The Daily Shot: 15-Feb-24

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Australia

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

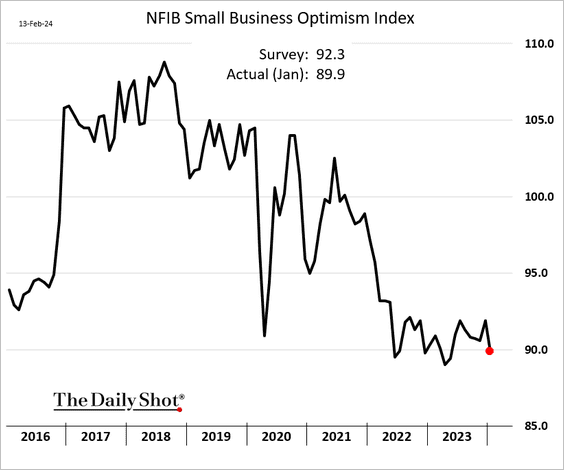

1. The NFIB small business sentiment index declined last month, …

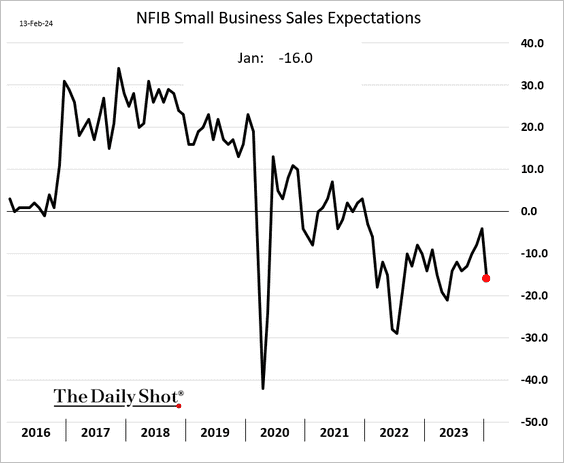

… as sales expectations deteriorated (partially due to frigid weather conditions).

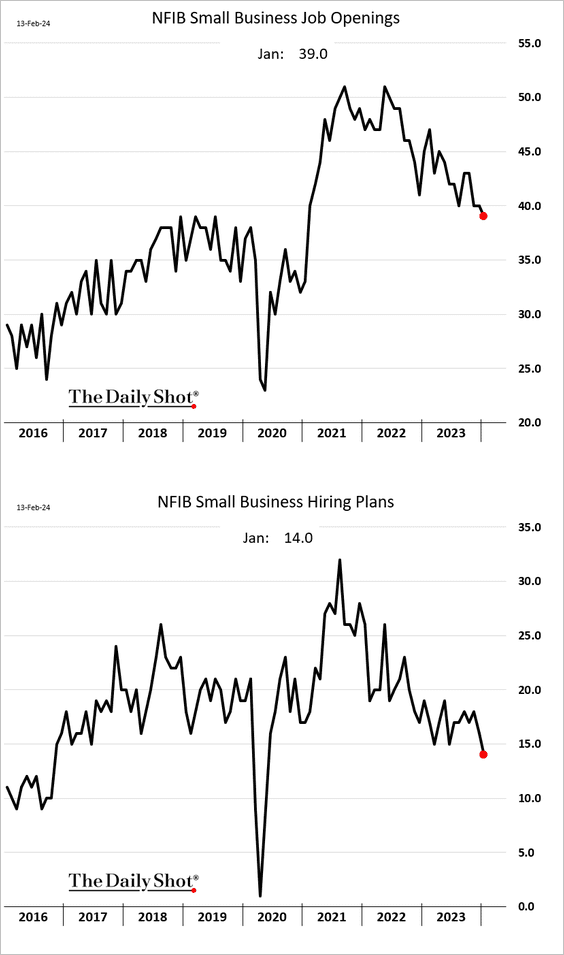

• Hiring continues to slow.

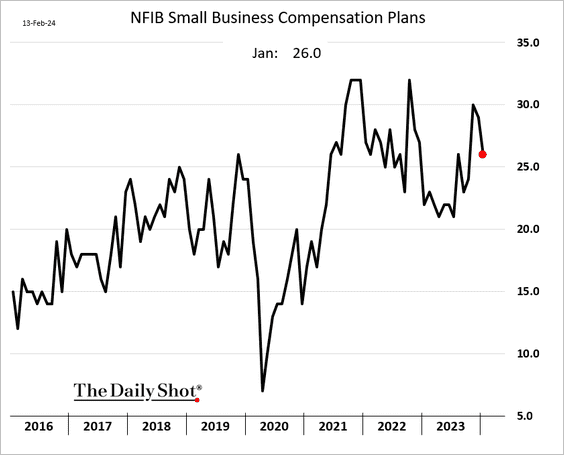

• The index of compensation plans eased.

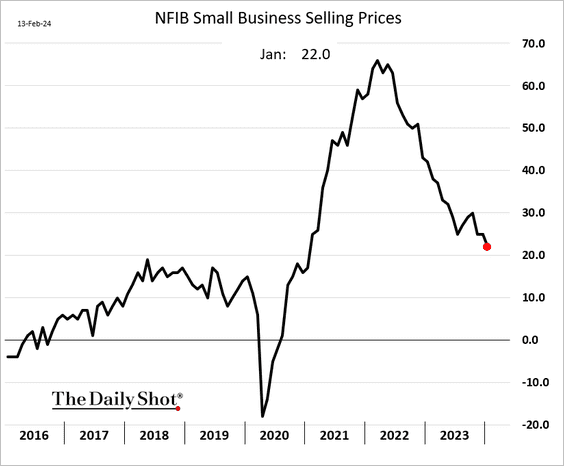

• Fewer businesses are boosting selling prices.

——————–

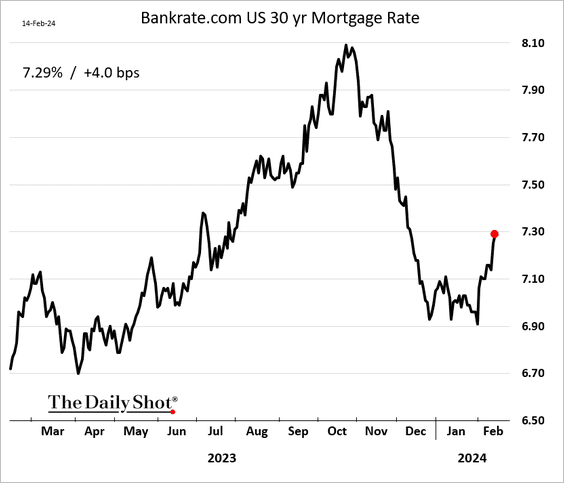

2. Mortgage rates have been rising.

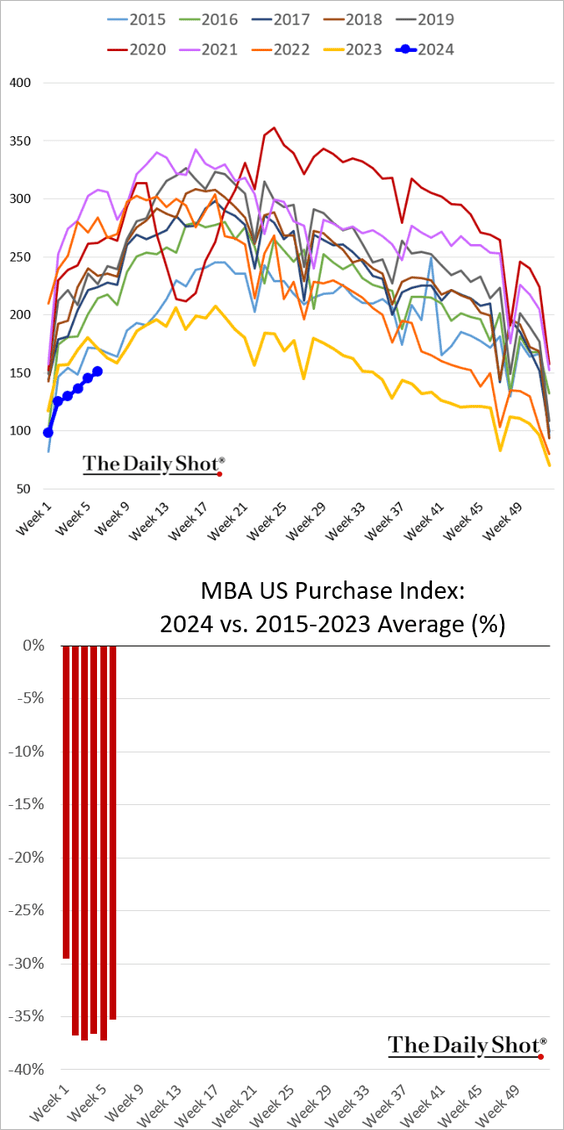

• Mortgage applications are holding at multi-year lows.

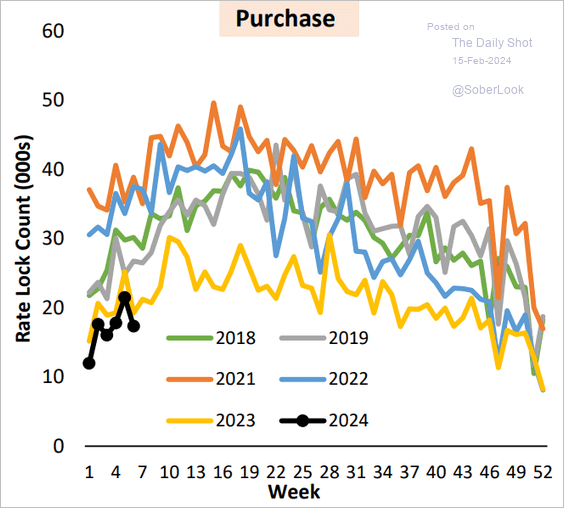

This chart shows the rate lock count.

Source: AEI Housing Center

Source: AEI Housing Center

——————–

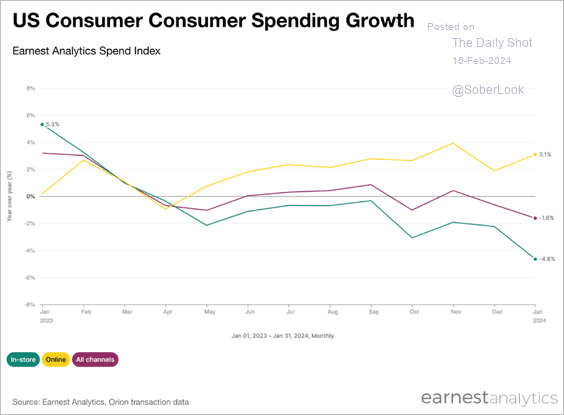

3. A pullback in retail sales last month?

Source: Earnest Insights

Source: Earnest Insights

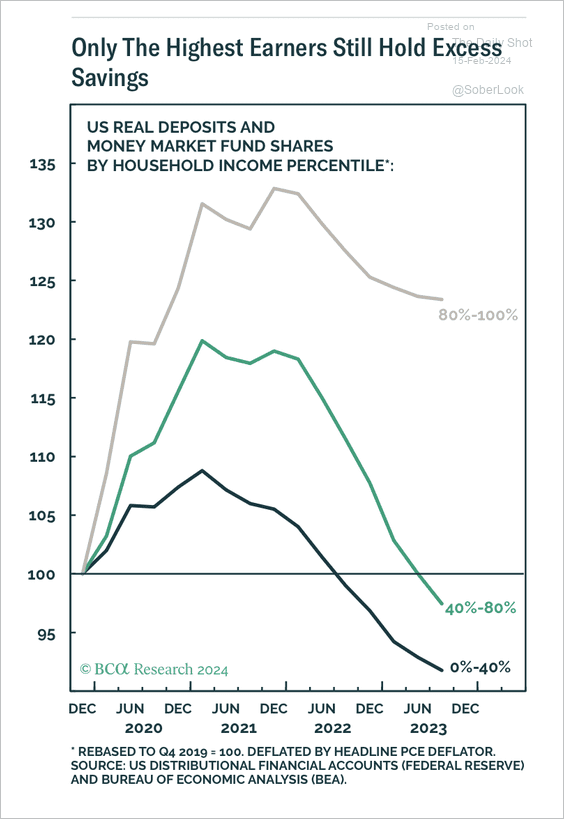

4. Excess savings remain elevated for high earners.

Source: BCA Research

Source: BCA Research

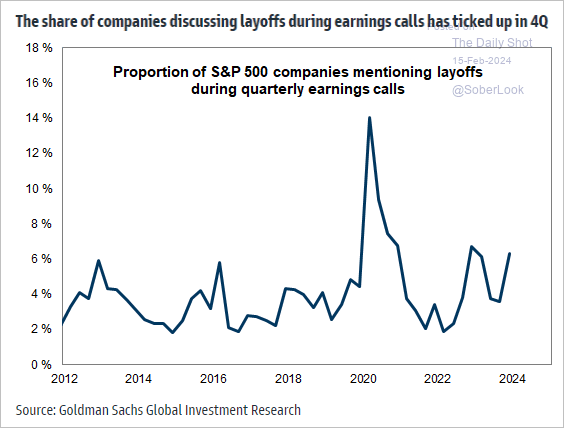

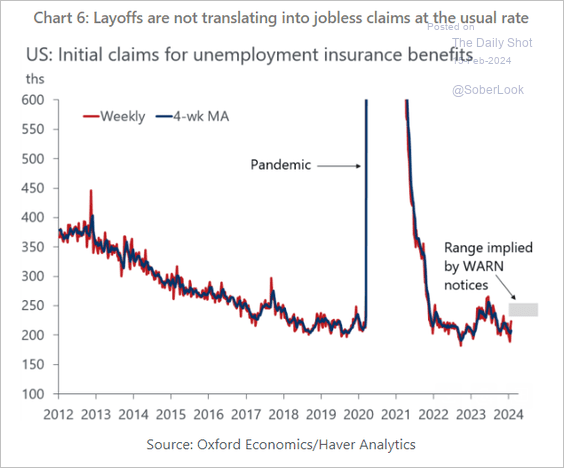

5. Next, we have some updates on the labor market.

• Discussions of layoffs have increased in the latest quarter’s earnings calls.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

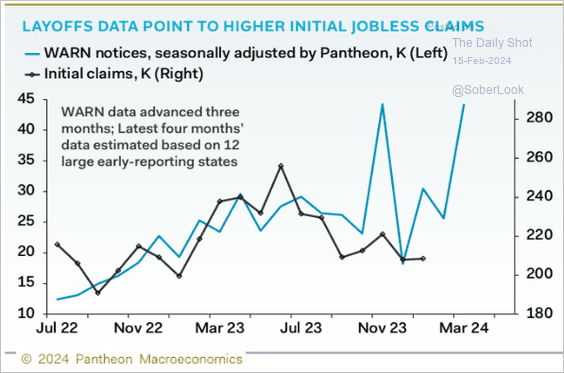

• WARN notices signal higher jobless claims ahead (2 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Oxford Economics

Source: Oxford Economics

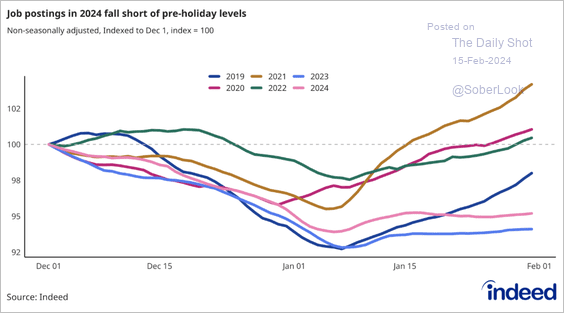

• Job postings on Indeed are running slightly above 2023 levels.

