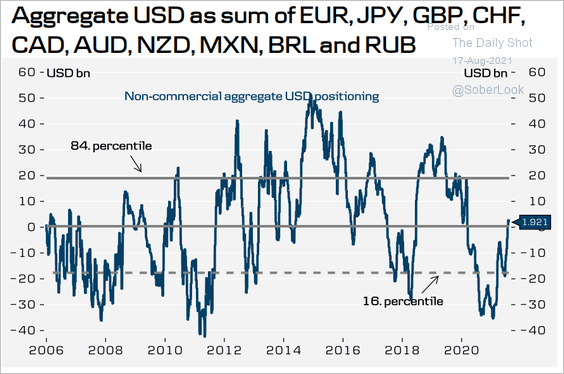

2. Speculative accounts continue to add to their net long dollar positions.

Source: Danske Bank

Source: Danske Bank

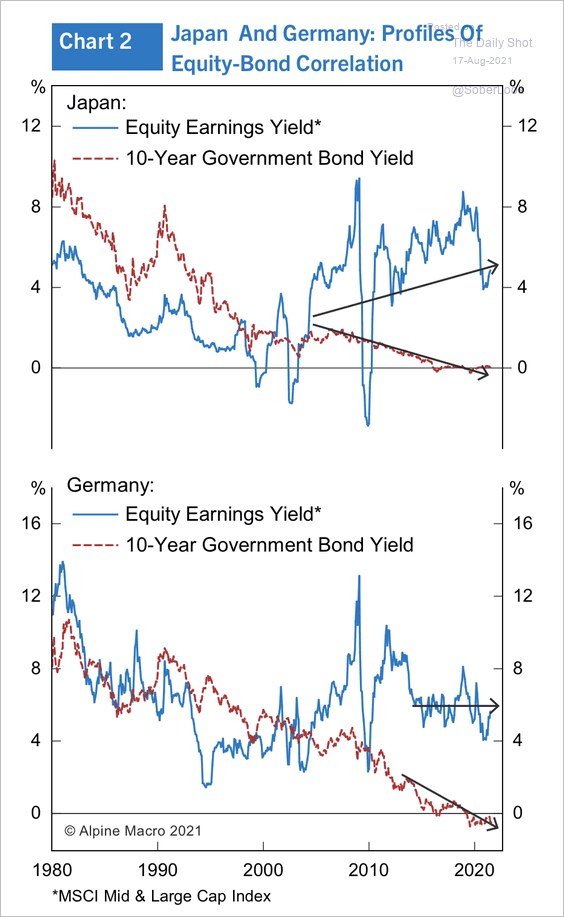

3. In Japan, earnings yields for stocks have risen once bond yields fell below 2% in the early 2000s. Meanwhile, the earnings yield in German stocks has been stuck around 5% over the past decade as Bund yields collapsed.

Source: Alpine Macro

Source: Alpine Macro

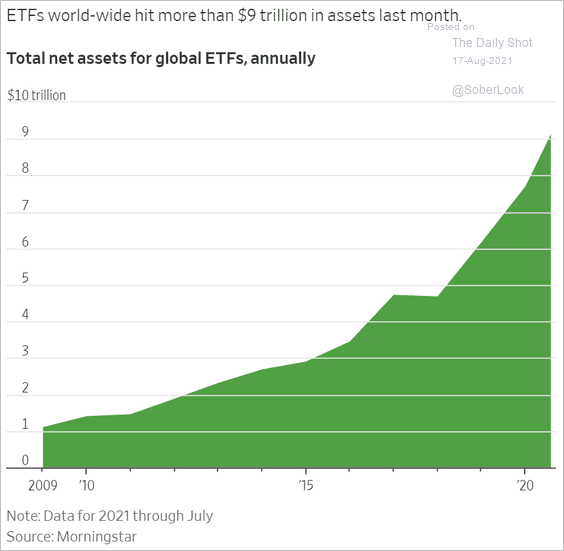

4. ETF assets have exceeded $9 trillion.

Source: @WSJ Read full article

Source: @WSJ Read full article

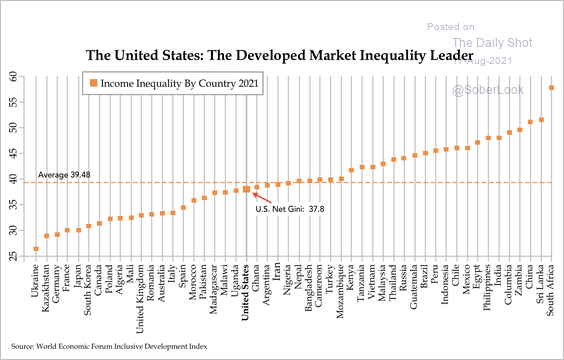

5. Here is a look at income inequality around the world.

Source: Quill Intelligence

Source: Quill Intelligence

——————–

Food for Thought

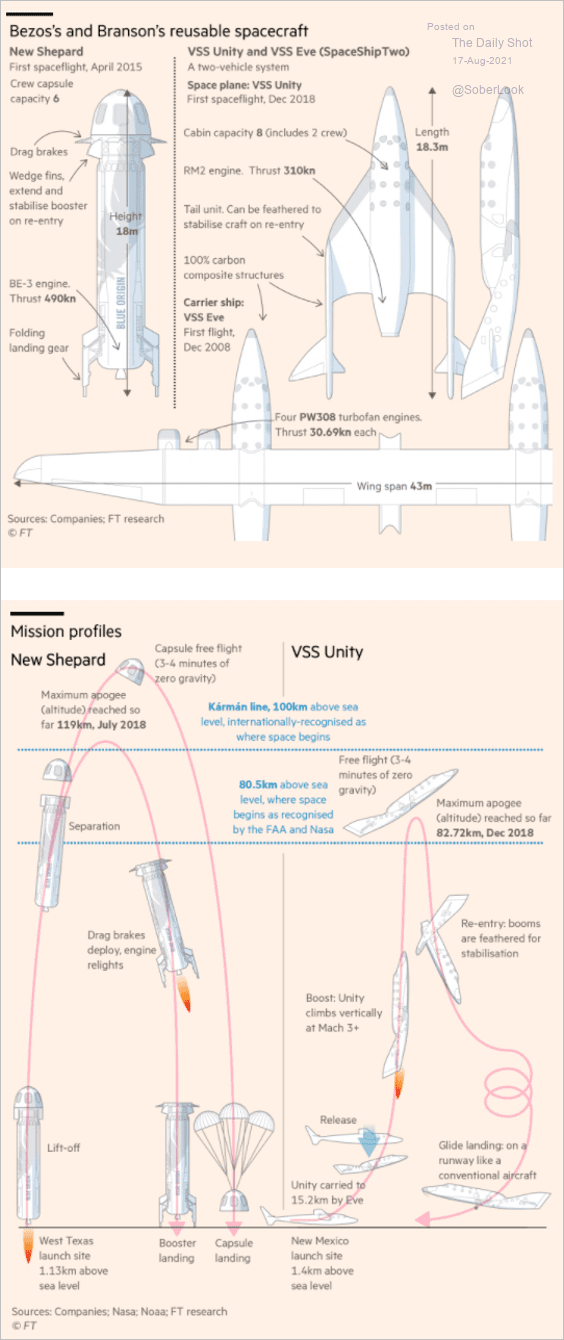

1. Bezos’s and Branson’s reusable spacecraft:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

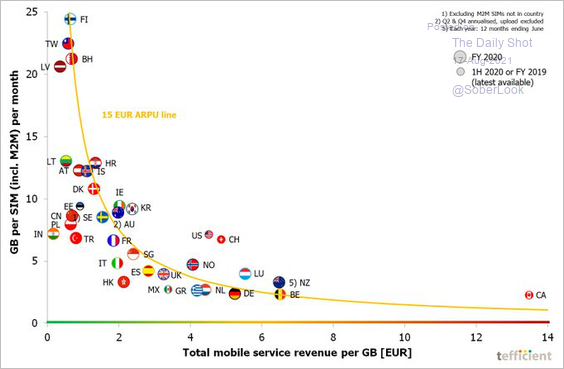

2. Cellular traffic vs. mobile revenues per gigabyte:

Source: @tefficient Read full article

Source: @tefficient Read full article