Source: @indeed

Source: @indeed

——————–

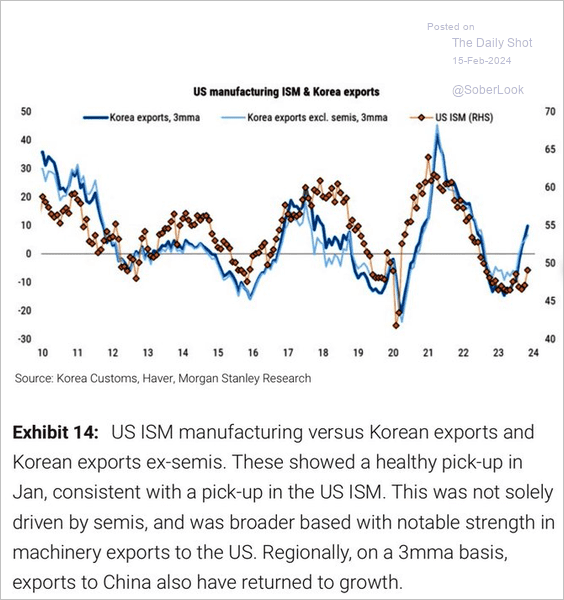

6. Leading indicators continue to signal a rebound in US manufacturing activity.

Source: Morgan Stanley Research; @WallStJesus

Source: Morgan Stanley Research; @WallStJesus

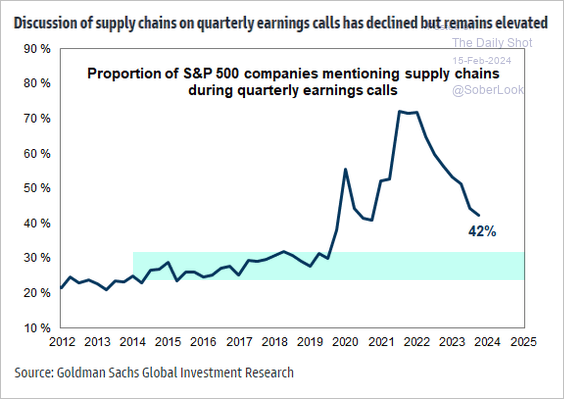

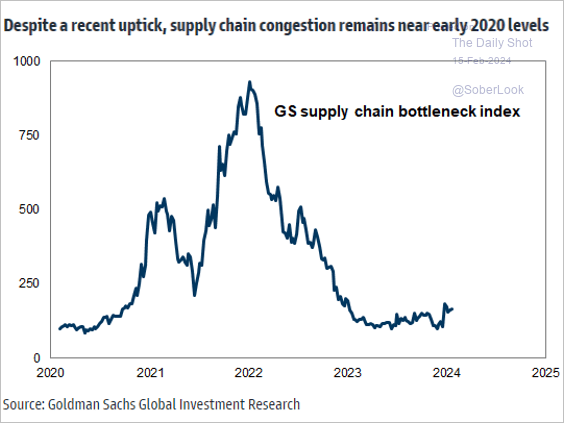

7. Companies are still grappling with supply chain issues.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

Back to Index

The United Kingdom

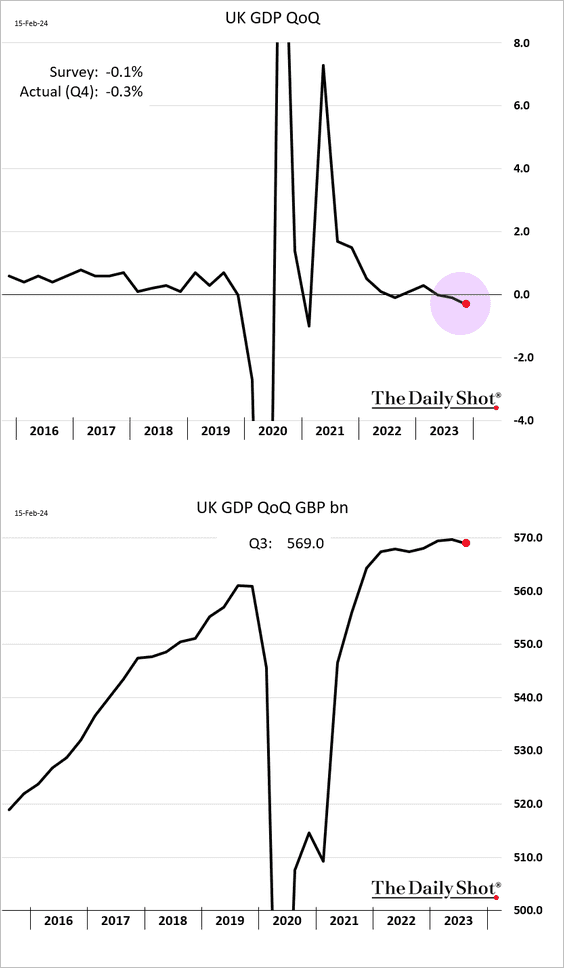

1. The economy slipped into a technical recession at the end of last year. We will have more on the UK GDP report tomorrow.

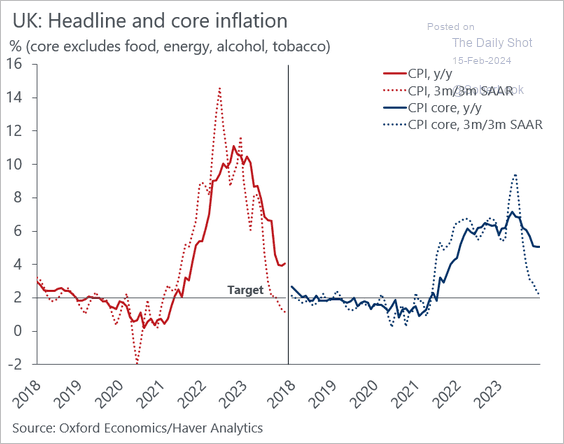

2. On a 3-month basis, inflation is hitting the BoE’s target.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

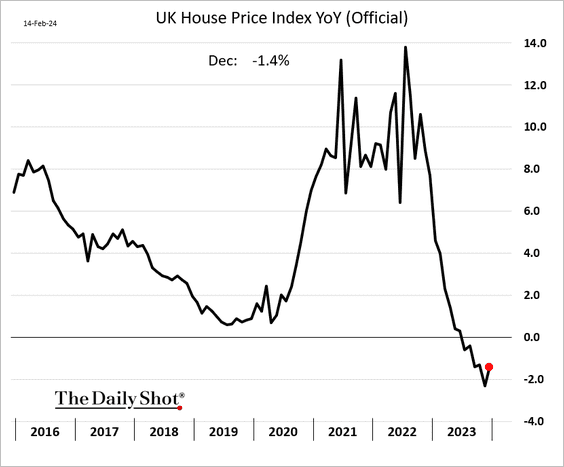

3. The official index of home price appreciation remains in negative territory year-over-year.

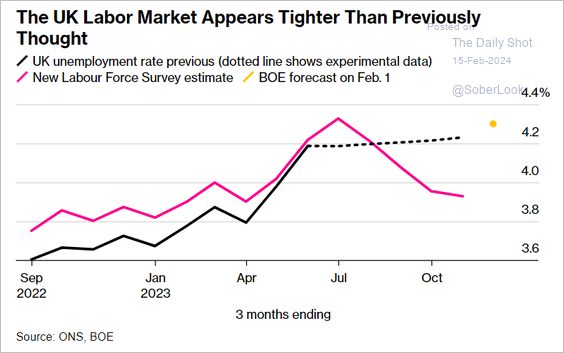

4. As we saw earlier, new employment data shows a tighter labor market.

Source: @economics Read full article

Source: @economics Read full article

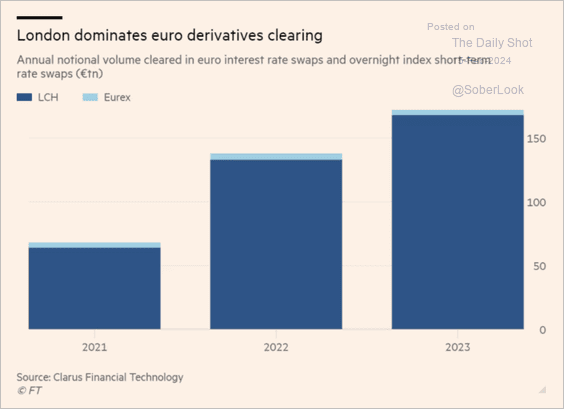

5. Brexit didn’t hurt London’s derivatives clearing business.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

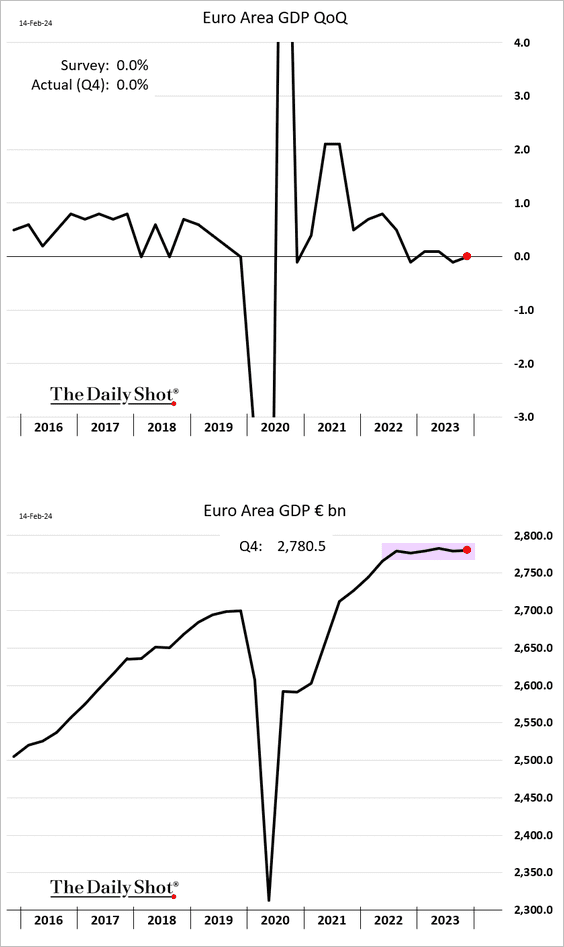

1. The euro-area economy managed to avoid a recession.

• After three consecutive declines the Dutch economy returned to growth last quarter.