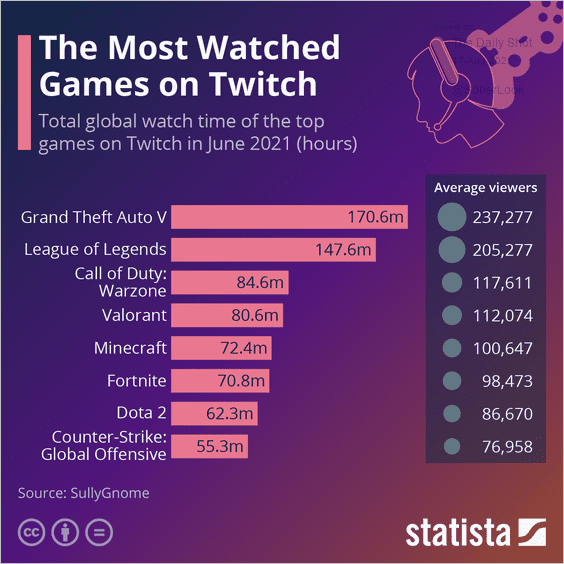

3. Most watch video games on Twitch:

Source: Statista

Source: Statista

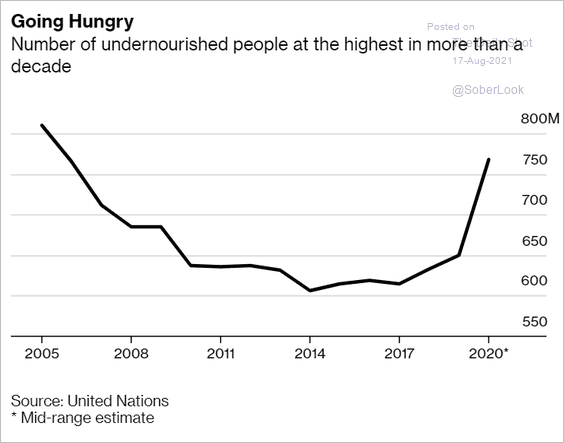

4. Undernourished people globally:

Source: @business Read full article

Source: @business Read full article

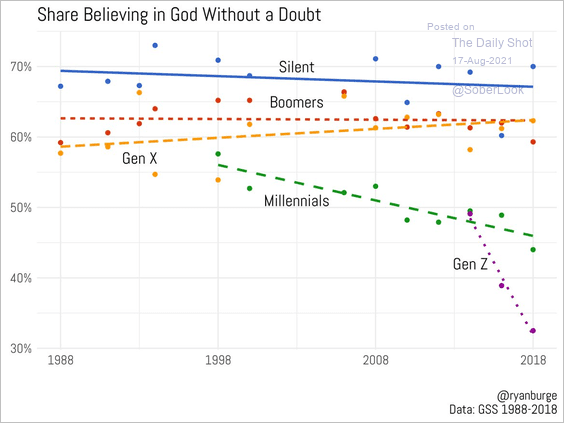

5. Share of US population believing in God without a doubt:

Source: @ryanburge

Source: @ryanburge

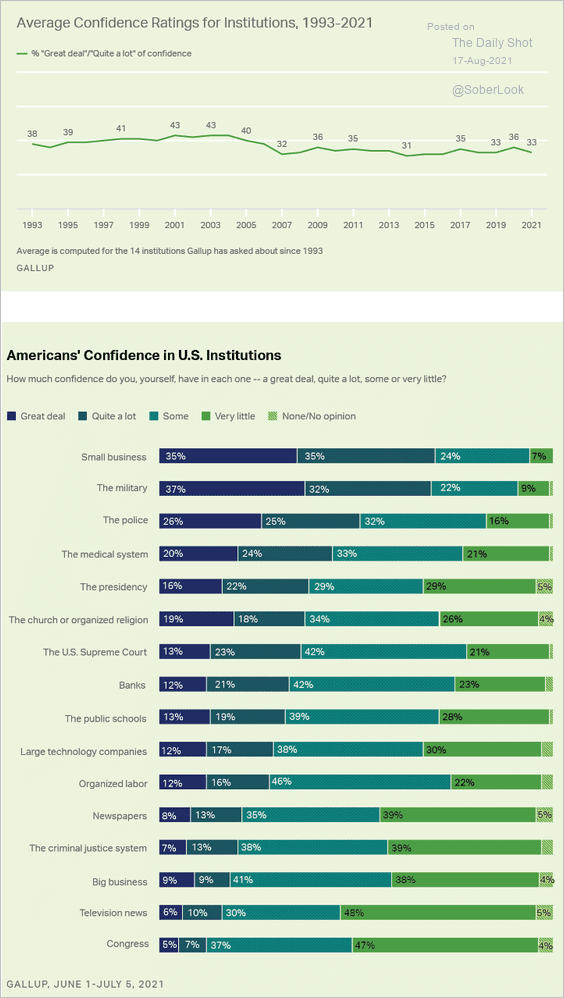

6. Trust in US intritutions:

Source: Gallup Read full article

Source: Gallup Read full article

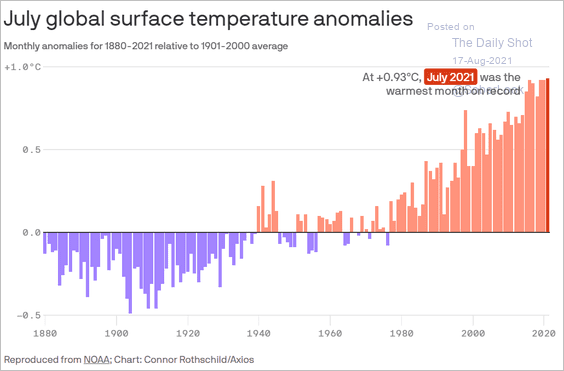

7. A warm July:

Source: @axios Read full article

Source: @axios Read full article