——————–

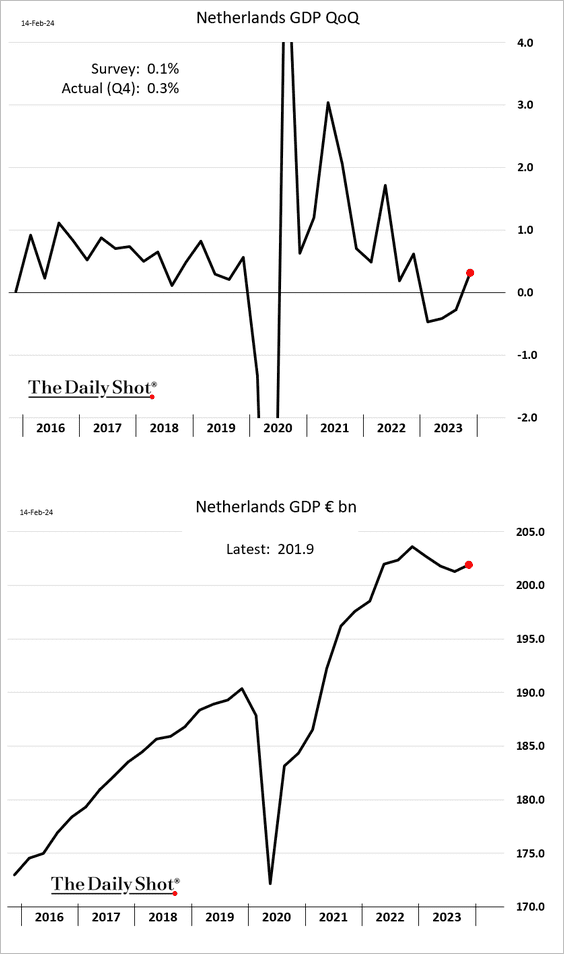

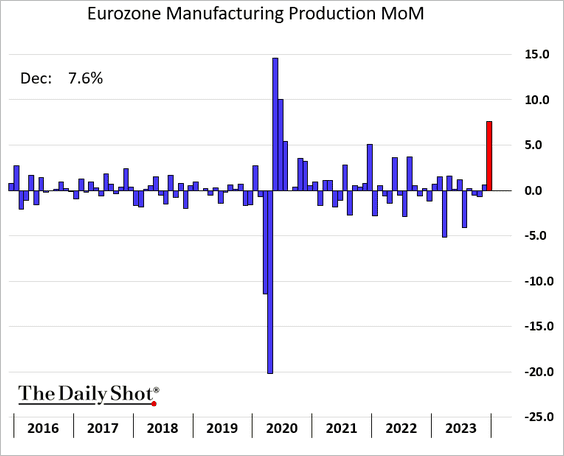

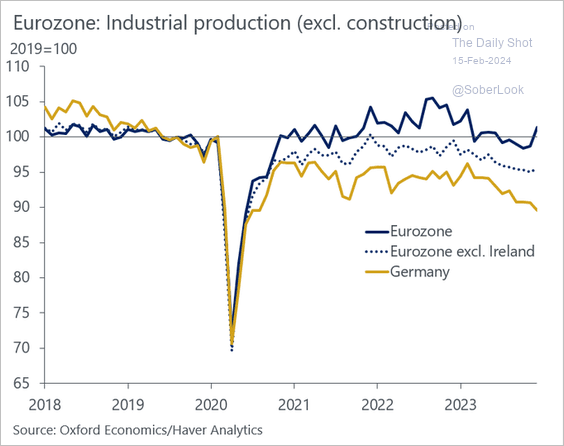

2. The Eurozone’s industrial production surged in December.

Here is the manufacturing output.

Source: @WSJ Read full article

Source: @WSJ Read full article

Much of the gain was driven by Ireland, where economic data tends to be lumpy.

Source: @DanielKral1, @OxfordEconomics

Source: @DanielKral1, @OxfordEconomics

——————–

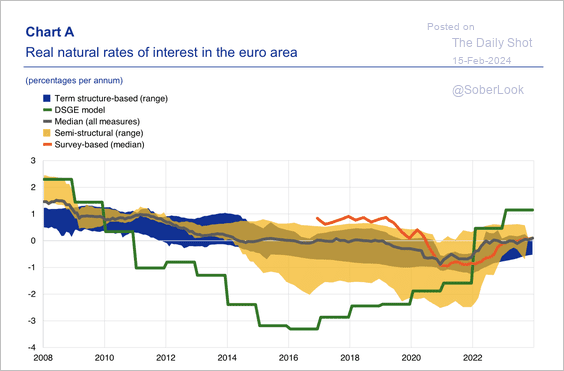

3. The median estimate for the neutral rate has risen by about 30 basis points compared with levels in mid-2019 before the onset of the pandemic.

Source: ECB

Source: ECB

Back to Index

Europe

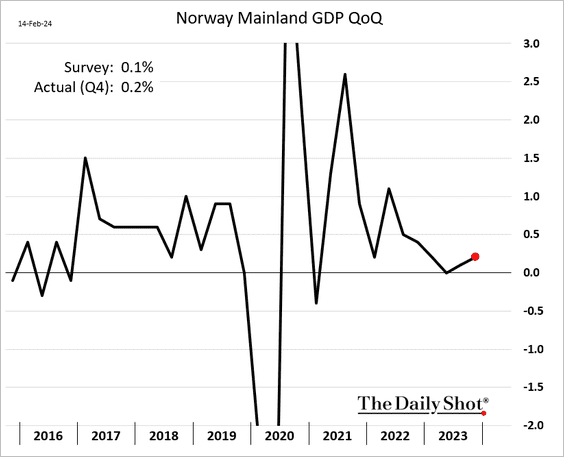

1. Let’s begin with Norway.

• The economy returned to growth in Q4.

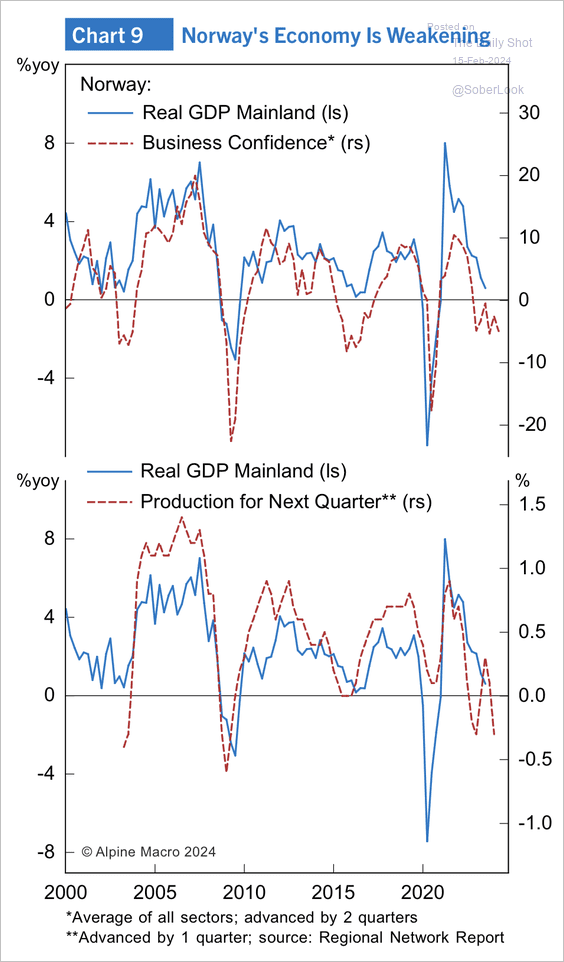

• The decline in Norway’s business confidence and production outlook points to weakness in real GDP.

Source: Alpine Macro

Source: Alpine Macro

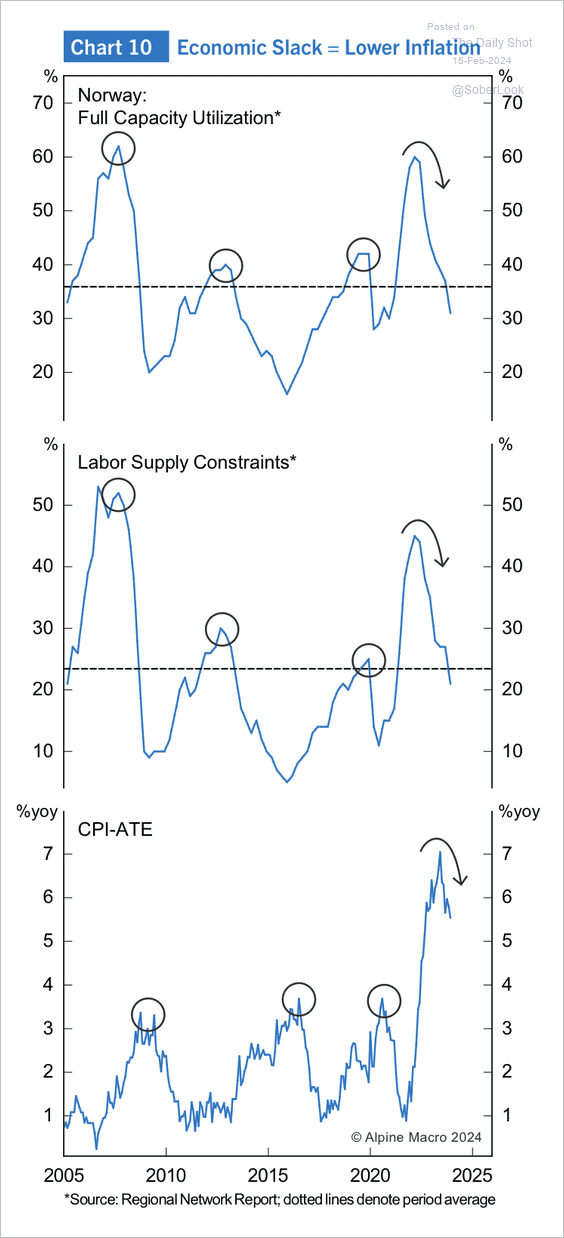

• A build-up of slack could exert downward pressure on underlying inflation in Norway.

Source: Alpine Macro

Source: Alpine Macro

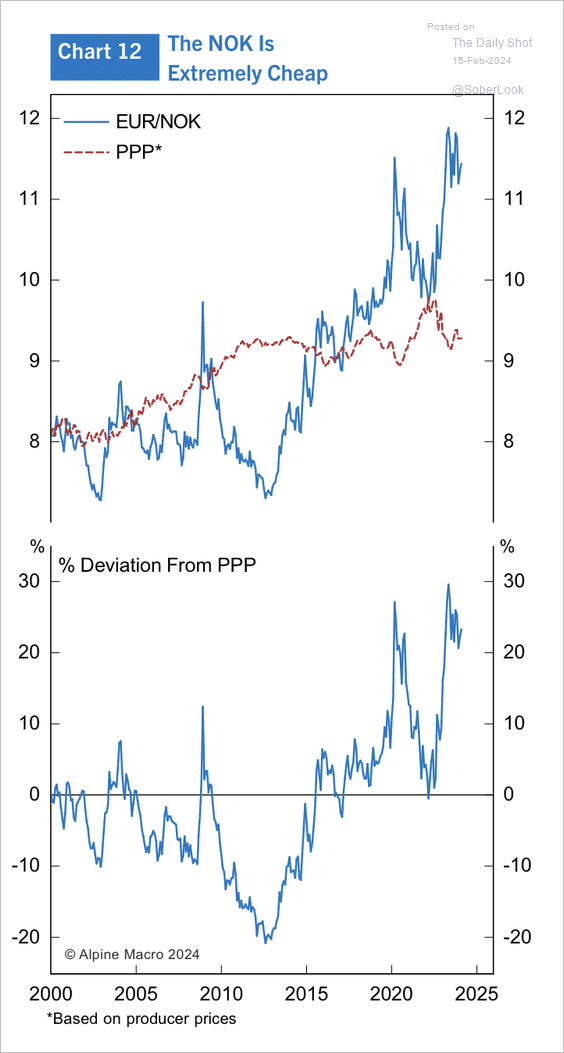

• EUR/NOK has deviated far above purchasing power parity.

Source: Alpine Macro

Source: Alpine Macro

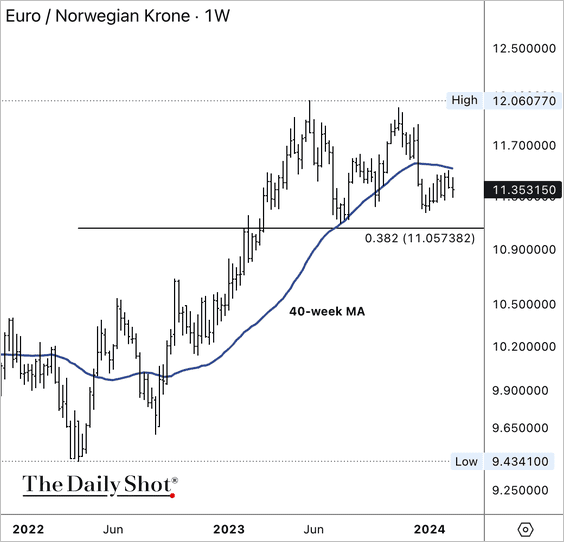

– EUR/NOK is trading below resistance at its 40-week moving average.

——————–

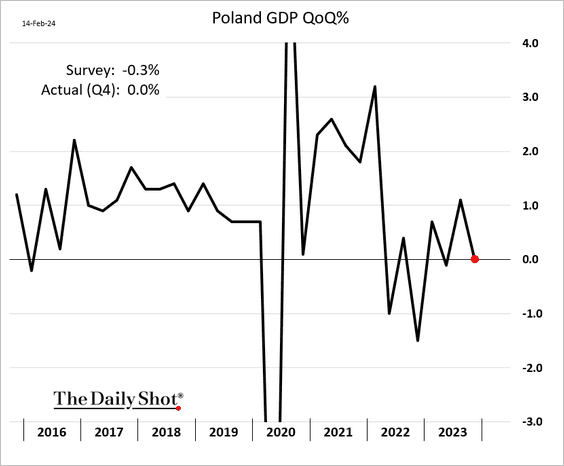

2. Poland’s economy avoided a contraction last quarter.

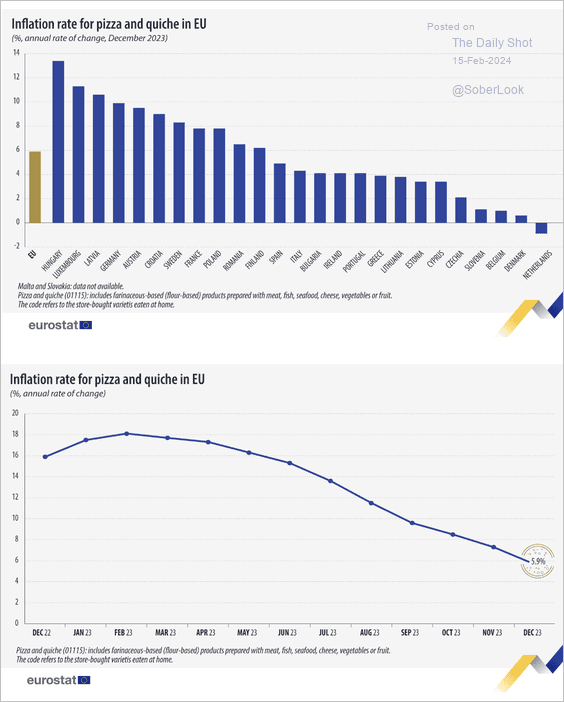

3. Here is a look at inflation for store-bought pizza and quiche in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Japan

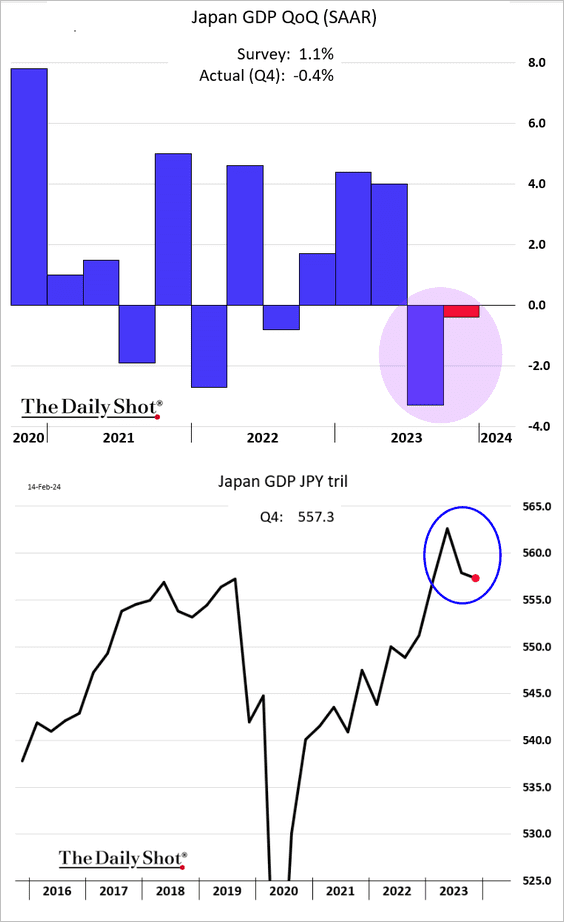

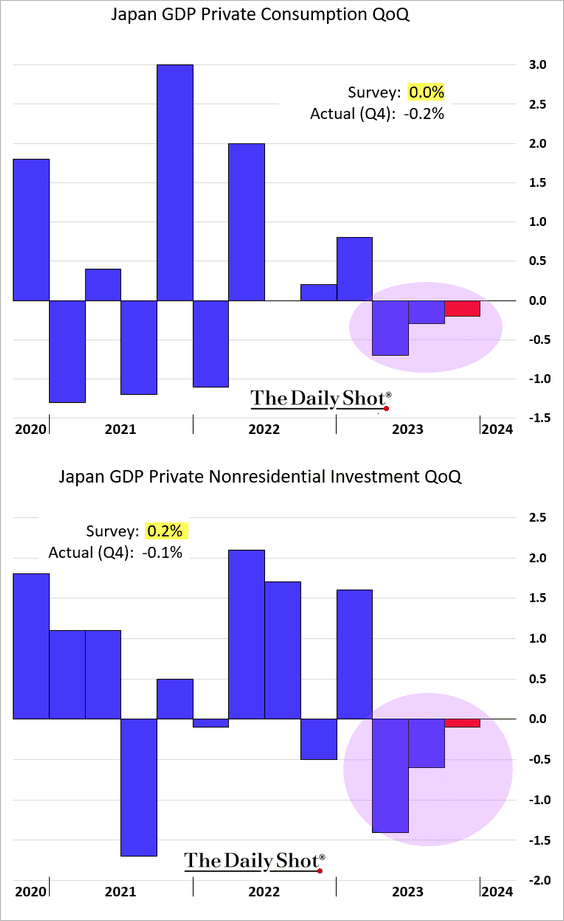

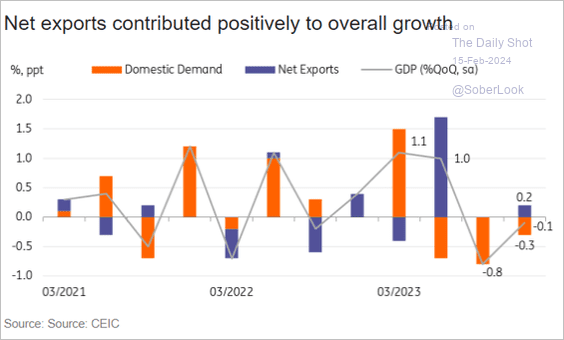

1. The economy unexpectedly slipped into technical recession last quarter, …

… dragged lower by weak domestic demand (consumer spending and business investment).

Source: ING

Source: ING

Source: CNBC Read full article

Source: CNBC Read full article

——————–

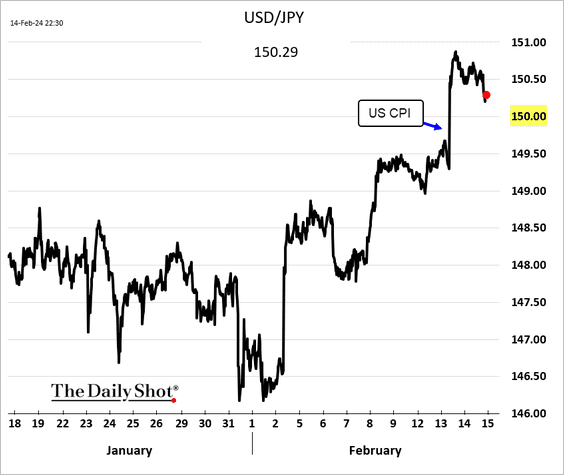

2. The authorities are not happy with the weakening of the yen past 150 to the dollar.

Source: Reuters Read full article

Source: Reuters Read full article

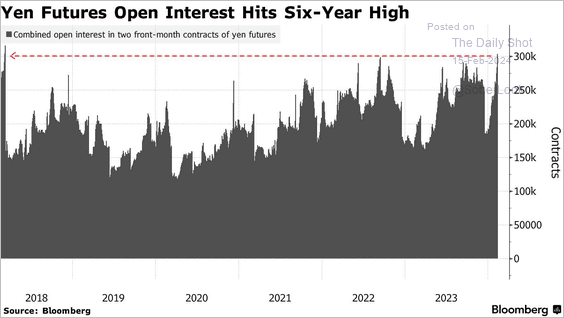

• Traders are betting on an intervention.

Source: @markets Read full article

Source: @markets Read full article

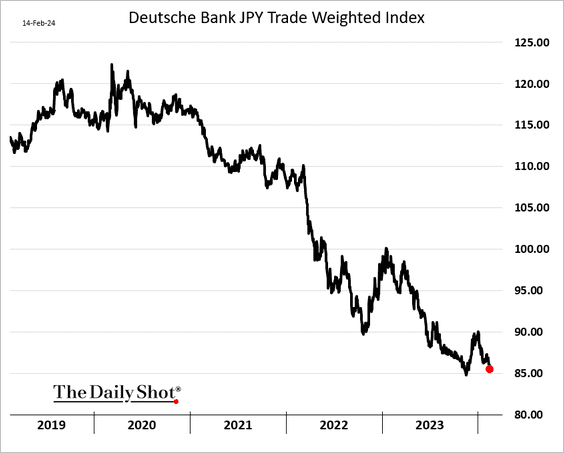

• Here is the yen trade-weighted index.

——————–

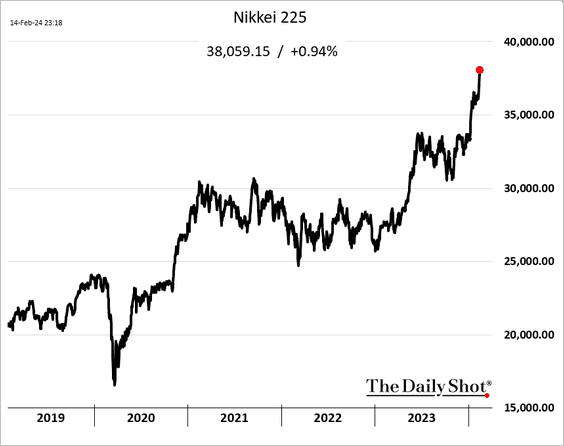

3. Stocks continue to surge.

Back to Index

Australia

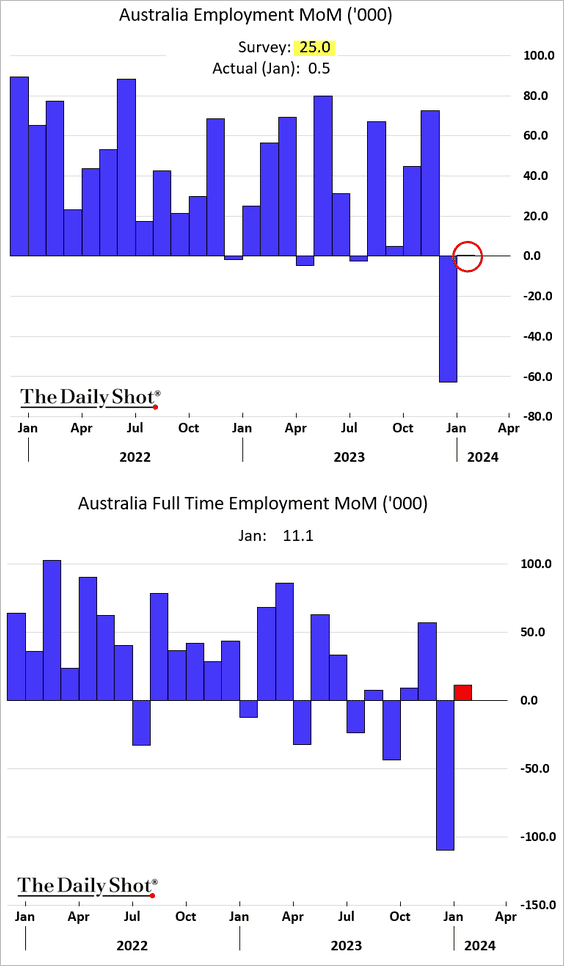

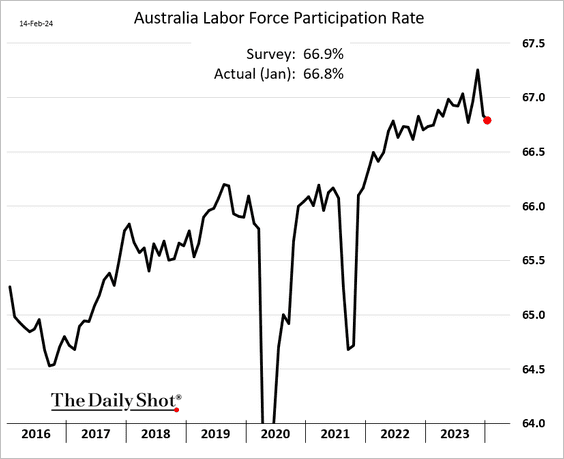

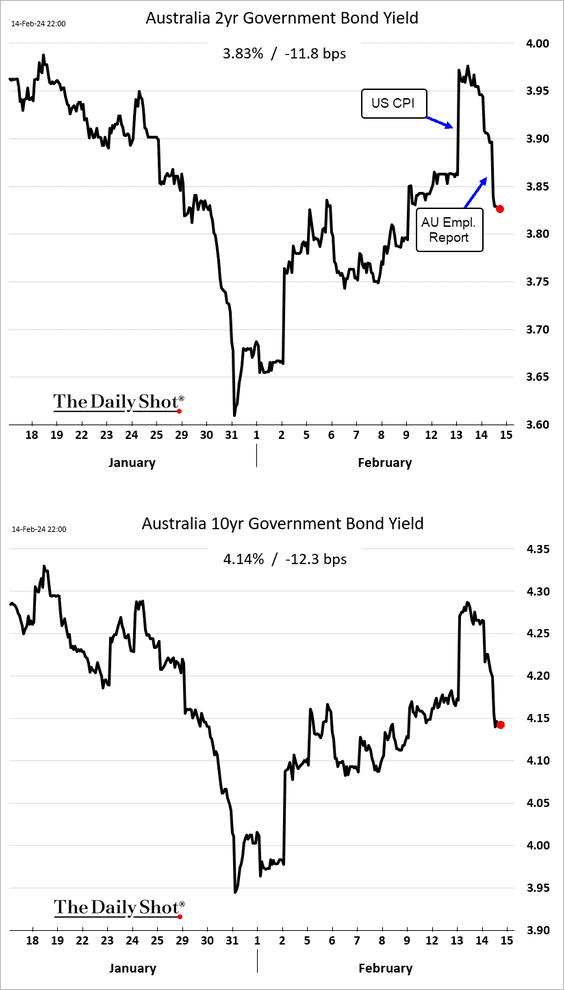

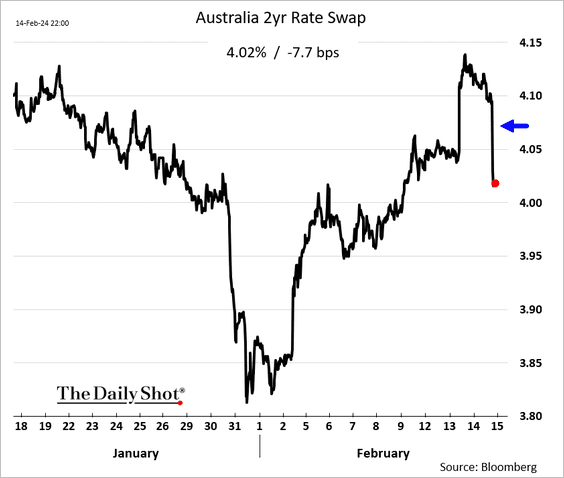

1. The employment report surprised to the downside again.

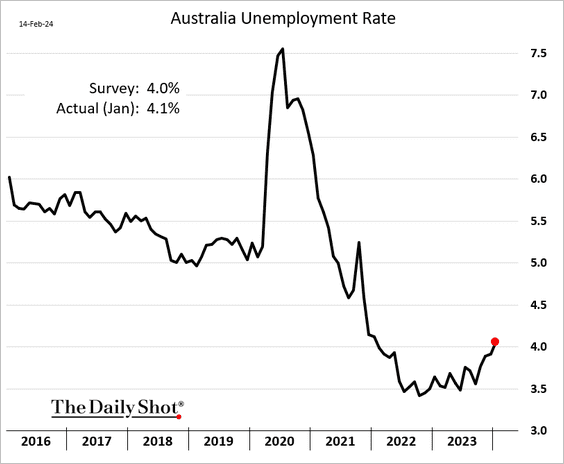

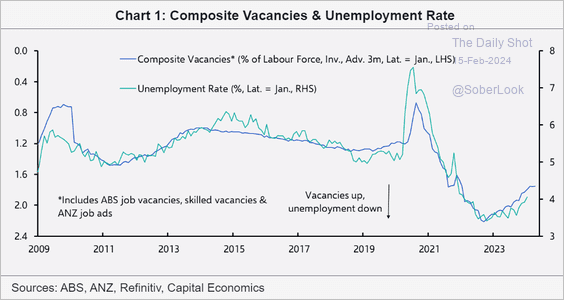

• The unemployment rate climbed …

… and may have further to rise.