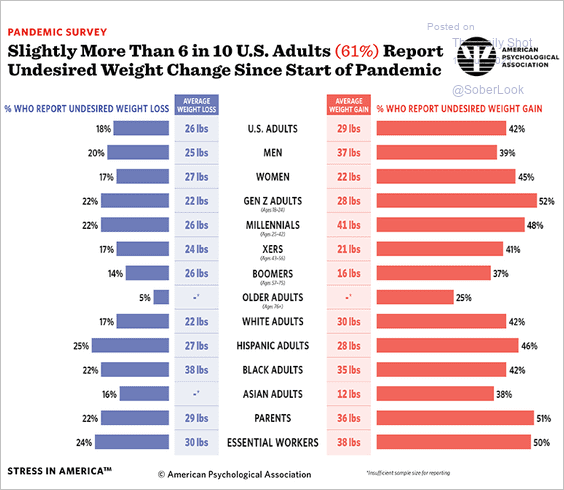

8. Undesired weight gain during the pandemic:

Source: APA

Source: APA

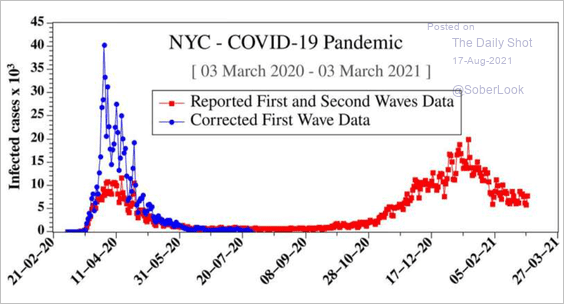

9. COVID undercounting in New York City’s first wave:

Source: Phys.org Read full article

Source: Phys.org Read full article

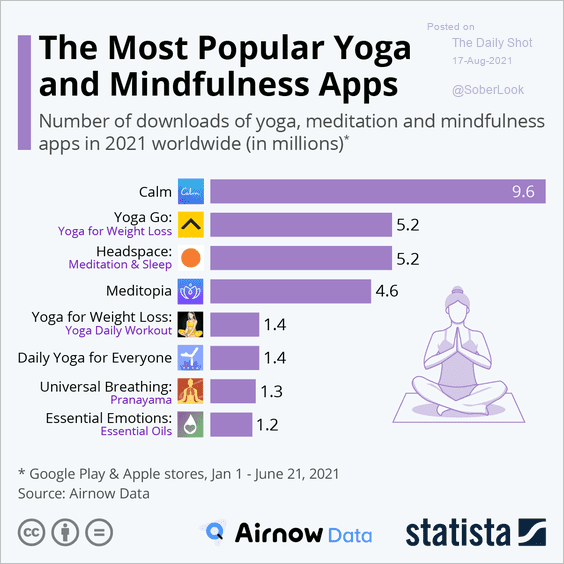

10. The most popular yoga and mindfulness apps:

Source: Statista

Source: Statista

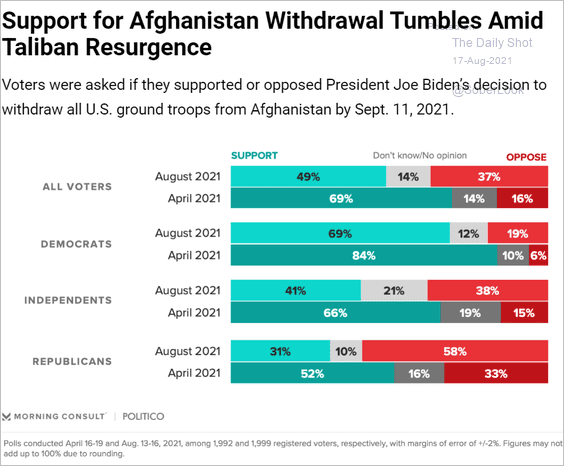

11. US support for Afghanistan withdrawal:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

12. Highest-paid MLB players:

Source: Sportico Read full article

Source: Sportico Read full article

——————–

Back to Index