Source: Capital Economics

Source: Capital Economics

• The participation rate edged lower.

2. Bond yields dropped in response to the soft employment report.

Back to Index

Emerging Markets

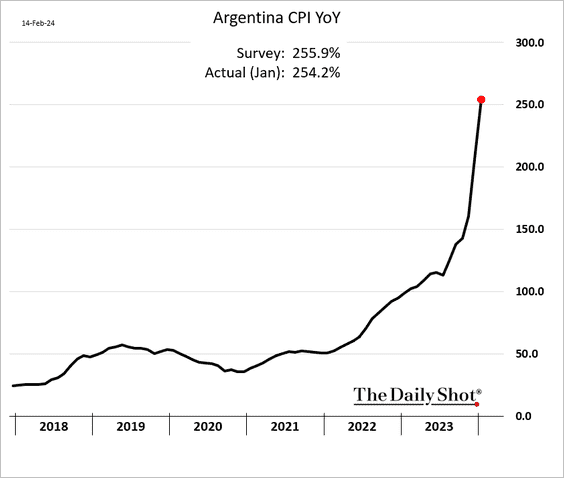

1. Argentina’s CPI blasted past 250% last month.

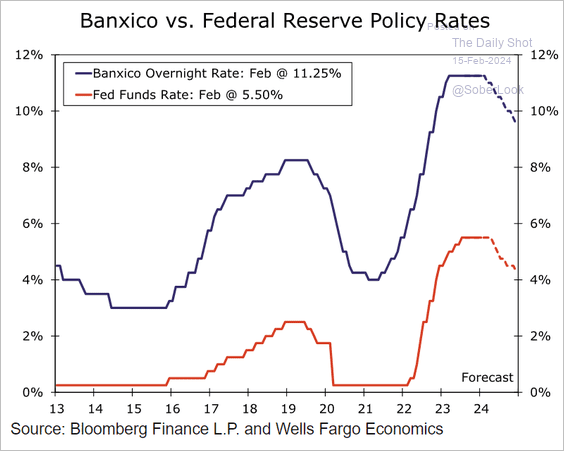

2. Will Banxico wait for the Fed to cut rates?

Source: Wells Fargo Securities

Source: Wells Fargo Securities

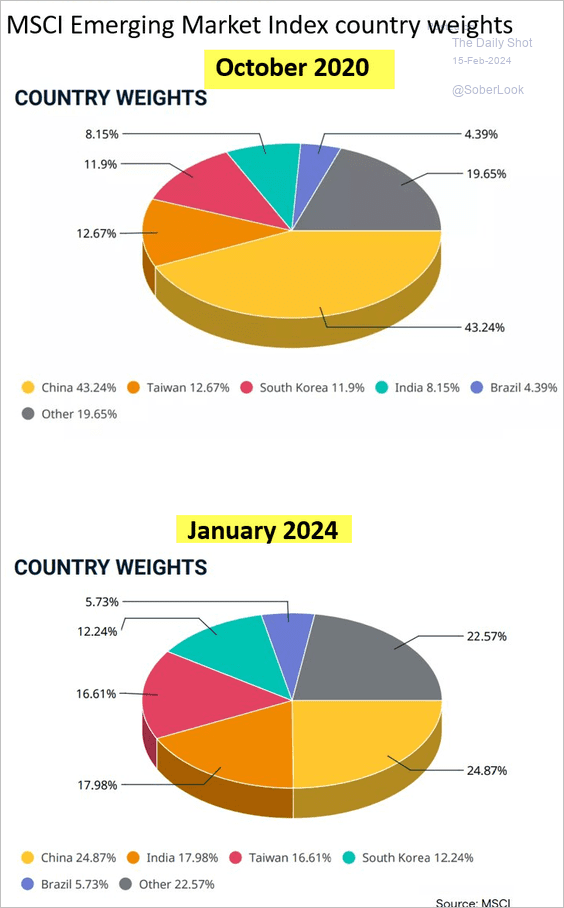

3. Here is a look at country weights in the MSCI EM Index in 2020 and 2024.

Source: MSCI

Source: MSCI

Back to Index

Cryptocurrency

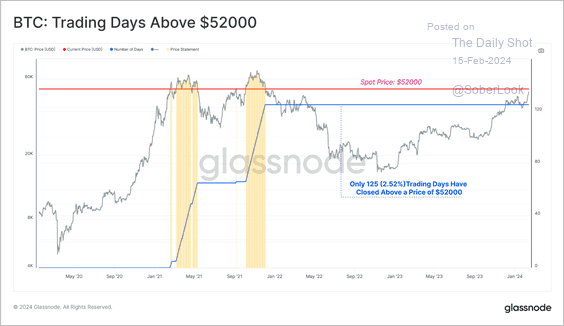

1. BTC/USD has only spent 125 trading days above $52K. Could we see a new all-time high soon?

Source: @KaikoData

Source: @KaikoData

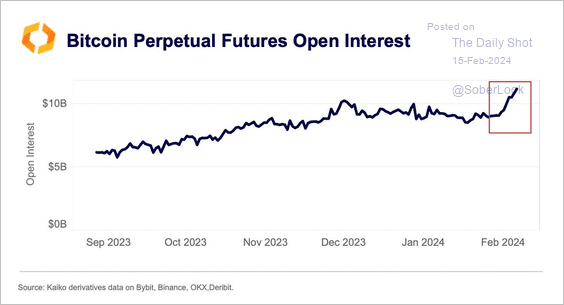

2. Open interest in the bitcoin perpetual futures market is rising, suggesting renewed speculative interest among traders.

Source: @KaikoData

Source: @KaikoData

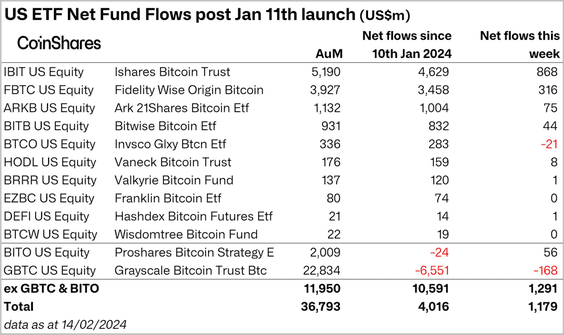

3. This table shows US spot-bitcoin ETF flows since the January launch date.

Source: CoinShares

Source: CoinShares

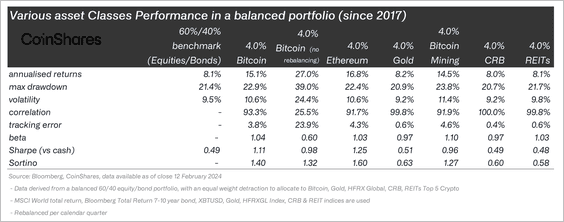

4. Here is a comparison of risk/return metrics for crypto and traditional assets included in a balanced portfolio.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

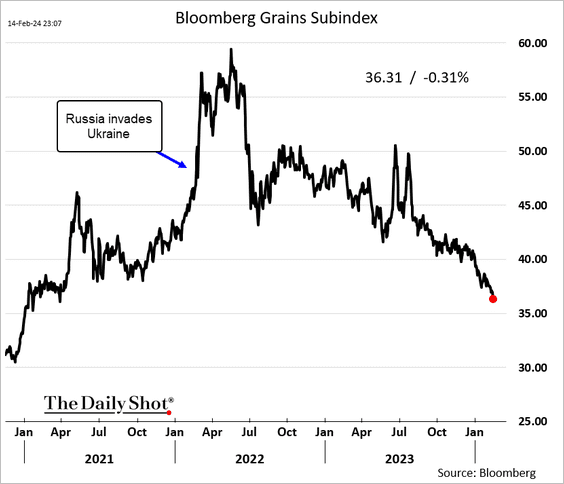

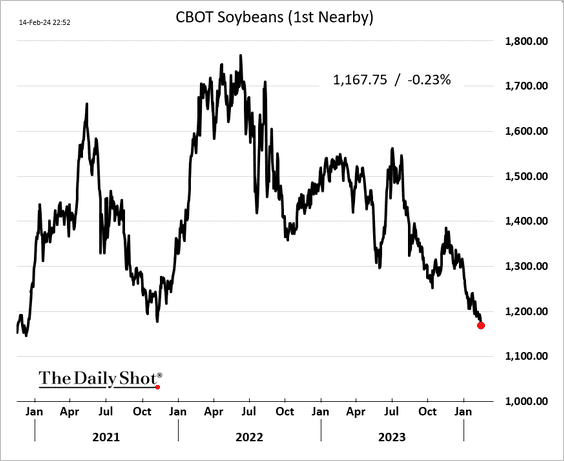

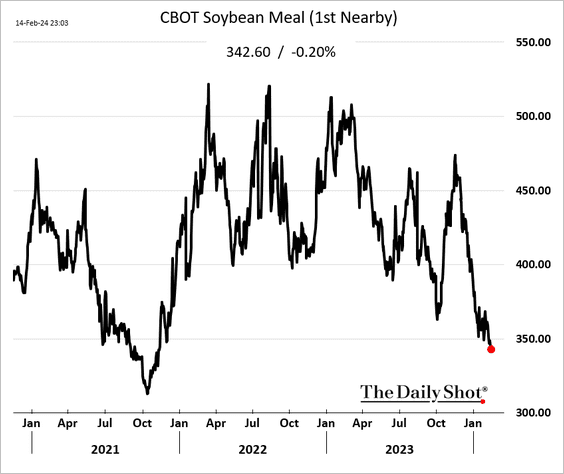

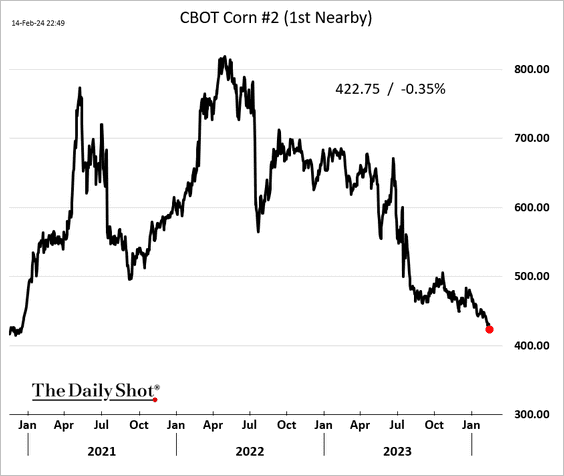

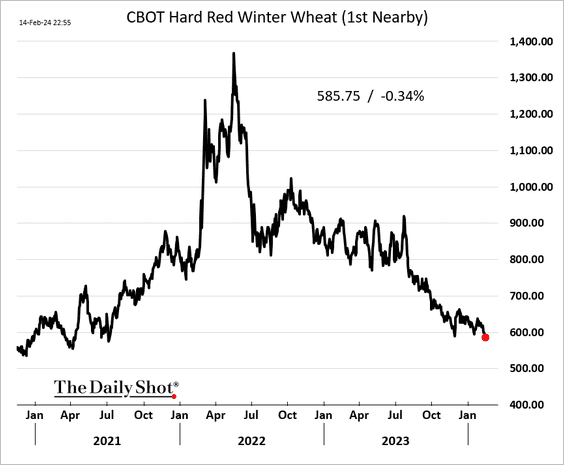

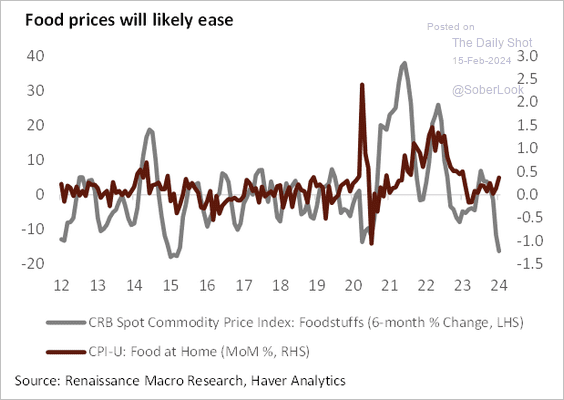

Commodities

1. US grain prices continue to sink.

• Bloomberg’s grains index:

• Soybeans:

• Soy meal:

• Corn:

• HRW wheat:

Will we see a pullback in food prices as a result?

Source: @RenMacLLC

Source: @RenMacLLC

——————–

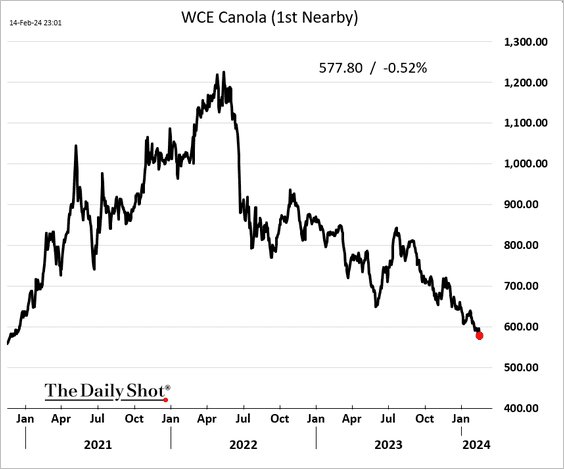

2. Canola futures are hitting multi-year lows.

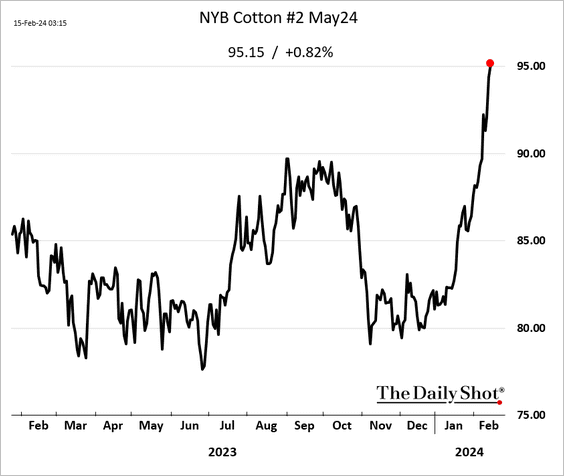

3. US cotton futures are climbing.

Back to Index

Energy

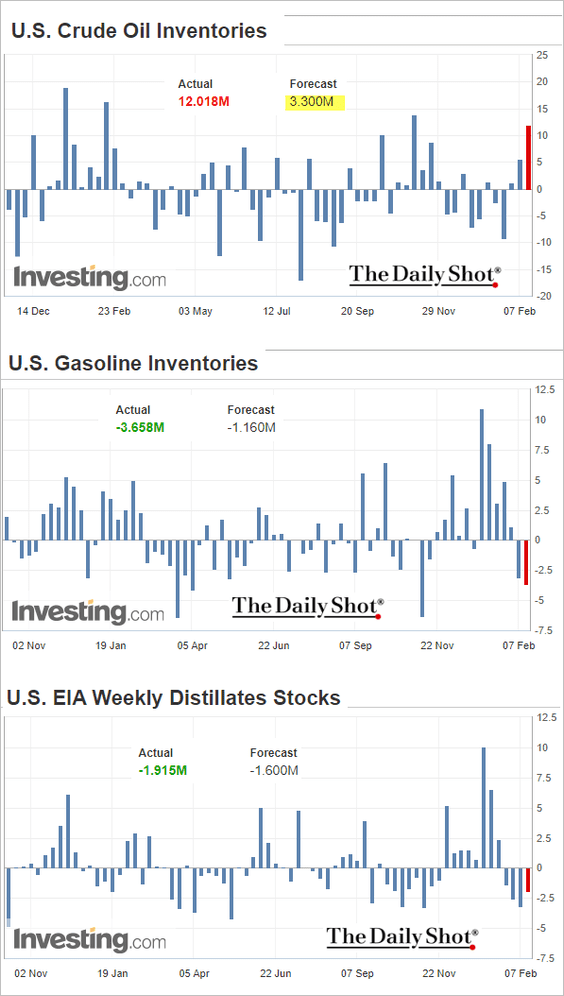

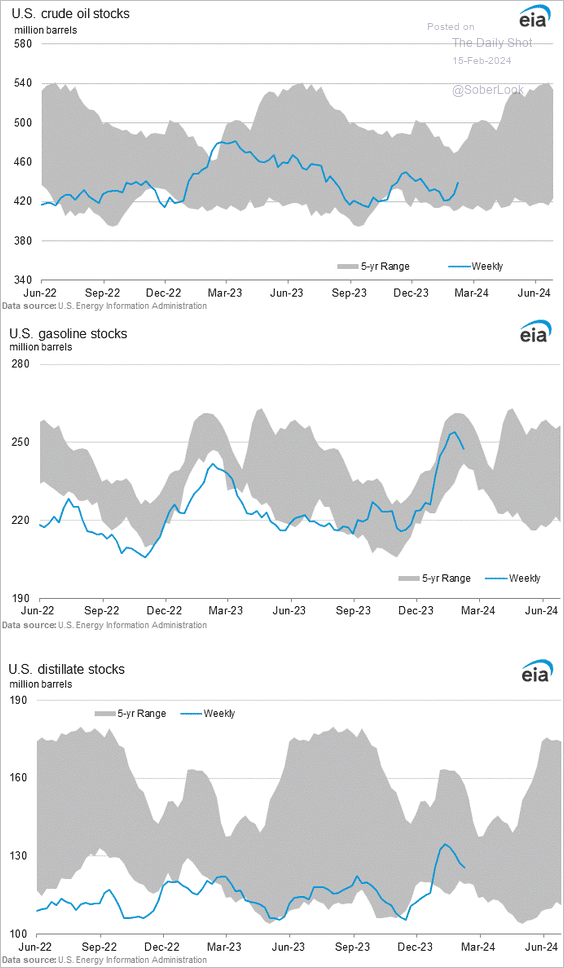

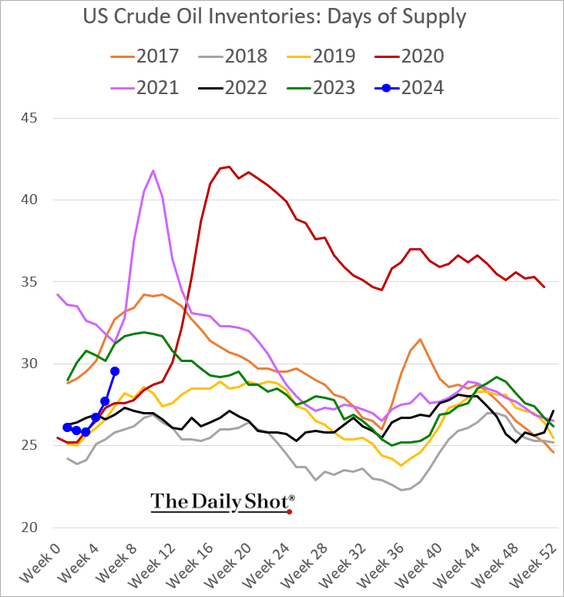

1. US oil inventories jumped last week, while refined product stockpiles continue to ease.

• Weekly changes:

• Inventory levels:

• Oil days of supply:

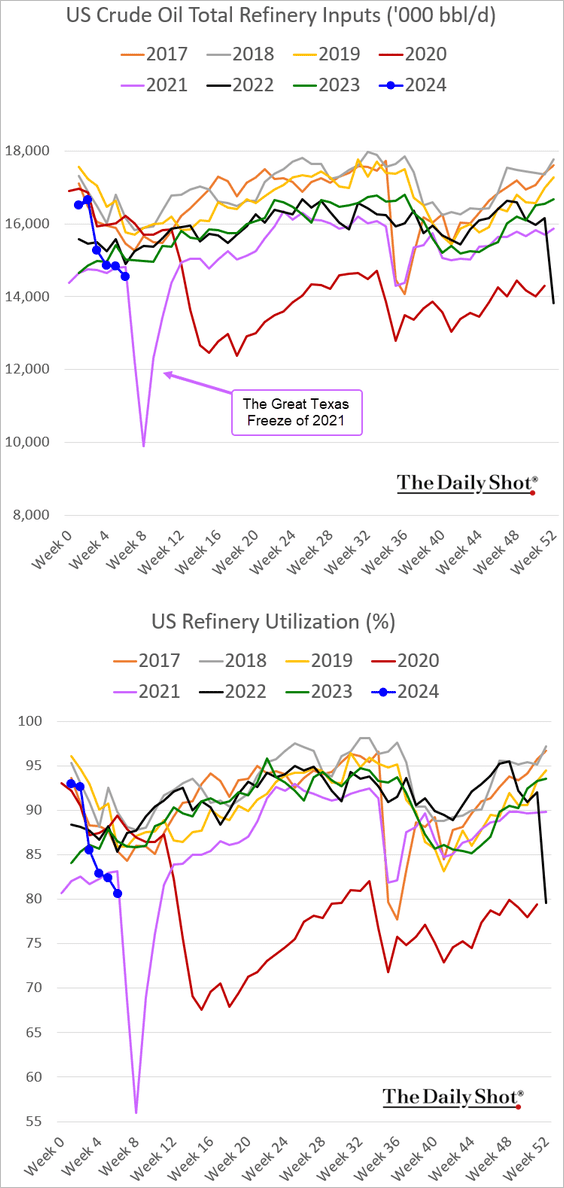

2. Last week saw a further decline in refinery inputs and utilization rates.

——————–

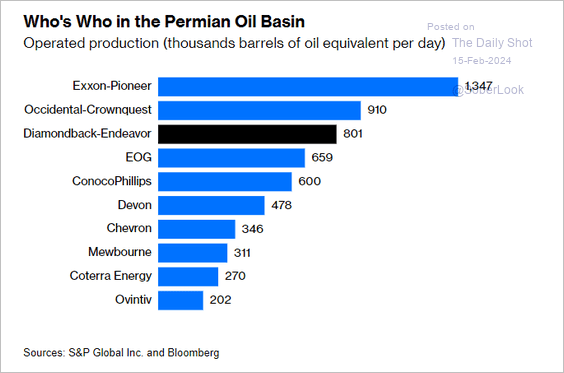

3. Here is a look at Permian production by company.

Source: @JavierBlas, @opinion Read full article

Source: @JavierBlas, @opinion Read full article

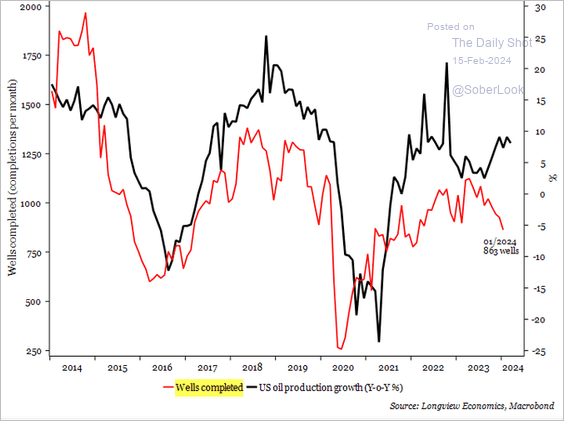

4. Lower US oil production ahead?

Source: Longview Economics

Source: Longview Economics

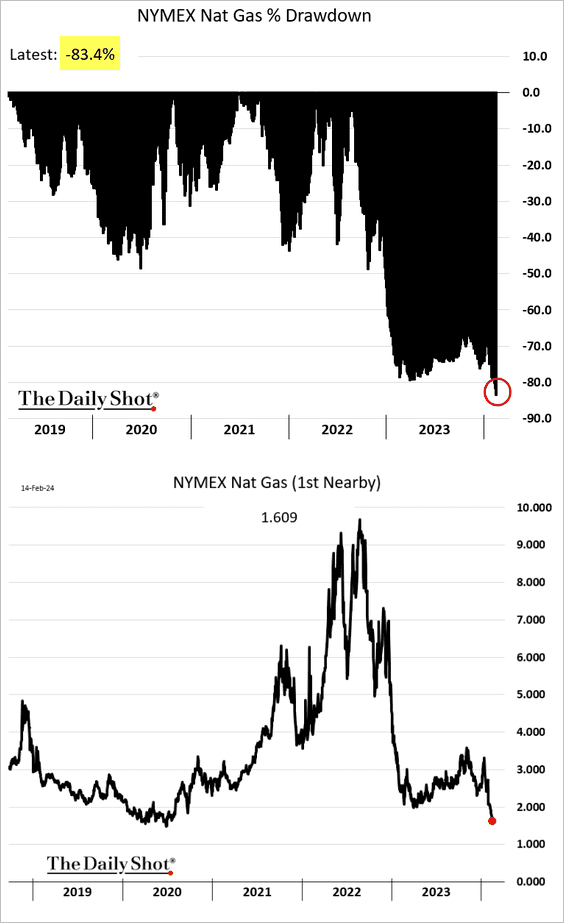

5. The US natural gas futures drawdown has been massive.

Back to Index

Equities

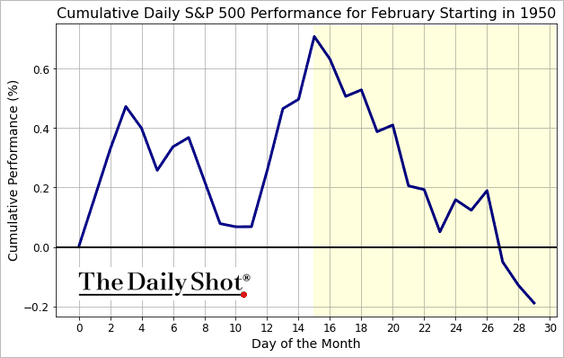

1. The S&P 500 is entering a seasonally challenging period of the month.

h/t @RyanDetrick

h/t @RyanDetrick

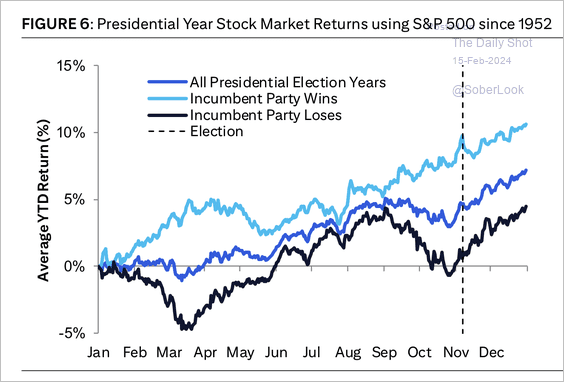

2. The S&P 500 typically rises during election years, especially if the incumbent party wins.

Source: Citi Private Bank

Source: Citi Private Bank

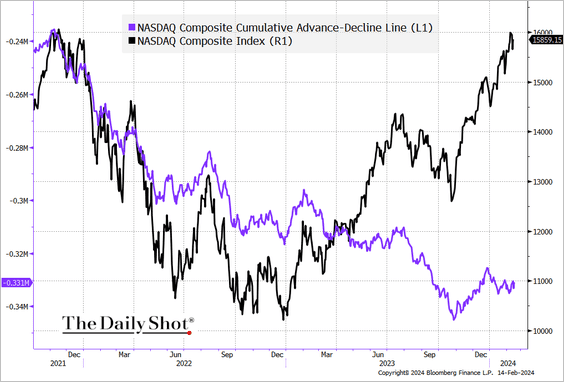

3. As measured by the Cumulative Advance-Decline Line, the breadth of the Nasdaq Composite has remained depressed even as the index surged in recent months.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

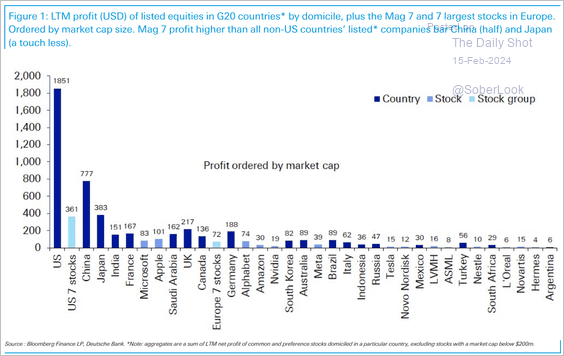

4. According to Deutsche Bank, the combined annual profits of the US “Magnificent Seven” stocks surpass those of a wide array of listed securities across all non-US countries, excluding China and Japan.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

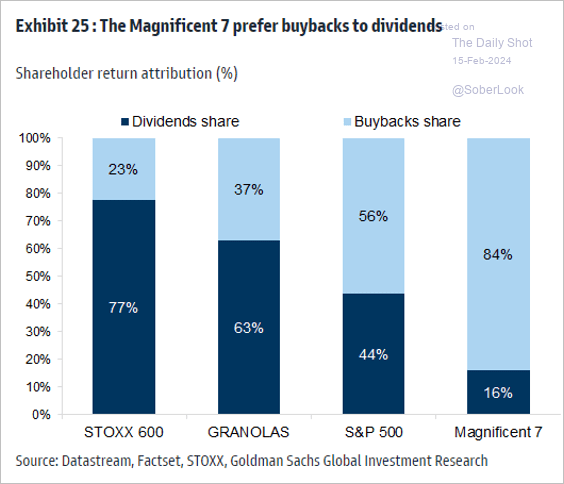

5. Here is a look at share buybacks vs. dividends for US and European markets (GRANOLAS = GlaxoSmithKline, Roche, ASML, Nestle, Novartis, Novo Nordisk, L’Oreal, LVMH, AstraZeneca, SAP, Sanofi).

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

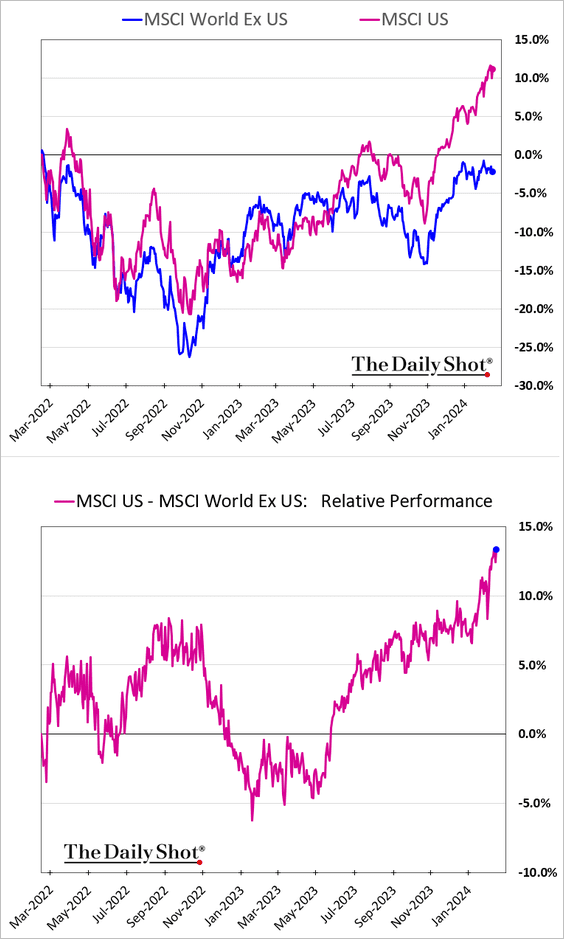

6. US shares have widened their outperformance vs. the rest of the world.

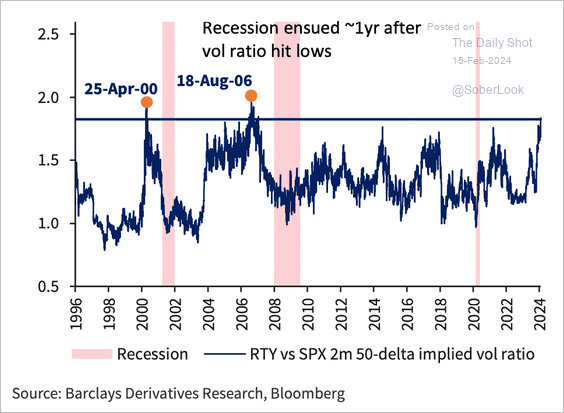

7. The Russell 2000 – S&P 500 implied volatility ratio is at multi-year highs.

Source: Barclays Derivatives Research; @dailychartbook

Source: Barclays Derivatives Research; @dailychartbook

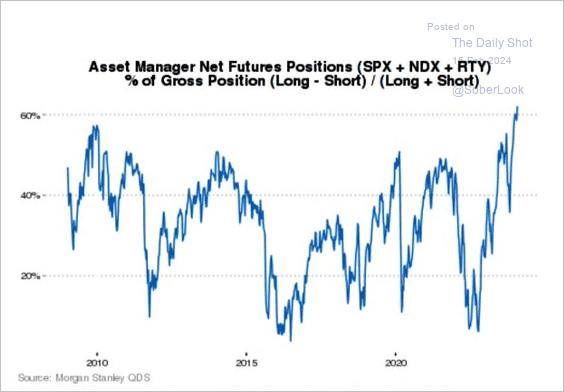

8. Asset managers are very long US equity futures.

Source: Morgan Stanley Research; @WallStJesus

Source: Morgan Stanley Research; @WallStJesus

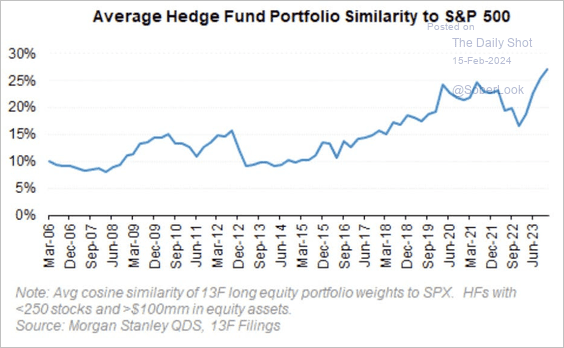

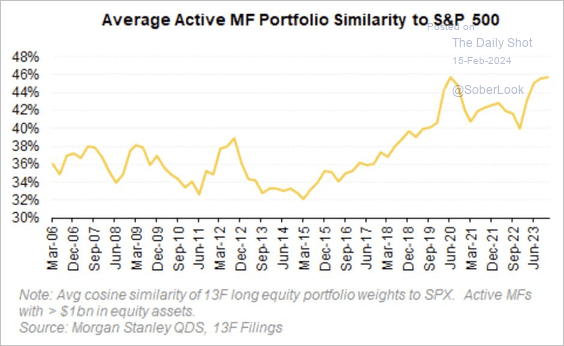

9. The beta of hedge funds and mutual funds to the S&P 500 is exceptionally high, potentially exacerbating a downturn in the index.

Source: Morgan Stanley Research; @dailychartbook

Source: Morgan Stanley Research; @dailychartbook

Source: Morgan Stanley Research; @dailychartbook

Source: Morgan Stanley Research; @dailychartbook

Back to Index

Credit

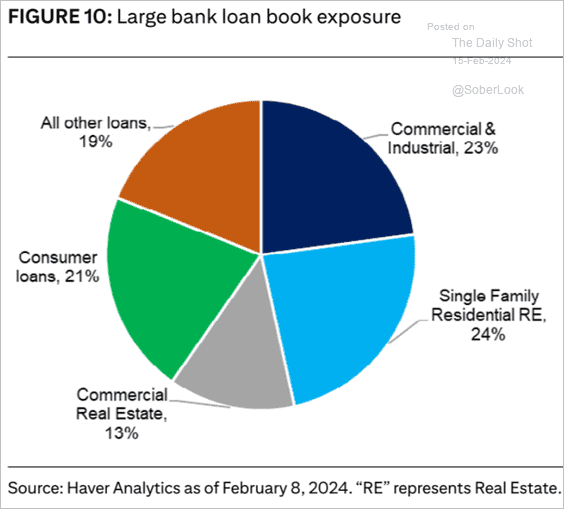

1. Here is a look at large banks’ loan book exposure.

Source: Citi Private Bank

Source: Citi Private Bank

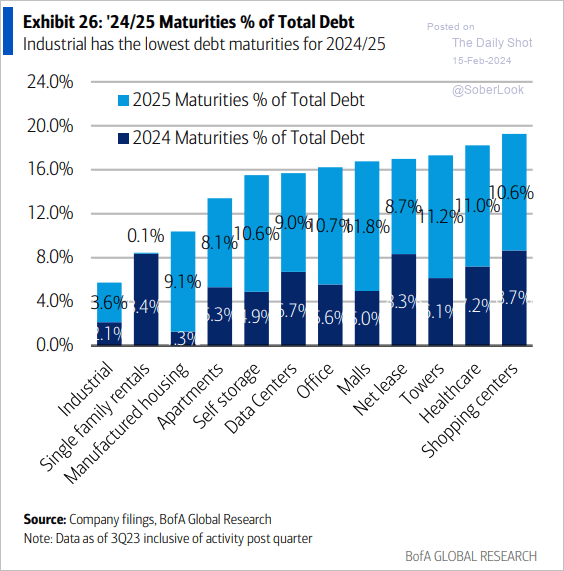

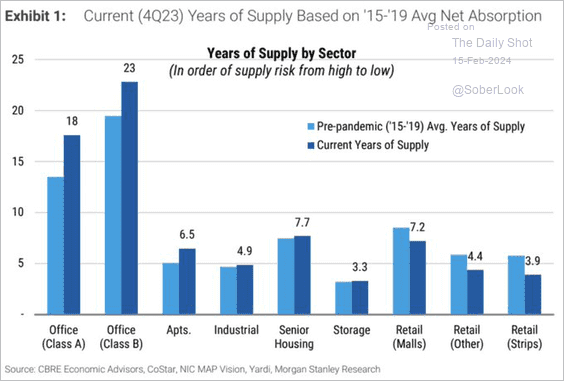

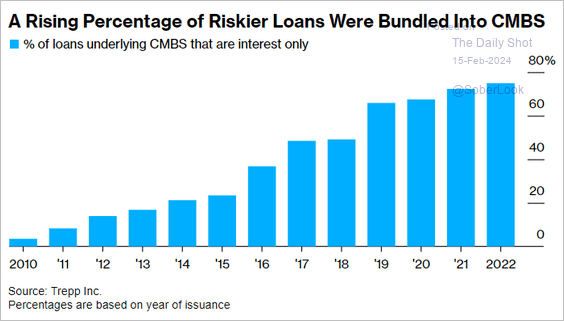

2. Next, we have some updates on commercial real estate.

• Near-term debt maturities:

Source: BofA Global Research

Source: BofA Global Research

• Time it would take to absorb current vacancies and under-construction inventory:

Source: Morgan Stanley Research; @AyeshaTariq

Source: Morgan Stanley Research; @AyeshaTariq

• CMBS interest-only loans:

Source: @markets Read full article

Source: @markets Read full article

Back to Index

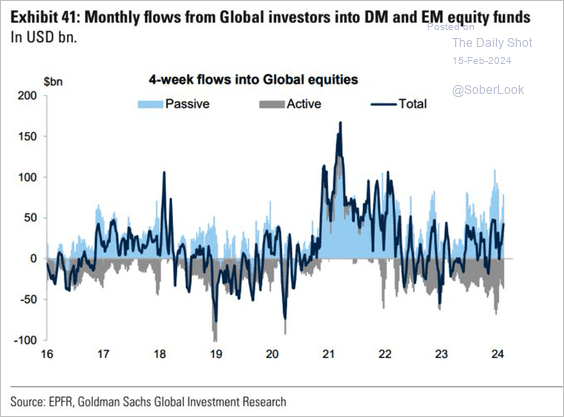

Global Developments

1. Here is a look at passive and active fund flows.

Source: Goldman Sachs; @WallStJesus

Source: Goldman Sachs; @WallStJesus

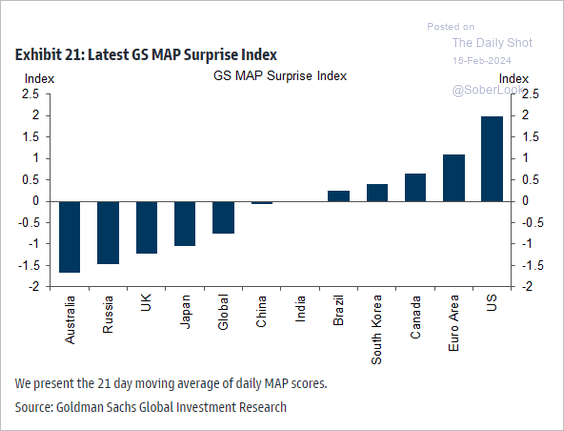

2. How are various economies performing relative to expectations?

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

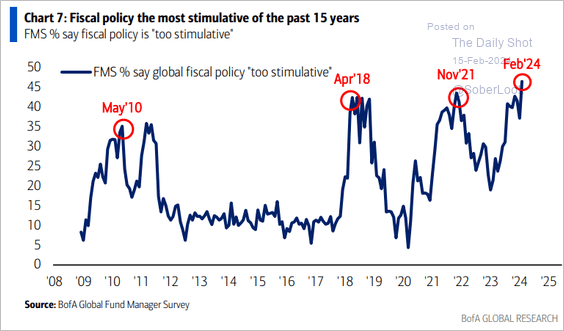

3. Investors view the global fiscal policy as too stimulative.

Source: BofA Global Research

Source: BofA Global Research

4. Supply chain bottlenecks continue to be relatively mild.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

Food for Thought

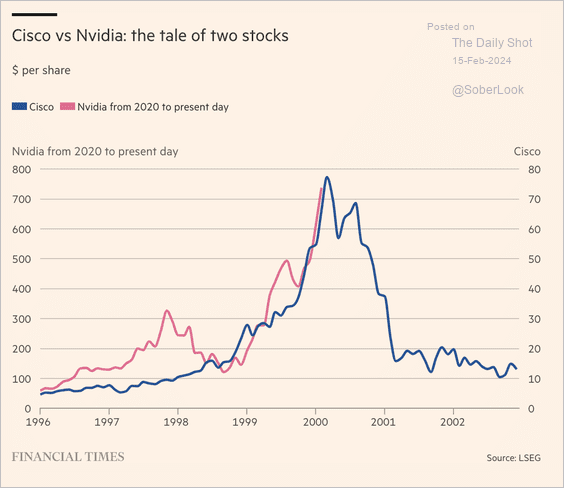

1. Nvidia bubble?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

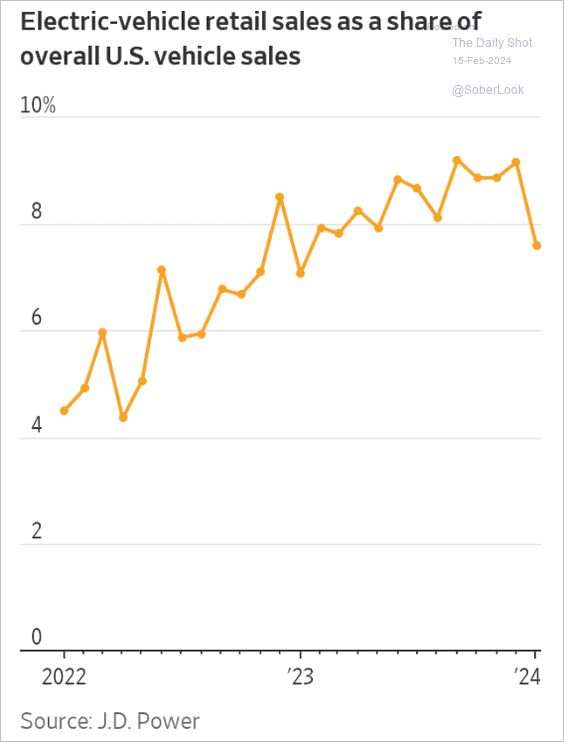

2. EV market share in the US:

Source: @WSJ Read full article

Source: @WSJ Read full article

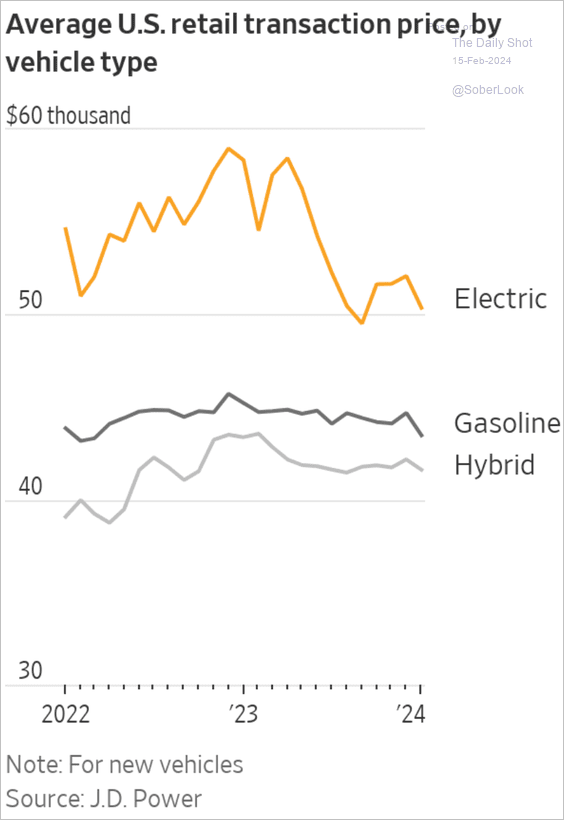

• EV prices:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

3. Largest semiconductor foundry companies:

![]() Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

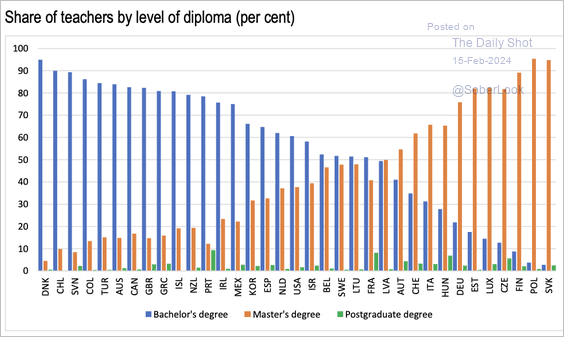

4. Teacher qualifications in OECD countries (upper secondary education):

Source: OECD

Source: OECD

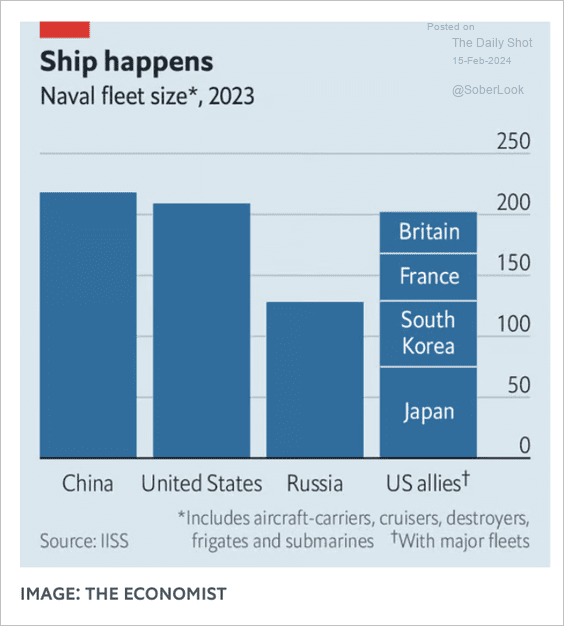

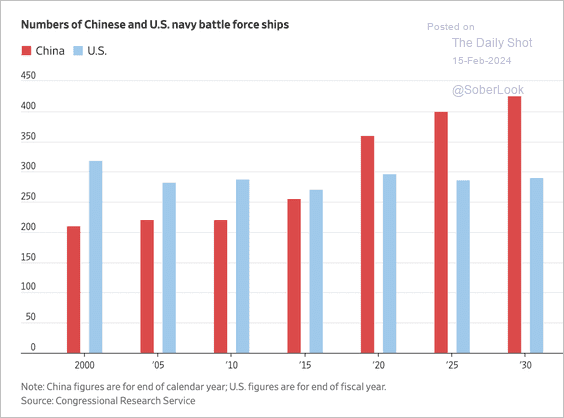

5. Naval fleets:

Source: The Economist Read full article

Source: The Economist Read full article

• Navy battle force ships:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

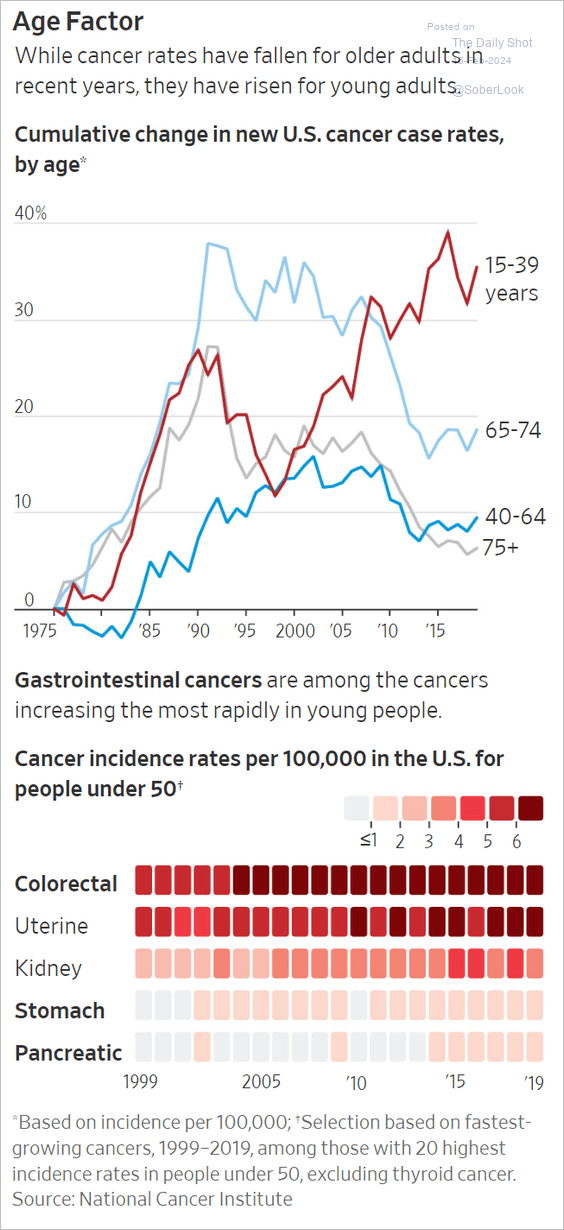

6. Cancer rates among younger adults:

Source: @WSJ Read full article

Source: @WSJ Read full article

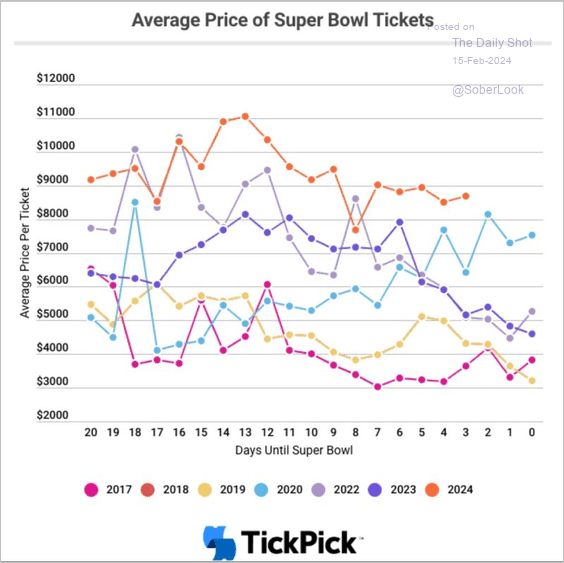

7. 2024 US Super Bowl ticket price inflation versus prior years:

Source: TickPick

Source: TickPick

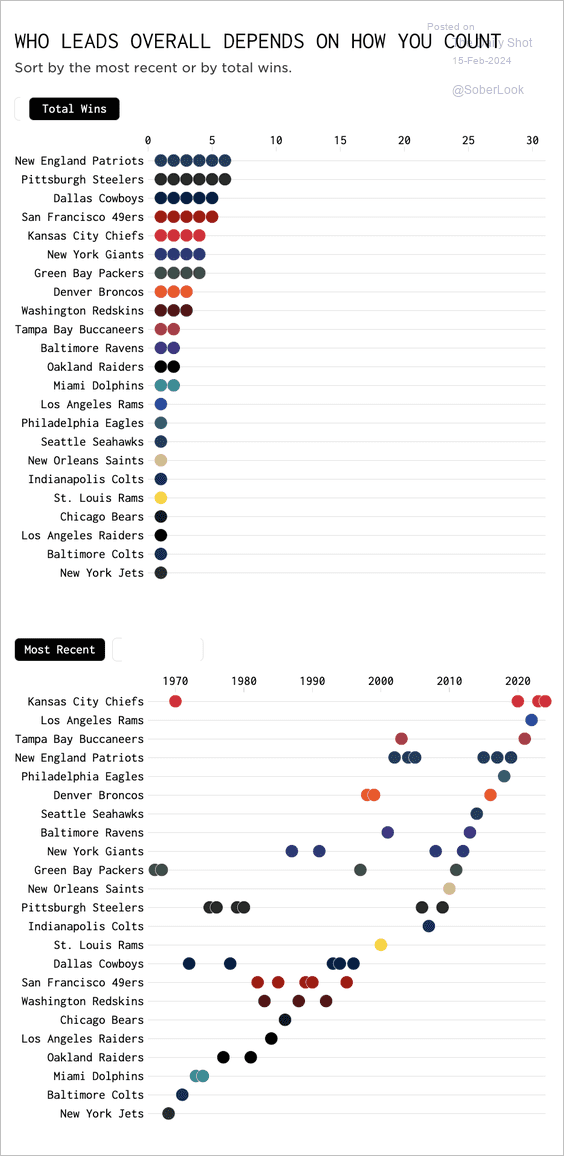

• Super Bowl wins by team:

Source: FlowingData Read full article

Source: FlowingData Read full article

——————–

Back to Index